DeFi Metrics

Key Takeaways

- The general crypto narrative has indisputably shifted away from DeFi, to Web 3.0 and gaming. Yet, many still rely on core DeFi principles to innovate continuously. In this issue, we explore a few metrics to reflect on the past bull market and see what narratives have (or have not) held up in the space.

- Fat Protocol Thesis states that the market cap of the protocol always grows faster than the combined value of the applications built on top. Nevertheless, value accrual does not imply sustainability. Profitability can be framed as the difference between transaction fees (total revenue) and token emissions (cost).

- As we know, thy who controls the liquidity, controls the DeFi universe. This is because protocols ultimately derive revenue from liquidity locked on their platforms. TVL / Total Revenue is a measure for this - efficient protocols derive outsized revenues from thin liquidity, enabling superfluous liquidity to flow elsewhere.

- Market Cap / TVL is one of the longest-standing DeFi metrics, yet is often applied across various DeFi protocols, ignoring each category's business model intricacies. Even when used to compare protocols within the same vertical, the ratio fails to encapsulate the differences in tokenomics between projects. However, it is a good proxy for the premium the market assigns to category leaders.

- With all the excitement about the impact of blockchain technology, it is easy to forget that most smart contract networks and DeFi dApps today are unprofitable on a total revenue basis, let alone on a protocol revenue basis. While the ancillary data today is dirty and sparse, we expect this to improve as these metrics (and others) become commonplace and crypto generally shifts beyond narratives to numbers.

Since DeFi’s summer ‘20 peak, the general crypto narrative has indisputably shifted away from DeFi, to Web 3.0 and gaming. Granted, the next billion users to crypto are more likely to onboard through gaming than the 69th fork of Uniswap. Yet, many still rely on core DeFi principles to innovate continuously. NFT projects are incorporating airdrops and collateralization of NFT assets, while Web 3.0 / gaming startups are faced with designing sustainable tokenomics, a tall task even for blue chip DeFi incumbents.

However, much of the price action is still driven by narratives and fleeting incentives. Metrics made popular during DeFi’s heyday, such as Market Cap / TVL, may even appear counterintuitive, as liquidity retained does not necessarily translate to higher market capitalization. From a fundamentalist’s perspective, ‘anything that has yield’ constitutes DeFi, as yield is used to incentivize liquidity, which can be re-directed or used to stimulate protocol activity. Trudging through these bear markets, the quality of yields will become more pertinent than during the bull. Highly inflationary protocols that find weak product-market fit with non-sticky liquidity will falter to make way for more sustainable designs.

In this issue, we explore a few metrics to reflect on the past bull market and see what narratives have (or have not) held up in the space.

Profitability

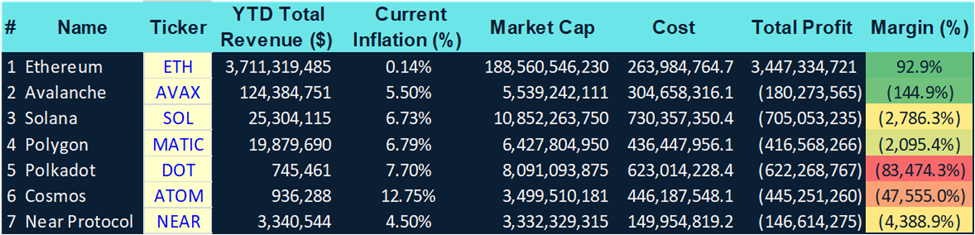

Perhaps the most prevalent narrative of the bull market is the Fat Protocol Thesis, which states that value concentrates in the blockchain protocol layer, instead of the application stack. Specifically, the market cap of the protocol always grows faster than the combined value of the applications built on top, since the success of the application layer drives further speculation at the protocol layer. This narrative has largely played out since early 2020, providing alternative smart contract network investors with eye-popping returns relative to more established networks.

Nevertheless, value accrual does not imply sustainability. To incentivize network activity (and, accordingly, transaction fees), smart contract networks pay validators (PoS) or miners (PoW) in token emissions, in addition to ecosystem funds and liquidity mining programs funded by treasury allocations (e.g. Avalanche Rush). If smart contract networks are thought of as technology companies, token inflation is akin to stock-based compensation, a common operating expense to bootstrap networks. The profitability of these Layer 1 networks can be framed as thedifference between transaction fees (total revenue)[1] and token emissions (cost).

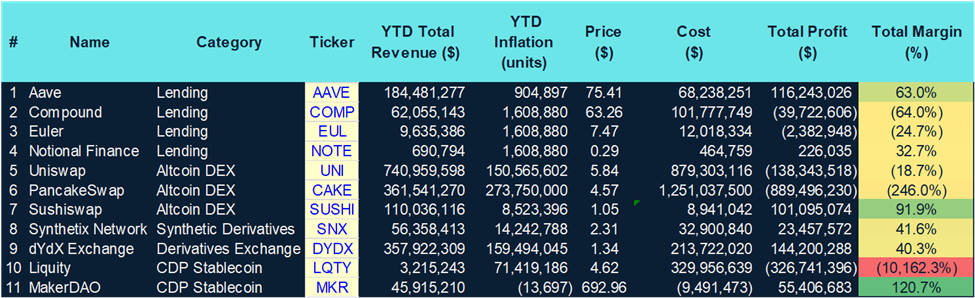

Figure: Profitability of Smart Contract Networks

Given Ethereum’s dominant position, it is perhaps unsurprising that it is the only currently profitable network according to the definition above. The network recently transitioned consensus mechanisms to PoS, drastically reducing emissions to PoW miners.

Polkadot and Cosmos appear to be the least profitable of the cohort. This can be attributed to the fact both function more similarly to ‘ecosystems’ than ‘networks,’ with weak transaction fee accrual within the Cosmos Hub and Polkadot parachains. The current inflation rates for both chains are also the highest among the competitor set, introducing sell-side pressure on the ATOM -11.00% and DOT tokens.

While market cap does accrue from application layers to protocol layers, how protocols become sustainable and profitable in the future remains to be seen. We present the following Catch-22 situations.

Protocols with fixed supplies such as Bitcoin assume that future transaction fees alone (instead of perpetual inflation) will suffice to compensate future validators and miners for securing the chain. As circulating supply converges with maximum supply, costs will decrease with lower inflation, yet revenue is dependent on whether the chain itself can achieve product-market fit by then with lower inflationary rewards.

Those with infinite supplies, such as Ethereum, Polkadot, and Cosmos, will face steady sell pressure given perpetual inflation. They will need to rely on burn mechanisms to stabilize issuance (and cost), as Ethereum has implemented with EIP-1559.

Using transaction fees less token inflation, we can also compare profitability across dApps and their categories. Sushiswap and MakerDAO appear to be the most profitable, with the former benefitting from its omnichain presence and the latter from its Peg Stability Module burning MKR (its YTD circulating supply decreased because of this).

Across dApp categories, ‘Synthetics’ appears to be the most lucrative as Synthetix and dYdX capitalize on derivatives trading regardless of market conditions. Pancakeswap and Liquity both have extremely high token emissions, weighing on profitability. Although ‘Lending’ and ‘Altcoin DEXes’ are perceived as cornerstone DeFi infrastructure, most of these projects in these categories remain unprofitable, pointing to the need for sustainable tokenomics design.

TVL Efficiency

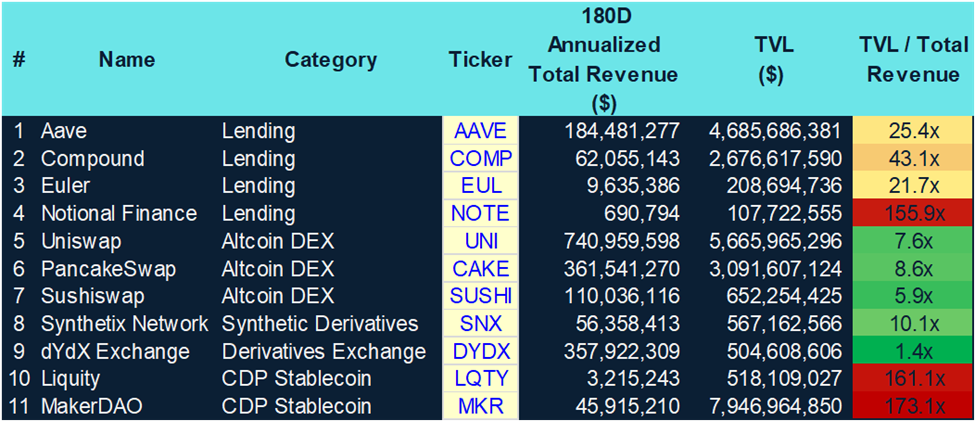

Armed with a framework for profitability, we can examine the efficiency of dApp protocols and categories. As we know, thy who controls the liquidity, controls the DeFi universe. This is because protocols ultimately derive revenue from liquidity locked on their platforms by charging a percentage fee from swaps or a portion of interest income from borrowing.

Accordingly, efficient protocols derive outsized revenues from thin liquidity, enabling superfluous liquidity to flow elsewhere. TVL / Total Revenue is a measure for this – protocols with low multiples indicate they are efficient, and vice versa.

In this regard, Altcoin DEXes and Derivatives are more efficient than Lending or CDP Stablecoin models, deriving higher revenue per unit of TVL. dYdX tops the table by this metric, generating 70c per dollar (1/1.4x) of TVL attracted.

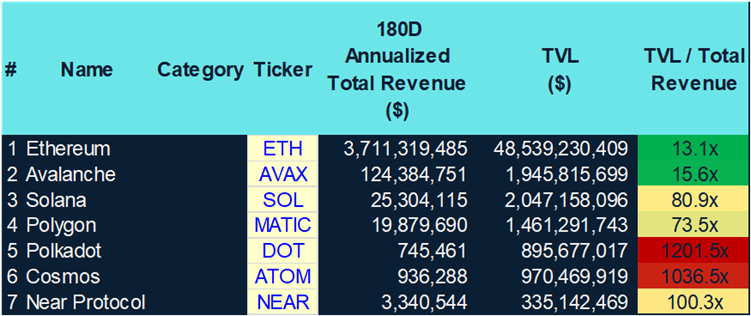

Figure: TVL / Total Revenue across Smart Contract Networks

On a smart contract network level, Ethereum and Avalanche are the most efficient, turning over 7c per dollar TVL attracted (1/13.1x). Polkadot and Cosmos are the least efficient since TVL is spread out over other chains within Polkadot parachains and the Cosmos ecosystem, in addition to weak fee accrual back to the canonical chains. Should the new Cosmos Hub proposal pass, we can expect ATOM -11.00% ’s value accrual to improve over the medium term.

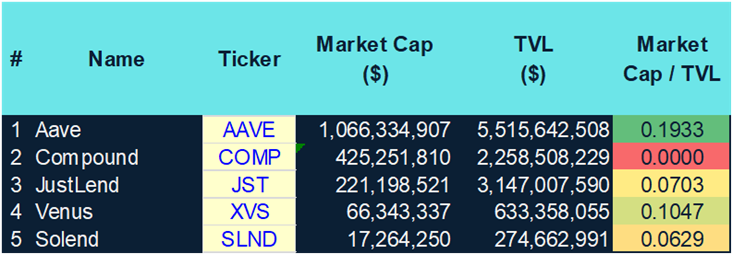

Category Premiums

Market Cap / TVL is one of the longest-standing DeFi metrics since its inception, yet it has been controversial when applied inappropriately. The metric is often applied across various DeFi protocols, ignoring each category’s (DEX / Lending / CDP stablecoins) business model intricacies.

Even when used to compare protocols within the same vertical, the ratio fails to encapsulate the differences in tokenomics between projects. Having said that, it is a good proxy for the premium the market assigns to category leaders, as shown below.

In the lending category, Aave commands a Mcap / TVL ratio of 0.2, more than twice that of its closest runner-up in the comp set, Venus. This is in part due to the lindy effect – DeFi users ‘trust’ legacy DeFi protocols more than newer forks with additional features, assigning a premium to each unit of liquidity attracted on Aave relative to its comp set. This is also in line with legacy protocols like Aave, usually offering lower inflationary rewards in comparison, commanding a higher market cap premium over stickier liquidity.

Despite kicking off the concept of liquidity mining in 2020, Compound lags in this metric, perhaps due to the slower speed at which it onboards collateral assets.

In the DEX category, Uniswap appears to command the highest premium of the comp set, with Osmosis and Serum being outliers given depressed TVLs. TVL on Osmosis plunged when Terra collapsed as UST was the most commonly paired with other tokens on the DEX. Raydium, on the other hand, lost market share to Saber, Atrix, and Orca.

Curve’s low ratio can be justified through the distribution of value (read: market cap) with its derivative protocol, Convex. Convex allows users to deposit their CRV or Curve LP tokens on the platform, essentially rehypothecating liquidity. Because of Curve and Convex’s symbiotic relationship, the sum of their market caps is a good proxy for the value of the Curve ecosystem. If we add Convex’s market cap ($337m) to that of Curve’s, we arrive at a healthier ratio of 1.12.

Bottom Line

With all the excitement about the impact of blockchain technology, it is easy to forget that most smart contract networks and DeFi dApps today are unprofitable on a total revenue basis, let alone on a protocol revenue basis. Within DeFi, ‘Synthetics’ and ‘DEX’ models appear more capital efficient with TVL than ‘CDP Stablecoin’ and Lending.’ While the ancillary data today is dirty and sparse, we expect this to improve as these metrics (and others) become commonplace and crypto generally shifts beyond narratives to numbers.

[1] While there has been discussion around using protocol revenue (transaction fee that accrues to token holders) instead of total revenue (total transaction fees) to calculate profitability, we argue for using total revenue instead. This is to provide profitability perspective on a protocol-wide level with its stakeholders and enable like-for-like comparisons with other projects with differing tokenomic structures.

Reports you may have missed

FIGURE: A TEAM OF PEPES CONCOCTING THE PERFECT TOKENOMICS Tokenomics (a portmanteau for token and economics) represents the monetary policy of tokens that directly contributes to their price fluctuations. In bull markets, tokenomics were given utmost priority, sometimes constituting full theses for investment decisions. When the euphoria wears off in the bear, however, founders and market participants are left realizing that tokenomics can delay a weak project’s demise, but cannot...

FIGURE: PEPE CROSSING BRIDGES TO EXPLORE ALTERNATE LAYER 1S / LAYER 2S Although ETH remains the dominant Layer 1 for most on-chain activity, alternate Layer 1s have demonstrated product-market fit throughout the bull market run of ‘20/’21. Solana (SOL -6.68% ) emerged as the ‘high-throughput chain’ focused on complex DeFi / gaming, BNB Chain (BNB) offers easy fiat on/off-ramps through Binance CEX, while Avalanche (AVAX) and Cosmos (ATOM -11.00% ) are building application-specific blockchains...

Articles Read 1/2

Enjoyed the read? Subscribe now for unlimited access!

Get invaluable analysis of the market and stocks. Cancel at any time.

Already have an account? Sign In d8e020-e42f81-f62f99-b85fa7-17ff50

Already have an account? Sign In d8e020-e42f81-f62f99-b85fa7-17ff50