The Ten Rules of Bitcoin Investing: No. 3

- Tom Lee’s First 5 Bitcoin (Replay)

- The Ten Rules of Bitcoin Investing: No. 1

- The Ten Rules of Bitcoin Investing: No. 2

- The Ten Rules of Bitcoin Investing: No. 4

- The Ten Rules of Bitcoin Investing: No. 5

(FSInsight.com’s head of research Tom Lee revealed the first five of his ten rules of Bitcoin investing on April 23, 2020 and gave an updated outlook for the remainder of the year. The final five of ten rules will be published later this year. The webinar is available on the website and the following is a condensed version of his comments. This is the third in a series of 10 scheduled reports, one for each of his rules. Stay tuned for the next one.)

The Ten Rules of Bitcoin Investing: Rule No. 3

Rule #3: Buy Bitcoin when it is higher than the 200-day moving average

If you have read the first two parts of this series, you’d know that the U.S. is going to be very important in the continued development of Bitcoin and crypto currencies and that the Bitcoin Misery index is a proprietary FSI tool that has been a good way to evaluate how investors feel about Bitcoin’s price action.

Now, I’m going to describe the usefulness of Bitcoin’s 200-day moving average (dma), and the halvening, which took place May 11. Bitcoin could be back in a bull market soon and here’s why:

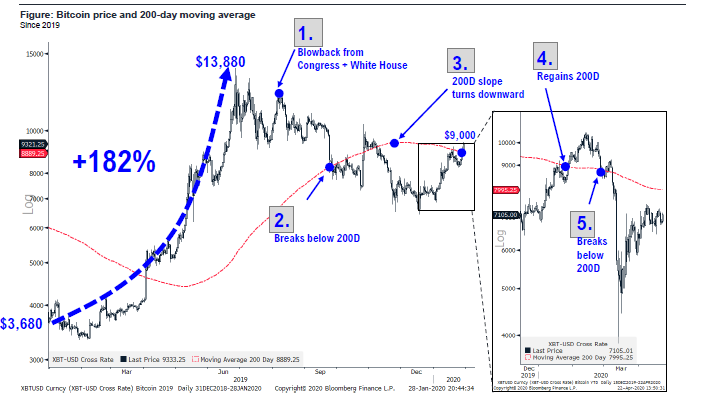

Bitcoin’s 200 dma (based on 200 calendar days, not 200 “equity trading days”) is around $8,050, and this level is important because it reflects the long-term trend in prices and is also essentially where most active traders have acquired their security/bitcoin.

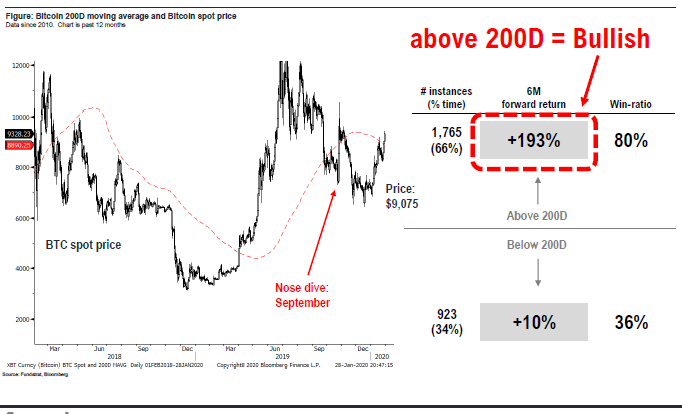

In a nutshell, when Bitcoin regains its 200 dma, as it has recently, the momentum will be viewed by investors as bullish. Why is that? Historically, Bitcoin acts much better when it is above its 200-dma. This will be a big positive. See chart below.

Remember, Bitcoin is viewed as a commodity, and hence investors are more constructive when Bitcoin is in a positive trend, and, as noted above, this is measured by its price relative to the 200-dma. As of today, May 14, Bitcoin is slightly above its 200-dma, having regained it on April 29.

The Halvening

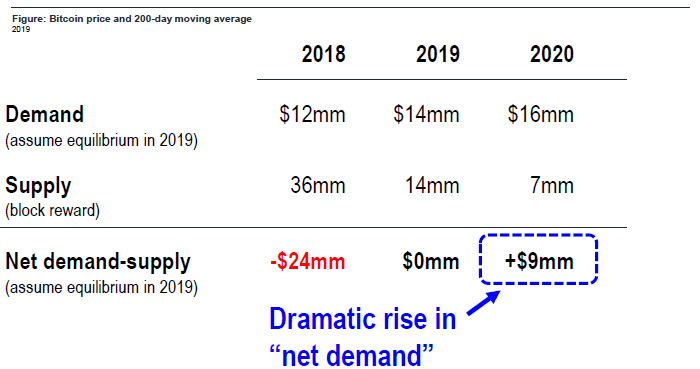

The other important point is the “halvening” for Bitcoin, which happened May 11. This affects the equilibrium of supply and demand of Bitcoin.

Recently, there has been a lot of skepticism regarding the boost to Bitcoin from the halvening. The negative arguments center around coin miners and their need to sell more Bitcoin if the value of the block reward is cut in half.

However, we think this is conflating the larger supply demand dynamic.

A simple illustration to the left shows that if demand is constant (we assume higher due to Iran) and supply is cut in half, this creates a net demand imbalance which should be resolved with a higher price to create a new equilibrium.

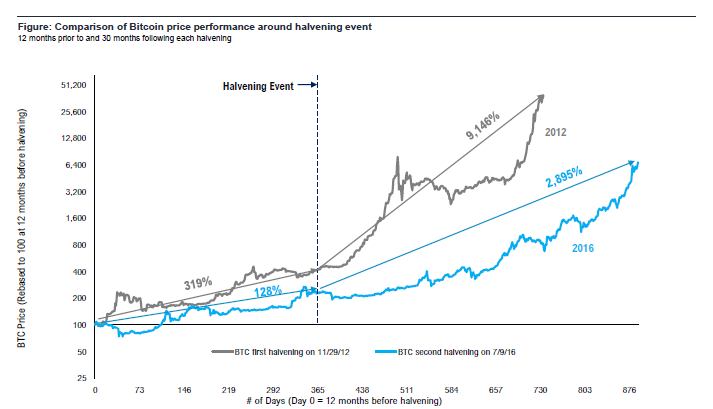

History shows “net demand” rises approximately 128% to 320% post-halvening, to go by the two preceding halvening events, when price gains were quite dramatic

Notice in the chart below the significant change in the gains of Bitcoin price into the halvening and after it took place. The halvening is a strong bullish signal about supply and demand. History shows that as demand changes you see a strong response.

(This is a third part in a series of Tom Lee’s 10 Rules for Bitcoin Investing. As a reminder, Rule No. 2, about the BMI index, was published on May 8, and No. 1, published on May 1, says that the USA is the determining factor for cryptocurrency’s future. For more, please see Tom’s Take May 1, or the webinar replay.)