Stablecoins I

Key Takeaways

- Stablecoins need utility beyond high inflationary yields that incentivize liquidity instead of organic growth. Those who mistake (and incentivize) liquidity for utility attract mercenary capital that will leave as quickly as it enters when yields inevitably compress.

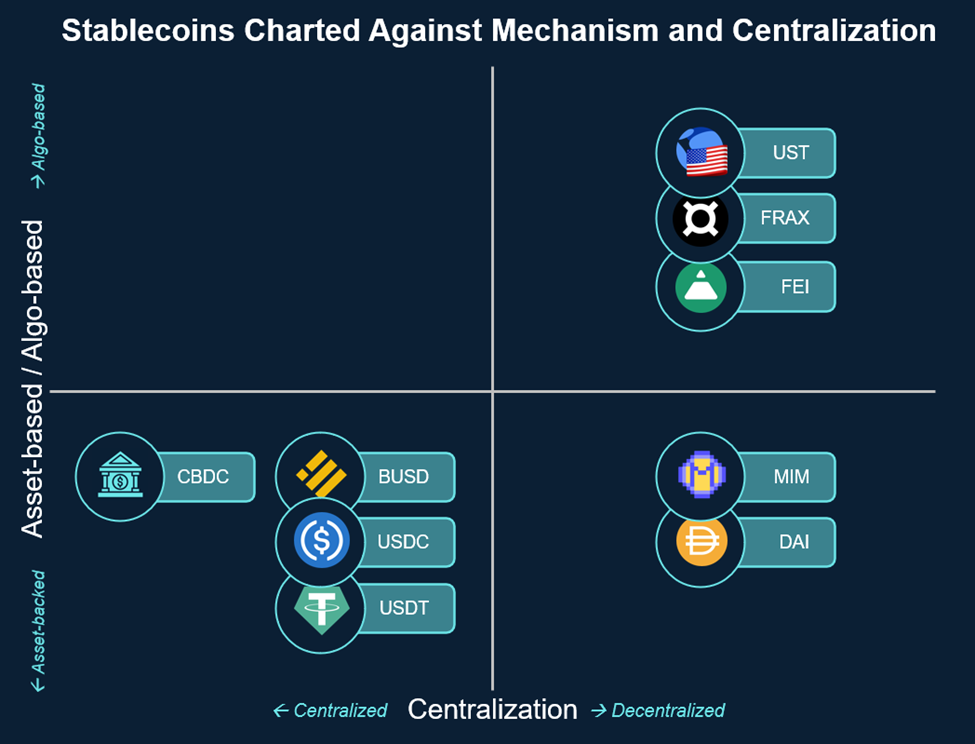

- The three stablecoin verticals are (A) Asset-backed Stablecoins, (B) Algorithmic Stablecoins, and (C) Central Bank Digital Currencies (CBDCs). Subverticals of (A) Asset-backed Stablecoins include: (A - i) Fiat-collateralized Stablecoins and (A - ii) Collateralized Debt Position (CDP) Stablecoins. Subverticals of (B) Algorithmic Stablecoins include (B - i) Purely Algorithmic Stablecoins, (B - ii) Fractional Algorithmic Stablecoins, (B - iii) Cash-and-carry Algorithmic Stablecoins, and (B - iv) Inflation-proof Algorithmic Stablecoins.

- Although we have written extensively on the unsustainability of Anchor’s 20% Earn Rate, alternate Layer 1 platforms seem to be willing to pay the price, having seen Luna’s success. Near Protocol and Tron Network announced a similar 20% and 30% 'savings rate' for USN and USDD, respectively.

- Bottom Line: Stablecoins are pivotal for price appreciation and liquidity within the digital asset ecosystem. However, not all stablecoins are created equally - users must understand the fundamentals behind these seemingly similar yet fundamentally different projects. While it is too early to call winners on algo stable models, the stablecoin-sharecoin combo is gaining popularity amongst other Layer 1 networks.

Finding Stability

Stablecoins (‘stables’) are cryptocurrencies that aim to peg their prices to another cryptocurrency, fiat money, or commodities. For the stables primer below, we specifically refer to stablecoins pegged to currencies, the most widely adopted of which is the U.S. Dollar.

Many stablecoin projects try to maintain the peg to their respective currencies, but few prevail. Learning from previous projects, stablecoins are easy to design (copypasta[1] and iterate) and launch. But relative to those who have gained and retained market share, it becomes apparent that utility is key to the longevity of stablecoin projects.

In the early days of a stablecoin, however, utility is non-existent. In a hasty attempt to create utility for their stablecoin, projects mistake liquidity for utility and start along that route. As we will see below, incentivizing (and bolstering) liquidity for stablecoins is superficially beneficial – it only enables more efficient selling of the stablecoin once those incentives end.

Alternatively, stablecoin projects can use the demand for leverage to bootstrap utility. The Terra ecosystem elected this route to ramp up demand for its stablecoin, TerraUSD (UST 0.53% ), by offering a 20% savings rate on Anchor. While borrowing demand is a legitimate source of yield and utility, whether it’s sustainable is another question. In previous DeFi Digest issues [1] [2], we quantified the sources and uses of funds in the Terra ecosystem, concluding that current borrowing demand and staking rewards cannot sustain the 20% Anchor Earn Rate.

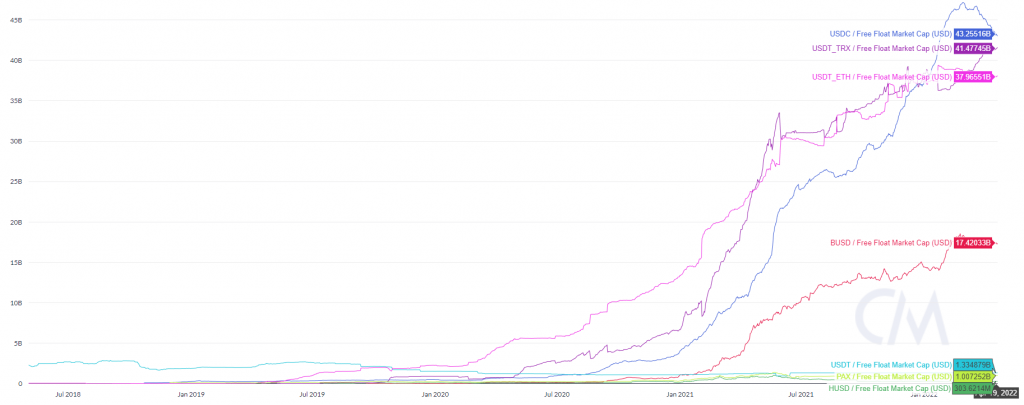

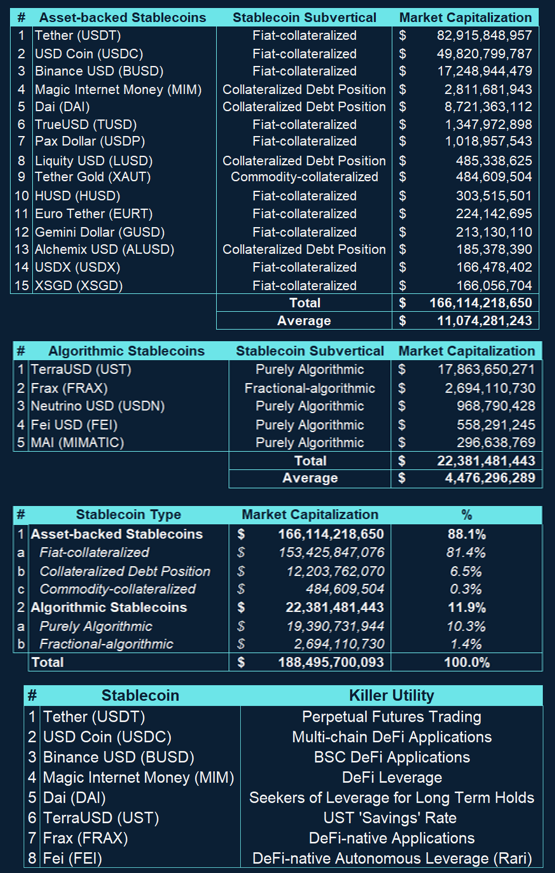

Thus, stablecoin project builders need to create actual utility for the token, while incentivizing liquidity that’s in pace with utility growth. Keeping this in mind, we examine the top 20 stablecoins by market capitalization of each vertical and subvertical. Unsurprisingly, algo stables constitute a mere 11.9% of the top 20 market cap, given their novelty. Although CDP stables have been around for longer, they come in at 6.5% of market cap. We examine the mechanisms through which stablecoins maintain their pegs today.

Asset-Backed Stablecoins – $166b Market Capitalization

Fiat-Collateralized Stablecoins – $153b Market Capitalization

For every unit of stablecoin minted, fiat-collateralized stablecoins custody an equal amount of U.S. Dollars or their equivalent value in their reserves. Built upon Omni atop of the Bitcoin network, Tether (USDT) was one of the earliest USD-backed stablecoins created in 2014. It owes its mainstream adoption to the rise of perpetual futures trading on Bitfinex.

While fiat-collateralized stablecoins are supposed to be backed in U.S. Dollars or equivalents, Tether has been the subject of ongoing controversy because of the lack of audited financial statements proving it has adequate reserves backing USDT. They paid a $41m fine to the US Commodity Futures Trading Commission (CFTC) for making misleading statements related to their backing in October ‘21, in addition to another $18.5m settlement with the New York Attorney General in February ‘21.

USDC issued by Circle has risen in popularity because of the controversy. Last week, Circle announced a $400m funding round led by Blackrock. The strategic investment by one of the largest global asset managers is intended to expand USDC’s footprint in capital markets. Additionally, Blackrock will become a primary asset manager of USDC cash reserves.

Although USDC is regarded as the next-best alternative relative to USDT, fiat-collateralized stablecoins are still centralized because of the need for USD -4.41% reserve custody. It’s also because of this reason that centralized algo stables aren’t censorship-resistant. In fact, $USDT and $USDC have blacklisted addresses holding their coins before.

Collateralized Debt Position (CDP) Stablecoins – $12b Market Capitalization

A Collateralized Debt Position (CDP) is a novel DeFi primitive that allows users to lock in stable or volatile assets as collateral in “vaults” to mint stablecoins. CDPs require borrowers to maintain healthy collateral ratios throughout their borrowing period, liquidating those who fail to do so.

CDP-based money markets have enabled a myriad of use cases, including:

- Unlocking cash flow for users who need liquidity but don’t want to part with their long positions

- Tax-optimization as borrowing is not regarded as a transaction and hence isn’t taxable[2]

- Short selling by borrowing tokens and selling for stablecoins, only to repurchase at a lower price when closing debt positions

CDP stablecoins are a subset of CDP money markets since borrowers can only collateralize volatile assets (ETH -5.22% ) to borrow stablecoins (e.g. DAI) instead of borrowing other volatile assets to short. Launched in late 2017, MakerDAO became the protocol that first popularized CDP-based stablecoins, inner mechanisms of which we have documented in ‘Decentralized Leverage, Baby.’

Algorithmic Stablecoins – $22b Market Capitalization

Purely Algorithmic Stablecoins – $19b Market Capitalization

Algorithmic stablecoins (‘Algo stables’) leverage algorithms built-in smart contracts to peg stablecoins against their respective currencies. The most popular version is Terra ecosystem’s UST 0.53% (stablecoin) and LUNA (sharecoin). We’ve written about LUNA and how it’s used to maintain the UST 0.53% peg to the U.S. Dollar in this Crypto Weekly issue.

Typically, algo stables deploy a 2-token model, consisting of a stablecoin and a sharecoin. This 2-token model maintains the peg of stablecoins by algorithmically manipulating the supply of the sharecoin. Essentially, the sharecoin (e.g. LUNA, FXS) acts as the volatility sink. As demand for the stablecoins (e.g. UST 0.53% , FRAX) changes, the supply (and prices) of the stabilizing tokens move accordingly to maintain the peg of the stablecoins.

These algorithmically-pegged stablecoins build their lindy effect[3] as they grow, and fewer LUNA or FXS tokens are needed (to redeem UST 0.53% and FRAX) as their prices appreciate. For example, when UST 0.53% depegs below $1, arbitrageurs only need to mint 0.01 LUNA by burning 1 UST 0.53% (assuming LUNA price is $100). Conversely, they need to mint 0.1 LUNA to profit from the arbitrage when LUNA is trading at $10.

Due to their algorithmic nature, purely algo stables do not custody other USD-equivalent or volatile assets. This means that purely algo stables are not backed. Instead, they regulate their sharecoin’s supply to hold their peg. Because of this, algo stables are more capital-efficient than their asset-backed counterparts – they don’t need to safeguard reserves as they grow. This material advantage perversely incentivizes algo stable projects to inflate at a pace far beyond organic growth, contributing to the demise of many projects that have taken a bite of the forbidden fruit.

While LUNA started as a pure algo stable, their Bitcoin purchases noted in previous Anchor issues start to blur the line. Effectively, Terra users will be able to redeem their UST 0.53% to mint Bitcoin (instead of Luna) at a 2% premium when UST 0.53% is off-peg. While Bitcoin is kept in a separate wallet belonging to Luna Foundation Guard, Terra’s purely algo stables model is starting to look very similar to that of Frax, as detailed below.

Fractional-Algorithmic Stablecoins – $3b

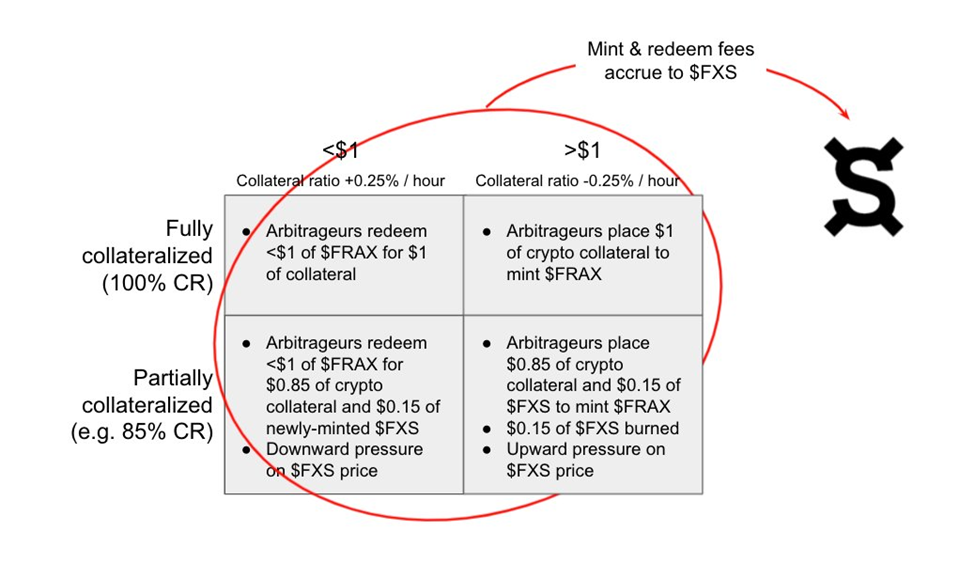

Fractional-algorithmic stablecoins rely on both collateral and algorithms to maintain their peg. Frax Finance is the largest stablecoin project by market capitalization that adopts this model, with FRAX as the stablecoin and FXS as the sharecoin. At launch, Frax’s treasury counted USDC as the primary collateral, but it has since included other LPs of USD-equivalent tokens from the largest stablecoin DEX (Curve) to help maintain its peg.

Because FRAX is not fully-backed, Frax’s collateral ratio (CR) provides some guidance to the extent that it is. To illustrate, a 50% collateral ratio means that $1 of FRAX can be minted by providing $0.50 USDC and $0.50 worth of FXS. This mechanism works in reverse when a user chooses to redeem their FRAX for the USDC and FXS they initially provided. Assuming a 50% collateral ratio again, a user is given $0.50 USDC and $0.50 of FXS in exchange for every FRAX stablecoin they provided.

An additional mechanic implemented by Frax Finance is the dynamic adjustment of its collateralization ratio, depending on which direction FRAX is depegged. If FRAX is trading at above $1, the protocol decreases the collateral ratio. If FRAX is trading at under $1, the protocol increases the collateral ratio.

The dynamic adjustment of Frax’s collateralization ratio is also time-weighted. When FRAX is at or above $1, the collateral ratio is lowered by 0.25% per hour and when the price of FRAX is below $1, the collateral ratio decreases by 0.25% per hour. Put differently, if the FRAX price is at or over $1 a majority of the time, the collateral ratio decreases. If FRAX is under $1 a majority of the time, then the collateral ratio increases towards 100% at a growing rate until the peg is restored.

Critics of the algorithmic stablecoin model may argue that the system is circular – Frax Finance mints FXS tokens to prop up FRAX value. But the introduction of time-based collateral ratio adjustment significantly mitigates this issue.

Cash-and-carry Algorithmic Stablecoins – n/a

In ‘‘Sources of Yield’, we wrote about how leverage is a core feature in DeFi, and funding rates in the perpetual futures market reflects the demand for leverage at any given time. To reiterate, arbitrageurs can long spot and short perpetual futures to harvest funding rates during bull markets, and vice versa during bear markets. Funding rates are the ‘cost of carry’ equivalent to that of the cash-and-carry trade in commodities markets.

UXD Protocol leverages funding rates to issue the UXD stablecoin and generate delta-neutral yields. Users deposit SOL on UXD, which is deposited on partner decentralized derivative exchanges to open short perp positions on SOL. UXD harvests the funding rates algorithmically on user deposits when funding is positive, while UXD’s insurance fund pays out funding rates when they are negative.

The spot and future positions are by definition market neutral, therefore pegged to USD. The material assumption that novel cash-and-carry based algo stables make is that funding rates harvested (and accumulated in the insurance fund) during bull markets will be sufficient to cover negative rates when the tides turn, not too different from Anchor’s Yield Reserve.

Inflation-proof Algorithmic Stablecoins – n/a

Last month, Frax Finance announced the launch of FPIS (sharecoin) and FPI 0.27% (stablecoin). If Consumer Price Index (CPI) prints 10%, the price of FPI 0.27% would appreciate by 10% annualized (0.83% monthly). FPIS is the governance token for FPI 0.27% , accruing seignorage value from the issuance of FPI 0.27% .

If a user wants to mint FPI 0.27% , they can only so do using FRAX (FXS sharecoin’s stablecoin). The FRAX accumulated by the treasury is then deployed to yield-bearing strategies in DeFi markets, although Sam Kazemian (Frax Founder) has remained tight-lipped about the specific strategies the treasury will implement.

When yields farmed are higher than the LTM CPI print, excess yield accrues to FPIS holders. Conversely, FPIS get minted and sold to plug the gap when yields are lower than CPI. From April’s CPI print of 8.5%, the treasury could theoretically swap FRAX for UST 0.53% and earn 19.5% on Anchor. At the end of April, FPI 0.27% appreciates by 8.5% in April, while FPIS appreciates by the difference (11.0%).

This novel DeFi primitive that hedges stablecoin holders against inflation is highly experimental, yet represents the speed at which DeFi projects are innovating to potentially solve for the largest pain point consumers face today.

Other Algorithmic Stablecoins – n/a

While there exists a myriad of other algo stable token designs, @mrinconcruz makes the argument that most algo stables are conceptually similar to coupon-based stablecoins such as Beanstalk. But that’s a conversation for another day, or now if you’d like to check out his article. Instead of an algorithmic stablecoin design problem, the recent Beanstalk exploit was due to a governance oversight combined with a flash loan[4], which we wrote about in the Crypto Daily on 4/18.

Central Bank Digital Currencies (CBDC) – n/a

According to the Federal Reserve, Central Bank Digital Currencies are money that a central bank can produce to be made widely available to the general public. CBDCs are a digital form of countries’ respective fiat currencies and also represent a claim on their central bank, as do banknotes.

Instead of issuing physical fiat, CBDCs are backed by the full faith and credit of the respective governments that issue them. In other words, CBDCs are digital fiat by decree. They are accounted for in a digital ledger that does not need to be distributed. In fact, Ripple announced a partnership with Bhutan’s central bank to pilot a CBDC product built on top of Ripple’s CBDC Private Ledger. CBDCs differ from the stablecoin models listed above in that they are centrally managed; they can be built atop centralized ledgers, and they are backed by the full faith and credit of nations.

Is the Ponzi Ending Soon, Or Has It Just Started?

Although we have written extensively on the unsustainability of Anchor’s 20% Earn Rate, alternate Layer 1 platforms seem to be willing to pay the price, having seen Luna’s success.

To be clear, Anchor’s model of using borrowing demand and staking rewards to offer attractive stable yields is a legitimate utility – much of DeFi is rehypothecation anyway. The issue is that stablecoin projects cannot afford to inflate beyond their organic, unincentivized growth.

Last week, details of Near Protocol’s native algorithmic stablecoin USN surfaced on Twitter, hinting at matching Anchor’s 20% Earn Rate. Just yesterday, the founder of Tron Network Justin Sun announced a $10B reserve that will offer 30% on USDD function similarly to that of Anchor. At first glance, these developments might seem wasteful and unsustainable, but can serve as an avenue for Layer 1 platforms to deploy their massive ecosystem funds (Near raised $800m in Oct ’21).

“The guy who starts the party isn’t the first one to dance. Instead, it’s the second guy who doesn’t think the first guy’s crazy, and joins in.”

– Anonymous Dancer

While we believe the music has to slow down some day, we acknowledge the role of Anchor’s zero-to-one innovation that will help inform DeFi primitives in the future. In light of Near and Tron’s announcements, we can imagine a future in which a few more prominent Layer 1 networks each have their native stablecoin that can be redeemed for their respective Layer 1 tokens.

Perhaps, the pegs of these stablecoins will be held with a Curve 10-pool only comprised of decentralized algorithmic stablecoins.

Bottom line

Stablecoins are a core part of infrastructure for the digital asset ecosystem, providing an avenue for market participants to take profits or simply observe and strategize in risk-off environments. Not all stablecoins are created equally, necessitating users to understand the fundamentals behind these seemingly similar yet fundamentally different projects.

Stablecoins need organic utility to gain net adoption beyond reflexive, unsustainable reward-giving. Incentivizing liquidity itself doesn’t drive use or demand; it merely facilitates swapping away. In degen speak, the type of capital that apes into 6-figure APY farms will just as quickly run for the exits when the APYs compress.

Editor’s Note: We would like to h/t @jonwu_ and @mrinconcruz for their thought leadership in the space. Their first-principles thinking on stablecoins and currencies as a whole has helped inform our take on this nascent space.

[1] Copypasta is DeFi slang for projects who merely fork the code of more established projects.

[2] Please refer to your respective tax jurisdictions to determine if DeFi borrowing from your jurisdiction is in fact tax-exempt.

[3] The Lindy effect is a theorized phenomenon by which the future life expectancy of some non-perishable things, like a technology or an idea, is proportional to their current age.

[4] Flash loans are a form of uncollateralized lending made possible by borrowing and repaying within the same block.