VCs Remain Focused on Infrastructure

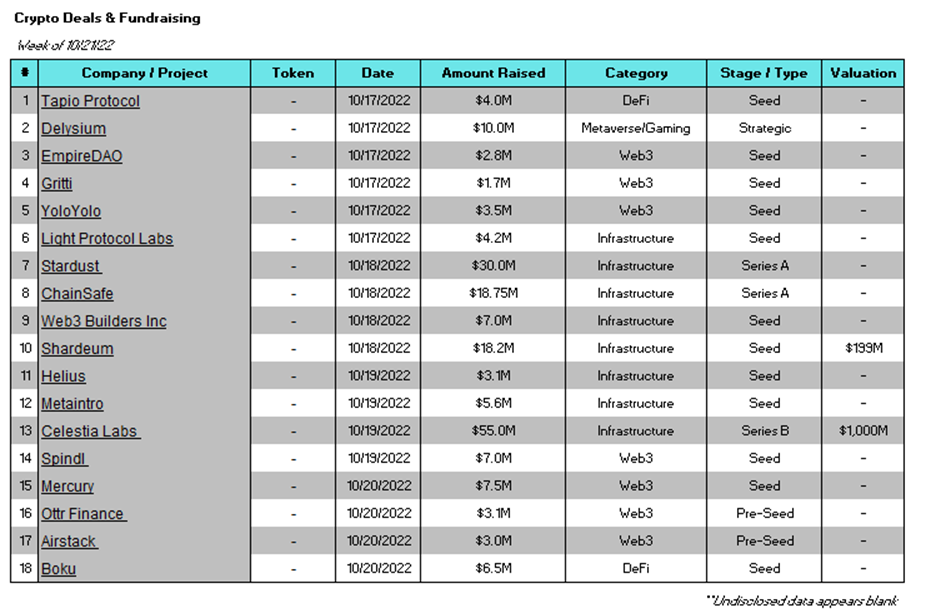

Funding pulled back this week, declining from $659M to $191M, with the number of deals declining from 24 to 18. Once again, infrastructure was the most heavily funded segment of the week – receiving nearly 75% of all funding at $142M. One of the most notable trends this year has been how, although crypto prices have declined, VCs are not slowing down on their crypto infrastructure investments. The segment typically receives $100M+ in funding each week. There were eight total infrastructure deals this week, the largest of which was Celestia Labs which raised $55M, putting it at a $1B valuation. We discuss Celestia more later in this report. Despite DeFi’s standout week last week, funding dropped to just $10M this week. Metaverse/Gaming was flat at $10M, and Web3 saw a slight increase from last week with $29M of funding. NFTs and CeFi have been particularly low-funded this month and received zero funding this week.

There was one crypto hedge fund raised this week – Edge Capital Management. The Florida-based fund raised $66.8M from investors to invest in early-stage DeFi projects with high growth potential.

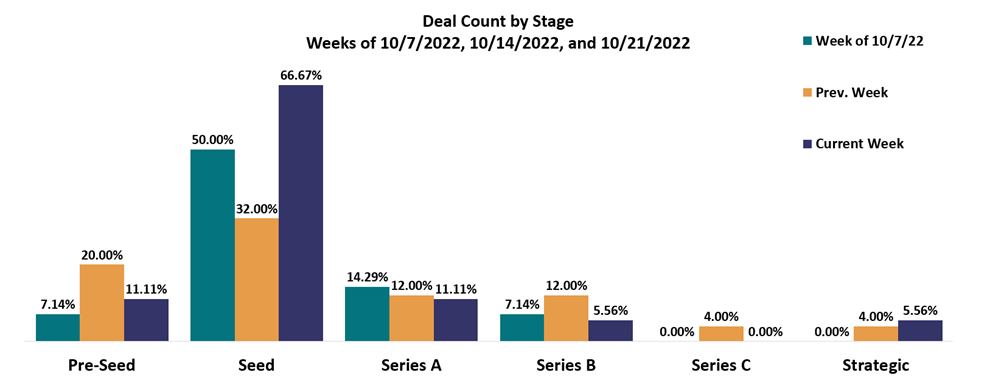

Pre-Seed and Seed deals accounted for nearly all deals this week, at 11.1% and 66.7%, respectively.

Deal of The Week:

Mercury, the sports engagement company using Web3 to reimagine the fan experience, has closed a $7.5 million seed round led by Multicoin Capital. Other investors include North Island Ventures, CrossLink Capital, and Brevan Howard. Mercury seeks to combine the highly tribal collegiate sports world and Web3 with unique digital experiences to enhance the fan experience. Matt Shapiro, Partner at Multicoin Capital, stated, “Mercury is catalyzing NFT adoption at the collegiate level by unlocking compelling new experiences that bring fans closer to the athletes and schools they love.” Mercury already has partnerships with colleges such as Kentucky, Kansas, Clemson, Villanova, and UCF, with more to be announced this fall. The funding will be used to expand Mercury’s leadership team and grow the pipeline of collegiate partnerships.

Why is this Deal of The Week?

Sports are a global phenomenon and certainly a large part of American culture. Although not as large of a market as professional sports, college athletics are still huge. The National Collegiate Athletic Association (NCAA) consists of 350 athletic programs across the country, each with its own fan base. In 2021, the NCAA brought in a total of $1.15 billion in revenue, and Mercury wants to tap into that revenue stream by providing a fresh and fun experience for fans. For example, Mercury has created a website for Kansas athletics called Rock Chalk in which fans can collect sports-themed NFTs, access exclusive player interviews and podcasts, and climb the fan leaderboards for a chance to win prizes such as game tickets or field passes. The unique experience has been a hit with Kansas fans, and it is no surprise that Mercury already has a strong partnership pipeline.

In addition to offering fans a new way of interacting with their favorite team, Mercury is beneficial to athletic programs. The NCAA recently changed its rules regarding student athletes’ ability to capitalize on their name, image, and likeness (NIL). Athletes can now financially benefit from sponsorships or marketing their “personal brand.” In a highly digitized world, there are few better ways for athletes to market themselves than an innovative Web3 platform. Colleges with a Mercury partnership will now have a leg up in recruiting athletes, as they can offer more exposure for athletes to grow their brand. The use of Web3 in traditional communities like sports continues to grow, and Mercury should benefit greatly from being one of the early movers in the collegiate sports market.

Selected Deals

Celestia Labs is the team behind Celestia, a modular consensus and data network, built to enable developers to easily deploy their own blockchain with minimal overhead. Celestia Labs believes this will lead to increased scalability and security, as well as attract developers. The company has secured $55 million in funding through a combined Series A and B round at a $1B valuation co-led by Bain Capital Crypto and Polychain Capital. In addition, the funding round also included investor participation from FTX Ventures, Coinbase Ventures, Galaxy Digital, Jump Crypto, and others.

ChainSafe is an infrastructure-based platform aiming to grow the Web3 ecosystem. The platform’s most notable product, Web3.unity, provides the software necessary for connecting blockchain technology with games. The company has secured $18.75M in funding through its seed round led by Round13. In addition, the funding round also included investor participation from Digital Finance Group, Jsquare, Fenbushi Capital, Hashkey Capital, and others. ChainSafe intends to use the capital raised to expand its workforce and fast-track product development.

Delysium is a Web3-based open-world gaming platform that implements the use of artificial intelligence. The company has secured $10M in funding through a strategic round led by VC Anthos Capital. In addition, the funding round included investor participation from Antalpha Ventures, Blockchain Coinvestors, Formless Capital, Immutable, and others. Delysium intends to use the capital raised primarily for content development.

Shardeum is an infrastructure-based smart contract platform aiming to onboard individuals to the blockchain. The company has secured $18.2M in funding through its seed round at a $199M valuation. The funding round included investor participation from Jane Street, Spartan Group, Foresight Ventures, Big Brain Holdings, and others. Shardeum intends to use the capital raised to expand its network, community, and workforce. In addition, Shardeum plans to launch a token (SHM 0.13% ) in Q1 2023.

Stardust, a company that provides developer tools for building games on the blockchain and allows developers to integrate NFTs easily, has raised $30M in a Series A round led by Framework Ventures. The round also saw participation from Acrew Capital, Blockchain Capital and Distributed Global.