Part 7

The Bitcoin Halving and its impact

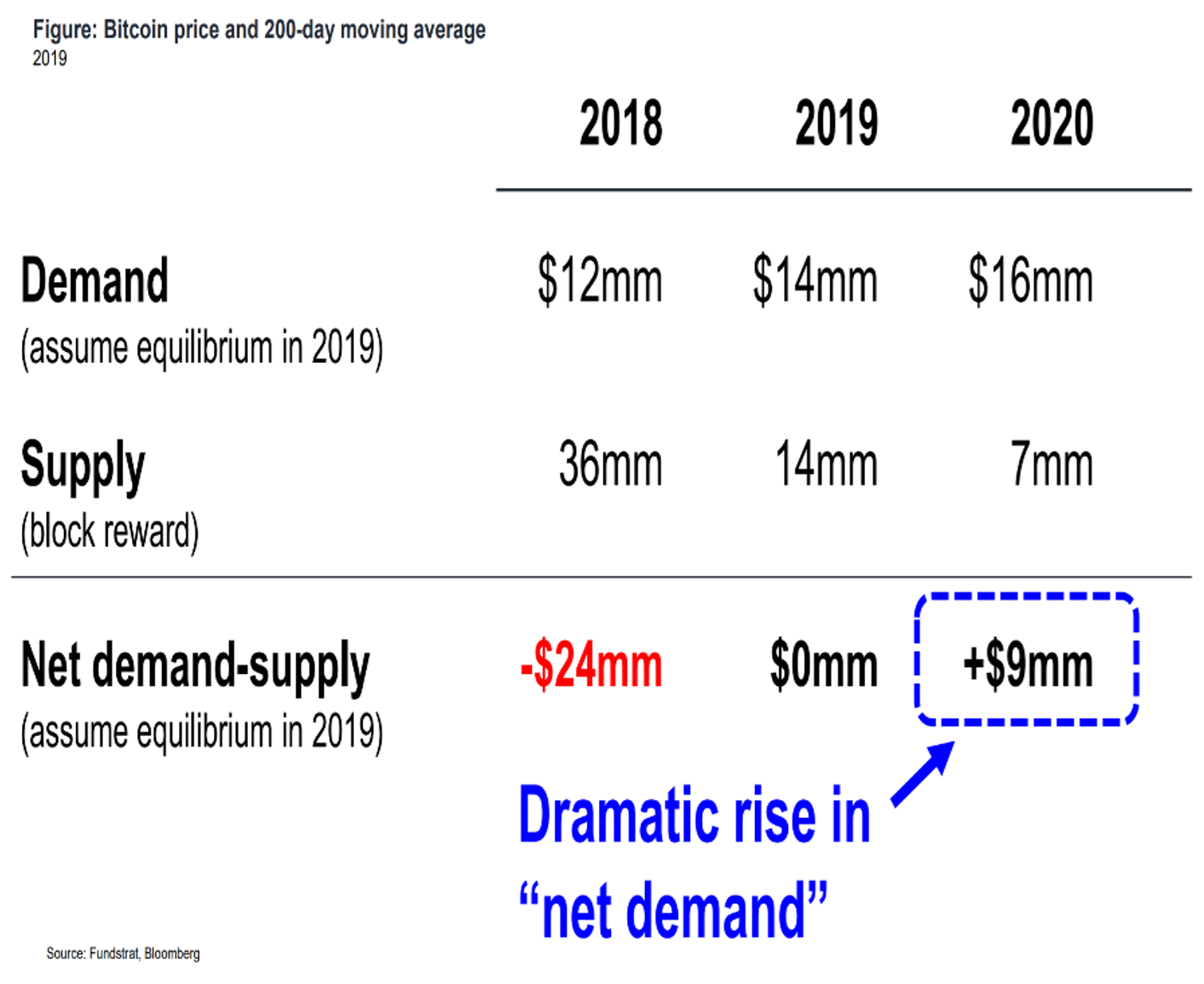

The fundamental valuation model we created for Bitcoin suggests that 2020 will be a good year. Halving events are subject to a lot of opinions and speculation, but we are unequivocal that it is bullish for the medium and long-term. Investing in Bitcoin will require you to understand what the Halving is. It is not when the price of Bitcoin cuts in half, it is like mining gold supposed to mimic how mining a commodity increases in cost over time. This is why Bitcoin has halving built into its code, it reduces the mining reward which ensures continued scarcity. This is one of the complexities of investing in Bitcoin. We also do a lot of analysis on the supply side. We find it can help make the conceptual connection from one investment class to another, because after all, although Bitcoin’s origins, uses, and history may be cloaked in mystique and notoriety at the end of the day it is a supply and demand asset like anything else. We calculate that the available supply to the market will be significantly diminished leading to upward price pressure. This is the thrust of our analysis.

We genuinely love to provide analysis in such a new and exciting market. If you’re a trader and you like to time the market, we’d love to help you though we don’t advise it for beginners. Timing the market for Bitcoin correctly is very hard and if you sell at the wrong time, even if you buy shortly after you can miss out on the bulk of your potential gains. We’ll help you avoid making that mistake with our easy-to-follow, actionable rules. Don’t invest in Bitcoin without our actionable tools and analysis.

Bitcoin is the most prominent of all cryptocurrencies and for investors new to the space, it is the easiest to invest in.

Over the last few years the market infrastructure has significantly developed; there are now futures and options exchanges for

instance. It has been almost 12 years and there has not been a single fraudulent transaction on the block chain. This in itself, we believe, demonstrates the value of Bitcoin, and despite its’ volatility and some past associations with unseemly actors or activities, we stand by our view that Bitcoin is potentially one of the best long-term investments you can put in your portfolio. In fact, the very reason that people use Bitcoin in highly risk-prone criminal transactions is precisely the reason it has value.

Despite it’s association with the criminal, if invest in Bitcoin.

Goldman Sachs isn’t going to be able to aimlessly (and criminally) shift your deliveries around to jack up their storage fee. Or what about the greatest bank robbery of all time? We’re talking of course about when the banks robbed everybody and got away with it with pretty minor slaps on the wrist, the Libor Scandal. These two episodes illustrate why some people don’t trust the ‘trusted’ third parties that they have to use. Now they don’t have to.

-

Bitcoin Investing: Is Bitcoin a Good Investment and How Much Should I Invest in Bitcoin?

-

What is All The Hype About Bitcoin?

-

Bitcoin compared to other assets

-

Bitcoin and inflation, how is Bitcoin related to inflation?

-

Cryptocurrency Investing in Modern Portfolios

-

Bitcoin as a Store of Value

-

The Bitcoin Halving and its impact

-

Is Bitcoin a Risk On Asset or is Bitcoin a Risk Off Asset?