Crypto Funds and Metaverse/Gaming have a Big Week

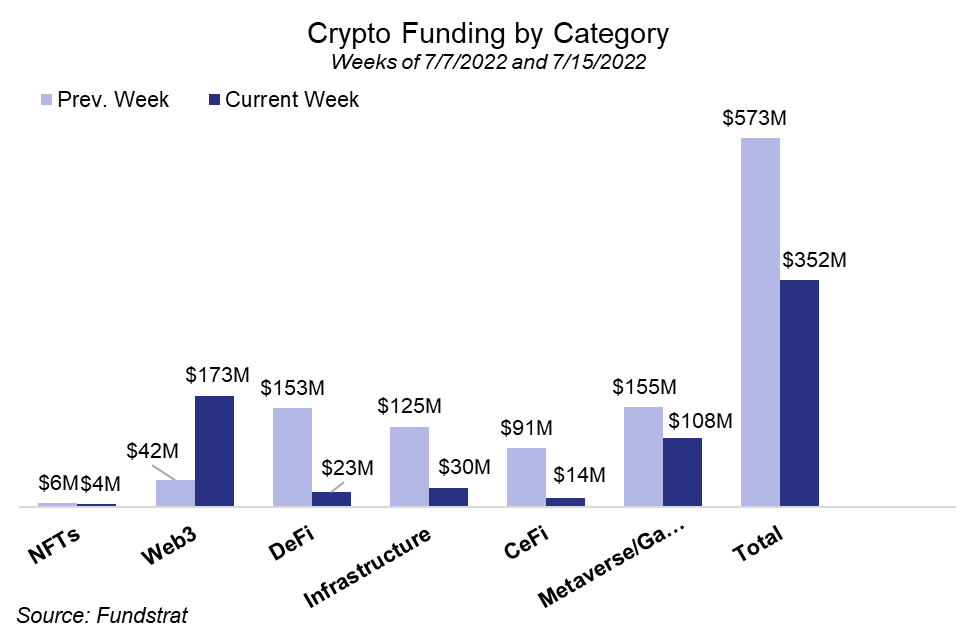

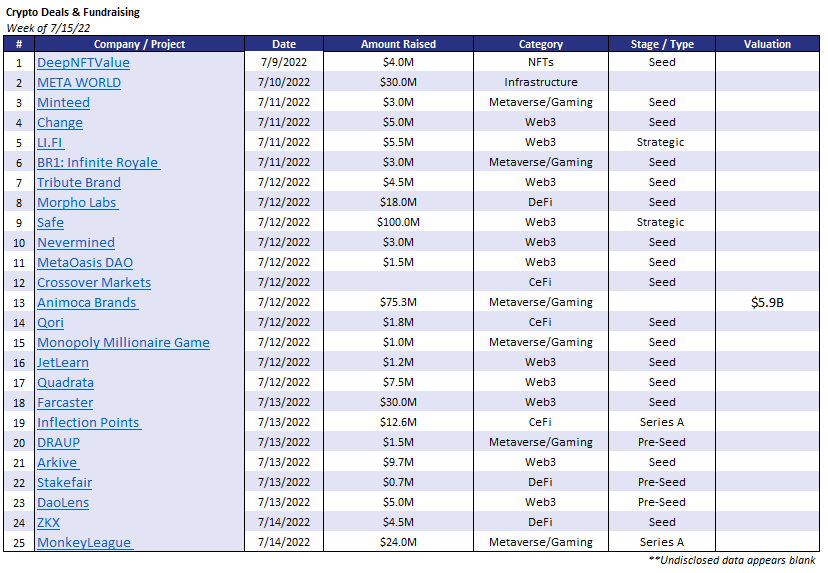

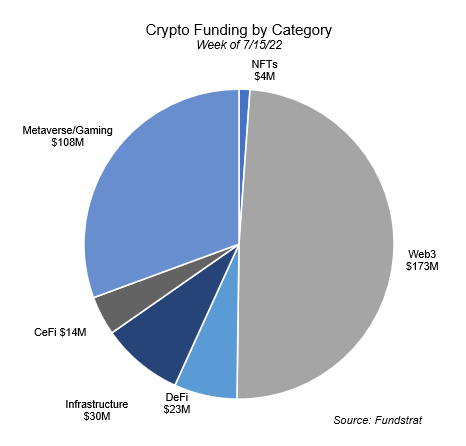

Funding declined from $573M last week to $352M this week, and total deals declined from 41 to 25 (please note that there were additional deals that hadn’t been announced that we have added to last week since our previous Funding Friday). Interestingly, Metaverse/Gaming funding was one of the highest funded sectors for the second week in a row. Six Metaverse/Gaming deals were done, including a $75.3M raise for Animoca Brand’s Metaverse/Gaming fund. Animoca Brands is one of the most well-established metaverse and gaming investors, and this raise puts their valuation at $5.9 billion. Web 3 funding also had a notable uptick this week, increasing from $42M to $173M, led by a $100M funding round in Gnosis Safe. Other categories such as DeFi and CeFi saw sharp declines, with funding decreasing ~85% each.

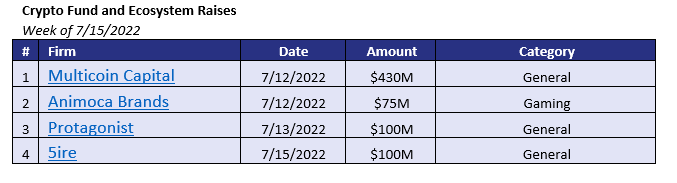

On top of the Animoca Brands fund this week, three other significant funds were raised (Protagonist, Multicoin Capital, and 5ire), totaling $725M in funding. This shows that, despite the bear market, investors are still looking to allocate to crypto funds. Multicoin Capital is particularly notable as they were one of the best returning funds of 2021 (returning investors 20,287% from inception in 2017 to December of 2021). Multicoin’s “Venture Fund III” will invest between $500,000 and $25 million in early-stage crypto projects and companies, and Multicoin $100 million or more for later-stage projects with an established brand and market presence. This Venture Fund III will also place greater emphasis on crypto projects that have demonstrated “proof of physical work,” or protocols that have created economic incentives for permissionless contribution.

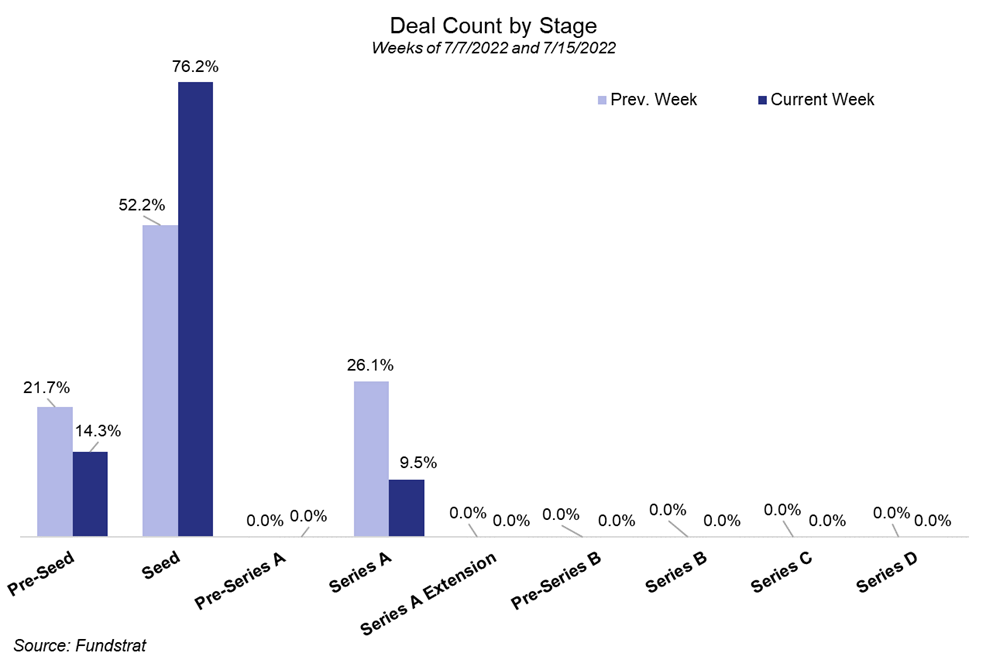

Continuing the trend we’ve seen for months, funding remains highly concentrated in the early stages. 76.2% of deals were Seed Round, up from 52.2% last week. The other deals comprised of 14.3% in Pre-Seed and 9.5% in Series A.

Deal of the Week

Farcaster, a decentralized protocol for building social networks founded by two former Coinbase executives, raised $30 million in a seed round. The round was led by Andreesen Horowitz (a16z) with participation from Coinbase Ventures, Standard Crypto, Balaji Srinivasan, and First Round Capital, among others. Farcaster is an open protocol that gives users ownership of their relationship with their audience and allows developers to build applications with new features on the network.

Why is this the Deal of the Week?

Centralized social media platforms currently have a great deal of control over their user’s ability to reach their audience. They can choose to suppress or highlight posts and even kick users off their platform with little to no recourse. Furthermore, these existing social media networks don’t allow developers outside of their company to innovate on their network. When social media networks initially gained traction, developers built on them to enhance UI, build alternate clients, and even launch highly successful gaming companies. As these networks grew, the social media companies cut off developers due to fears of reduced revenue and unnecessary complexity. Farcaster differentiates itself from existing social media networks by ensuring open access to its network for users and developers – just as Gmail does with email and Github does with Git. This decentralized access ensures that the social media site can’t ignore users and be monopolistic, creating a market-based approach where the best ideas win. Farcaster currently has a tutorial showing how to build a simple app to read messages from any user and is building the first client application to make it easy for people to get started (in beta).

Selected Deals

Hidden Road is a global credit network catered toward institutional investors. The CeFi-based platform aims to provide an alternative solution in prime brokerage and credit intermediation. The company has secured $50M in funding through its Series A round led by Castle Island Ventures with participation from FTX Ventures, Citadel Securities, Coinbase Ventures, Uncorrelated Ventures, XBTO, Greycroft, Humla Ventures, SLN Capital, Wintermute, Profluent Trading, and Corner Capital.

BR1: Infinite Royale is a risk-based battle royale game built on the Solana Blockchain. The game aims to incorporate smart contract automation and non-fungible token (NFT) technology. Players will also be able to earn Solana (SOL) tokens based on their number of kills. The platform has secured $3M in funding through its seed round with participation from Solana Ventures, 6th Man Ventures, Shima Capital, and Justin Kan. The company plans to use the capital raised for advancing software and game development.

Safe is a Web3-based company that focuses on providing a secure digital asset management platform. The company has secured $100M through its strategic funding round led by 1kx with participation from Tiger Global Management, A&T Capital, DCG, Greenfield One, Rockaway Blockchain Fund, Blockchain Capital, ParaFi, Superscrypt, Lightspeed, Polymorphic Capital, Zee Prime, Brevan Howard Digital Assets, Blockchain.com, Collider Ventures, Coinbase Ventures, FalconX, and additional angel investors.

Morpho Labs is a DeFi protocol that aims to optimize borrowing and lending for the platform’s users. It plans to accomplish this by implementing a new form of lending that offers users competitive rates. The company has secured $18M in funding through its seed round with participation from Andreessen Horowitz, Coinbase Ventures, Variant, Nascent, Semantic Ventures, Cherry Ventures, Mechanism Capital, Spark Capital, Standard Crypto, and 80 other institutional/angel investors.

Animoca Brands is a software and venture capital company that has a broad portfolio of metaverse, gaming, and NFT related investments. The company secured $75.32M in funding for its most recent fund, valuing the company at $5.9 billion. The round saw participation from Kingsway Capital, Liberty City Ventures, Alpha Wave Ventures, 10T Fund, Generation Highway, SG Spring Limited Partnership Fund, and Cosmic Summit Investments Limited. Animoca intends to use the capital raised to fund acquisitions, investments, and product development.