Metaplanet Takes the MicroStrategy Approach, SOL Nears Important Support Level

Market Update

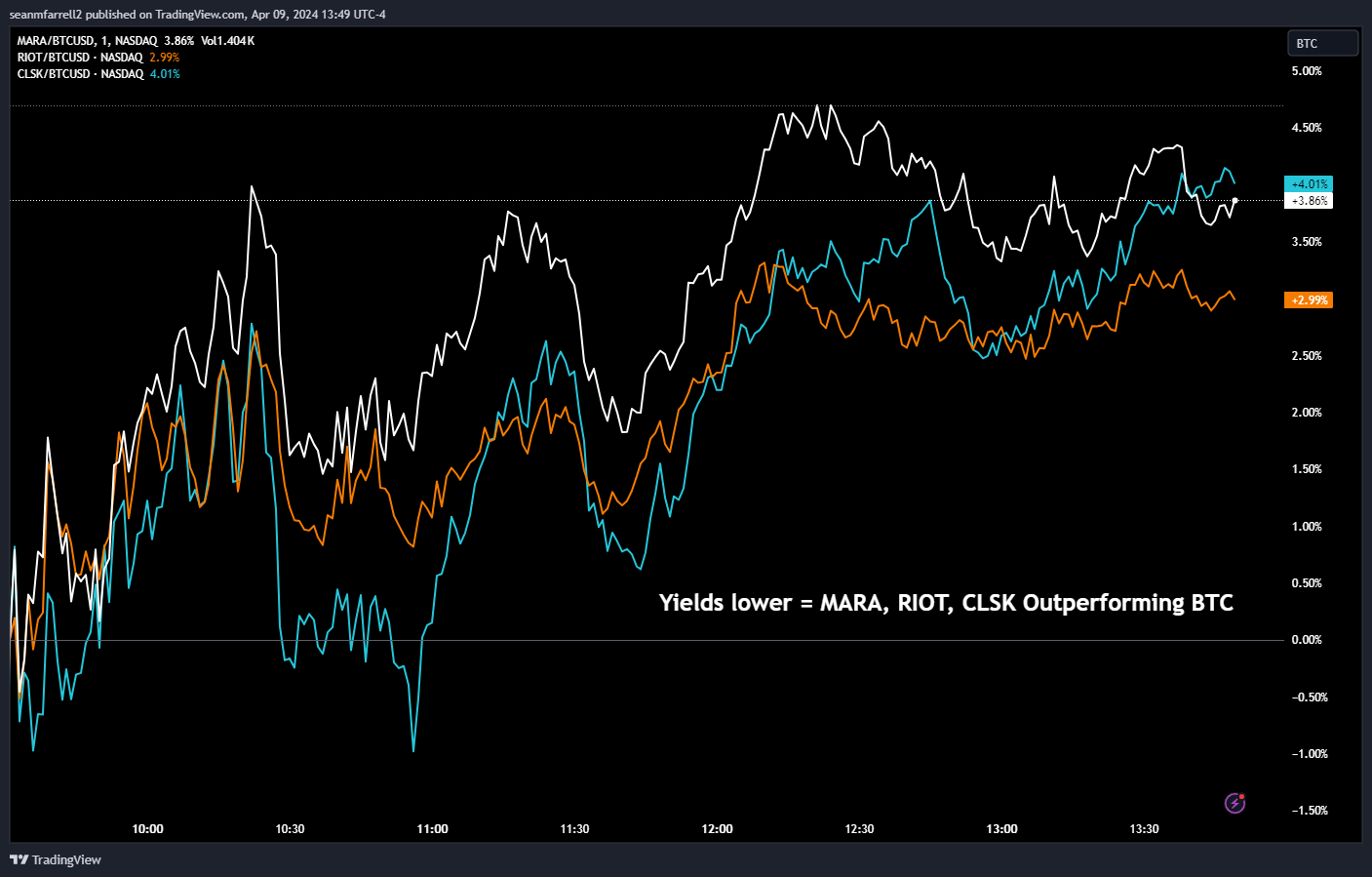

- It has been a challenging day for crypto prices, with $BTC giving back yesterday's gains to fall to $68.5k, $ETH declining to $3,500, and $SOL currently trading around $176. Most altcoins are also experiencing downturns. The lone standout among large cap crypto assets today is $TON, which is rallying on rumors of USDT launching on the TON Network. Equity indices also faced a drawdown earlier in the day, sliding after the US market opened. However, they have since recouped most of their losses, with the SPX down by 0.3% and the QQQ down a mere 0.10%. Interest rates are declining in anticipation of a significant CPI report tomorrow, with the consensus expecting a 3.4% headline CPI and a 3.7% Core CPI. Meanwhile, gold continues to demonstrate resilience, reaching yet another all-time high. Today's market dynamics offer a clear illustration of how interest rates impact miner performance in relation to Bitcoin. Although miners are not witnessing a dramatic surge, the major ones are outperforming Bitcoin, likely due to today's sharp decrease in interest rates.

- Metaplanet, originally a budget hotel operator turned Web3 infrastructure provider, experienced a 90% surge in its share price over two days, following the announcement of adding $6.56 million worth of Bitcoin to its balance sheet. This strategic move, made in collaboration with Sora Ventures, Morgan Creek Capital's Mark Yusko, and others, aims to reduce Metaplanet's exposure to the Japanese yen, which has suffered due to Japan's prolonged low-interest-rate environment. Additionally, the company intends to provide Japanese investors with an avenue to crypto investment through a publicly traded entity, leveraging a preferential tax structure amidst Japan's high taxes on unrealized crypto gains. This strategy draws inspiration from MicroStrategy, known for its significant Bitcoin holdings, and represents a broader trend of corporations integrating Bitcoin into their treasury assets as a hedge against inflation and a means for long-term capital appreciation.

- DeBridge, a cross-chain interoperability protocol, has initiated the first season of its points program as a precursor to its anticipated token launch, retroactively rewarding over 200,000 existing users for their loyalty and $2.3 million in collective fee contributions based on past engagement. The program, which includes partners like Jupiter and Solflare who have incorporated deBridge into their offerings, aims to incentivize both past and future user activities by offering enhanced rewards and encouraging new users to explore its efficient, liquid, and competitively priced bridge transfers. With plans to decentralize governance and distribute power among its community through these points, deBridge is moving towards the introduction of its native token, details and timelines of which remain under wraps. Amidst this, the protocol's unique approach to liquidity transfers—eschewing the need for asset locking for direct chain-to-chain transfers—stands out as a significant innovation, having already facilitated nearly $1 billion in transactions and attracted 112,000 new users in the recent quarter.

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

Solana has now pulled back to what should represent an important area of near-term support for this recent weakness. $SOL lies right near 4/5 lows which also lies right at an area of support drawn from the bottom made back on 3/20. Given that two prior minor lows happened near this area, it can add to the likelihood of being a significant area to pay attention to. However, interestingly enough, $SOL daily pattern looks nearly identical to the formation shown by $NVDA on its own path through the month of March into April, with initial peaks in March that were tested successfully with a lower high in late March before pulling back to test the prior lows in early March. Specifically, when projecting forward in NVDA's pattern about a week, one can make out nearly the exact same pattern for Solana. In NVDA's case, the retest of lows failed to hold and the stock went lower this week. Applying this same possibility to SOL, any breach of $168 would be thought to decline to $160-$162 which looks formidable as support and should not represent anything more than just minor near-term weakness in its larger pattern. Thereafter, i expect a push back higher in $SOL into late April into May, where i expect this to make new all-time highs. Overall, despite many viewing this pattern as being bearish, i feel that the entire consolidation since mid-March merely represents a choppy, overlapping corrective pattern which should prove short-lived and buyable within the next couple weeks on any further weakness. The ability to make a weekly close back over $185 would signify the first real sign of strength which could take SOL back to new highs.

Daily Important Metrics

All metrics as of April 9, 2024 1:15 PM

All Funding rates are in bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $1.35T | $68,813 | ↓ -4.15% | ↑ 63% | |

ETH ETH | $421B | $3,503 | ↓ -4.85% | ↑ 54% | ↓ -8.97% |

SOL SOL | $78B | $176 | ↓ -2.81% | ↑ 73% | ↑ 9.71% |

DOGE DOGE | $27B | $0.1891 | ↓ -7.36% | ↑ 112% | ↑ 50% |

ADA ADA | $21B | $0.6023 | ↓ -1.68% | ↑ 1.61% | ↓ -61% |

DOT DOT | $13B | $8.89 | ↓ -1.48% | ↑ 9.62% | ↓ -53% |

LINK LINK | $10B | $17.57 | ↓ -3.91% | ↑ 17% | ↓ -46% |

MATIC MATIC | $8.9B | $0.9033 | ↓ -4.24% | ↓ -5.92% | ↓ -69% |

NEAR NEAR | $7.8B | $7.40 | ↓ -0.74% | ↑ 106% | ↑ 43% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| BITW | ↓ -32% | $33.61 | ↓ -4.85% | ↑ 44% | ↓ -19% |

| ETHE | ↓ -22% | $25.30 | ↓ -6.99% | ↑ 30% | ↓ -32% |

News

QUICK BITS

CoinDesk Stablecoins Are Seeing Adoption as a Cross-Border Settlement Mechanism: Bernstein Solana is leading the field in blockchain payments, but the network has scalability issues, the report said. |

The Block Uphold adding Bitcoin support to its new Vault wallet The company's recently launched Vault wallet is adding Bitcoin support at a time when the community appears to be growing. |

MARKET DATA

CoinDesk Solana Meme Coin Generator Pump on Track for $66M Yearly Revenue The tool has made over $5 million since going live in early March, with thousands of tokens issued daily. |

CoinDesk Metaplanet Shares Soar as Japanese Firm Mimics MicroStrategy on Bitcoin Buying Metaplanet began as Red Planet Japan, a budget hotel operator, before pivoting to become a Web3 developer. |

The Block Solana DEX Zeta Markets set to airdrop 100 million Z tokens Zeta Markets, a Solana-based decentralized exchange, is set to launch and airdrop 100 million Z tokens next month. |

REGULATION

The Block SEC delays decision on spot bitcoin ETF options American regulators are again delaying a decision by 45 days on whether to allow options on spot bitcoin ETFs. |

CoinDesk Key Congressman McHenry Is Bullish U.S. Stablecoin Law Will Pass This Year The window is narrowing for legislation to set up rules for stablecoin issuers in 2024, but the retiring chairman of the House Financial Services Committee says... |

FUNDRAISING AND M&A

CoinDesk Blockchain Developer Monad Labs Raises $225M Led by Paradigm The company is looking to offer an Ethereum-compatible environment that's faster than the original. |

The Block A16z Crypto Startup Accelerator joins $3.2 million seed round for OpenTrade Backers include the a16z Crypto Startup Accelerator (CSX), CMCC Global, Draper Dragon, Ryze Labs and Plassa Capital. |

The Block KIKI World offers users blockchain-based rewards, collectibles and community experiences centered around beauty products. |

Reports you may have missed

Investors will have a lot to digest this week, including various data releases such as consumer confidence, ADP Employment, JOLTS, and non-farm payrolls. Likely more important is the FOMC meeting and Treasury Quarterly Refunding Announcement (QRA), both set for Wednesday. Equities are gaining to start the week with the $SPY and $QQQ both up approximately 0.30% as the DXY 0.00% (-0.44%) slides after the BOJ intervened to support the Yen against the dollar. Crypto assets are struggling so...

Major equity indices are rallying on the back of solid earnings, with both the $SPX and $QQQ up over 1%. Meanwhile, crypto markets are churning lower, which is understandable as we should not expect crypto to rally alongside equities during an earnings-driven market. Crypto remains an apparently undecided market ahead of next week's FOMC meeting and the Quarterly Refunding Announcement (QRA), evidenced by another day of ETF outflows and a...

U.S. equity indices are under pressure today following disappointing economic growth in conjunction with hotter-than-expected prices paid, sparking stagflation fears and reducing the chances of rate cuts. The $SPY has declined 0.91% to test $501 and the $QQQ has dropped 1.12% to $421, being weighed down by a 12% drop in META following its Q1 earnings release. Crypto markets are faring better, with BTC 1.86% (-0.28%) trading at $64k and ETH -0.39% ...

Crypto assets are building on the weekendâs gains. $BTC (+3.47%) eclipsed $72.7k this morning before paring gains to approximately $71.8k. $ETH (+5.58%) is showing relative strength today, gaining to $3,650, helping the ETHBTC ratio reclaim the .05 mark. Last weekâs ETF net flows totaled $484 million, displaying the continued demand for exposure among traditional investors. Equity indices are relatively flat today, with the SPY and QQQ both gaining about 0.05%...