Appchains

Key Takeaways

- The appeal of Appchains is the freedom and flexibility they provide to design a network optimized for an app's specific needs.

- If an application has a critical mass of users and economic activity, another potential monetization point would be migrating to its own blockchain so that network fees accrue to their dApp and token holders rather than the base layer L1.

- The crypto market is starting to see the first signs of the Appchain Thesis coming into fruition as promising new projects and existing category winners like dYdX chose to maximize value capture by building their own network.

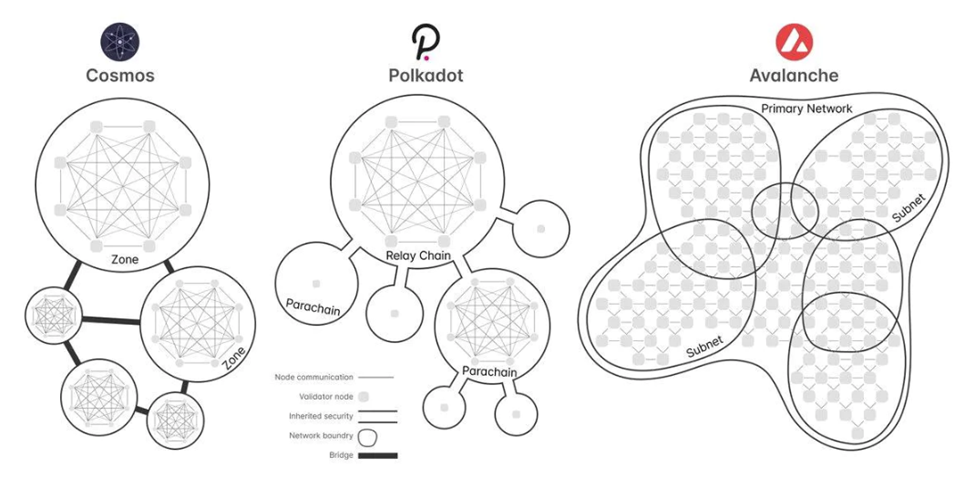

- There have been a few approaches to creating a network of interoperable chains. Some of the most popular and valuable by Market Cap include Cosmos, Polkadot, Avalanche, and recently Polygon.

- Appchains can only be built on networks designed to support them, so they still rely on an underlying chain's validators for security but operate independently within the ecosystem. While there is a clear desire for the sovereignty and customization of appchains, the value capture of tokens from host networks still needs to be determined.

What is an Appchain?

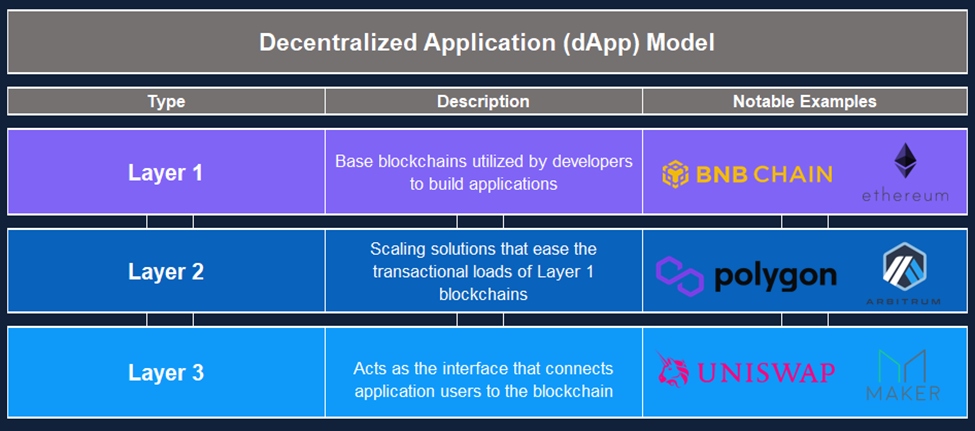

Appchains, short for application-specific blockchains, are built to run one specific application or use case. They differ from general-purpose L1/L2 infrastructure chains that run many decentralized applications (dApps) concurrently. While both dApps and appchains technically exist on a base layer blockchain, the key difference is that appchains also operate their own sovereign blockchains while dApps do not. In this piece we will cover factors driving the rise of appchains, how value capture is shifting from this rise, and potential investment opportunities created with that shift.

Why build an Appchain Instead of a dApp?

dApp Model

When developers build a new application on an established L1 like Ethereum, the application and its developers inherit many benefits of an established ecosystem: more resources, tools, potential users, and, most importantly, security to run the application. They also inherit the underlying network’s design choices and limitations, including protocol consensus, governance, and scalability. User transactions from their application must compete for block space with the base layer transactions and other applications on the network. High activity can cause the application’s performance to deteriorate with longer processing times and higher network fees, causing poor user experiences. Furthermore, developers face a longer timeline for updates and potential application changes since they depend on underlying L1 upgrades.

Appchain Model

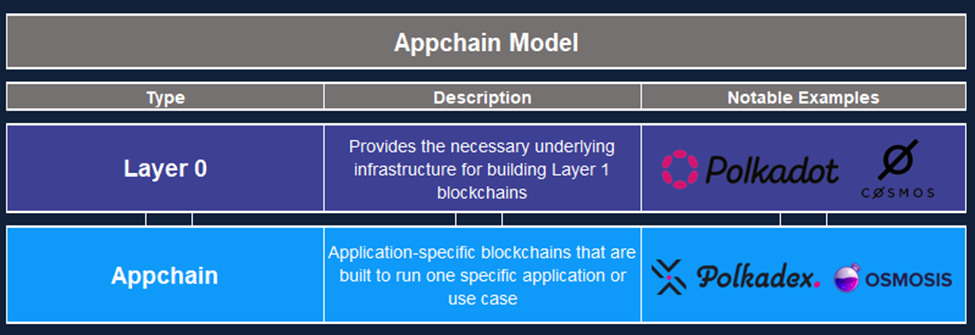

Appchains are built using software development kits (SDK) from an underlying base-layer. Foundational layers that support appchains have typically been called layer-zero, although recently layer-one chains have also begun to create roadmaps that cater to appchains, which we will discuss later in the piece. These base layers are built to enable customization that isn’t possible in the typical dApp environment.

The appeal of Appchains is the freedom and flexibility they provide to design a network optimized for an app’s specific needs. Rather than fit a dApp into constraints inherited from an L1, the app’s developers can make design choices for the network that improves their app without worrying about competing for limited block space. Teams can customize critical design decisions like the chain’s economic, governance, and consensus structures. These changes create opportunities to improve the underlying product and related token’s value capture.

Where Value Accrues

Fat Protocols

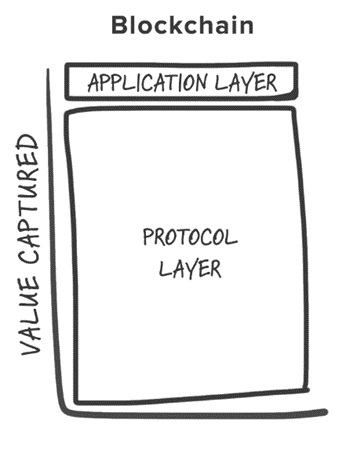

In the last bull market, some of the top-performing tokens belonged to new general-purpose L1 (Layer-one) chains such as Solana (SOL) and Fantom (FTM). These protocols looked to compete and provide an alternative to Ethereum’s model for delivering underlying infrastructure to build decentralized applications (dApps). While many of these gains have been retraced throughout crypto’s bear market, for a while, it seemed Joel Monegro’s now widely cited 2016 ‘Fat Protocols’ thesis was playing out. Value seemed to accrue to underlying L1 protocol tokens faster than the product-related dApp tokens built on their rails.

Foundational L1s accrue value through transaction fees paid for block space, which is deemed valuable due to its security and user bases. The first iteration of decentralized applications followed crypto users and economic activity, building on top of L1 base networks and layering their product fees on top of network-related ones. Rather than attempting to create a blockchain from scratch, dApps followed the path of least resistance. It’s still too early to tell whether this trend will continue and whether the Fat Protocols thesis truly comes to fruition.

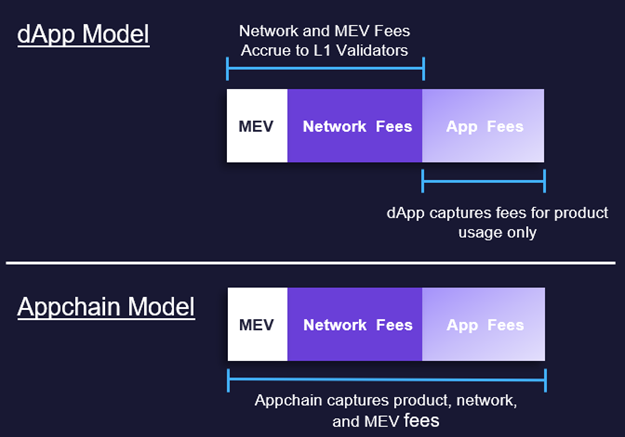

Now that many applications have matured and achieved some product market fit, many dApp developers are beginning to ask if it makes sense to continue this model of building on an existing L1. If an application has a critical mass of users and economic activity, another potential monetization point would be migrating to its own blockchain so that network fees accrue to the dApps and their token holders rather than the base layer L1. Additionally, migrating to their own chain gives dApps more flexibility to optimize protocol decisions to their needs.

Appchain Thesis

The Appchain Thesis has evolved over the years, with the first iteration in Polkadot’s 2016 whitepaper alluding to a network of different chains with a shared validator set providing security. It presented questions about whether dApps are better off with their own blockchain rather than building on top of an all-encompassing architecture like Ethereum. Polkadot was ahead of its time, when early dApp developers experimented with novel products and focused on finding users rather than the best way to monetize. Despite being a first mover in the appchain space, the Polkadot network has seen limited traction.

The thesis has further evolved, with some versions flipping the Fat Protocols thesis. Rather than underlying infrastructure chains capturing the majority of value, the Appchain Thesis argues that value could accrue to “Fat Applications” as they seek to capitalize on the opportunity to monetize using their own blockchain. Now that many dApps have some product market traction with consistent users and revenue, creating an appchain becomes a potential step to optimize their value capture. Last year top decentralized dYdX announced it would migrate to become an appchain despite successfully operating on Ethereum’s L2. One of the reasons cited for the change was that fees could “accrue to validators and their stakers”, presumably dYdX token holders. dYdX is undoubtedly a first mover in adopting this framework, but many successful dApp teams will likely ask themselves if they should do the same.

Interoperability

Appchains can only be built on networks designed to support them, so they still rely on an underlying chain’s validators for security but operate independently within the ecosystem. While this is a potential vulnerability, it enables teams to create a blockchain that meets users’ needs without starting up a validator network from scratch.

If a significant shift to appchains happens, some potential winners could be underlying protocols that enable them to be developed. These protocols establish interoperability between different chains, a key friction point among blockchain users navigating funds cross-chain. There have been a few approaches to creating a network of interoperable chains. Some of the most popular and valuable by Market Cap include Cosmos, Polkadot, Avalanche, and recently Polygon. These projects aim to connect an interoperable network of sovereign blockchains rather than just dApps. This is typically accomplished through a shared SDK and validator set. The underlying demand and utility for host network tokens vary by chain. Each team continues to evolve its network and tokenomics to enable appchain growth in its ecosystem.

Cosmos Zones

Cosmos is a decentralized network of independent parallel blockchains. The Cosmos ecosystem offers top-notch tools for application developers to launch appchains. Popular chains built using Cosmos include Binance Chain, Cosmos Hub, Crypto.com, and the infamous Terra Classic. The critical components of the ecosystem include the Cosmos SDK, which enables developers to build the execution layer and logic for their blockchains; Tendermint, a consensus engine ensuring fast finality; and IBC, a secure protocol that enables seamless interoperability between different blockchains. Cosmos allows cross-chain communication between sovereign chains, similar to the European Union’s railways connecting independent nations.

Appchains on Cosmos are known as Zones and operate using a hub-and-spoke network model. The Cosmos Network validates transactions through a Proof-of-Stake (PoS), with the Cosmos Hub sitting at the center of the network and connecting all zones.

Atom Token

While Cosmos developer tools are widely successful by many measures, directly contributing to the creation of billions in value within crypto, that success has not extended to its related token, ATOM -3.26% . Despite the Cosmos hub being the top standard for creating appchains, its corresponding token has yet to see much adoption due to its lack of utility within the ecosystem. Appchains launched on Cosmos have their own validator networks and network fees paid in their native tokens. This nullifies the demand for ATOM -3.26% since appchains can launch on the network without using ATOM -3.26% . The token also has had a high relative staking yield of ~20%, heavily diluting supply and adding further selling pressure throughout the bear market. It should also be noted ATOM -3.26% operates on its own L1, putting the chain on a similar footing to other appchains using the Cosmos SDK.

ATOM -3.26% ’s lack of value accrual is being addressed in a set of upgrade proposals for ATOM -3.26% 2.0, which look to redesign tokenomics in the ecosystem. Although the community shot down the overall proposal, Interchain Foundation, the development team behind Cosmos development, continues to work on the upgrades mentioned to implement changes piecemeal.

The reworked tokenomics have four main pillars meant to increase demand and utility for ATOM -3.26% :

- Interchain Security – Enables appchains to initiate without the burden of setting up the validator set. The validators are obtained externally, meaning they are sourced from either Cosmos Hub or other service providers.

- Liquid Staking – Encourage the adoption of liquid staking providers for ATOM -3.26% and Cosmos ecosystem projects. Part of this is creating additional sources for ATOM -3.26% to access yield, which could bring down network inflation to more sustainable levels.

- Interchain Scheduler – An on-chain marketplace for blockspace, allowing for equitable distribution of MEV (maximum extractable value). This would allow Cosmos to create value for its ecosystem through tokenizing MEV and selling it in the market.

- Interchain Allocator – An initiative to use proceeds from revamped tokenomics to fund new projects on-chain and encourage protocol coordination of on-chain financial agreements (token exchanges, liquidity incentives, treasury management, financings, etc.). This would see Cosmos take a more active role in investing and growing value in its ecosystem, where the team as been passive compared to funding from other L1s.

Cosmos has found demand in its underlying technology, with major projects announcing they are launching natively on the chain, including dYdX and Circle’s USDC, among others. If the team can redesign the network in a way that evolves utility for its ATOM -3.26% while retaining properties that have led to their success as the go-to network for appchains, there is a compelling story for Cosmos as a best-in-class investment for exposure to the appchain thesis.

Polkdadot Parachains

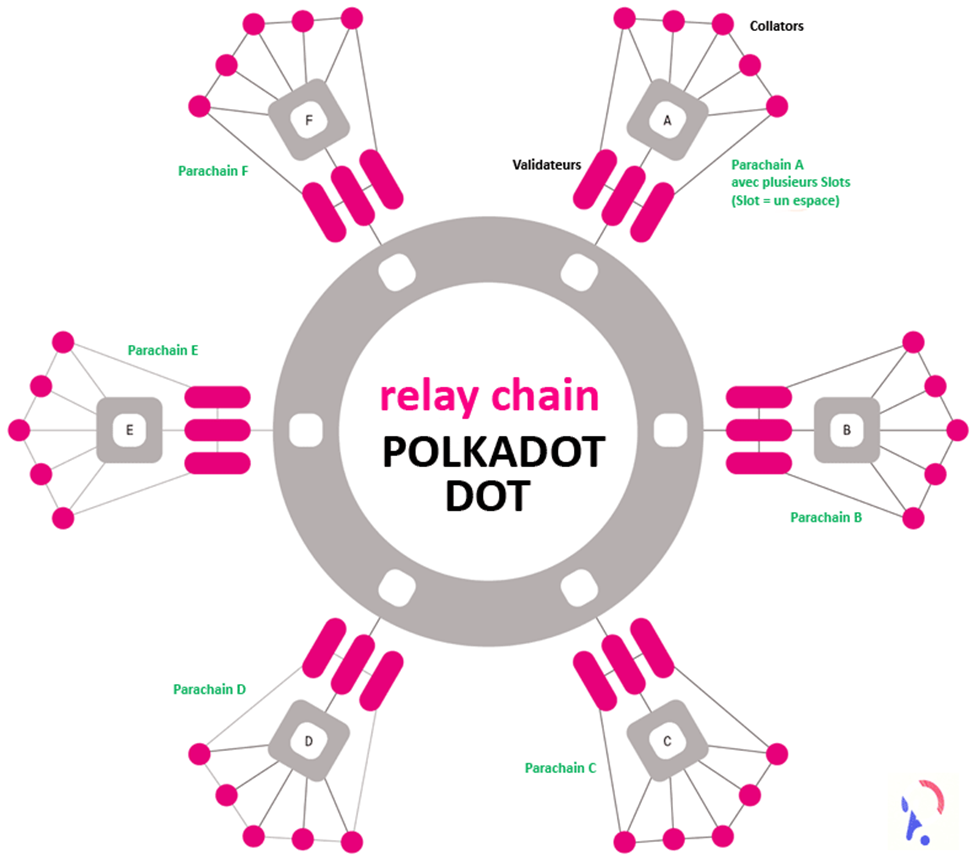

The primary difference between Polkadot’s Parachains and Cosmos’s Zones lies within the network’s governance structure. Within the Cosmos network, validators consist of the 100 largest ATOM -3.26% holders. In comparison, Polkadot relies on collators (similar to validators on other blockchains) to maintain and collect para chain-related transactions.

Polkadot uses the Relay Chain, a Proof-of-Stake (PoS) mechanism that allows validators to stake DOT as the platform’s central Layer 0 blockchain. The Relay Chain validates all transactions from parachains, a network of Ethereum Virtual Machine (EVM) compatible Layer 1 chains. Parachains function as a bridge that connects the Polkadot Network to other Layer 1 blockchains. In addition, the operation of specific projects or applications utilize parachains. Examples of existing projects include Litentry, an identity aggregator, and Acala, a DeFi hub. However, to access one of the limited 100 parachains, developers must participate in an auction-like process where participants vote for promising projects.

While Polkadot’s Parachains enable cross-chain compatibility, the Relay Chain’s inability to support smart contracts limits overall network performance. In addition, the auction process and the limited number of parachains offered are obstacles that developers currently need to navigate. However, Polkadot has recognized its capacity-related limitations and is working to improve it through parathreads. While Polkadot can support up to 10,000 parathreads, they differ from parachains as developers are required to pay per block.

DOT Token

To summarize, for cross-chain composability to be achieved, a slot on the relay chain is required. To have a slot on the chain, DOT must either be staked or used as a form of payment. Therefore, if there is demand from projects to develop on Polkadot, there should be incremental demand for DOT. Yet this mechanism may lead to less demand for DOT, if there is less demand from development teams to build in the ecosystem.

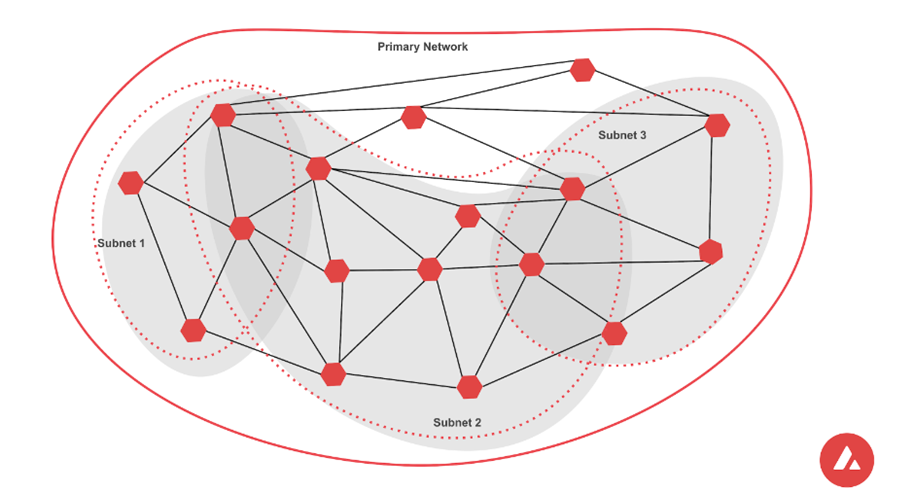

Avalanche Subnets

Avalanche mainnet was launched in September 2020. It introduced a multichain framework with three chains known as P, X, and C. These chains serve crucial and distinct purposes within the Avalanche ecosystem while offering the same capabilities as a single network, also known as the Primary Network. The Avalanche consensus mechanism and Primary Network are specifically designed to support interconnected blockchains called subnets, which function as sovereign entities.

Subnets are a type of validator within the Primary Network and operate using the same Virtual Machines (VMs), but they have their own set of rules. Subnets allow for the creation of customized blockchains to meet specific use cases while ensuring that high-traffic applications do not congest the Primary Network. They also support a separation of concerns. Within the context of blockchain technology, this means validators can focus specifically on blockchains of their interest. Different platforms and developers can also define validator hardware requirements. Developers can design subnets stipulating regulatory compliance by limiting validator locations, requiring licenses, KYC/AML, or defining privacy parameters for on-chain data.

AVAX Token

A subnet must contribute at least one validator to the Primary Network, requiring a stake of 2,000 AVAX. Each subnet has its own consensus mechanism and relies on a varying number of P-Chain validators, ranging from three to all available validators. Subnets can choose between utilizing AVAX for gas or their native token, with most existing subnets currently opting to use their native token. Thus beyond the required stake for the primary network and its utility as a standard unit of account between subnets, incremental AVAX demand from subnets has been limited. Chains launching subnets that use AVAX as the native gas token and the growth of additional subnets on the network could potentially contribute to increased demand.

Polygon Supernets

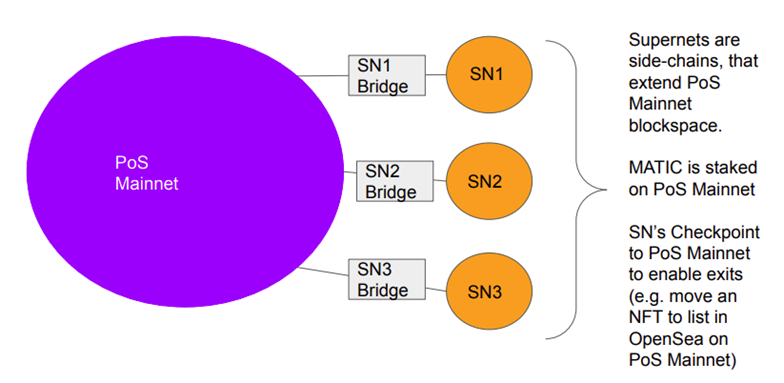

Ethereum sidechain Polygon has recently shifted strategy to begin accommodating appchains through Supernets. Supernets are designed to be a scalability solution that assists developers in creating their own blockchains. Builders on the Polygon network are provided access to various tools and validators for seamless integration and management by third parties. Supernets operate trustless and have built-in EVM (Ethereum virtual machine) support. Essentially, supernets are a collection of interconnected networks which serve as a data-sharing center that supports collaborative work.

MATIC Token

Polygon’s token MATIC was one of the most successful of the last bull cycle, rising over 140x from less than $0.02 in Q4 2020 to an all-time high of $2.92 in December 2021. The team benefitted as a scaling solution for Ethereum that operated as a sidechain with a dynamic native ecosystem. While the network continues to see technological and business development progress, it has faced stiff competition in market share from new Ethereum scaling solutions. The token has underperformed Ethereum and Bitcoin since Q4 ‘22, and it seems the team is looking to rebrand the chain with this recent strategy shift. Currently, there are three options for deployment, each with different implications for MATIC:

- Sovereign Chain for Supernet: This chain is overseen by a sole validator, resulting in substantial cost savings for maintenance expenses.

- Shared Security Chain for Supernet: Expert validators possessing stakes of 20,000 or more Polygon (MATIC) tokens validate this chain, ensuring robust security measures.

- Layer-2 Chain: Currently in the developmental phase, this chain utilizes zero-knowledge rollups to enhance the scalability of supernets.

While no one can say Polygon is resting on its laurels, recent announcements about the strategy shift to appchains and a Zero Knowledge-based ‘value layer’ have failed to drum up enthusiasm for the token. This is likely due to confusion about where the MATIC token will fit in after Polygon undergoes its transition to Polygon 2.0 and allegations from the SEC that MATIC may be an unregistered security. While this grand vision could be signs of strategy drift and execution risk, Polygon could be at the forefront of two massive ecosystem trends in appchains and Ethereum scaling solutions. If the team can deliver, it may be able to capitalize on crucial pivots in the ecosystem as developers seek sovereignty, security, and privacy for their appchains.

Conclusion

The ease and optionality for launching appchains continue to improve as projects begin to understand the benefits of building on an appchain instead of a traditional L1 dApp. The market is starting to see the first signs of the appchain thesis coming into fruition as promising new projects and existing category winners like dYdX chose to maximize value capture by building their own network. In addition to existing Layer-zero networks offering appchain functionality, existing networks are transitioning to multi-network-like architecture, which resembles the world Cosmos and Polkadot envisioned when developers only thought building in an existing L1 was the only option. While there is a clear desire for the sovereignty and customization of appchains, the value capture of tokens of host networks still needs to be determined. Yet as these supporting networks execute their technical vision, they can tie demand for their token to the growing demand for appchain enablement.