BitDigest August 6 · Issue #715

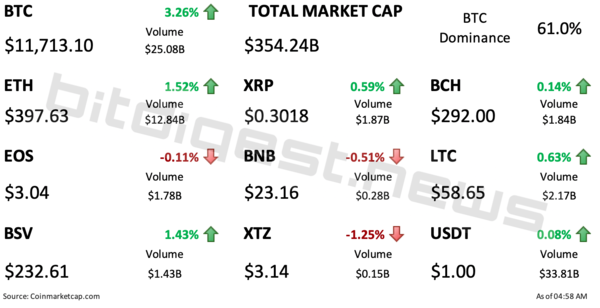

- Bitcoin drives crypto market cap back above $350 billion

- Members of the Congressional Blockchain Caucus tell the IRS staking rewards should be taxed differently

- SEC Director responsible for ICO enforcement stepping down

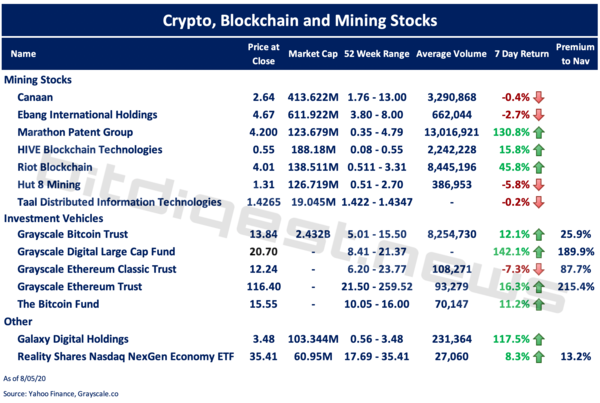

Weekly Stock Review

Highlights from the North American listed crypto, blockchain and mining stocks:

- The Grayscale Digital Large Cap Fund (OTCQX: GDLC) was the top performer among the North American blockchain and crypto stocks reporting a 142% price increase. GDLC’s premium to NAV jumped from 27.8% to 189.9%.

- For the second week in a row, Marathon Patent Group (NASDAQ: MARA) posted a a considerable return with a new all-time-high of $4.79. MARA is up 130% over the past seven days and investors are moving into the crypto mining stock with average weekly volume increasing 61%.

- Canaan (NASDAQ: CAN) announced that the company has reshuffled it board, separating with five former directors and adding four new independent ones.

- Galaxy Digital (TSX: GLXY.V) spiked over the past few days hitting a new 12-month high of high of $3.48.

- Investors moved into Grayscale’s Bitcoin Trust (OTCQX: GBTC) with the run up in the price of bitcoin; average volume increased 50% this week.

- The Bitcoin Fund (TSX: QBTC-U.TO) reached a new all-time-high of $16.

- Hut 8 Mining (TSX: HUT.TO) announced that it is taking over management from Bitfuty at its Medicine Hat facility to reduce costs and streamline operations.

Bitcoin Needs Electricity

Last week I reported that the Bank of Japan was working to ensure that the digital yuan would be fully accessible to all citizens, and more importantly it would be resilient and able to survive a natural disaster and loss of power.On Tuesday, many parts of New York lost power due to the impact of Hurricane Isais. As I write this, power has yet to return in my neighborhood (I was able to charge my computer in my office and am linking to my phone’s hotspot). While I was very fortunate that the damage I encountered was limited to falling trees and branches, this incident made me think about the impact of the loss of electricity on bitcoin. Without power, bitcoin is not lost – the decentralized structure provides for geographic distribution of the nodes – but on a more personal level, the lack of energy prohibits transactions from being completed. As we continue the path towards a digital world we must address this limitation. Without power, our digital future cannot be achieved.

The Headlines

The IRS Should Consider Staking Rewards Differently than Traditional Gains

SEC’s Director of Enforcement Steps Down

Russia’s Largest Bank Considering Stablecoin

INX Plans to IPO by Years End

Davey is Coming to Bitcoin

Blockchain Salaries More Than Double in China

Market Data

Bitcoin Gaining as Quasi-Currency Store of Value

Bitcoin Still Prevalent on Dark Web

Exchange, Custody and Product News

OKEx Launching P2P Trading Platform in India

Coinbase Adds Support for .Crypto Domains

Kraken Offering Zero-Fee Deposits and Adjusts Minimum Order Sizes

Thoughts on the Ecosystem

Investor Age Influences Choice of Asset Class

Reports you may have missed

Major equity indices are rallying on the back of solid earnings, with both the $SPX and $QQQ up over 1%. Meanwhile, crypto markets are churning lower, which is understandable as we should not expect crypto to rally alongside equities during an earnings-driven market. Crypto remains an apparently undecided market ahead of next week's FOMC meeting and the Quarterly Refunding Announcement (QRA), evidenced by another day of ETF outflows and a...

U.S. equity indices are under pressure today following disappointing economic growth in conjunction with hotter-than-expected prices paid, sparking stagflation fears and reducing the chances of rate cuts. The $SPY has declined 0.91% to test $501 and the $QQQ has dropped 1.12% to $421, being weighed down by a 12% drop in META following its Q1 earnings release. Crypto markets are faring better, with BTC-1.35% (-0.28%) trading at $64k and ETH-0.84% ...

The crypto market is pulling back from its recent surge, with $BTC falling below $65,000, $ETH trading under $3,200, and $SOL fighting to stay above $150. As expected, altcoins are also generally declining, although a few notable performers are scattered across the market. Currently, $BONK and $WIF, two prominent memecoins on Solana, are showing resilience, up 12% and 6%, respectively. Additionally, $HBAR initially doubled in price following reports that Blackrock...

Blockchain Association Sues the SEC, Cosmos Patches Potential Reentrancy Vulnerability

U.S. Treasury rates and the DXY (-0.46%) are sliding today following weaker-than-expected S&P Flash PMI data, helping catalyze a 1% rally in equity indices. Manufacturing PMI came in at 49.9 vs. 52.0 expected, and Services PMI read 50.9 vs. 52.0 expected. Bitcoin miners have benefited as rates retreat and transaction revenue remains elevated, with $RIOT, CLSK, and $MARA showing weekly gains of 26%, 16%, and 14%, respectively. Crypto assets are mixed with BTC-1.35% ...