Decoupling VC From The Market

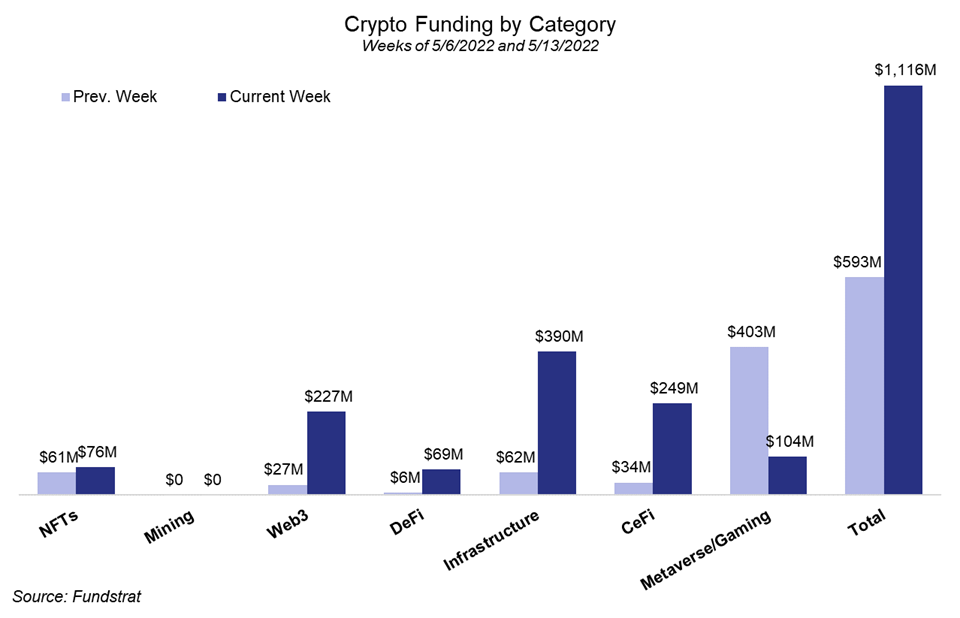

This week, venture capital apparently didn’t read any of the crypto news, nearly doubling last week’s fundraising total when the market dropped 25% over the previous seven days. There was a solid distribution across sectors in a week that saw $1.1 billion raised across 43 projects, though Infrastructure took the top spot at $390 million. CeFi raised $249 million, with Web3 projects following closely behind at $227 million. Rounding out the bottom came Metaverse/Gaming at $104 million and NFTs at $76 million.

There were also four new funds that together raised $1.5 billion, the largest fund being an ecosystem fund for Flow to support NFT projects and development on the platform. In capital markets, Alborz, a sustainable bitcoin mining partnership between Cipher and WindHQ, was able to secure a $47 million secured credit facility from BlockFi to start accumulating ASICs.

Deal of The Week

KuCoin (KCS) is the fifth-largest crypto exchange by trading volume. The company became a decacorn (worth ≥ $10 billion) after its $150 million Pre-Series B at a valuation of $10 billion. The funding round was led by Jump Crypto, with other participants including Circle Ventures, IDG Capital, and Matrix Partners.

Why Is This a Big Deal?

KuCoin has seen exponential growth since its Series A back in 2018, which has come almost entirely from its trading platform alone. That platform has also been able to generate enough revenue for the company to finance its operations and growth strategies for nearly three years without the need for outside capital. However, KuCoin plans to redefine the platform far beyond just a trading platform. Much of this week’s announcement of their funding round focused on how the digital assets space is growing beyond just a financial investment opportunity. KuCoin will focus almost all of the $150 million into going beyond centralized trading services. The company identified the Web3 market as its primary focus, but it is also funneling resources into building self-custody crypto wallet products as well as DeFi and NFT platforms. (KuCoin Raises $150M in Round Led by Jump Crypto at $10B Valuation)

Deals & Fundraising

- Chainalysis, one of the largest blockchain investigators and data service providers, raised $170 million in a Series F that brought the company’s value up to $8.6 billion. GIC led the round with participation from Accel, Blackstone, Dragoneer, and BNY Mellon, among others.

- BVNK is a neobank and payments platform that helps businesses looking to integrate crypto investing and payments into their service offerings. The company closed a $40 million Series A led by Tiger Global, drawing further participation from Anchorage Digital, Coinlist, and many individual investors.

- Naetion (NTN), a Danish Web3 developer that rebuilds Web2 products – like a payroll management tool, social media platforms, etc. – into blockchain-based apps, brought in a $150 million investment from GEM Digital.

- Talos, a technology services provider for institutions, raised $105 million in a Series B that helped the company join the unicorn community with a valuation of $1.25 billion. General Atlantic led the funding round with help from Stripes, BNY Mellon, Citi, and Wells Fargo Strategic Capital, among many others.

- Irreverent Labs is a blockchain game developer working on a Play-to-Earn (P2E) NFT cock fighting game, MechaFightClub. The company closed a $40 million funding round that saw backing from a16z, Mantis VC, Infinity Ventures Crypto, and Unlock Venture Partners, among many others.

Please see below for the full list of deals

Crypto Deals & Fundraising

| # | Company / Project | Token | Date | Amount Raised | Category | Stage / Type | Valuation |

| 1 | Chainalysis | 5/12/2022 | $170M | Infrastructure | Series F | $8,600M | |

| 2 | Lighthouse | 5/12/2022 | $7M | Web3 | Seed | ||

| 3 | BVNK | 5/12/2022 | $40M | CeFi | Series A | $340M | |

| 4 | BitCoke | COKE 2.01% | 5/12/2022 | $20M | CeFi | Strategic | |

| 5 | Lightspark | 5/12/2022 | Infrastructure | ||||

| 6 | Solidus Labs | 5/12/2022 | $45M | Infrastructure | Series B | ||

| 7 | Casa | 5/11/2022 | $21M | CeFi | Series A | ||

| 8 | Chainflip | FLIP | 5/11/2022 | $10M | DeFi | ||

| 9 | MARA | 5/11/2022 | $23M | Web3 | Seed | ||

| 10 | Branch | 5/11/2022 | $13M | Metaverse/Gaming | Seed | ||

| 11 | Moralis | 5/11/2022 | $40M | Infrastructure | Series A | $215M | |

| 12 | Finnt | 5/11/2022 | $4M | DeFi | Seed | ||

| 13 | Neptune Mutual | 5/11/2022 | $5M | Infrastructure | |||

| 14 | Co:Create | CO | 5/10/2022 | $25M | NFTs | Seed | |

| 15 | D-ETF | DETF | 5/10/2022 | $50M | DeFi | ||

| 16 | Freeverse.io | 5/10/2022 | $11M | NFTs | Series A | ||

| 17 | Fuse Labs | FUSE -0.09% | 5/10/2022 | $5M | Web3 | ||

| 18 | Highlight | 5/10/2022 | $11M | Web3 | Seed | ||

| 19 | Jambo | 5/10/2022 | $30M | Web3 | Series A | ||

| 20 | KuCoin | KCS | 5/10/2022 | $150M | CeFi | Pre-Series B | $10,000M |

| 21 | Naetion | NTN | 5/10/2022 | $150M | Web3 | ||

| 22 | Paper | 5/10/2022 | $9M | NFTs | Seed | ||

| 23 | pSTAKE | $pSTAKE | 5/10/2022 | DeFi | Strategic | ||

| 24 | Stanhope Financial Group | 5/10/2022 | $10M | CeFi | Series A | ||

| 25 | StarryNift | 5/10/2022 | $10M | NFTs | Pre-Series A | ||

| 26 | Talos | 5/10/2022 | $105M | Infrastructure | Series B | $1,250M | |

| 27 | TimeShuffle | TIMS | 5/10/2022 | $2M | Metaverse/Gaming | Seed | |

| 28 | Arianee | ARIA20 | 5/9/2022 | $21M | NFTs | Series A | |

| 29 | Dirt | 5/9/2022 | $1M | Web3 | Seed | ||

| 30 | HTR Group | 5/9/2022 | Infrastructure | ||||

| 31 | Irreverent Labs | 5/9/2022 | $40M | Metaverse/Gaming | Series A | ||

| 32 | King of Planets | KOP N/A% | 5/9/2022 | Metaverse/Gaming | |||

| 33 | Nyan Heroes | NYN | 5/9/2022 | $8M | Metaverse/Gaming | Strategic | $100M |

| 34 | SO-COL | 5/9/2022 | Web3 | $100M | |||

| 35 | Xangle | 5/9/2022 | $17M | Infrastructure | Series B | ||

| 36 | Cassava Network | CSV -0.20% | 5/7/2022 | $8M | Infrastructure | Seed | |

| 37 | Bnext | B 3.14% 3X | 5/6/2022 | $5M | DeFi | ||

| 38 | Haegin | 5/6/2022 | $39M | Metaverse/Gaming | Strategic | ||

| 39 | Hike | 5/6/2022 | Metaverse/Gaming | ||||

| 40 | Januar | 5/6/2022 | $6M | CeFi | Seed | ||

| 41 | Klein Finance | 5/6/2022 | $1M | DeFi | Seed | ||

| 42 | KoinBasket | 5/6/2022 | $2M | CeFi | Pre-Seed | ||

| 43 | Ready Games | AURA -4.58% | 5/6/2022 | $3M | Metaverse/Gaming | Token Sale |

Crypto Funds and Ecosystem Raises

| # | Firm | Date | Amount | Category |

| 1 | Flow | 5/10/2022 | $725M | NFTs |

| 2 | SPiCE VC | 5/10/2022 | $250M | Infrastructure |

| 3 | 6th Man Ventures | 5/12/2022 | $145M | Metaverse/Gaming, Web3 |

| 4 | Fasanara Capital | 5/11/2022 | $350M | Web3 |

Crypto Capital Markets

| # | Firm | Date | Amount | Category |

| 1 | Alborz | 5/6/2022 | $47M | Mining |