Decentralized Finance: A Primer

DeFi Overview & Irrefutable Growth

Decentralized Finance (DeFi) is a vertical within the digital asset space that allows users to access financial services without centralized intermediaries. It became the first breakthrough application of smart contracts, having been in development since 20171. Leveraging smart contract functionality on different blockchains, DeFi strives to create a more accessible, efficient, and transparent financial system.

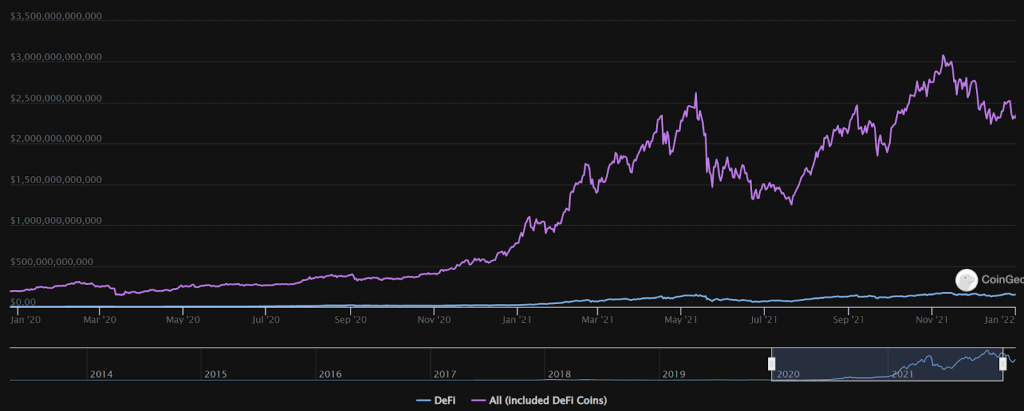

DeFi’s breakneck adoption is evidenced by metrics on all fronts. Total Value Locked (TVL), a measure of capital locked inside Layer-1 networks or DeFi protocols, reached $1 billion in May 2020 and breached $250 billion by the end of 2021. Market capitalization of DeFi coins grew from $1.7 billion before peaking at $170 billion in November 2021, representing a 5.6% of total crypto market capitalization. DeFi’s product-market fit also began reflecting in revenue figures, as some of the largest protocols collected a cumulative $4 billion in fees as of February 2022.

Figure: TVL in DeFi (2020 – 2021)

Figure: DeFi Revenue by Protocol

Going Back to the Roots

But DeFi hasn’t always been the $150b+ market capitalization behemoth that it is today. In fact, roots of DeFi can be traced back to early 2020 when Compound kicked off liquidity mining2 in June, affectionately known to veterans in the space as “DeFi Summer”.

Figure: Timeline of Cornerstone DeFi Launches in 2020

Fast forward to today, there are hundreds of DeFi protocols offering traditional financial services, including decentralized trading, permissionless borrowing and lending, algorithmic stablecoins, peer-to-peer insurance, synthetic derivatives, fund management and all the permutations in between.

The Competitive Advantage

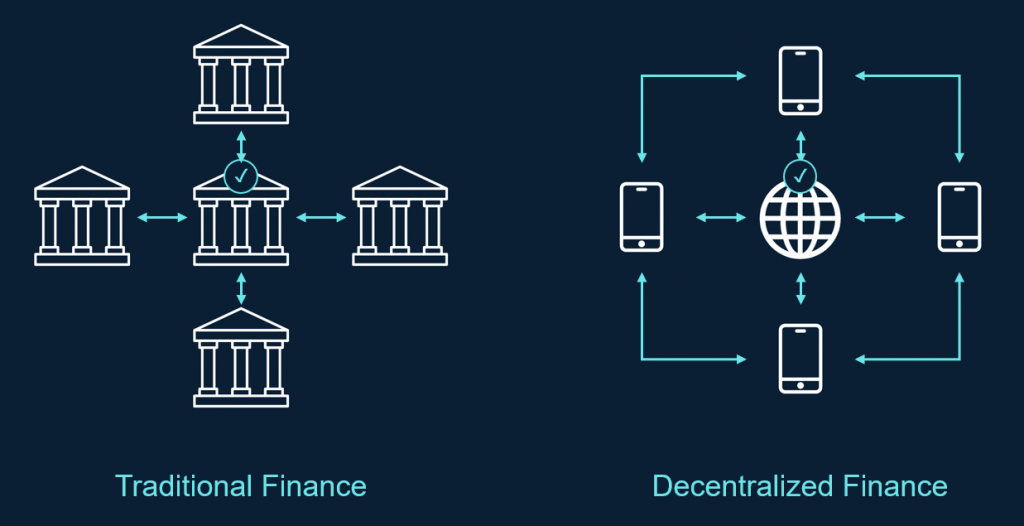

“But ser, why DeFi over TradFi3?”, an intellectual skeptic may ask. Accessibility, decentralization and transparency are the three core reasons why a growing pool of global talent are committed to advancing this vertical of digital assets.

In 2021, the Federal Reserve estimated that a whopping 18% of Americans were either unbanked or underbanked. Put in other words, 63 million Americans either did not have a bank account or have opted out from alternative financial services4. If we zoom out to the rest of the world, this figure balloons to 1.7 billion. This phenomenon can be partially explained not only by inaccesibility due to low income, discrimination, or lack of documentation, but also a growing distrust in financial institutions amongst the younger demographic.

DeFi has the potential to bridge this gap. Anyone with an internet connection and a mobile device or computer can access DeFi apps, as opposed to undergoing extensive registration and KYC processes that may disproportionately discriminate against race, religion, age, nationality, or geography based on legacy policies. As approximately two thirds of all unbanked adults have a mobile phone, DeFi therefore presents a viable solution and we are starting to see early signs of product-market fit from the TVL, transaction, and revenue metrics quoted above.

There is little question that regulated financial institutions that comply with government laws and regulations are some of the most secure places to park funds. But they are not without their own flaws – even large banks can fail. Washington Mutual, the United State’s largest savings and loan association that held deposits over $188 billion, and Lehman Brothers, the fourth-largest investment bank with over $680 billion in assets, were some notable examples.

Many attribute the cause of their downfall due to a lack of transparency and over-centralized authority over significant amounts of clients’ funds and assets. A Credit Default Swap (CDS) underwriter in 2008 had a rough estimate of the quality of Mortgage-Backed Securities (MBS) backing these financial instruments, based on ratings issued by credit ratings agencies, who were perversely incentivized to give good ratings in hopes of future business. As if it weren’t complicated enough, retail investors were mostly oblivious of these misaligned incentives and their potential implications to the wider market.

This is in stark contrast to DeFi, where *all* transactions are executed through smart contracts (lines of code) that are publicly available for everyone to see and inspect. In addition, most DeFi projects today are governed by Decentralized Autonomous Organizations (DAOs) that hold votes on everything from fee mechanics and distribution, protocol design, and treasury management. By leveraging blockchain technology and decentralized governance, token holders (analogous to shareholders) can actively steer the direction of their favorite projects while holding the management teams accountable, all in real-time.

If Bitcoin today were to compete with central banks, then DeFi competes with commercial banks. The combination of reasons above is why on a long enough time horizon, many believe DeFi represents the next leap forward for finance. Even as DeFi yields start to compress as it gains mass adoption over the next few decades, they will still outperform that of TradFi simply because of lower operating costs in the form of back-office staff, rental fees of buildings and ATMs, and tiered fees along the payment processing rails. As Marc Andreesseen puts it eloquently, “Software is eating the world”. Or in DeFi’s case, blockchain is eating traditional finance.

Is Decentralized Finance Even… Decentralized?

The arguments made above aren’t to say that DeFi is perfect – in fact, it is far from it. In 2021, $1.3 billion in cryptocurrency was lost to hacks. This represents a 2.6x increase from the $500 million lost in 2020, but industry enthusiasts can find respite in $1.3 billion representing 0.05% of total market capitalization in 2021, down from 2.78% from 2020.

The lead cause cited was centralization, where 286 out of 1,737 audited projects included privileged ownership. These (ironically) centralized issues can be easily solved using multi-signature wallets or Decentralized Autonomous Organizations (DAOs) instead of using one or a set of private keys.

Apart from centralized Operations Security (OPSEC) issues, authority centralization still exists in DeFi today. Successful DeFi projects often have one or a few prominent figures that the community members look up to and entrust with their funds. The sheer amount of capital (in the millions) kept by project treasuries can cloud the judgment of these founders and managers, leading to mismanagement and deviation from projects’ original visions.

Much of DeFi infrastructure today still relies on Web 2.0. Seeds of community-building are planted on platforms such as Twitter and Discord, having no decentralized alternative when they sprout. Web-hosting services such as Amazon Web Services (AWS) are even prominent DeFi projects (such as dYdX) maintain their front and back-end – even AWS has a page dedicated to “building decentralized applications”.

Bearing these issues in mind, it’s easy to lose sight that decentralization is not binary. Instead, it lives on a spectrum. The surfacing of the issues listed above do not spell doom and gloom for the nascent vertical – they are valid criticisms that the space needs to address before users are deemed financial visionaries instead of internet cypherpunks.

DeFi Digest – The Road Ahead

Similar to how we saw the implications of Bitcoin on money in 2017 when it wasn’t fully apparent, we at Fundstrat recognize the impact blockchain technologies have on finance in the decades to come.

Having said that, DeFi Digest represents an initiative on our part to provide institutional-grade research on all things Decentralized Finance, spanning from new product launches, to the latest news and implications, and select opportunistic strategies. We will attempt to breakdown the different broad categories of DeFi, provide color on fund flows between different Layer 1s and DeFi protocols and break down the inner mechanics (and mathematics) of different DeFi subverticals.

The team counts education as our north star, arming our subscribers with the insights to better understand DeFi projects, their respective structures and incentives of all participants involved. We hope that by adopting this education-first approach, our subscribers can ultimately craft their own DeFi strategies suited to their own risk appetite, diversifying their exposure within the digital asset space.

Bottom Line

Despite being in the space for some time, it never ceases to amaze me how anyone with internet today can permissionlessly access financial services on the internet. Through the launch of DeFi Digest, I hope to be able to share this excitement with you as we venture into the next paradigm of finance, together.

Footnotes

- Ethereum was the first notable smart contract platform, having raised 2 2 million through an ICO in 2014.

- Liquidity mining refers to the reward program of giving out the protocol’s native token in exchange for capital.

- Ser is DeFi slang for “ TradFi is an abbreviation for traditional finance.

- Alternative financial services include money orders, check cashing services, payday loans or payday advances, pawn shop loans, auto title loans or tax refund advances.