The Ten Rules of Bitcoin Investing: Rule No. 1

- Tom Lee’s First 5 Bitcoin (Replay)

- The Ten Rules of Bitcoin Investing: No. 2

- The Ten Rules of Bitcoin Investing: No. 3

- The Ten Rules of Bitcoin Investing: No. 4

- The Ten Rules of Bitcoin Investing: No. 5

(FSInsight.com’s head of research Tom Lee revealed the first five of his ten rules of Bitcoin investing on April 23 and gave an updated outlook for the remainder of the year. The webinar is available on the website and the following is a condensed version of his comments. This is the first in a series of 10 reports from his webinar, one for each of his rules. Stay tuned for the next one.)

The Ten Rules of Bitcoin Investing

Cryptocurrencies and Bitcoin (BTC) have been around for over a decade, a time period in which they are solidly up. However, as an asset class the believers in it are few, to go by the minuscule amount of money invested, 0.1% of the total, vs. other financial assets.

Still, as I have noted before, Bitcoin has shown and continues to show great resilience, such as during the financial turmoil of 2020, for example. Earlier in the year, I gave a 2020 outlook that proposed the escalation of geopolitical risk, the coming halvening and the U.S. election year as the three major positive developments for Bitcoin in 2020. These 3 developments supported Bitcoin’s solid run at the start of the year

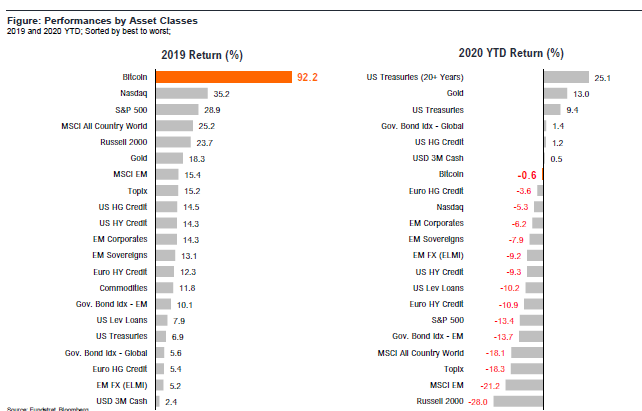

As coronavirus spread around the world, Bitcoin fell along with other asset classes and global markets. Nevertheless, Bitcoin remains one of the best-performing assets and is outperforming almost all equity market indices on a relative basis. (See chart below).

Let’s start with my first (out of ten) rules of Bitcoin investing. I’m not trying to sound nationalistic, but the fact of the matter is that for cryptocurrencies, the U.S. is the future for the next three to five years.

While many think, and rightly so, that cryptocurrencies are for folks in those parts of the world that are unbanked or where their own currencies are debased, that’s not the most important part of the story. In the foreseeable future, adoption in the U.S. is key, and here’s why.

Rule No. 1: The USA is the Future

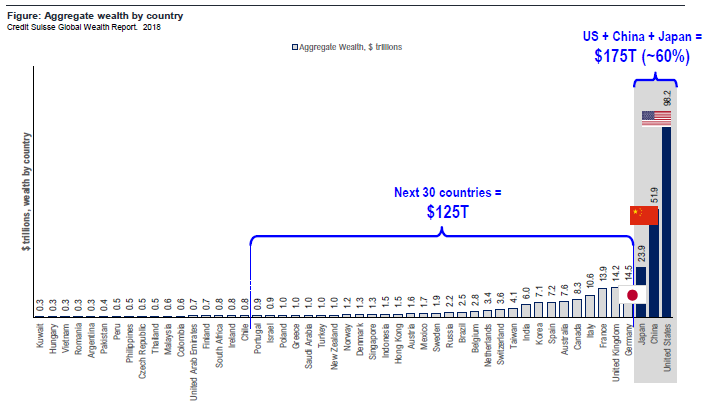

If you think about where the world’s global wealth, about $300 trillion, is located, more than 60% of it is found in the U.S., China and Japan. To appreciate why the US is a big deal for Bitcoin, take a look at the world’s aggregate wealth (per recent Credit Suisse Global Wealth Report).

The top three dwarf all other countries. (See chart below.) We are talking about $175 trillion out of the world’s total. Moreover, at nearly $100 trillion, you will note that the U.S. is more than half of the three major countries and one third of the total. The U.S. is unique given its demographics, national wealth, and deep and liquid markets.

The U.S. is the most important major economy for digital assets per the Bitcoin Market Potential Index, created in 2015 by Garrick Hileman, professor at the London School of Economics LSE. The BMPI highlights countries’ best potential for Bitcoin adoption. The U.S. ranks fifth overall but is the only major country in the top ten. (See nearby BMPI table.)

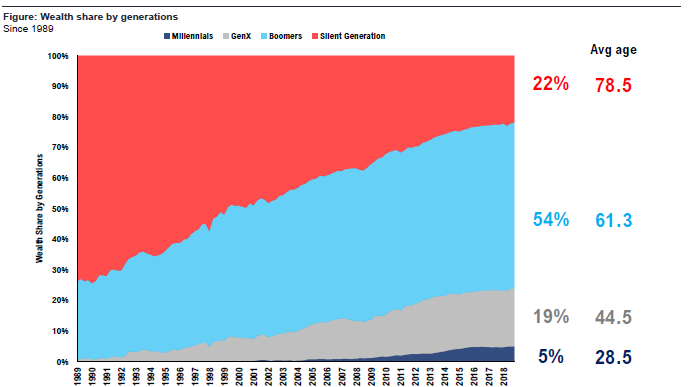

And more specifically to the U.S., Millennials here are set to inherit some $68 trillion over the next two decades, according to a study by Coldwell Banker. In addition, the latest Federal Reserve Survey of Consumer Finances shows that Boomers and the Silent Generation control about 77% of the wealth. The Silent Generation controls $22 trillion today and is an average age of 78.5 (oldest is 88.5). (See chart below.)