CeFi, DeFi, and Everything In Between

Key Takeaways

- Over the past two weeks, we have seen the bear markets bringing out the worst in digital asset markets. We attempt to define and outline the differences and similarities of these entities that are crucial infrastructures in digital asset markets.

- Centralized Finance (CeFi) encompasses intermediaries that work with other centralized service providers to offer financial products and services to their customers. Conversely, Decentralized Finance (DeFi) comprises platforms that leverage smart contracts to offer similar products and services, all in a permissionless manner.

- Three Arrows Capital (3AC) started as a prop shop but began to take external capital from CeFi to lever up on their own equity, far beyond their legal remit. If we can extract any lessons from 3AC’s unwinding, perhaps this serves as a reminder of the Halo Effect when it comes to fund managers in crypto.

- While 3AC exemplified the opacity of CeFi dealings, not all DeFi protocols are transparent and immutable, despite users self-custodying their own funds. Solend, the largest borrowing and lending platform on Solana, voted to control the funds of their largest depositor on the platform. They later reversed this decision, undermining decentralization and immutability in DeFi.

- Solend’s governance fiasco was only made possible by ‘upgradeable smart contracts’, which allows developers to iteratively add new features to their projects, or fix any bugs they may find in production. Done correctly, smart contact code should be upgraded by a DAO controlled by the community that collectively owns the protocol, not by the developers directly.

- Solend was not the first DeFi protocol to do so - Merit Circle (MC) held a vote to cancel Yield Guild Game’s (YGG) SAFT in May. Although MC put forth credible arguments for the removal of YGG as a seed investor, this sets a dangerous precedent for future deals.

- Closing Thoughts: The crypto winter of ‘22 has been a challenging time for digital asset markets. The takeaway from all these different developments and stakeholders is that crypto still has a long way to go before we deserve mainstream adoption. Investors should look for projects that are ideologically and practically aligned with the permissionless, peer-to-peer, governance-minimized protocols that represent the backbone of this industry.

Over the past two weeks, we have seen the bear markets bringing out the worst in digital asset markets. Rumors of insolvency flew rampant in the face of volatility, affecting behemoths that were previously deemed ‘too sophisticated/large to fail.’

Celsius, which we covered in detail in The Tide Pulling Out, was one of the first to waver, fueling fears of contagion in this nascent space. We then wrote about 3AC’s unwinding in Three Arrows (Right to the Chest), noting how even behemoths in the space are susceptible to hubris and mental bias.

It is more important now than ever to discern the rumors from the truth, the guilty from the innocent. Only by continually identifying (ir)responsible actors and extracting learnings from each black swan event, can we advance the space towards mainstream adoption.

CeFi & DeFi

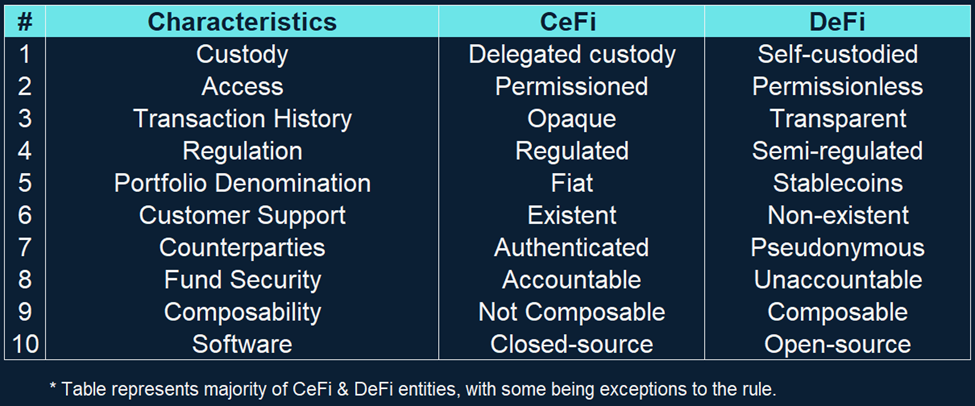

Before diving into the specifics, we attempt to define and outline the differences and similarities of these entities that are crucial infrastructures in digital asset markets. Centralized Finance (CeFi) encompasses intermediaries that work with other centralized service providers to offer financial products and services to their customers. Some prominent examples include crypto exchanges such as Binance and FTX, custodians such as BitGo, and prime brokerages such as FalconX.

Conversely, Decentralized Finance (DeFi) comprises platforms that leverage smart contracts to offer similar products and services, all in a permissionless manner. Using DeFi protocols necessitates technical knowledge and autonomy, leaving users susceptible to losses from buggy code, malicious actors, and simple user errors.

Prior to insolvency issues in recent weeks, CeFi was generally considered ‘safer’ than DeFi due to its regulatory scrutiny and accountability towards user funds, offering returns of DeFi in exchange for a spread. Illustrated by the examples below, however, the lines between CeFi and DeFi are getting increasingly blurry, birthing the term ‘CeDeFi.’

Final Thoughts on Three Arrows Capital

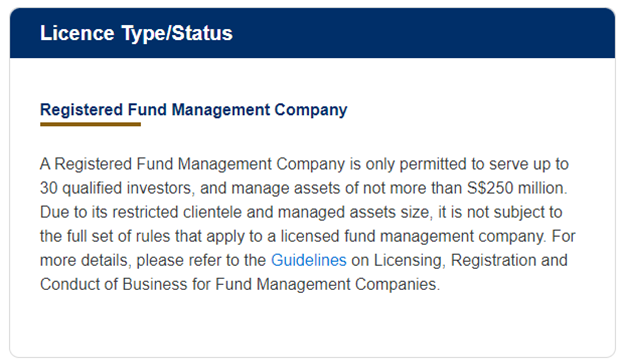

For those who missed last week’s Crypto Weekly, Three Arrows Capital (‘3AC’) was once regarded as a premier multi-strategy hedge fund in the Southeast Asian region. Established by former classmates Su Zhu and Kyle Davies in 2012, the fund was rumored to have $10 – $18 billion AUM at its peak. 3AC started as a prop shop but began to take external capital to lever up on their own equity, far beyond their legal remit.

Figure: 3AC’s Registration Parameters with MAS

3AC’s woes started with the unwinding of LUNA & UST 0.74% , as they had committed more than $200m to buy locked LUNA tokens as part of Luna Foundation Guard’s $1 billion raise in February. While they were not the only fund caught offside (50% of hedge funds had some form of exposure to LUNA), 3AC had borrowed against relatively illiquid products GBTC 5.61% (Grayscale) and $stETH (Lido Finance) to be long on other assets.

“Having a large amount of leverage is like driving a car with a dagger on the steering wheel pointed at your heart. If you do that, you will be a better driver. There will be fewer accidents but when they happen, they will be fatal.”

Warren Buffett

And indeed, leverage proved fatal to 3AC. Luna’s collapse introduced a significant amount of BTC sell pressure into the market, which in turn hurt the collateral ratios of their leveraged positions. To make matters worse, the Fed’s liquidity tightening measures exacerbated the prices at which they could exit – stETH traded at 7% discount to ETH earlier this month and the GBTC discount to NAV reached all time lows at ~34%.

Consequently, 3AC repaid 40k ETH and removed 100k stETH from Aave in the last two weeks alone. Established DeFi protocols (such as Aave) performed as designed, highlighting their permissionless nature during this period of market volatility.

Despite their efforts to de-leverage, 3AC has confirmed to be liquidated by FTX, Deribit and BitMEX and has largely remained in radio silence, except for the tweet below confirming their distressed situation.

Figure: Su Zhu Confirming 3AC’s Insolvency Rumors

Funds blowing up are nothing new, even for giants like 3AC (cc: Archegos Capital Management). But their size was size, and undercollateralized leverage across multiple counterparties spelled contagion. 3AC’s once stellar reputation in the space served as a double-edged sword – lenders across the industry have been extending leverage to them, even uncollateralized ones.

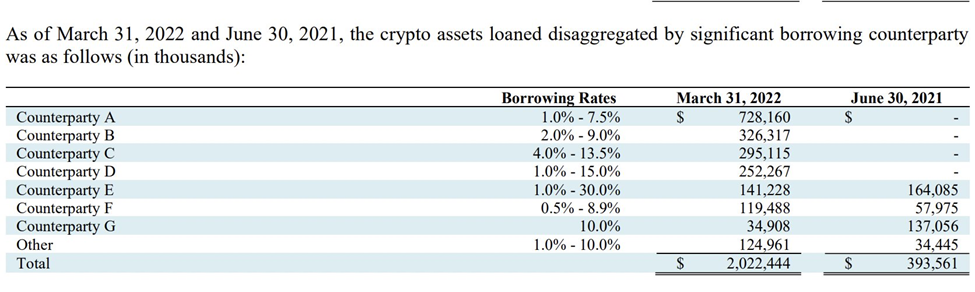

Although the details of their insolvency remain opaque, several stakeholders have accused 3AC of gross negligence. So far, seven counterparties are speculated to have some exposure towards 3AC’s bad debt, with potentially more to surface as liquidity continues to tighten. Voyager reported $666m in uncollateralized, unrepaid loans from 3AC, reflecting 33% of their loan book per their Q1 ‘22 report.

But the 3AC saga didn’t stop with financial degeneracy (read: irresponsible leverage) – some have accused them of criminal wrongdoing. DeFiance Capital and Starry Night Capital, once closely linked to 3AC, have worked to distance themselves from the troubled firm after rumors of 3AC illegally tampering with their funds. Arthur hinted at a relationship gone sour, while Starry Night Capital moved their entire portfolio to a single wallet address.

Even smaller firms were not spared. 3AC allowed smaller firms to trade through their account, effectively running an unlicensed prime broker. 8 Blocks Capital alleged that 3AC withdrew $1m of their funds and ‘ghosted’ them upon requests to withdraw their own capital.

Figure: 8 Blocks Capital CEO Alleging that 3AC Misappropriated Their Funds

These stakeholders and creditors lent funds and dealt with 3AC off-chain, aptly illustrating CeFi’s lack of transaction history transparency as described above. If we can extract any lessons from 3AC’s unwinding, perhaps this serves as a reminder of the Halo Effect[1] when it comes to fund managers in crypto.

These funds are run by humans (albeit smart ones) and are susceptible to the same mental biases as you and I. They face the same in hubris and deterministic thinking in the face of success in the bull markets. Let this serve as a reminder that markets are often unpredictable, even for the mortals that many put atop a pedestal.

As of last week, 3AC’s Kyle Davies has commented that they are “exploring options including asset sales and a rescue by another firm”, although it is unclear which firm is interested in assuming their bad debt. While the full extent of 3AC’s contagion is still unknown, we plan to follow and report on relevant developments. In the meantime, we have compiled a bundle of public wallets we believe to be owned by 3AC here.

Solend – Solana’s CeDeFi Protocol

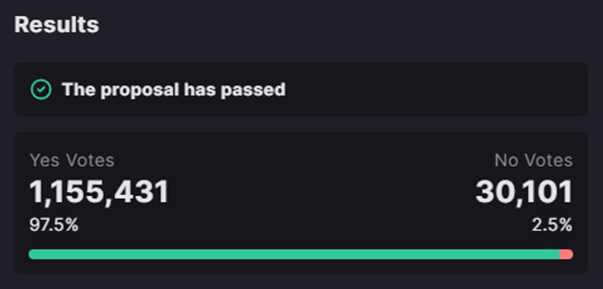

While 3AC exemplified the opacity of CeFi dealings, not all DeFi protocols are transparent and immutable, despite users self-custodying their own funds. Solend, the largest borrowing and lending platform on Solana by TVL, held their first governance vote to control the funds of their largest depositor on the platform, which passed with a 97.5% majority.

Figure: Solend’s First Governance Proposal (SLND1) Poll Results

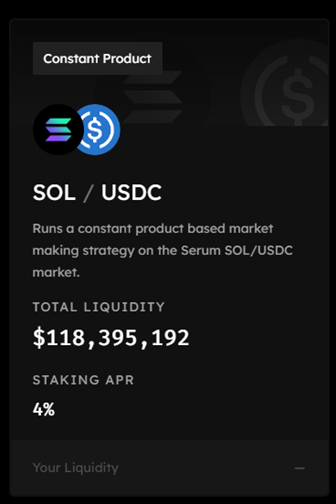

As of 19th June, this particular whale had 5.7M SOL deposited ($170M) on Solend and borrowed $108M of USDC and USDT against it. Due to the market downturn, their position had a liquidation price of $22.30, with Solana’s price reaching an all-time-low of $26.63 over the past two weeks.

Understandably, the Solend team grew nervous about the implications of the whale’s liquidations. Similar to 3AC, the whale’s size was also size, comprising 25% of Solend’s TVL, 95% of SOL deposits, and borrowed 88% of USDC available.

In the face of the whale’s liquidation, the entire Solana ecosystem would also be put at risk, let alone Solend. Given that liquidators generally market sell on DEXes to lock-in profits, they would be especially active and spamming the liquidate function to reap liquidation fees, which has been known to be a factor causing Solana to go down 12 times so far in 2022.

Figure: Deepest On-chain SOL Liquidity

The whale’s position was also larger than the deepest on-chain liquidity pool. This meant that their liquidation would crash the on-chain price of SOL, putting other borrowers at risk of further cascading liquidations. The proposal of selling the whale’s funds via Over-The-Counter (OTC) trades instead of through DEX(es) would hence avert the sell-pressure off-chain.

One of the lessons from Celsius’ insolvency in Crypto Weekly: The Tide Pulling Out was ‘not your keys, not your cheese.’ However, Solend’s first governance proposal to take control of user funds was an anomaly in DeFi of ‘custody your keys, still not your cheese.’

Although controlling the whale’s funds would save SOL price and Solend in the short term, doing so would have far grimmer implications for DeFi long term. The decentralization ethos which attracted us to the space would effectively be compromised, rendering the largest borrowing/lending market in Solana DeFi indistinguishable from ‘CeDeFi.’

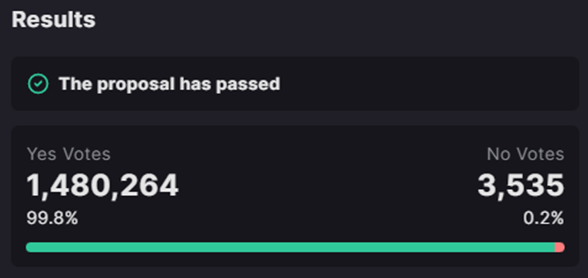

Since the passing of the first proposal, the Solend team has received strong criticism for even suggesting taking control of the whale’s funds on the platform. In response, they held another governance vote to reverse the first proposal, which also passed with an overwhelming majority.

Figure: Solend’s First Governance Proposal (SLND1) Poll Results

While we understand that Solend was caught between a rock and a hard place, their complete ‘180’ within the span of days casts light on the fragility of governance in crypto. They demonstrated that governance proposals can be reversed, undermining another core DeFi pillar – immutability.

Upgradeable Smart Contracts

Solend’s dizzying governance dance was only made possible by ‘upgradeable smart contracts’. These contracts can be upgraded to modify their code, while preserving their address, state, and balance. Optimistically, this functionality allows developers to iteratively add new features to their projects, or fix any bugs they may find in production.

But alas, developers are humans, too. Having witnessed the bull market run of 2021 and the value that their protocols have attracted, some have abused upgradeable smart contracts to gain short-term protection at the expense of long-term viability. This is where DeFi starts to creep into CeFi territory, where DeFi protocols can leverage upgradeable smart contracts to change the rules of the game.

Upgradeable smart contracts are not in and of themselves evil – they will be necessary for DeFi protocols to continually experiment and build towards the decentralized financial system that we long for. Having said that, proper safeguards such as timelocks[2] and actual decentralization (developers and VCs do not vote on governance proposals) are necessary to ensure the absence of foulplay.

Done correctly, smart contact code should be upgraded by a DAO controlled by the community that collectively owns the protocol, not by the developers directly. If the DAO is sufficiently decentralized, it’s trustless adaptation towards sustainable design. Solend is an example of DAO governance done incorrectly by using upgradeable smart contracts.

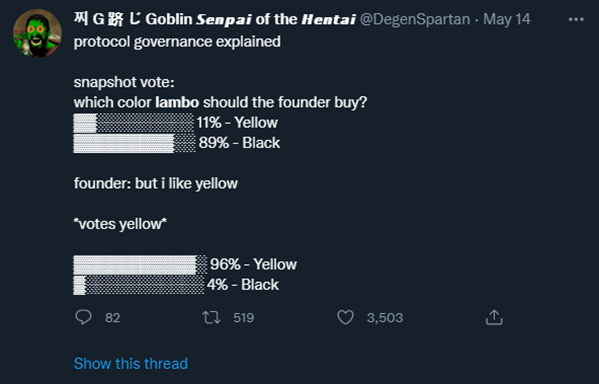

Mutable DeFi Governance

Figure: @DegenSpartan Criticizing The State of Governance in Crypto

Funnily enough, this is not the first time governance has been abused in crypto. In May, Merit Circle (MC) held a vote to cancel Yield Guild Game’s (YGG) SAFT[3], claiming that the gaming guild added close to no value since investing in the seed round. The proposal involved refunding YGG their initial investment, and removing their MC seed tokens from circulation.

Although MC put forth credible arguments for the removal of YGG as a seed investor, this sets a dangerous precedent for future deals. Projects can effectively cancel private deals done in the past, should the majority of token holders agree. Because of crypto’s quality of pseudonymity, the project team and close affiliates can collude and vote for the outcome they want, making ‘majority’ less meaningful.

MC later passed another proposal to buy out YGG’s 30x returns by buying out their MC 1.73% allocation, albeit at a discount. In this case, it doesn’t help that the motives are blurry given that both MC and YGG compete in the same Play-to-Earn space.

Closing Thoughts

The crypto winter of ‘22 has proved to be a challenging time for digital asset markets as a whole. Funds that were once regarded as heroes have turned into villains. CeFi is regulated but has obscurity mimicking that of TradFi. Much of DeFi that was supposed to be decentralized proved to be centralized after all.

The takeaway from all these different developments and stakeholders is that crypto still has a long way to go before we deserve mainstream adoption, much longer than we would expect. Those interested in protecting themselves at the expense of the crypto ethos have reared their ugly heads and will perish.

Dangerous and important precedents are being set right now, and investors should be paying attention: look for projects that are ideologically and practically aligned with the permissionless, peer-to-peer, governance-minimized protocols that represent the backbone of this industry.

If no learnings are drawn from these mistakes, we will be creating a financial system that masquerades as something superior, whilst being subject to the same human flaws as the incumbent. Our saving grace is that blockchain technology is valuable and superior, regardless of token price. It will be up to us – the builders, investors, and writers in the space to learn from these mistakes and continually build through the bear markets.

[1] The halo effect is the tendency for positive impressions of a person, company, brand or product in one area to positively influence one’s opinion or feelings in other areas.

[2] Timelocks are smart contracts that delays function calls of another smart contract after a predetermined amount of time has passed. Timelocks are mostly used in the context of governance to add a delay of administrative actions and are generally considered a strong indicator that a project is legitimate and demonstrates commitment to the project by project owners.

[3] SAFT stands for Simple Agreement for Future Tokens and is a form of an investment contract. They were created as a way to help new cryptocurrency ventures raise money without breaking financial regulations, specifically, regulations that govern when an investment is considered a security.