The Ten Rules of Bitcoin Investing: Rule No. 2

- Tom Lee’s First 5 Bitcoin (Replay)

- The Ten Rules of Bitcoin Investing: No. 1

- The Ten Rules of Bitcoin Investing: No. 3

- The Ten Rules of Bitcoin Investing: No. 4

- The Ten Rules of Bitcoin Investing: No. 5

(FSInsight.com’s head of research Tom Lee revealed the first five of his ten rules of Bitcoin investing on April 23, 2020, and gave an updated outlook for the remainder of the year. The webinar is available on the website and the following is a condensed version of his comments. This is the second in a series of 10 reports from his webinar, one for each of his rules. Stay tuned for the next one.)

The Ten Rules of Bitcoin Investing: Rule No. 2

Rule #2: Consensus mostly right, thus Bitcoin Misery Index

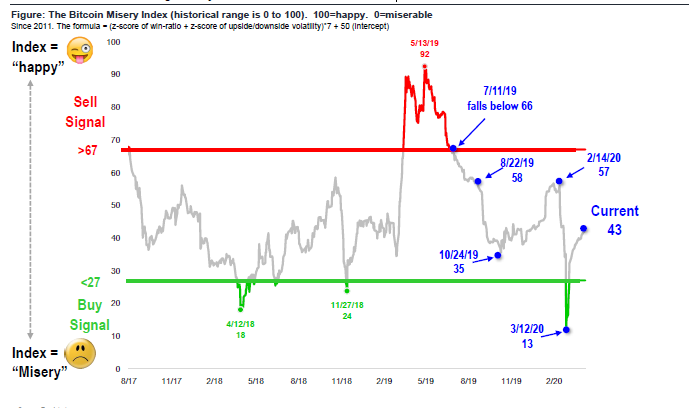

The Bitcoin Misery Index (BMI) is a diffusion index, a proprietary tool that we invented for our clients interested in cryptocurrency investing. In essence, the BMI is a proxy for how investors feel about bitcoin’s “price action.” It measures the expected sentiment of a holder of bitcoin (where a reading of 50=Neutral, <27=Misery, and >67= Happy).

Though we do not recommend timing the market, the BMI has had a very instructive practical history. Theoretically, it has been a good way to evaluate Bitcoin’s price for those who have timed Bitcoin via BMI, as you will see below. Again, we don’t recommend timing the market, but the BMI is useful for entry points. We believe it is a good investment tool and it’s available on our website.

Where are we now? Currently, the BMI resides around 43, a recovery from a recent low at 13. See nearby chart.

As you can see in the chart, the BMI slipped below 66 on 7/11/19. Although it then temporarily bottomed at 35 on 10/24/19 and recovered to 57 in mid-February 2020, the BMI then proceeded to tank all the way down to 13 amid the coronavirus (COVID 19) outbreak.

Since then, investor sentiment has improved as the BMI gradually climbed back to the current level around 43.

What does this mean?

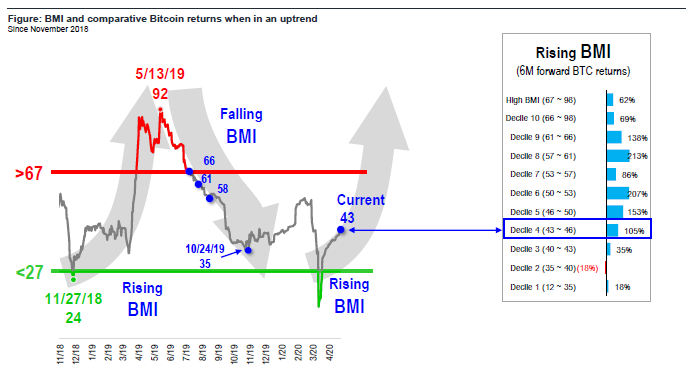

Well, with the BMI rising as it is, history suggests about a 105% six months forward return when the BMI is at 43. However, once the BMI begins an uptrend (such as now), investors should note that a reading of 43 is not associated with the best scenario, based on six months forward returns for Bitcoin.

More specifically, since 2011, when BMI is 43 (or decile 4), the average 6M return for Bitcoin is 105%. While this is definitely good, as a signal it is not as strong as waiting for the BMI reading to rise towards 50-53 (decile 6) or even more ideally, 57-61 (decile 8). See chart below.

(This is a second in a series of Tom Lee’s 10 Rules for Bitcoin Investing. As a reminder, Rule No. 1, published on May 1, says that the USA is the determining factor for cryptocurrency’s future. For more, please see Tom’s Take May 1, or the webinar replay.)