Part 1

Bitcoin Investing: Is Bitcoin a Good Investment and How Much Should I Invest in Bitcoin?

What Was The Gold Standard And What Does It Have To Do With Bitcoin?

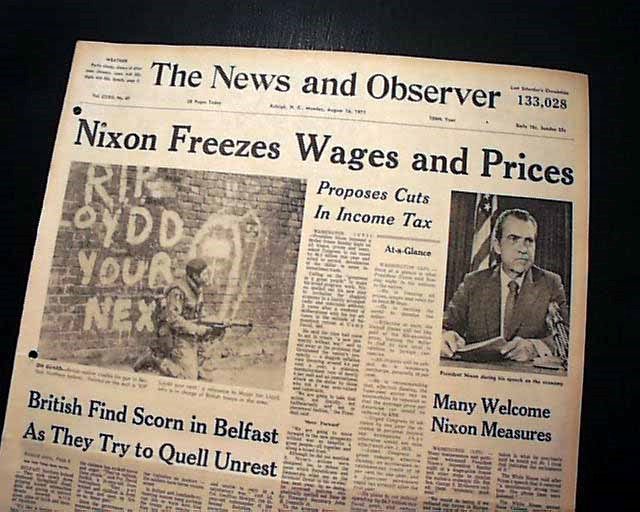

Now, what is this action—which is very technical—what does it mean for you? Let me lay to rest the bugaboo of what is called devaluation. If you want to buy a foreign car or take a trip abroad, market conditions may cause your dollar to buy slightly less. But if you are among the overwhelming majority of Americans who buy American-made products in America, your dollar will be worth just as much tomorrow as it is today. The effect of this action, in other words, will be to stabilize the dollar. –President Richard M. Nixon, August 15th 1971

Turns out, devaluation was more than just a ‘bugaboo.’ The gold window was officially closed, though few Americans were tuned in that Sunday evening to see Nixon’s address. Even fewer understood the long-term significance of his historic announcement. He had already made a big network splash the month before by announcing his visit to China that would forever change the world, and while that was meant for fanfare, this announcement was made on purpose with few watching.

President Richard M. Nixon withdrew the United States from the gold standard to the chagrin of classical economists. What is the gold standard? Some of our younger readers may not remember that until Nixon’s actions every single US note should have been able to be exchanged for the appropriate amount of gold, the price of which was fixed at $35 an ounce. Abolishing the gold standard would launch a brave new world with floating exchange rates and a fiat reserve currency and would ultimately lead to the demise of the international financial order of the day. History debates the merits of the move greatly but one thing is clear, the value of the dollar was not stabilized, in the short, medium or long-term.

What is undebatable is that the dollar began a precipitous decline, along with interest rates that would last for the next fifty years. At the time of the announcement, the American public was much more focused on the soon-to-be-announced fate of Lt. William Calley by his military tribunal for war crimes related to his actions in the deplorable My Lai Massacre.

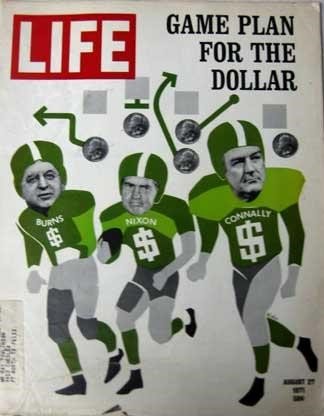

This bold move was a politically motivated one not spearheaded at the Federal Reserve but instead by Nixon himself and Treasury Secretary John Connally, who would later go personally bankrupt in the economic devastation that would follow. In the first recorded conversation on the subject, which was on July 27, 1971, Nixon said “One way to work Arthur [Burns] (Federal Reserve Chairman at the time) on this, knowing his ego, is to get him to think the idea was his.” Connally obediently replies “That’s right.” Burns never quite came around, when he discovered Nixon’s intentions he famously said “What a tragedy for humankind.” Milton Friedman would famously refer to him, because of his uncouth and self-serving betrayal of conservative economic principles as “The most socialist US President of the 20th century.”

The End The Gold Standard, The Beginning of ‘Gold Bugs’

The move was popular with the public at the time. Nixon successfully spun perhaps the most consequential economic moment in the second half of the twentieth century as a patriotic defense of the dollar against foreign speculators. His authenticity isn’t supported by his subsequently documented efforts to exert political pressure on the Fed to secure election. By the end of the 1970s, the dollar had lost a third of its’ value and the United States endured the worst economic recession since the Great Depression; the notorious period of “Stagflation.” Many think ending the gold standard when Nixon did contributed.

According to Keynesian theory at the time, the robust fiscal program of the Nixon administration should have alleviated the situation but instead it created one that was previously considered theoretically impossible, stagnating growth occurring simultaneously as rampant inflation. This toxic economic mix caused conservative investors, or ‘gold bugs’ as they were disparagingly called, to favor an asset above the fray of national assets. Which at least in their minds was gold. Investors wanted something at the time that was independent from the machinations of Great Powers and the personalities leading them.

The period of economic misery that followed led to an eventual changing of the guard at the Fed, and Milton Friedman’s monetarists would have their great success in the early 80s, turning the US economy around by taking the political poison pill of a recession in 1982. This time the President did not interfere with then Chairman Volcker to his credit. When inflation went down the Fed reversed policy and Regan streamlined the Federal government and reduced taxes, resulting in strong growth. Some even today advocate returning to the gold standard, however, it is considered somewhat outside the mainstream.

Many want a hedge against the uncertainty of future government policy today, many did in the past as well, particularly many who’d lived through the Great Depression and the era that Americans were legally prohibited from owning gold, not to mention the Second World War. That experience had conditioned them to distrust financial institutions and government policy around assets, Gold to them seemed safe, everyone wanted gold. Indeed, during the Second World War (also that generations second crisis) when commerce broke down many people across the globe had to resort to storing wealth in jewelry; diamonds, gold, silver and of course art. Much of this was plundered and appropriated. It seemed to many the ultimate insurance policy in a less stable world.

-

Bitcoin Investing: Is Bitcoin a Good Investment and How Much Should I Invest in Bitcoin?

-

What is All The Hype About Bitcoin?

-

Bitcoin compared to other assets

-

Bitcoin and inflation, how is Bitcoin related to inflation?

-

Cryptocurrency Investing in Modern Portfolios

-

Bitcoin as a Store of Value

-

The Bitcoin Halving and its impact

-

Is Bitcoin a Risk On Asset or is Bitcoin a Risk Off Asset?