The Rollercoaster Ride Continues

Key Takeaways

- The global crypto market continues to exhibit a range-bound choppiness, waxing and waning on the latest headlines.

- We discuss the White House’s executive order on crypto. In short, we think it is incredibly bullish for the industry and is emblematic of the ongoing shift of the Overton window for digital assets.

- LUNA has outperformed the market over the past few weeks, demonstrating the impact of adding bitcoin as a reserve asset.

- We discuss the importance of subnet architectures and how impending investments in the Avalanche ecosystem might catalyze adoption.

- The current macro setup is starting to show similarities to the one in 2019 when bitcoin and other risk-on assets rallied in the wake of dovish reversal by the Fed.

- Bottom Line – We continue to believe it is wise to maintain existing long positions in BTC and ETH and look to add on dips as ongoing geopolitical conflict and macro uncertainty could result in continued volatility. We will continue to monitor demand-side metrics for signs of a more sustained bull market run.

Weekly Recap

The global crypto market continues to exhibit a range-bound choppiness, waxing and waning on the latest headlines. We saw ETH -5.16% and BTC -2.72% start the week above the $43k level after benefitting immensely from Russian sanctions and the narratives surrounding them.

Since then, markets have retreated as commodity prices skyrocket – oil hit $130 per barrel, wheat prices reached a 14-year high, and a metal exchange had to roll back transactions and limit trading because nickel prices were getting out of hand.

Such price action had many in traditional markets beating the “stagflation” drum, thus causing equities and cryptoassets to flounder.

Bitcoin caught a bid briefly on Tuesday evening following the leak of President Biden’s Executive Order on crypto, which had a surprisingly optimistic tone (more on this below) but is once again finding it to be a challenge to remain above the $40k level.

This choppiness is directly in line with what we had forecasted for the first half of this year in our Annual Outlook, and presently, few signs are pointing to any imminent breakout from this pattern.

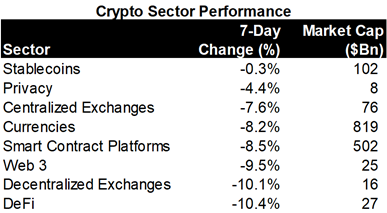

In concert with the previous couple of months, we saw stables and currencies outperform speculative alts. DeFi continues to lag smart contract platform performance, a trend reflective of a lack of willing market participants to supply liquidity to many of these protocols.

Source: Messari

An Executive Order We Can Get Behind

On Wednesday morning, the White House released its Executive Order on Ensuring Responsible Development of Digital Assets. Well, this was its official release. Sec. Yellen’s office accidentally leaked her response to the EO the preceding night, tipping off markets ahead of time.

While there was some media-fueled apprehension surrounding this release, most negative speculation was hot air and did not receive any credence in investing circles. At its core, this EO was a directive to form an organized strategy around investigating digital assets and developing a game plan for regulating them.

A common misconception from those outside of the digital assets space is that the industry is unfriendly to regulation – this is largely untrue. The digital assets industry is simply wary of the unclear regulatory environment that has persisted since the emergence of crypto as an asset class and wants to prevent any laws that unnecessarily stifle innovation.

A vital goal of this directive seems to be discovering ways in which the government can provide more specific guardrails around cryptoassets and allow innovation to flourish domestically. We think this is incredibly bullish for the industry and is emblematic of the ongoing shift of the Overton window for digital assets. Merely a few years ago, crypto was nothing but a useless Ponzi, and now it is recognized as a critical piece of technology from both an economic and geopolitical perspective.

The White House has finally come to terms with the fact that bitcoin and the broader crypto industry are offering something that consumers demand. While it might be potentially disruptive to the way they are used to doing business, it is inevitable. An attempt to put a stranglehold on crypto will simply enrage a growing cohort of politicians that have adopted pro-crypto stances and will likely shift innovation to other jurisdictions, ultimately hurting the United States.

There are already examples abroad that point to the political advantages of embracing crypto. For example, a pro-crypto candidate who was very outspoken about crypto adoption on the campaign trail won South Korea’s presidential election on Wednesday. We will likely continue to see countries that espouse democratic values start to rally behind the crypto industry, as it is (in its ideal state) a tool to promote individual and economic freedom.

Here is the White House fact sheet on the Executive Order:

Digital assets, including cryptocurrencies, have seen explosive growth in recent years, surpassing a $3 trillion market cap last November and up from $14 billion just five years prior. Surveys suggest that around 16 percent of adult Americans – approximately 40 million people – have invested in, traded, or used cryptocurrencies. Over 100 countries are exploring or piloting Central Bank Digital Currencies (CBDCs), a digital form of a country’s sovereign currency.

The rise in digital assets creates an opportunity to reinforce American leadership in the global financial system and at the technological frontier, but also has substantial implications for consumer protection, financial stability, national security, and climate risk. The United States must maintain technological leadership in this rapidly growing space, supporting innovation while mitigating the risks for consumers, businesses, the broader financial system, and the climate. And, it must play a leading role in international engagement and global governance of digital assets consistent with democratic values and U.S. global competitiveness.

That is why today, President Biden will sign an Executive Order outlining the first ever, whole-of-government approach to addressing the risks and harnessing the potential benefits of digital assets and their underlying technology. The Order lays out a national policy for digital assets across six key priorities: consumer and investor protection; financial stability; illicit finance; U.S. leadership in the global financial system and economic competitiveness; financial inclusion; and responsible innovation.

Specifically, the Executive Order calls for measures to:

- Protect U.S. Consumers, Investors, and Businesses by directing the Department of the Treasury and other agency partners to assess and develop policy recommendations to address the implications of the growing digital asset sector and changes in financial markets for consumers, investors, businesses, and equitable economic growth. The Order also encourages regulators to ensure sufficient oversight and safeguard against any systemic financial risks posed by digital assets.

- Protect U.S. and Global Financial Stability and Mitigate Systemic Risk by encouraging the Financial Stability Oversight Council to identify and mitigate economy-wide (i.e., systemic) financial risks posed by digital assets and to develop appropriate policy recommendations to address any regulatory gaps.

- Mitigate the Illicit Finance and National Security Risks Posed by the Illicit Use of Digital Assets by directing an unprecedented focus of coordinated action across all relevant U.S. Government agencies to mitigate these risks. It also directs agencies to work with our allies and partners to ensure international frameworks, capabilities, and partnerships are aligned and responsive to risks.

- Promote U.S. Leadership in Technology and Economic Competitiveness to Reinforce U.S. Leadership in the Global Financial System by directing the Department of Commerce to work across the U.S. Government in establishing a framework to drive U.S. competitiveness and leadership in, and leveraging of digital asset technologies. This framework will serve as a foundation for agencies and integrate this as a priority into their policy, research and development, and operational approaches to digital assets.

- Promote Equitable Access to Safe and Affordable Financial Services by affirming the critical need for safe, affordable, and accessible financial services as a U.S. national interest that must inform our approach to digital asset innovation, including disparate impact risk. Such safe access is especially important for communities that have long had insufficient access to financial services. The Secretary of the Treasury, working with all relevant agencies, will produce a report on the future of money and payment systems, to include implications for economic growth, financial growth and inclusion, national security, and the extent to which technological innovation may influence that future.

- Support Technological Advances and Ensure Responsible Development and Use of Digital Assets by directing the U.S. Government to take concrete steps to study and support technological advances in the responsible development, design, and implementation of digital asset systems while prioritizing privacy, security, combating illicit exploitation, and reducing negative climate impacts.

- Explore a U.S. Central Bank Digital Currency (CBDC) by placing urgency on research and development of a potential United States CBDC, should issuance be deemed in the national interest. The Order directs the U.S. Government to assess the technological infrastructure and capacity needs for a potential U.S. CBDC in a manner that protects Americans’ interests. The Order also encourages the Federal Reserve to continue its research, development, and assessment efforts for a U.S. CBDC, including development of a plan for broader U.S. Government action in support of their work. This effort prioritizes U.S. participation in multi-country experimentation, and ensures U.S. leadership internationally to promote CBDC development that is consistent with U.S. priorities and democratic values.

The Administration will continue work across agencies and with Congress to establish policies that guard against risks and guide responsible innovation, with our allies and partners to develop aligned international capabilities that respond to national security risks, and with the private sector to study and support technological advances in digital assets.

LUNA Living up to its Name

A few short weeks ago, we discussed Terra (LUNA), a proof-of-stake layer 1 platform centered on algorithmic stablecoins. Investors in the platform employed an innovative strategy to increase confidence in UST 0.67% ’s peg to the USD by putting $1 billion of BTC into a reserve treasury.

A quick recap:

The most popular and widely used Terra stablecoin is UST, which is pegged to the US dollar. In contrast to centralized stablecoins like USDC and USDT, which are backed by tangible assets, Terra’s native token LUNA is used to maintain the 1:1 peg of Terra stablecoins to their respective base assets. UST and LUNA act as counterbalancing forces that seesaw depending on UST demand.

When the demand for UST increases and the token starts to lose its peg to the upside, users will mint additional supply of UST by “burning” an equivalent amount of LUNA. Conversely, UST is burned, and LUNA is minted when the peg is below $1.

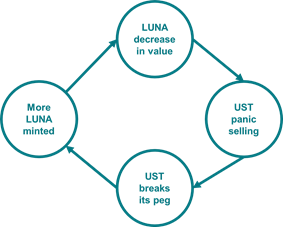

One major (and fair) criticism of UST and other algorithmic stablecoins is their inherent reflexivity. A vast market selloff can cause significant downward pressure on the 1:1 peg. This downward pressure could incite further exit from UST positions, resulting in additional minting of LUNA, and so on, until users find themselves amid a “death spiral.”

Source: Fundstrat

Ultimately, once sufficient economic activity is built around Terra, the risk of such a “bank run” should be de minimis. That said, there is a particular “chicken and egg” problem at play, as incentivizing developers to build additional economic activity around Terra requires confidence in UST. But in the meantime, to encourage growth around UST, Luna investors introduced BTC as a reserve asset for UST.

We noted that this was the perfect marriage of the innovative web3 solutions pushing the boundaries of interoperability and composability with the ultimate bastion of decentralization in bitcoin. Bitcoin is the ultimate reserve asset and is starting to be used as such. We expect to see BTC used similarly across DeFi in the years to come. At some point, nation-states will follow in the steps of El Salvador and Terra and increasingly build a bitcoin position in their respective country’s reserves.

Source: TradingView, Twitter

The strategy appears to be paying off quite well, as the UST market cap has increased by nearly $2.5 billion since the announcement of the BTC reserves, and LUNA has increased commensurately as a result. We think this can be attributed to a few things:

- There has been increased demand for stablecoins amid the recent market tumult.

- We think the demand for decentralized stablecoins has increased due to rising concerns of government overreach on centralized stablecoins.

- The bitcoin reserve has influenced investors to reprice the risk of the otherwise reflexive Terra platform.

As a result of the above, LUNA has outperformed the entire large-cap crypto market, reaching a new all-time high on Wednesday afternoon.

Over the long term, we are constructive on LUNA and think that the sustainability of UST’s peg will lead to increased demand and continued adoption of the algorithmic stablecoin.

An Avalanche of Capital

On Wednesday, the Avalanche Foundation announced that it would grant 4 million AVAX tokens worth of incentives (nearly $290 million at current prices) to encourage the adoption of its subnet architecture.

Source: Coindesk

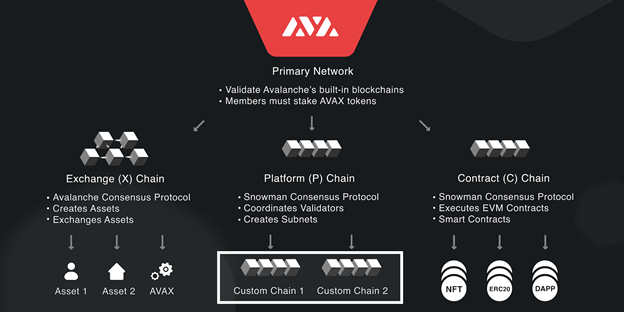

What are subnets, and why are they important?

Subnets are separate blockchains linked to Avalanche, share certain tools and features, but can be uniquely tailored to specific applications. Importantly, they are a tool with which a layer 1 platform can scale effectively, as subnets are effectively siloed operations. One subnet does not compete for the same computing resources as the other subnets. This means that if an application is throttling speed and throughput on Subnet A, it does not inhibit Subnet B. Cosmos (ATOM -3.26% ) and Polkadot (DOT) are platforms that feature similar architectures.

Source: Avalanche Foundation

The topic of subnet importance probably deserves a research piece of its own. We think the most significant use case for the Avalanche platform is bridging the centralized financial world with DeFi. Subnets allow for a permissioned front-end to interact and leverage the interoperability, composability, and global liquidity of DeFi. This allows TradFi borrowers, lenders, and market makers to sacrifice some elements of decentralization (for things like KYC) in exchange for these benefits.

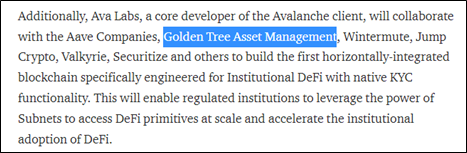

We are already seeing the primary Avalanche development team pursue such implementations of subnets, as Ava Labs is reportedly collaborating with Aave, Golden Tree, Wintermute, Jump Crypto, and others to build a blockchain designed explicitly for Institutional DeFi.

Source: Avalanche Foundation

In addition to DeFi initiatives, there are also efforts to spur growth in NFTs and gaming. The other significant initiative funded by the new program is the construction of a new subnet for the NFT gaming platform DeFi Kingdoms (JEWEL).

While there remain some technical questions surrounding the interoperability of assets between subnets, we think that the launch of this fund speaks to the fact that the development team at Ava Labs will work through any challenges to make this initiative a success. We think that this may be a significant catalyst for the platform, which is already a burgeoning platform with tons of activity on the “main chain.”

A Look Ahead

While we did not conduct a deep dive of on-chain activity for Bitcoin or Ethereum in this note, we have continued to monitor user behavior internally. We have yet to find substantive evidence of a definitive bullish shift in investor sentiment.

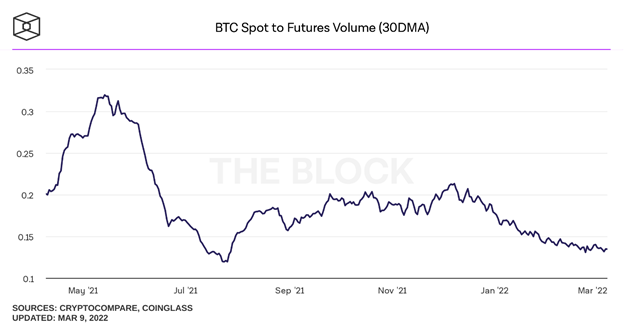

We continue to believe that cryptoasset prices are mainly being driven by a low liquidity environment and an active derivatives market. We think the chart below from The Block speaks to this fact.

With thin order books in mind, it is important to consider the events that are transpiring in the near-term:

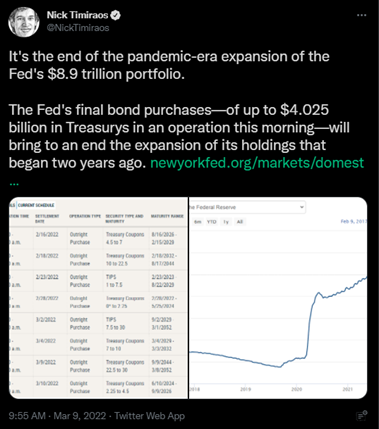

- The Federal Reserve finally ended its bond-buying initiative that has been in overdrive since the start of the pandemic. We will have a first glimpse of what removing the party’s punch bowl might do to asset prices.

- On Thursday, February’s CPI figure was released and, as expected, was very high.

- Then, next week, Jerome Powell is likely to finally raise rates 25 bps in an attempt to reintroduce the world to something known as a cost of capital.

Source: Twitter

We think that the impending rate increase (along with 3-4 additional increases) is already priced into most assets. However, with the backdrop of a commodities squeeze, a non-zero chance of nuclear conflict, and oil hitting $130 per barrel, we are bound to witness further volatility at some point.

We think it is appropriate to remind our clients of what transpired the last time that the Fed raised rates and tried to reduce the size of the Federal balance sheet. Liquidity dried up, asset prices fell, and they were consequently forced to reverse both actions.

We think that given the current macro backdrop, we may see a similar setup in which asset prices waver on increased rates and quantitative tightening. The Fed will have the choice of “accepting” excessive structural inflation or recession, at which crossroads they may decide to reverse course on tighter monetary policy. We could similarly see risk assets spike as they did in 2019 when BTC doubled from its trough if this were to occur.

Either way, we are heading towards a world of negative real rates, the debasement of fiat currencies, and the increasing adoption of digital assets among individuals, corporations, and governments.

Source: TradingView

Potential Floor for BTC Price

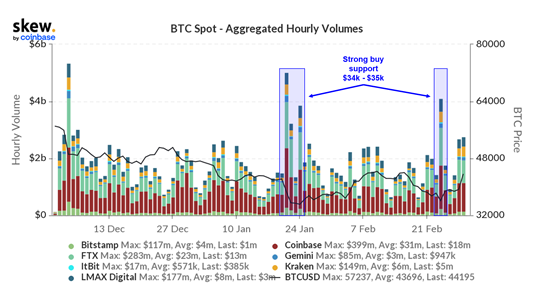

As we mentioned in last week’s note, recent price action has provided interesting data that supports a price “floor” for bitcoin around the $33-$35k level.

We have seen firm buying support in this area for the second time since the market’s all-time high in November and subsequent drawdown. The previous instance was at the market low around January 24th, and the second was around the issuance of sanctions on Russia. If we see another significant bout of downward pressure on prices, recent precedent gives us some confidence that buyers could step up in this area.

Bottom Line

We continue to believe it is wise to maintain existing long positions in BTC and ETH and look to add on dips as ongoing geopolitical conflict and macro uncertainty could result in continued volatility. We will continue to monitor demand-side metrics for signs of a more sustained bull market run.