Spot ETH ETFs to Launch in Hong Kong, EigenLayer Launches Actively Validated Services

Market Update

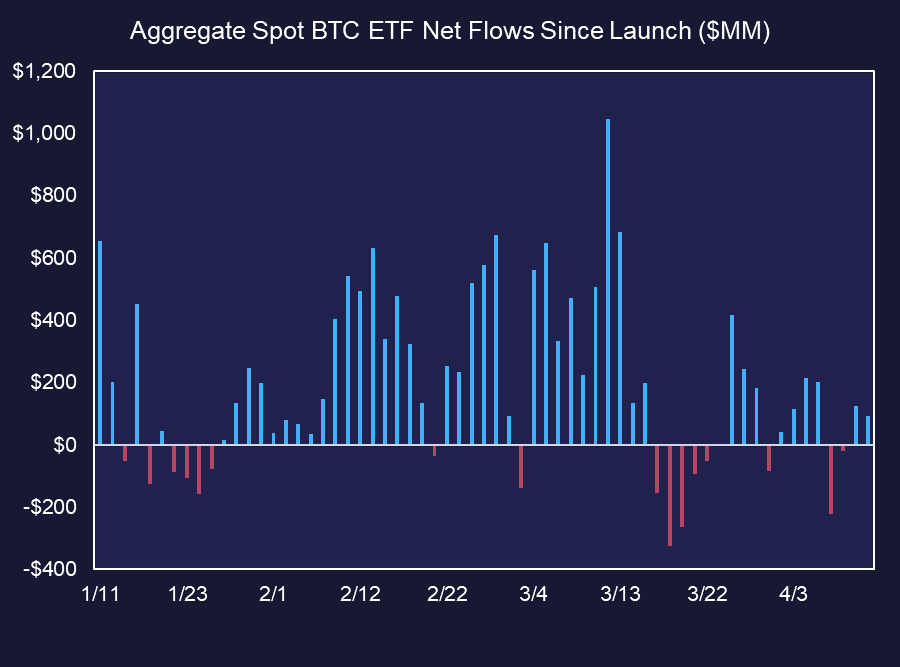

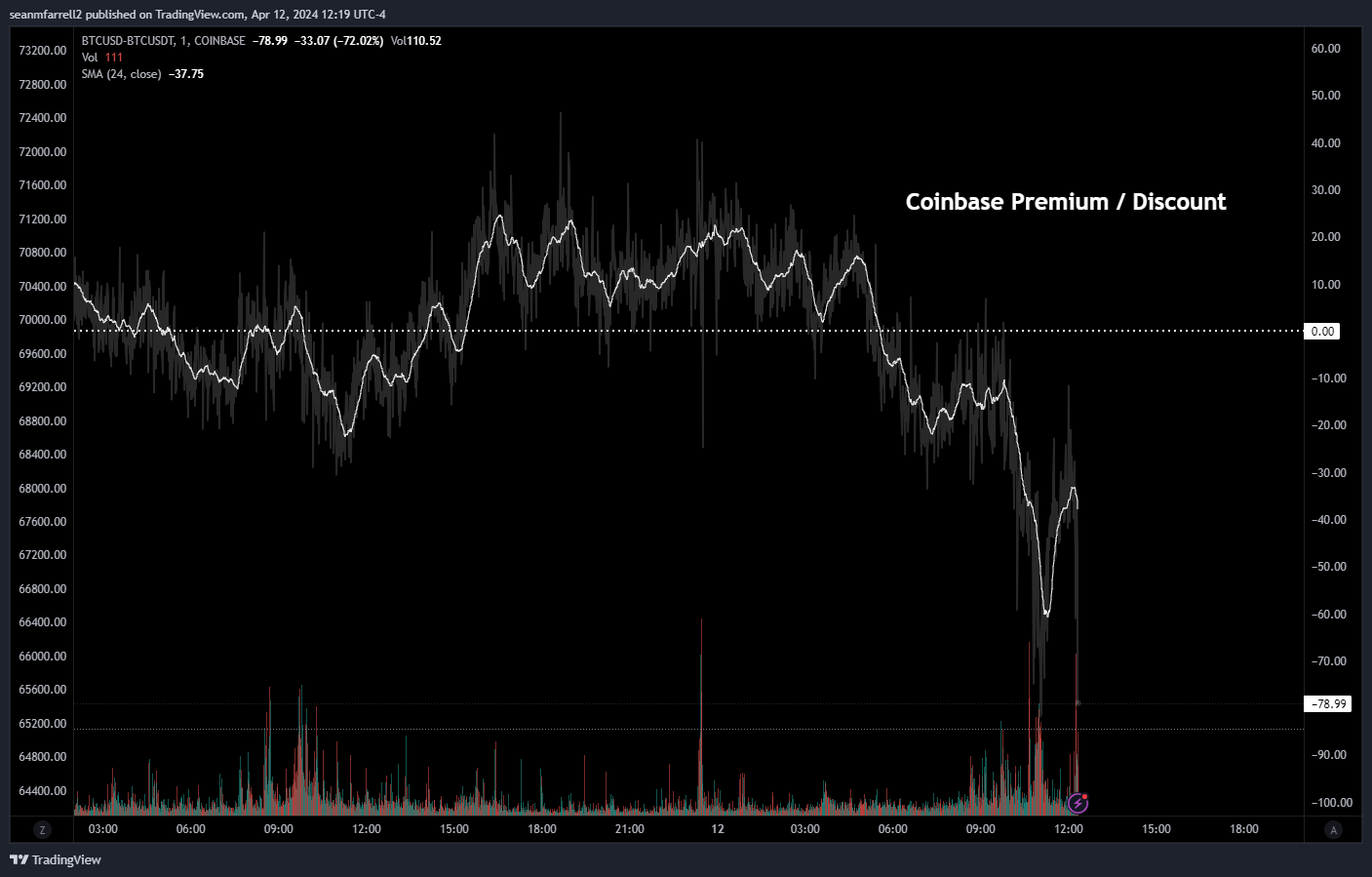

- The subpar consumer sentiment numbers released today likely did not help asset prices, but geopolitics seems to be in the driver's seat today, with rumors of escalation in the Middle East pushing rates lower while driving the DXY and gold higher. Most risk assets, including crypto, have sold off based on these reports. $BTC has retreated from nearly $72k in the overnight hours to $69.5k, while $ETH has dipped below $3500, and $SOL is trading around $167. Altcoins have pulled back more significantly, with very few in the top 100 showing gains today. Despite this, flows into ETFs turned positive over the past two days, a positive sign following a hot CPI print, but there likely were some panic outflows in the morning hours, indicated by the pronounced discount on Coinbase following the US market open. This discount is recovering, and prices seem to be stabilizing.

Source: Farside Investors, Fundstrat

- On Wednesday we discussed rumors about imminent spot BTC ETF approvals in Hong Kong. It appears that, based on today's report from Bloomberg, there is rising confidence that we see both BTC and ETH spot ETFs approved as soon as next week. This approval will allow the Hong Kong subsidiaries of prominent mainland Chinese asset managers, Harvest Fund Management and Bosera Asset Management, to launch bitcoin and ether spot ETFs. This move aligns with the Hong Kong Securities and Futures Commission's (SFC) recent initiatives to broaden institutional investors' engagement with digital assets. According to Singapore-based crypto services company Matrixport, the integration of these ETFs into the Southbound Stock Connect program could channel significant Chinese capital flows, by their estimates potentially unlocking $25 billion in investment flows into these Hong Kong-listed ETFs.

- As part of its stage 3 mainnet launch, EigenLayer has introduced six new actively validated services (AVS) - AltLayer ($ALT), Brevis, Eoracle, Lagrange, WitnessChain, and Xterio. These services, designed to enhance various aspects of the Ethereum ecosystem, follow the initial launch of EigenDA, EigenLayer's first AVS. The functionalities of these new services range from improving blockchain communication speeds to integrating real-world data into decentralized apps. They will be secured using EigenLayer’s restaking protocol, which allows users to restake their ETH or LSTs to support these third-party applications. The next major phase of the EigenLayer rollout introduces in-protocol payments and slashing later this year. The total value locked in EigenLayer now exceeds $15 billion, reflecting its growing influence in the crypto ecosystem.

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

Ethereum's break of Thursday's 3476 lows is a temporary negative technically speaking that likely allows for a bit more weakness into early next week before a rally can get back underway. Today's decline postpones the thoughts of an immediate rally. However, the structural pattern of the recent consolidation has been quite constructive towards suggesting this is a minor pullback only and looks to be taking the shape of a corrective ABC pattern. Thus, initial targets could materialize at levels just fractionally below current prices, which could target 3344. That level would allow for the recent decline from 4/8 to be equal to the more recent weakness from 4/11 peaks, and should constitute an excellent area for dip-buying next week. Following a bit more weakness, a strong push back to new high territory is expected into May and the act of making a daily close back above 3615 should drive a rally to 4090. At present, $ETH consolidation is mirroring the cycle composite that suggests that a low might materialize into 4/20 when the Bitcoin halving takes place. Thus, weakness in ETH, $BTC and other coins likely will encounter some strong support on any weakness into next week.

Daily Important Metrics

All metrics as of April 12, 2024 12:26 PM

All Funding rates are in bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $1.35T | $68,823 | ↓ -1.20% | ↑ 63% | |

ETH ETH | $412B | $3,435 | ↓ -1.56% | ↑ 51% | ↓ -12% |

SOL SOL | $74B | $167 | ↓ -3.23% | ↑ 64% | ↑ 1.13% |

DOGE DOGE | $28B | $0.1943 | ↑ 1.67% | ↑ 118% | ↑ 55% |

ADA ADA | $20B | $0.5605 | ↓ -3.08% | ↓ -5.44% | ↓ -68% |

DOT DOT | $12B | $8.09 | ↓ -1.50% | ↓ -0.22% | ↓ -63% |

LINK LINK | $10B | $17.06 | ↓ -0.31% | ↑ 14% | ↓ -49% |

MATIC MATIC | $8.3B | $0.8415 | ↓ -2.73% | ↓ -12% | ↓ -75% |

NEAR NEAR | $6.9B | $6.54 | ↓ -3.15% | ↑ 82% | ↑ 19% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| BITW | ↓ -32% | $34.31 | ↓ -1.97% | ↑ 47% | ↓ -16% |

| ETHE | ↓ -23% | $24.93 | ↓ -3.09% | ↑ 29% | ↓ -34% |

News

QUICK BITS

The Block Hong Kong to approve spot bitcoin, ether ETFs as soon as Monday: Bloomberg Hong Kong regulators are expected to greenlight spot ETFs for both bitcoin and ether as early as Monday, Bloomberg reported. |

The Block Anza releases proposed congestion fixes on Solana devnet, asks validators to upgrade on testnet Anza, Solana’s development and client team, deployed a congestion fix (via version 1.18.11) to the devnet. |

CoinDesk Hong Kong-Listed Bitcoin ETFs Could Unlock Upto $25B in Demand, Crypto Firm Says Singapore-based Matrixport expects mainland Chinese investors to move billions into potential Hong Kong-listed spot BTC ETFs through the Stock Connect program. |

MARKET DATA

CoinDesk Bitcoin Meme Coin PUPS Fuelled by Hype Ahead of Runes Release Ordinals and Runes are both projects by long-time Bitcoin developer Casey Rodarmor, which has created trust and lent an idea of authenticity among users. |

The Block BlackRock’s spot bitcoin ETF crosses $15 billion in total inflows BlackRock’s IBIT spot bitcoin ETF is now in the top 100 of all exchange-traded funds by assets under management. |

DOSE OF DEFI

CoinDesk Chaos at MarginFi Shakes up Solana DeFi's Borrow-and-Lend Landscape Solend and Kamino were the biggest winners in the Solana DeFi landscape. |

The Block $26 million in ‘unnecessary liquidations’ hit Blast-based lender Pac Finance An Aave fork on Blast unexpectedly updated its liquidation threshold, causing a large swatch of liquidations. |

WEB 3.0

The Block EigenLayer has introduced six new actively validated services with the mainnet rollout earlier this week, advancing its ecosystem. |

Reports you may have missed

Major equity indices are rallying on the back of solid earnings, with both the $SPX and $QQQ up over 1%. Meanwhile, crypto markets are churning lower, which is understandable as we should not expect crypto to rally alongside equities during an earnings-driven market. Crypto remains an apparently undecided market ahead of next week's FOMC meeting and the Quarterly Refunding Announcement (QRA), evidenced by another day of ETF outflows and a...

U.S. equity indices are under pressure today following disappointing economic growth in conjunction with hotter-than-expected prices paid, sparking stagflation fears and reducing the chances of rate cuts. The $SPY has declined 0.91% to test $501 and the $QQQ has dropped 1.12% to $421, being weighed down by a 12% drop in META following its Q1 earnings release. Crypto markets are faring better, with BTC -1.15% (-0.28%) trading at $64k and ETH -4.33% ...

The crypto market is pulling back from its recent surge, with $BTC falling below $65,000, $ETH trading under $3,200, and $SOL fighting to stay above $150. As expected, altcoins are also generally declining, although a few notable performers are scattered across the market. Currently, $BONK and $WIF, two prominent memecoins on Solana, are showing resilience, up 12% and 6%, respectively. Additionally, $HBAR initially doubled in price following reports that Blackrock...

Blockchain Association Sues the SEC, Cosmos Patches Potential Reentrancy Vulnerability

U.S. Treasury rates and the DXY (-0.46%) are sliding today following weaker-than-expected S&P Flash PMI data, helping catalyze a 1% rally in equity indices. Manufacturing PMI came in at 49.9 vs. 52.0 expected, and Services PMI read 50.9 vs. 52.0 expected. Bitcoin miners have benefited as rates retreat and transaction revenue remains elevated, with $RIOT, CLSK, and $MARA showing weekly gains of 26%, 16%, and 14%, respectively. Crypto assets are mixed with BTC -1.15% ...