The UST Unwind and Its Implications

Key Takeaways

- Leading algorithmic stablecoin TerraUSD (UST) broke from its peg this week, exacerbating a macro-driven drawdown in cryptoassets.

- We break down the mechanics behind this de-pegging and ongoing unwind of UST and discuss the risks that remain in the market.

- We expect the UST de-pegging to serve as ammunition for regulators looking to crack down on all private stablecoins and advocate for centrally controlled CBDCs.

- Bitcoin was met with observable support at $30k, in line with our forecast last week. However, we are not ready to call a bottom for the crypto market just yet.

- Strategy – Our near-term outlook remains cautious. It is reasonable to expect downside volatility around continued rate increases and QT. We think opportunistically purchasing near-term (1-3 months) put protection on long crypto positions and reducing exposure to more speculative altcoins are valuable measures to mitigate this risk. Despite this, we remain constructive on cryptoasset prices for 2022 and expect tides to shift in early 2H.

The Makings of a Quasi-bank Run

As if investors needed more reasons to be bearish, the market was thrown into a slight bout of chaos on Monday after a quasi-bank run on UST. Please refer to our prior work on the topic for further background information on UST’s functionality, Luna Foundation Guard, Anchor, and stablecoins.

First Peg-Break

We have ample reason to believe that the “run” on UST 1.20% was not a coincidence, but a deliberate exploit of UST’s (clearly fragile) architecture.

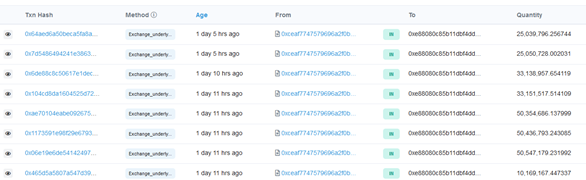

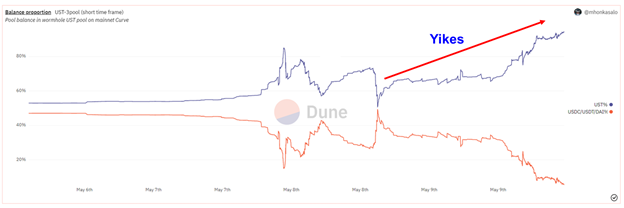

On Saturday, prior to any market panic, the Luna Foundation Guard removed approximately $250 million in two separate transactions from the UST-3pool Curve pool, reportedly in preparation for the launch of the upcoming 4pool. Immediately following the first LFG transaction, a seller took to Curve to swap $85 million of UST for USDC, putting the Curve UST-3pool consisting of UST, USDC, USDT, and DAI noticeably out of balance. It seems apparent that this party was reacting to the already-reduced liquidity in the pool and taking the opportunity to push the pool out of balance. The seller of UST was flooding the exchange with supply at a pace that exceeded marginal demand. The sight of a supply/demand imbalance for UST created a positive feedback loop that caused bids for UST to fall. Ultimately, a lack of buying support caused UST to break below $1.00, down to nearly $0.98.

Source: @mhonkasalo on Dune Analytics

The market quickly started to show signs of cracking, as many onlookers wondered what was happening behind the scenes. To remedy the situation, another market participant(s) commenced market-selling ETH -1.52% for USDT on exchanges, which was then brought to Curve, thus bringing the Curve pool closer to equilibrium, and closing the gap between UST and $1.00.

Source: Etherscan, @resonancethis on Twitter

Spiraling

Following this initial bout of fear instilled in the crypto market, traditional markets opened on Monday, and risk assets continued their persistent sell-off, with the DJIA shedding 500 points and the Nasdaq falling 3% at open. It appears that the party who held the short side of this UST (or LUNA) trade smelled blood in the water and continued with its market swaps on Curve, with the knowledge that few buyers would want to step in to catch a falling knife in the form of an algo stablecoin that appears to be unwinding. As of Monday afternoon, nearly all non-UST liquidity on Curve was completely drained.

Source: @mhonkasalo on Dune Analytics

There was an attempt at defending the peg on Binance by buyers that put forth bids in the hundreds of millions of dollars. This effort was largely futile, as UST remained well below its $1.00 peg.

Source: TradingView

LFG Commitments

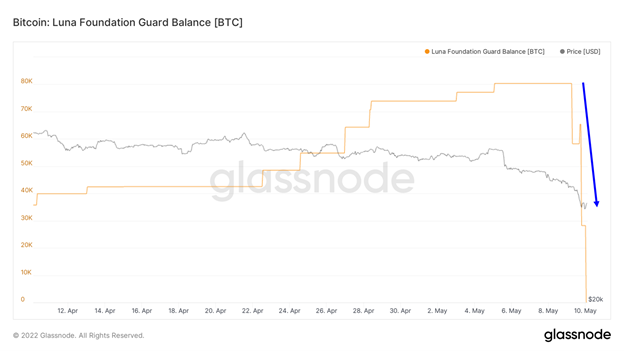

In response to this market volatility, the Luna Foundation Guard (LFG) committed to lending out $750 million of bitcoin and $750 million of UST to traders that were tasked with maintaining the UST’s parity with the dollar. In short, traders could market sell BTC -2.64% for UST when it falls below $1.00 and use the loaned UST to purchase BTC once markets settle.

We can see below that the LFG reserves were completely depleted on Monday afternoon.

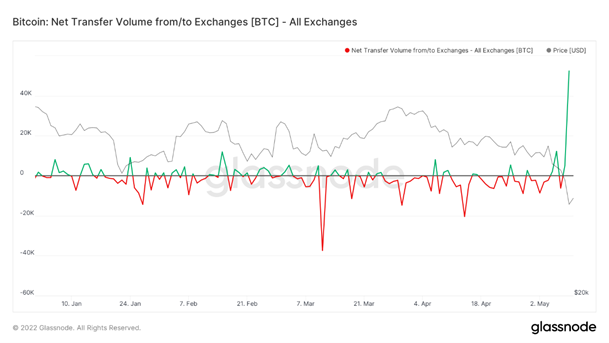

The coins sent to traders to make a market for UST added considerable liquidity on exchanges for bitcoin.

As noted yesterday, while this loaned BTC increased the potential selling pressure in the market, it is a small percentage of bitcoin’s average daily volume. Additionally, selling into declining prices is unlikely to effectively save the UST peg. As we observed yesterday, market makers started selling BTC to support UST, but quickly realized that this selling merely exacerbated the issue since falling prices were reducing the ammunition available to support the peg and did nothing to help save the peg.

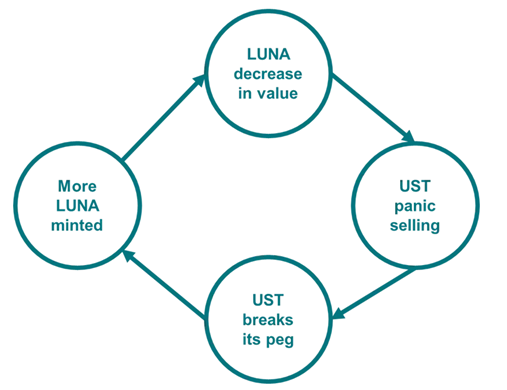

The real downside risk is in LUNA and UST prices, as further market volatility could lead to a complete “death spiral,” as discussed in this previous weekly note and this DeFi Digest.

Source: Fundstrat

It is difficult to say whether the LFG capital was deployed yet, or if the trading firms the capital was lent to are waiting for a more supportive environment to market buy. Regardless, we do not think that the existence of this dry powder is ready to be deployed is a grave concern for bitcoin and ether prices.

The more considerable risk is in another bout of market panic, caused by the macro environment and exacerbated by LUNA-driven risk that could lead to BTC and ETH losing support.

Where Are We Now?

When all was said and done (this note is being constructed in the early morning hours on Tuesday, 5/10), UST plummeted to $0.62 on Coinbase and other comparable exchanges and remains below $0.92, as investors appear to have lost confidence in the algorithmically backed stablecoin.

At the time of writing, TerraUSD’s market cap is $16.5 billion, and LUNA’s market cap is $11.7 billion.

Source: TradingView

What Are the Key Implications?

- We have noted in prior research that UST, while a mostly admirable attempt at developing a stablecoin outside the purview of the government, required functional utility (such as being the preferred stablecoin on a particular exchange or payment network) to maintain its peg. Clearly, heavily subsidized yield on Anchor is the only reliable source of demand for UST, and therefore, it is not likely that UST retains its peg and gets out of this unscathed/without major changes to its model.

- As this note is being constructed, UST is finding some short-term footing, but there remains a sizeable amount of UST and LUNA that could still unwind. Although it is likely that many holders of UST and LUNA would use ETH and BTC as their choice of exit liquidity, an unwind of $16.5 billion in UST and $11.7 billion in LUNA could add to the bearish sentiment across risk assets and drive the overall market lower.

- Pegs have fallen before – USDT has “broken the buck” on several occasions. However, restoring trust in a collateralized stablecoin is a much easier task than restoring trust in an algo stablecoin. If UST regains its peg, there is no question that buying LUNA here would produce sizeable returns. However, the core issues with UST will persist, and it will only be a matter of time before the algo stablecoin would need to confront its fate, layer UST into applications that facilitate massive, sustained demand, and/or introduce a collateral-based feature such as the one employed by Frax (FRAX). The best-case scenario for most crypto investors would probably be a “slow bleed” of UST into a market that accepts its death. Regardless, we do not feel this long-LUNA trade is worth the risk, especially given the current inhospitable macro environment for altcoins.

- From a long-term regulatory perspective, we could see this event being used as ammunition by regulators looking to bring all stablecoins under strict KYC regulations and perhaps serve as a tailwind for the central banks that are pushing for a CBDC. As we have noted before, centrally operated, permissioned CBDCs carry the risk of abuse of control by governments through the introduction of strict surveillance mechanisms. Coincidentally, the Fed released a Financial Stability Report on Monday citing stablecoins as risky due to them being “prone to runs.” (Interesting timing, huh?)

Is This the Bottom?

Bitcoin briefly dipped below $30k, where it immediately caught a bid, while ether touched $2,200 before springing higher. This is consistent with the support range noted in our previous weekly note.

Source: TradingView

We saw substantial volumes on bitcoin’s approach to $30k, confirming that there is a cohort of investors that are ready to scoop up any bitcoin sold at these levels.

Source: TradingView

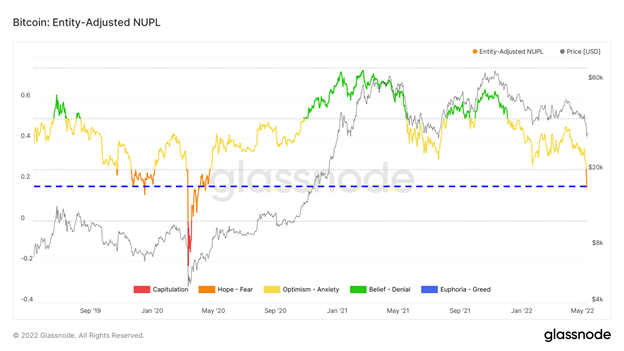

We also saw some slight capitulation from long-term bitcoin holders this week, which is a hallmark of most bear market lows. Additionally, the overall profitability of bitcoin wallets plummeted to levels last seen in early 2020. This could mean that those still in the market are long-term holders or holders that just bought into the market at these levels and are currently holding their BTC “at cost.” Often a dramatic decrease in NUPL precedes a climb higher.

Despite these early signs of a market trough, we are not quite ready to call a bottom, given the macro headwinds, most notably the CPI print that drops tomorrow. We think that a softer number than analysts expect could help make the case that this is a longer-term floor.

Strategy

Our near-term outlook remains cautious. It is reasonable to expect downside volatility around continued rate increases and QT. We think opportunistically purchasing near-term (1-3 months) put protection on long crypto positions and reducing exposure to more speculative altcoins are valuable measures to mitigate this risk. Despite this, we remain constructive on cryptoasset prices for 2022 and expect tides to shift in early 2H.