Crypto Market Breaking Higher Ahead of CPI, MSTR Purchases $800M in BTC

Market Update

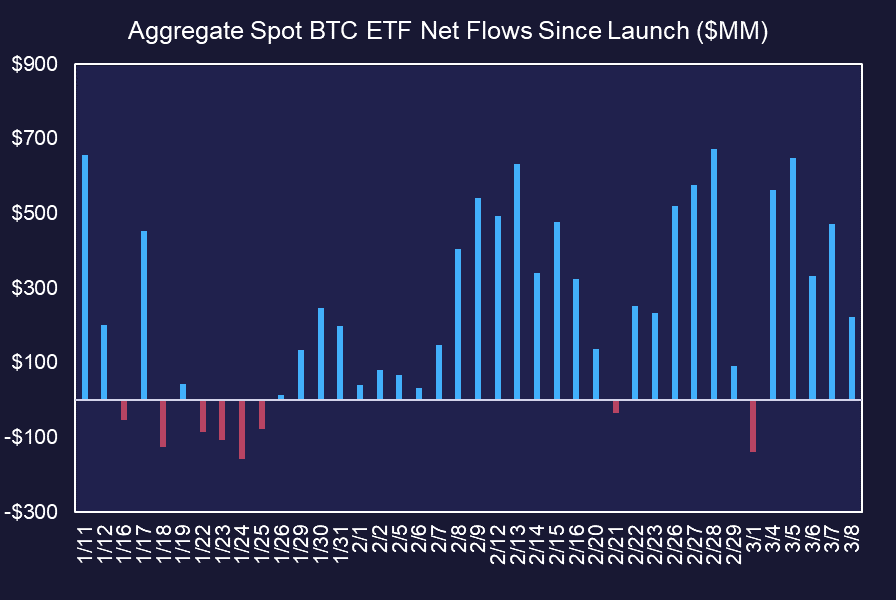

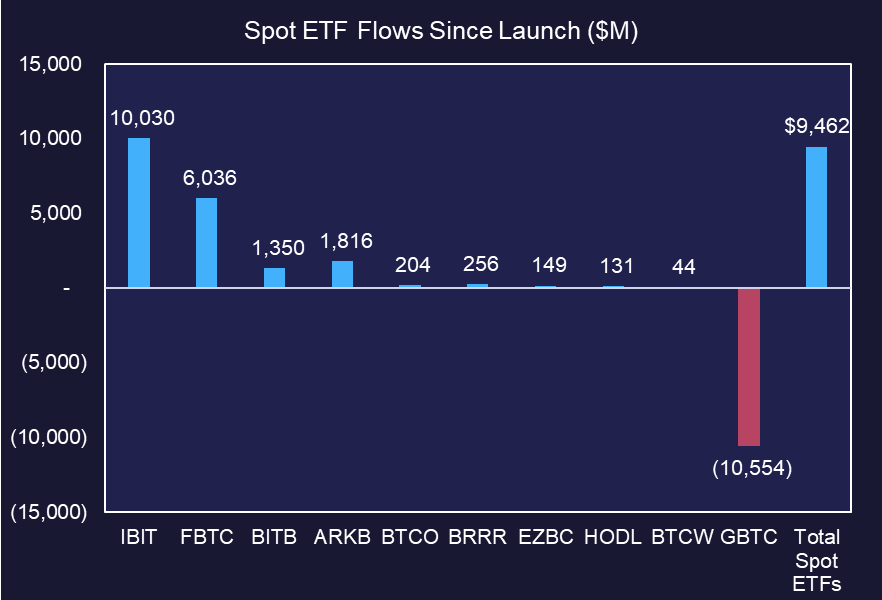

- Bitcoin broke out above $70k during the overnight hours, now floating above $72k, marking another new ATH. This price action was closely mirrored by $ETH's resurgence above $4k, currently trading around $4050. $AVAX is outperforming on the day, following the announcement that South Korean game publisher Nexon Group will transition its popular MMO RPG, MapleStory, onto the Avalanche network as MapleStory Universe. Meanwhile, $NEAR also continues to outperform, likely fueled by anticipation of NEAR co-founder's upcoming appearance on a panel alongside NVIDIA CEO Jensen Huang at next week's conference. Despite the backdrop of rising rates ahead of an anticipated hot CPI print on Wednesday, the crypto market is showing remarkable strength. MSTR and COIN are both experiencing upward momentum this afternoon as well, following the announcement that MSTR closed $800 million in convertible notes and used the proceeds to purchase more $BTC (more details below). These flows transpired last week alongside another $2.2 billion in net inflows from BTC ETFs (chart below). However, miners continue to find themselves under pressure, underperforming against BTC due to the elevated rate environment. Major equity indices such as the QQQ and SPX are witnessing slight declines, down 0.30% and 0.20%, respectively, on the day, while gold continues to show strength, up approximately 0.20% today.

Source: Farside Investors, Fundstrat

- MicroStrategy completed an offering of 0.625% convertible senior notes due in 2030, raising an aggregate principal amount of $800 million. This total includes an additional $100 million of notes issued following the full exercise of an option by initial purchasers. The offering featured notes convertible into cash, MicroStrategy's class A common stock, or a combination thereof, under specific conditions. The initial conversion rate is 0.6677 shares per $1,000 principal amount, implying a premium over the stock price as of the closing date. The proceeds were used to acquire an additional 12,000 BTC for $821.7 million, utilizing both the proceeds from the convertible notes and excess cash, at an average price of $68,477 per bitcoin. MicroStrategy now holds 205,000 BTC, acquired for $6.91 billion at an average price of $33,706 per bitcoin. The offering, initially set at $600 million, closed at $800 million, indicating significant investor interest in potentially securing MSTR stock, a proxy for BTC, at a discount upon conversion.

- The Ethereum network is set for a significant upgrade this week with the deployment of the Dencun upgrade on Wednesday. This upgrade is designed to address key areas of scalability, efficiency, and security, with a particular focus on EIP-4844, also known as proto-danksharding. Proto-danksharding introduces the concept of temporary data blobs in transactions, which is expected to substantially reduce gas fees for rollups like $OP and $ARB and enhance the network's scalability by increasing throughput and lowering transaction costs. By improving the user experience (UX), Dencun aims to promote broader adoption of layer-two rollups. These rollups process transactions on the L2 to boost efficiency and reduce costs, while still relying on the Ethereum mainchain for security assurances.

- Jito Labs, a developer of an alternative $SOL client, has decided to discontinue its mempool functionality, which was a crucial component of its technology but facilitated expensive front-running, or sandwich attacks, on crypto traders. Although Solana's core system doesn't include a mempool, Jito's client did, through its Block Engine aimed at optimizing MEV on-chain. This move comes after a six-week struggle to curb exploitative trading strategies that preyed on transactions waiting in the Jito mempool. Despite efforts to mitigate these negative MEV effects through various means, the persistent issue led Jito Labs to ultimately remove the mempool. Jito Labs remains committed to enhancing Solana's performance for all users while seeking other revenue avenues for validators and stakers.

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

Fantom's breakout above late December peak at 0.566 resulted in a sharp period of upward acceleration that has carried $FTM prices to the highest levels since Spring 2022. Technically speaking, this breakout represented a move above a one-year Cup and Handle pattern which often can prove bullish when the neckline of this pattern is exceeded. While short-term momentum has gotten overbought following a doubling in price since late February just a few weeks ago, FTM's rally has barely even retraced 0.236% of the prior decline since late 2021. Thus, FTM has seen a rapid period of mean reversion in recent weeks, but remains well off all-time high territory. Upside targets lie near $1.42, with intermediate-term resistance found at $1.82, near the 50% retracement of its entire decline from 2021. Technically this remains in a bullish upward acceleration phase, and dips should likely find strong support near 0.60-0.70 before pushing higher.

Daily Important Metrics

All metrics as of March 11, 2024 10:15 AM

All Funding rates are in bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $1.43T | $72,597 | ↑ 4.05% | ↑ 72% | |

ETH ETH | $485B | $4,040 | ↑ 2.87% | ↑ 78% | ↑ 5.66% |

SOL SOL | $65B | $147 | ↑ 1.17% | ↑ 44% | ↓ -28% |

ADA ADA | $27B | $0.7630 | ↑ 5.24% | ↑ 29% | ↓ -43% |

DOGE DOGE | $25B | $0.1739 | ↑ 0.19% | ↑ 95% | ↑ 23% |

DOT DOT | $14B | $10.76 | ↑ 4.26% | ↑ 33% | ↓ -39% |

LINK LINK | $12B | $21.07 | ↑ 6.20% | ↑ 41% | ↓ -31% |

MATIC MATIC | $12B | $1.21 | ↓ -1.38% | ↑ 26% | ↓ -46% |

NEAR NEAR | $7.1B | $6.78 | ↑ 14% | ↑ 88% | ↑ 17% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| GBTC | ↑ 1.04% | $64.81 | ↑ 6.05% | ↑ 76% | ↑ 3.98% |

| BITW | ↓ -34% | $38.02 | ↑ 3.06% | ↑ 55% | ↓ -17% |

| ETHE | ↓ -6.71% | $35.23 | ↑ 2.14% | ↑ 81% | ↑ 9.13% |

| BTCC | ↑ 0.09% | $13.19 | ↑ 4.68% | ↑ 61% | ↓ -11% |

News

QUICK BITS

The Block Bloomberg analysts substantially lower likelihood of spot Ethereum ETF approval in May to 30% Analysts are noting a lack of signs — such as filings — that would indicate the SEC is gearing up to let in more crypto ETFs. |

MARKET DATA

CoinDesk Crypto Funds Weekly Inflows Surge to Record of $2.7B Bitcoin remained the focus of investors seeing $2.8 billion worth of inflows. |

CoinDesk Bitcoin Surge Sees Crypto Trading Volumes Exceed the Stock Market in South Korea The KOSPI trading volume recorded 11.4794 trillion won on Mar.8, compared to nearly 12 trillion won on local crypto exchanges on Sunday. |

CoinDesk Bitcoin CME Futures' Open Interest Reaches Record High of $10B Notional open interest refers to the dollar value of the active or open futures contracts at a given time. |

CoinDesk MicroStrategy Acquires 12,000 BTC With Convertible Senior Notes Proceeds The software firm, founded by staunch bitcoin advocate Michael Saylor, now holds 205,000 BTC worth around $14.7 billion. |

FUNDRAISING AND M&A

The Block Eclipse Labs raises $50 million in Series A funding ahead of expected Q2 mainnet Eclipse Labs is developing an Ethereum Layer-2 solution using the Solana Virtual Machine (SVM), aiming for scalability and composability. |

WEB 3.0

The Block Iconic MMORPG MapleStory moves to Web3 with Avalanche Nexon Group announced its partnership with Ava Labs to launch its online role-playing game MapleStory on the Avalanche network. |

The Block Tether to launch USDT stablecoin on Celo blockchain Tether is set to launch its USDT stablecoin on Celo, an EVM-compatible blockchain that is transitioning to an Ethereum Layer 2 network. |

Reports you may have missed

Major equity indices are rallying on the back of solid earnings, with both the $SPX and $QQQ up over 1%. Meanwhile, crypto markets are churning lower, which is understandable as we should not expect crypto to rally alongside equities during an earnings-driven market. Crypto remains an apparently undecided market ahead of next week's FOMC meeting and the Quarterly Refunding Announcement (QRA), evidenced by another day of ETF outflows and a...

U.S. equity indices are under pressure today following disappointing economic growth in conjunction with hotter-than-expected prices paid, sparking stagflation fears and reducing the chances of rate cuts. The $SPY has declined 0.91% to test $501 and the $QQQ has dropped 1.12% to $421, being weighed down by a 12% drop in META following its Q1 earnings release. Crypto markets are faring better, with BTC -0.82% (-0.28%) trading at $64k and ETH 3.80% ...

It has been a challenging day for crypto prices, with $BTC giving back yesterday's gains to fall to $68.5k, $ETH declining to $3,500, and $SOL currently trading around $176. Most altcoins are also experiencing downturns. The lone standout among large cap crypto assets today is $TON, which is rallying on rumors of USDT launching on the TON Network. Equity indices also faced a drawdown earlier in the day, sliding after...

Crypto assets are building on the weekendâs gains. $BTC (+3.47%) eclipsed $72.7k this morning before paring gains to approximately $71.8k. $ETH (+5.58%) is showing relative strength today, gaining to $3,650, helping the ETHBTC ratio reclaim the .05 mark. Last weekâs ETF net flows totaled $484 million, displaying the continued demand for exposure among traditional investors. Equity indices are relatively flat today, with the SPY and QQQ both gaining about 0.05%...