Arculus: A wallet bridging security and usability

CLICK HERE for the full copy of this report in PDF format.

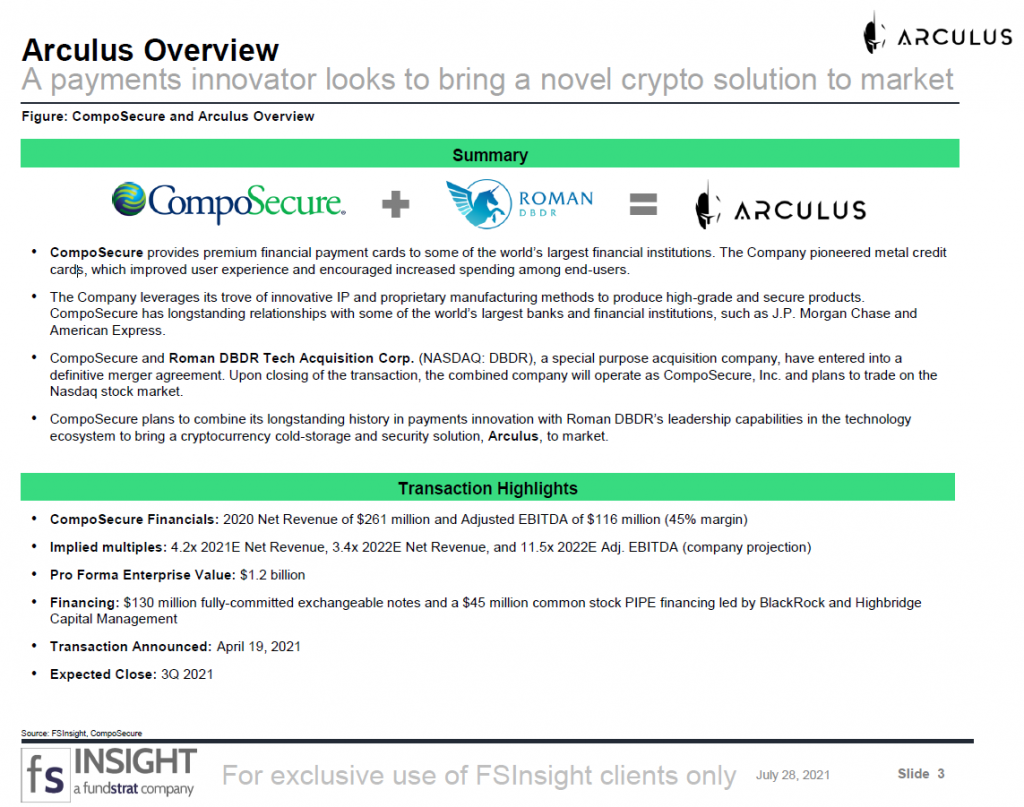

CompoSecure Holdings, LLC (“CompoSecure,” or the “Company”) designs and manufactures metal payment cards for many of the world’s leading financial institutions. The Company was the first to produce a metal card in 2003 in partnership with American Express and has since forged deep relationships with additional issuers/resellers such as JP Morgan Chase, Capital One, and Fiserv ( Slide 12 ). The Company produces cards for a variety of proprietary and co-branded programs and has demonstrated a history of improving security and customer

experience through various design improvements. The Company is now leveraging its experience in secure payment hardware solutions to enter the digital asset space starting with the launch of its Arculus Cold Storage Wallet.

- CompoSecure enters SPAC deal. CompoSecure and Roman DBDR Tech Acquisition Corp. (NASDAQ: DBDR), a special purpose acquisition company, recently entered into a definitive merger agreement valuing the combined entity at approximately $1.2 billion. The transaction is expected to close in Q3 2021 and proceeds from the transaction will be used to implement its growth strategy centered around the centered around the cryptocurrency cold storage and security solution, Arculus (Slide 3).

- Crypto goes mainstream. Digital assets have emerged as an entirely new asset class for institutional and retail investors alike. There are an estimated 100 million users across all cryptoassets and in 2020, crypto surpassed $1 trillion in total market cap (Slide 21). Recently, rising demand for cryptoassets has led to an increase in hacking activity across the entire digital asset landscape. As crypto becomes increasingly ubiquitous, the need for better security options becomes paramount (Slide 22).

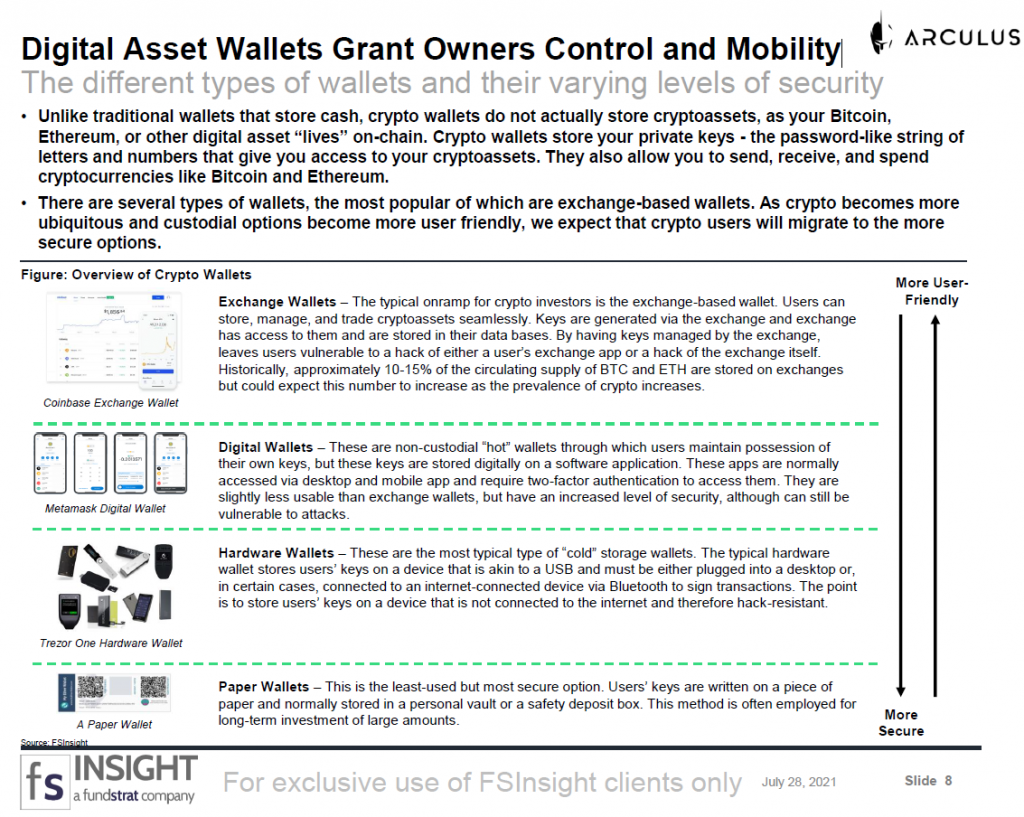

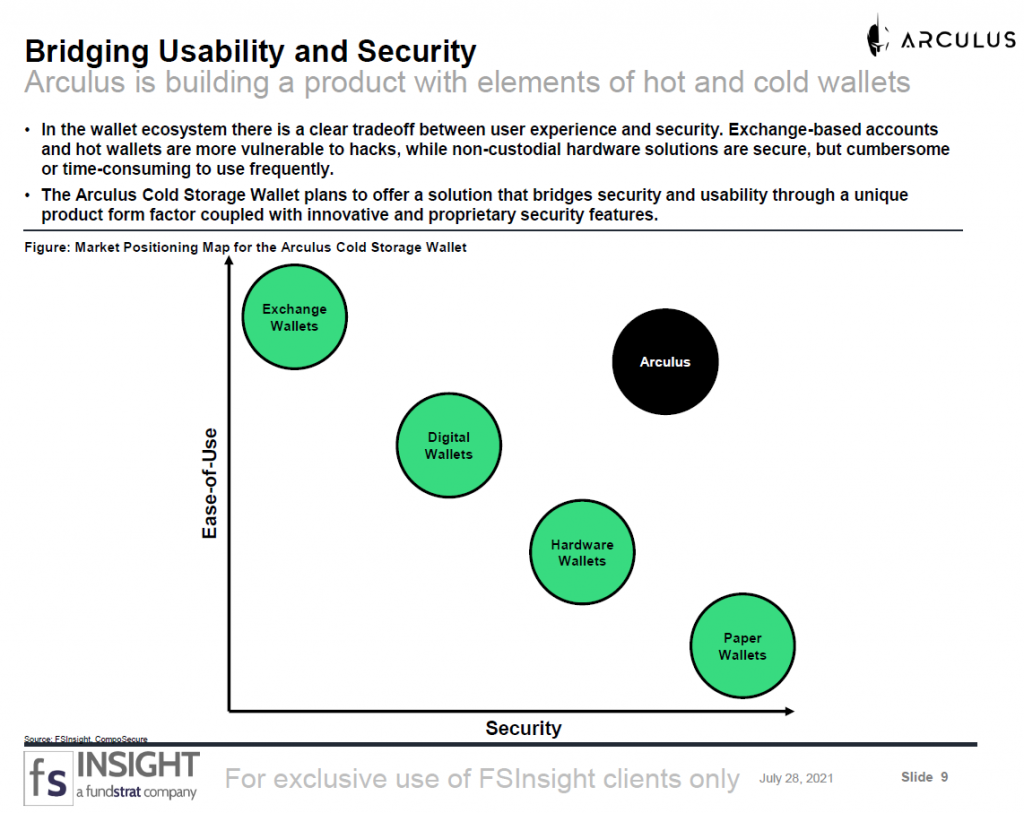

- Demand for better wallets. Wallets are tools employed by crypto users to store, manage, and swap cryptoassets. There are several types of wallets exchange based, digital, hardware, and paper all of which suffer from the historically inevitable tradeoff between usability and security (Slide 8). “Cold Storage” hardware devices have become increasingly popular as digital asset holders seek secure storage solutions that are offline and offer the highest security level (Slide 24). Unfortunately, most of these hardware solutions are cumbersome USB-like devices and require a connection to a desktop, leading to a subpar user experience.

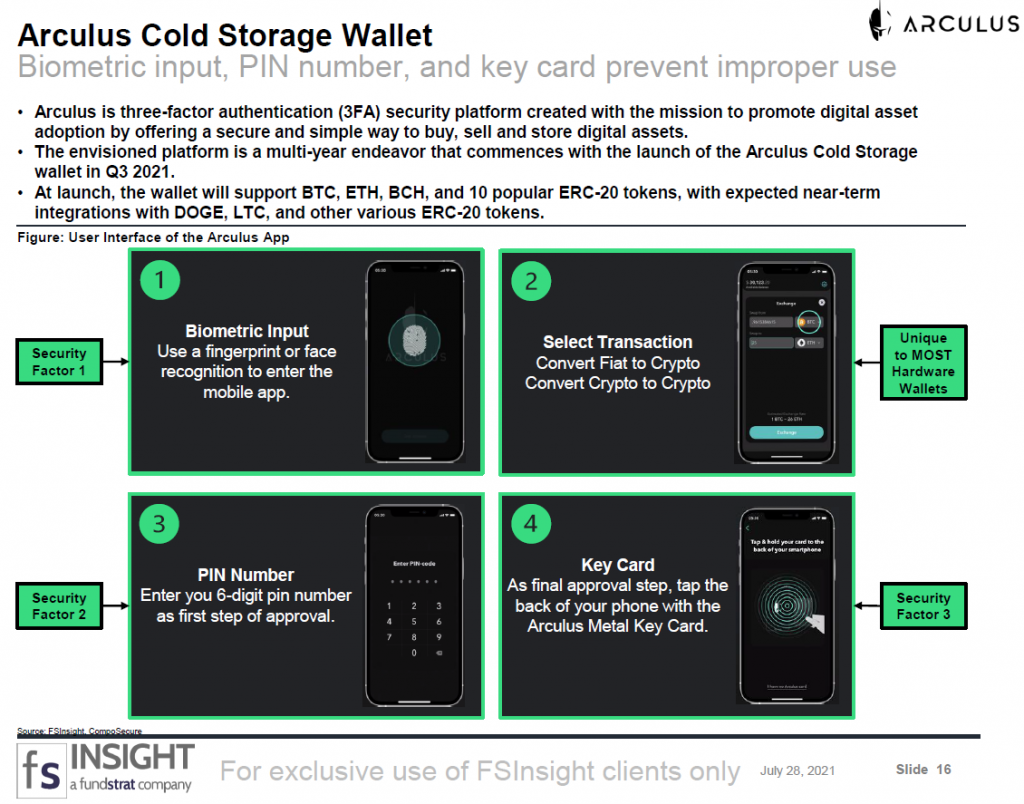

- Arculus wants to bridge the best features of hot and cold wallets. Arculus is three factor authentication (3FA) security platform created with the mission to promote digital asset adoption by offering a simple, secure way to buy, sell, and store digital assets. The envisioned platform is a multi year endeavor that commences with the launch of the Arculus Cold Storage wallet in Q3 2021. The wallet is comprised of a mobile interface through which a user can easily manage and transact their digital assets and a metal card that is applied as the third level of authentication and is where any private keys are stored in an “air gapped” environment (Slide 16).

- CompoSecure is positioned to bring Arculus to life. A byproduct of its successful legacy business is a unique foundation upon which the Company can build its Arculus platform. The Company’s manufacturing capacity can satisfy high scaling requirements, and its proprietary manufacturing processes may result in favorable unit economics for the Arculus hardware product. Further, the Company can tap into its longstanding relationships with premier card issuers to sell its wallet product via the Arculus brand or a white labeled solution (Slide 26).

- Risks. Unforeseen regulatory hurdles that raise costs and create unanticipated operational burdens, an inability to sustain and ultimately leverage business relationships with key partners, degradation of relationships with American Express or JP Morgan Chase, increased competition from within the crypto space, and slower than anticipated mass adoption of hardware wallets (Slide 31).

Bottom Line: The Arculus Cold Storage Wallet has yet to launch, so we lack tangible KPIs to observe, but it does appear that CompoSecure is skating to where the puck is going within the crypto industry. We expect operational cold storage wallets to gain popularity for long-term investors and digital assets traders who are cautious about leaving their assets on an exchange or a non-custodial hot wallet. If CompoSecure successfully leverages its payments industry relationships and achieves its projected unit economics, the Arculus business has the potential to make waves in crypto security.

Key slides from this report…

Cover Page (Slide 1)…

Arculus Overview (Slide 3)…

Digital Asset Wallets Grant Owners Control and Mobility (Slide 8)…

Bridging Usability and Security (Slide 9)…

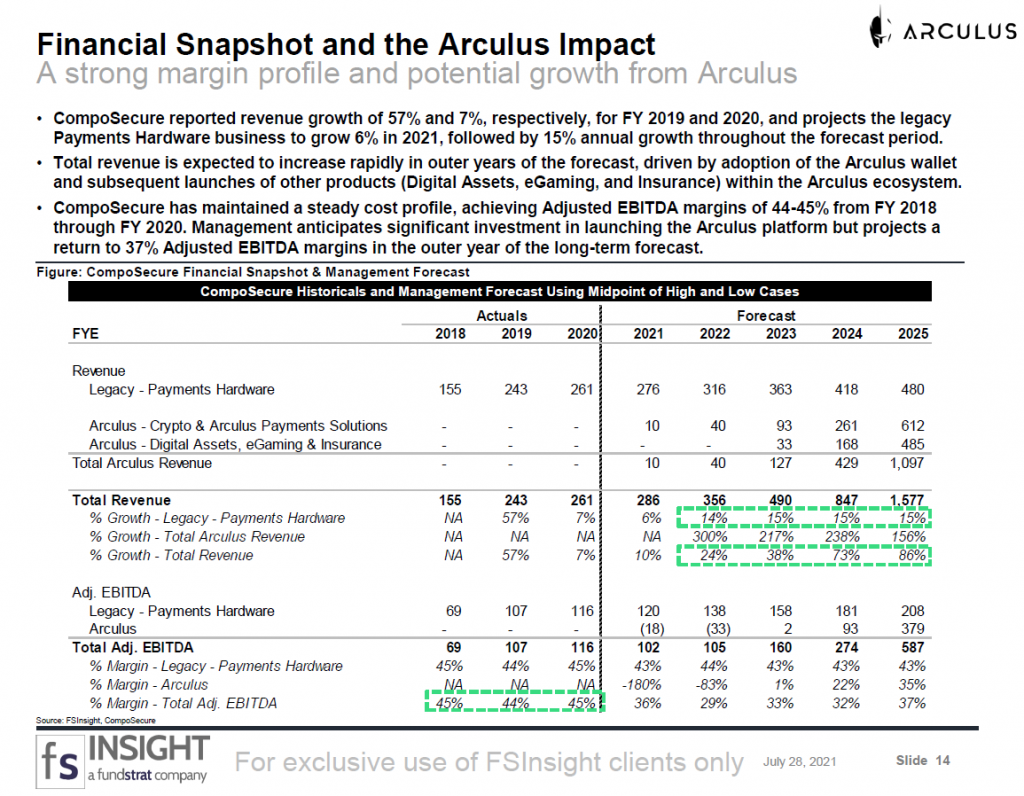

Financial Snapshot and the Arculus Impact (Slide 14)…

Arculus Cold Storage Wallet (Slide 16)…