A View Into ‘22

Key Takeaways

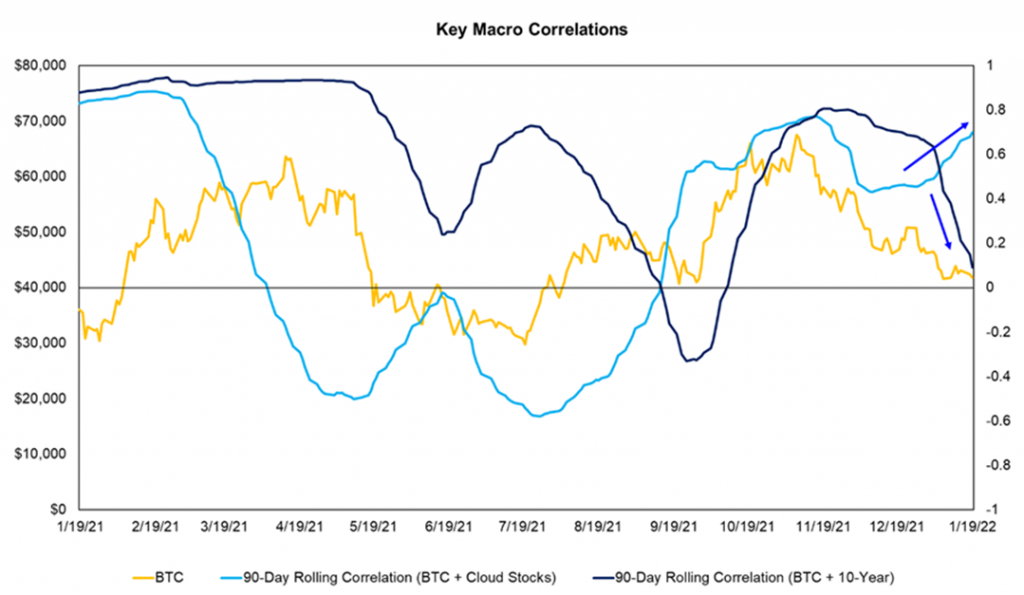

- Macro continues to dominate the crypto discourse as the 90-day rolling correlation between BTC and the BVP Emerging Cloud Index approaches 1.

- We discuss our thoughts pertaining to where Bitcoin sits on investors’ risk curves, how it will move to a lower risk bucket in 2022, and why this would be a major tailwind for the asset.

- SOPR gives us a view into the profile of recent sellers. Meanwhile, long-term holders continue to accumulate, siphoning supply from “paper hands.”

- We investigate the concept of dormancy flow and the bullish signal it might be providing investors.

- Bottom Line: Bitcoin and the broader crypto market remain subject to the whims of macro variables, but there are early signs of seller exhaustion. We still think it is possible to see a short-term rally in late January, but overall maintain that monetary tightening might continue to present choppy waters for crypto through Q1 and into Q2. As more supply shifts to long-term holders, this is a wise time for the long-term Bitcoin investor to accumulate. As outlined below, we think there is a convincing macro thesis for Bitcoin and crypto to thrive in 2022, despite near-term risks.

Macro Mania

Consistent with the past several weeks, macro headlines have dominated the discourse surrounding Bitcoin and the wider crypto market.

Historically, PMs have debated whether BTC is a truly uncorrelated asset since it generally performs well when risk assets do. However, recent results are indisputable as the BTC price has moved in lockstep with high-growth tech stocks.

As demonstrated by the chart below, the 90-day rolling correlation between BTC and the BVP Emerging Cloud Index is approaching 1 while its correlation with the US 10-year has decreased sharply and is fast-approaching -1.

We resurface the chart below once again, just to reinform people on the recent divergence of the 10-year and BTC price. As we have discussed before, Bitcoin’s outsized negative correlation with rates and positive correlation with tech stocks has much to do with its adoption among legacy market participants. We think that most marginal sellers at this stage of the recent drawdown are likely from investors whose portfolios are weighted towards legacy assets.

We note that the past week has been somewhat encouraging as Bitcoin has displayed signs of inching toward a decoupling from macro variables. BTC performed quite robustly against the Nasdaq 100 (QQQ), up 3.52% over the previous 7 days (at the time of writing). This is despite the 10-year reaching a 2-year high as it continues its ascent to 2.0%.

This is a small sample size, and subject to reverse course, but it suggests that we may have shaken out a good portion of speculative traders that are perhaps more risk-averse or short-term oriented than the other cohorts of Bitcoin holders.

What Now?

To reiterate a few points from our note last week, we think that short-term traders might be presented with a challenging market over the next several months as BTC (and crypto) is jostled around by fears over reduced liquidity from Fed tightening and rising interest rates. It is likely that we stay range-bound below prior all-time highs in the immediate-term. However, this choppy market won’t last indefinitely. Below, we bring you through some of our thoughts on how the rest of 2022 might shake out through the lens of evolving risk curves.

Risk Curves

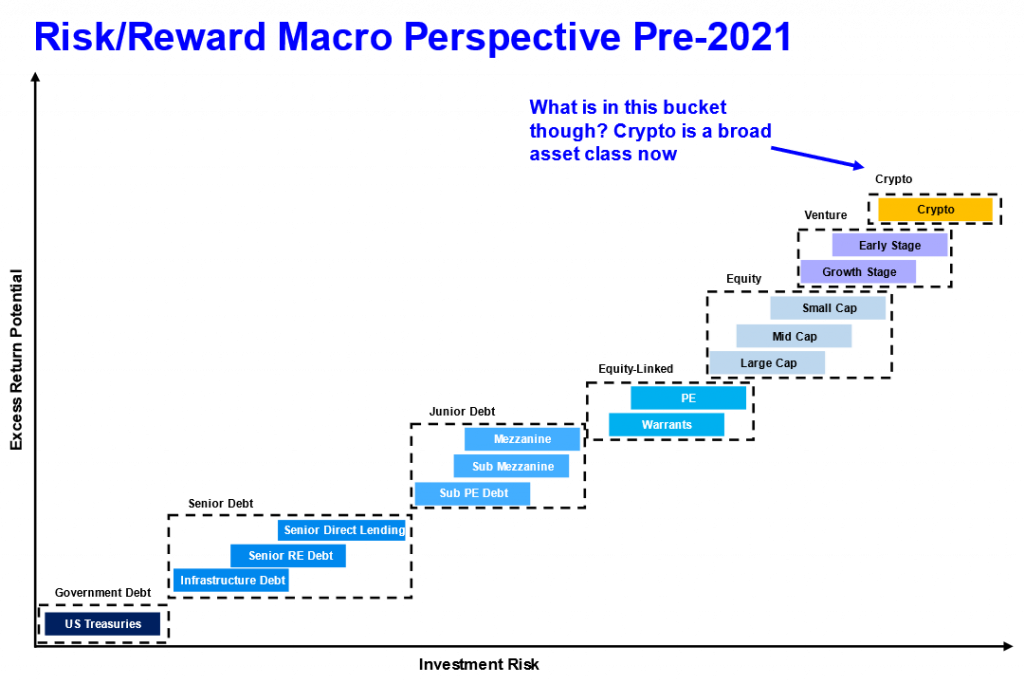

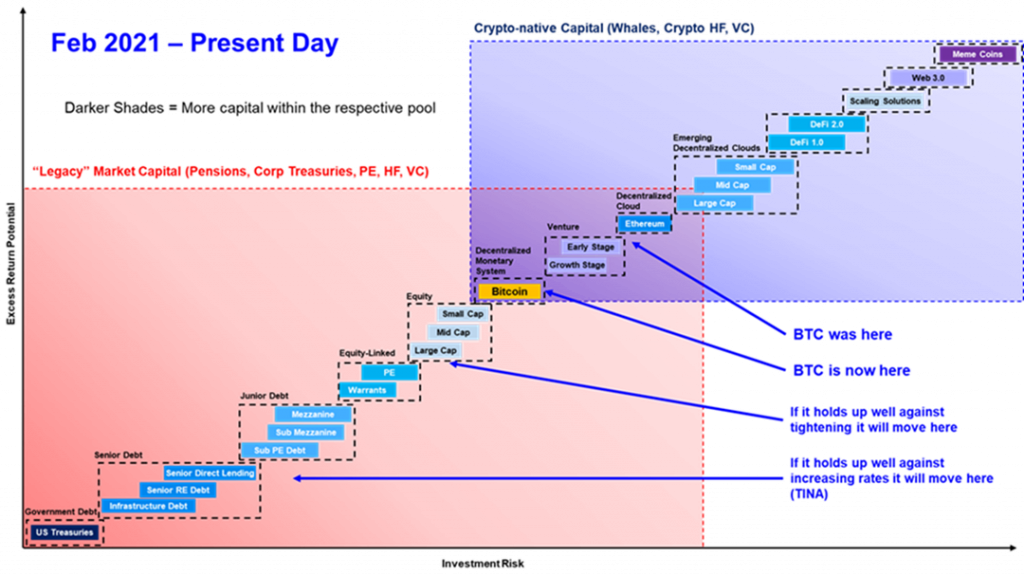

The graph below might be familiar to some of our long-term clients. It is a conceptual map of the relative risk and return between major asset classes. This was historically a very useful tool to develop frameworks around market rotations from a macro perspective. This high-level curve also worked well because crypto was rather monolithic prior to 2020 – there was Bitcoin and a few alternative layer 1 blockchains that have since vanished into obscurity.

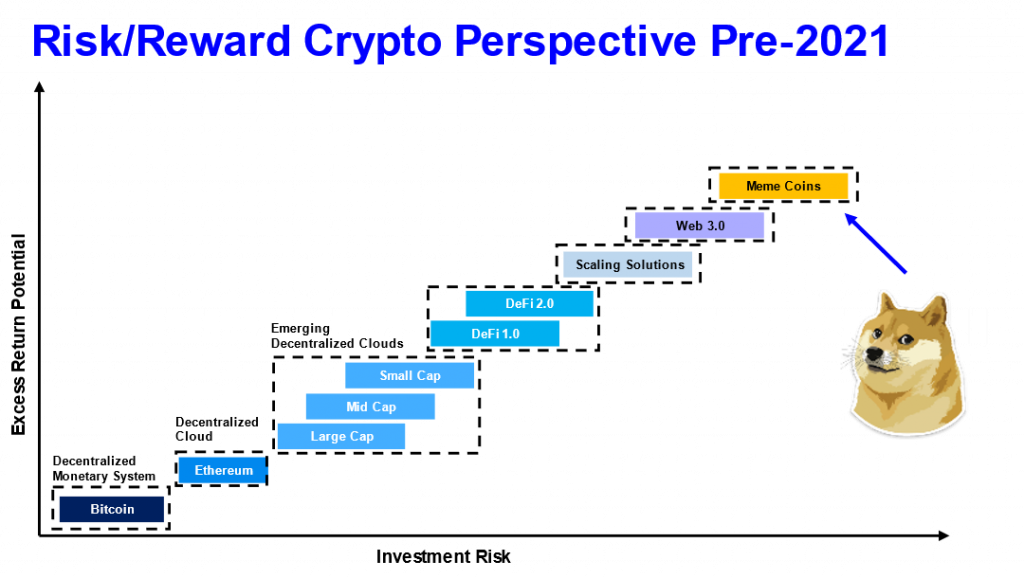

Given the products that have been developed, the subsectors within crypto that have been defined, and the capital from both legacy and crypto-native investors that has flooded the market, we must break out the Crypto box above into its own risk curve.

Below is a rough sketch of where each subcategory of crypto resides on the risk curve. I am sure there are plenty of hairs to split regarding which goes where, but this is directionally correct. There is Bitcoin (decentralized monetary system), Ethereum (the OG decentralized computing network), followed by other proven layer 1’s, DeFi projects, scaling solutions, web3.0 projects, and at the very top right, the meme coins.

The detail-oriented reader will note that each of these is labeled “pre-2021.” We will elaborate on that further below.

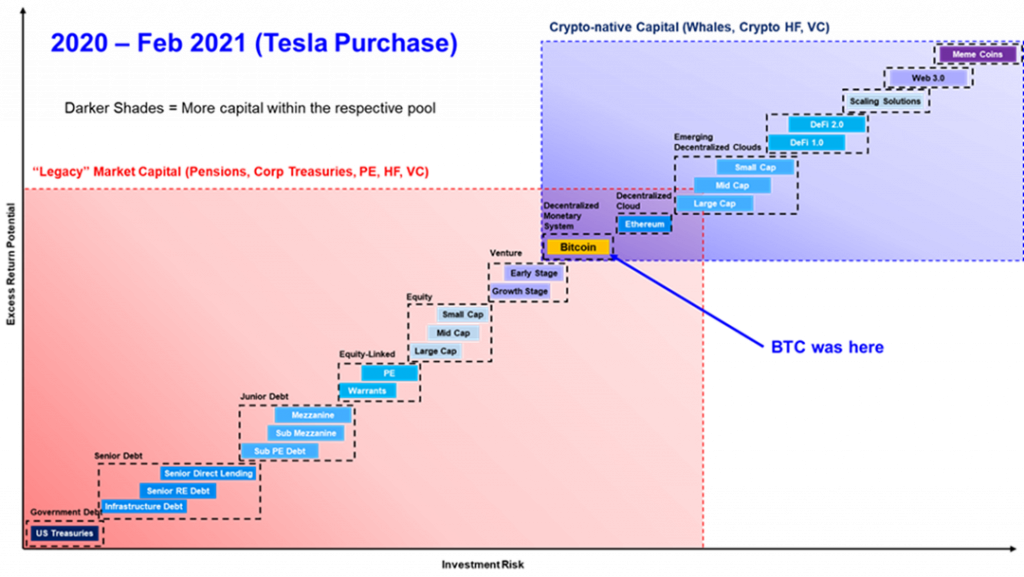

Below, we piece the two charts together to achieve a more complete picture. Starting in 2020, it became clear that there were two very distinct risk curves for two separate pools of capital. As denoted by the blue box below, mostly crypto-native capital rotated their holdings from BTC, to altcoins (Alt L1’s, DeFi, Web3.0, etc) and back depending upon how much capital flowed into the system during times of speculative run-ups in price. These crypto-native investors include early adopters and some hedge funds and VC funds that were first-movers in the industry.

The red box represents “legacy” market capital – this is the money invested by pensions, corporations, private equity, hedge funds, and venture capitalists that traditionally treated crypto like the plague. In prior bull market cycles, many Bitcoin enthusiasts would sound the alarm regarding the “institutions” and that they were coming to the space with loads of cash. This red box represents these storied “institutions.”

You can see that a small part of this capital is overlapping. This represents the capital that flowed into the industry during times of excess and speculation, and often would recede once the party was over.

(Note: if the image is difficult to view, we suggest viewing this piece online and clicking to enlarge)

Then in February 2021, Time’s Person of the Year Elon Musk, decided to take a leap, put bitcoin on Tesla’s balance sheet and started accepting it as payment.

At the time, people were unsure of Elon’s motivations, but it caused markets to stir. Bitcoin went on to hit a new all-time high and Coinbase would make history a couple months later as the first crypto exchange to go public in the US.

The Overton window had moved too far – it was time that institutions of all shapes, sizes, and risk profiles had a fiduciary responsibility to at least acknowledge the presence of bitcoin as an investable asset.

This brings us to our current situation, as represented by the chart above. In our view, since the full-scale institutionalization of Bitcoin started in 2021 (to be fair to Michael Saylor, he did make a huge gamble in 2020, way before Elon, but unfortunately that was still viewed as crazy at the time), a couple of things have occurred:

- Bitcoin moved down the risk curve and now sits below venture capital. One could argue that it could supplant small cap equities as well, but we will keep the chart as-is for conservatism. This means that more legacy capital relative to 2020 has been “orange-pilled” or is at least well-versed on the bitcoin thesis.

- Legacy capital expanded its reach further up the crypto risk curve, and crypto-native capital extended further down the risk curve. The latter is exemplified by an estimated $30 billion raised by crypto protocols and companies in 2021 (Source: Dove Metrics). It is likely that this will have enormous rippling effects in the years to come.

Looking forward, we see 2022 as the potential year in which bitcoin decouples from its high-growth, risk-on narrative and moves further down legacy investor’s risk curve on its way to realizing its ultimate use case as a global decentralized monetary system.

While we can’t provide the exact way in which this transpires, we think there are two key things to consider, which are noted on the graph above:

- When the Fed tightens the balance sheet, risk assets will react. At some point, the marginal BTC seller will be exhausted, and price will remain range-bound regardless of market turmoil. Due to supply constraints (BTC illiquid supply at ATH) we think that this could occur at a much higher price than legacy investors anticipate. This would cause a lot of the capital destined for equities, particularly ones that do not benefit from inflationary environments to be reallocated to Bitcoin. Bitcoin would effectively, move down the risk curve and sit below equities.

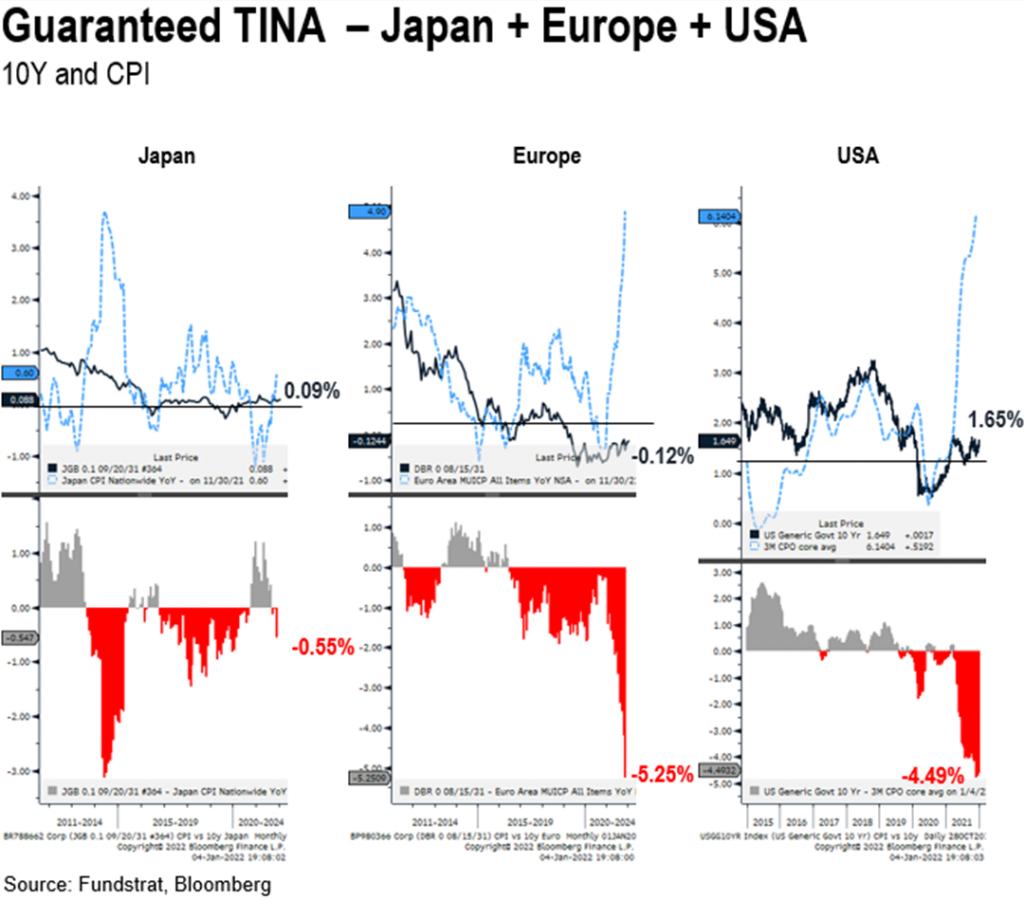

- As discussed last week, the Fed is going to raise rates. The latest estimates place strong confidence in at least a 25-bps increase in March. With global real rates negative due to inflation, it will be difficult to realize real yield in bonds. This would enact an inflationary-driven “TINA” scenario (There Is No Alternative), and some of the capital previously allocated to low yield bonds will be rerouted to bitcoin (in addition to equities). Below is a chart from our very own Tom Lee that illustrates this concept quite well.

Can we be certain that this is how things will play out? Absolutely not. But this is how we are thinking about things as we head deeper into Q1 and brace ourselves for the impending stare-down with the Fed.

As you all know, Bitcoin is subject to a “halvening” every four years or so, after which the market reaps the benefits from a programmatically reduced supply issuance. Since the industry’s inception, every cycle has ended abruptly and has treated market participants to a multi-year winter following 12-18 months of revelry. We posit that a good share of crypto-native market participants is envisioning an elongated crypto winter – we are not.

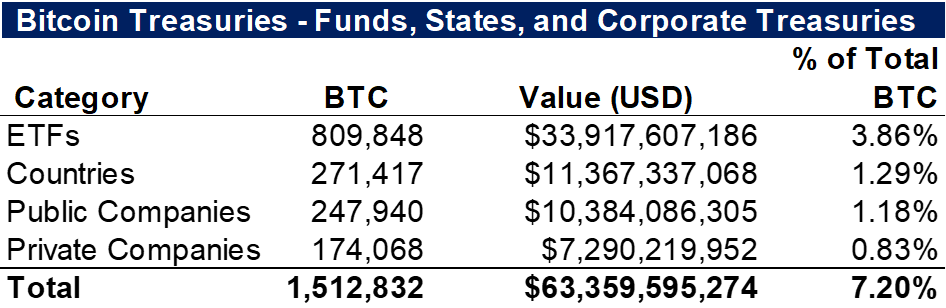

There are few last words more famous than “this time is different.” However, there is ample reason to believe that this time is different for bitcoin and the rest of crypto. We plan to continue to highlight these reasons throughout our research, but we think the chart below does a sufficient job for the time being.

In addition to unprecedented monetary stimulus, a key reason this time is different is the new horses in the race – these are the funds, nation-states, and companies holding Bitcoin, thus bringing legitimacy to its standing among the old guard. Once the numbers above start to climb, the supply constraints on the bitcoin network could bring us to a whole new level.

On-Chain Update

So far this year, Bitcoin’s price has been predominately driven by macro forces, while other valuation frameworks have taken a back seat. However, several on-chain metrics have begun flashing buy signals.

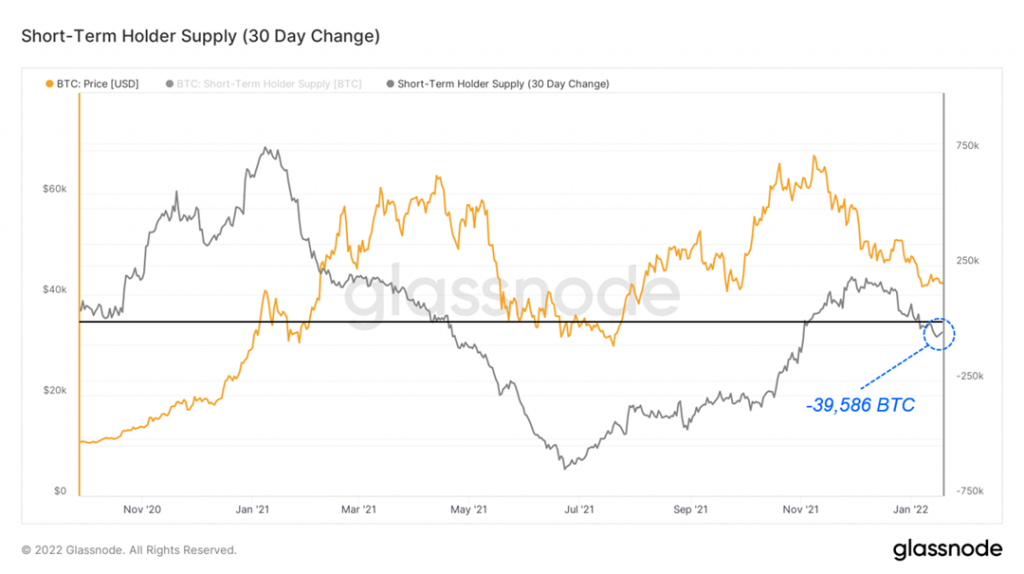

First off, it’s important to note the recent lack of spot demand for bitcoin and its weight on price. Short-term holders have sold off nearly 40,000 BTC in the last 30 days as price has slid. Apart from November and part of December, short-term holder selling has been the norm since price peaked in April.

Realized Price calculates the average cost paid per bitcoin. When a buyer purchases a bitcoin at a higher price than the long-term average (currently at $24,291), Realized Price increases, which makes it a helpful metric for gauging spot demand. As you can see below, since December, the change in Realized Price has been flat and even negative more recently, as short-term holders have sold at a lower price than they purchased. A lack of spot demand can also be observed early in summer ’21 following the steep price declines of the spring. It is also important to note that an increase in spot demand accompanied the subsequent rally in July.

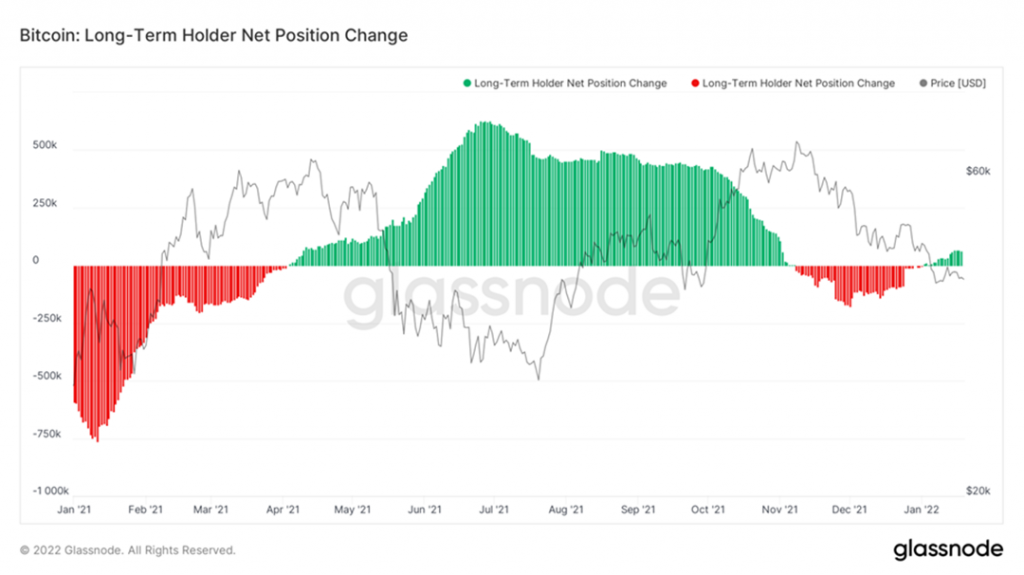

Looking at the chart below, we can see that the increased spot demand that helped catalyze the late summer/fall rally was predominately driven by long-term holders accumulating at depressed prices. Fast forward to the more recent November to December downtrend, we can see that long-term holders flipped from buyers to sellers. As is usually the case, this coincided with the brief stint mentioned above of short-term holders buying merely to sell at a loss over the subsequent 30 days. Lastly (and most importantly), this chart shows that long-term holders have begun accumulating once again at what they most likely believe are depressed prices. As we have stated before, this is a good barometer for long-term-oriented investors to increase their rate of accumulation.

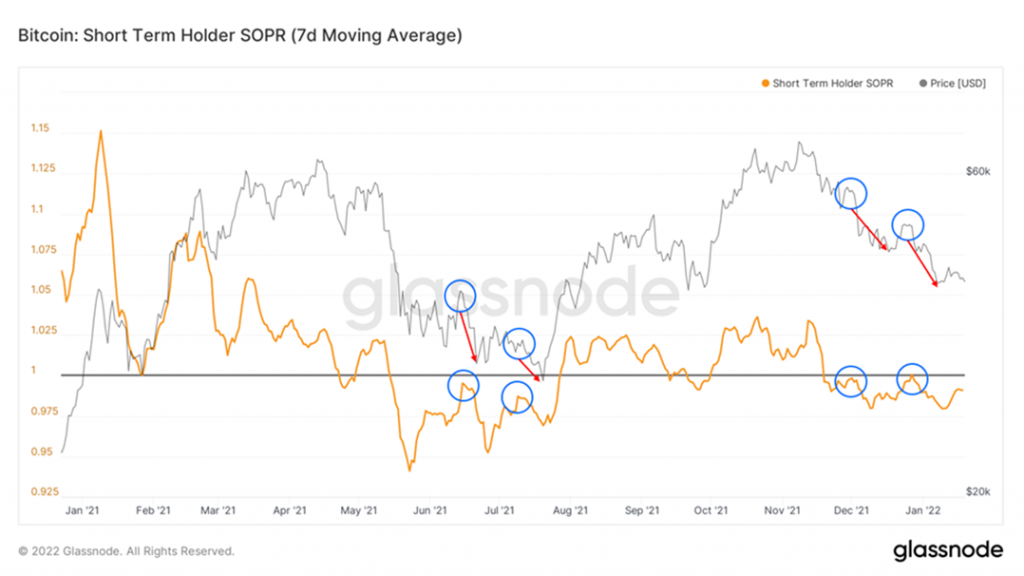

Taking a step back – how do we know short-term holders are selling the bitcoins they recently purchased at a loss? SOPR, which measures the price sold/price paid per bitcoin, has been sub 1 for the short-term holder cohort. SOPR = 1 is a critical psychological level because it indicates a position’s break-even price.

Generally, when investors are in a losing position, their goal is to exit the position unscathed. This simple truth causes SOPR = 1 to act as a resistance level where investors are more willing to sell for close to or at break-even. During weak price action, investors’ willingness to sell at SOPR = 1 generally causes downtrends to continue until selling is exhausted. Below you can see how this has played out using short-term holder SOPR. Again, the recent trend is not dissimilar to the summer months.

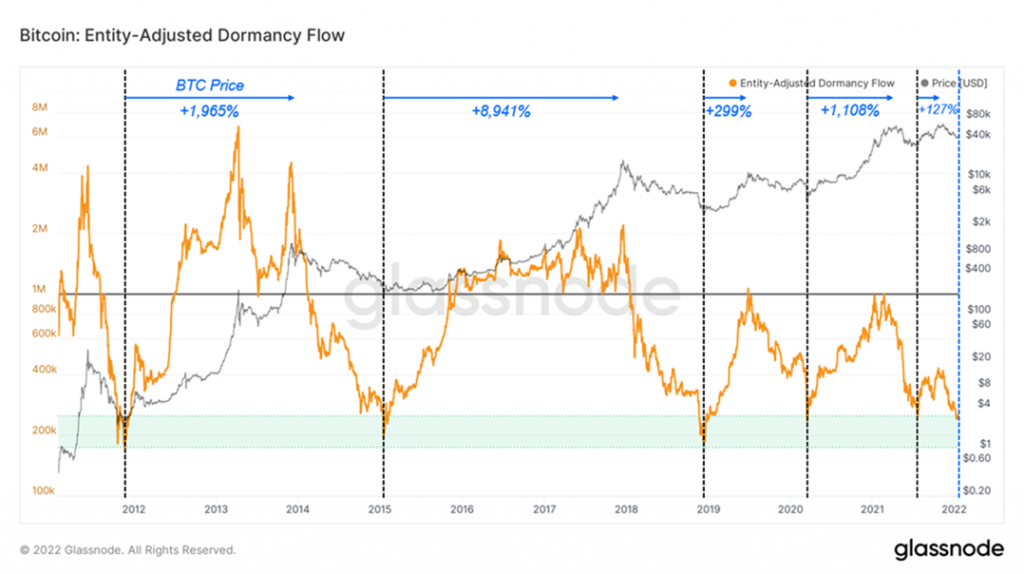

In previous notes, we’ve mentioned the concept of a “coinday,” which can be defined as a day in which a specific bitcoin has been held. If you were to purchase a bitcoin today and hold it for seven days, the Bitcoin network would have accumulated seven coindays. If you were to sell your bitcoin after this point, seven coindays would be destroyed. We can take this concept one step further by calculating the ratio between coindays destroyed and the volume of bitcoins transacted to arrive at “Dormancy.”

Dormancy is helpful in better understanding investor behavior as higher Dormancy indicates investors are selling older coins on average and destroying more coindays. We can also leverage Dormancy in a valuation framework by taking Bitcoin’s current market cap and dividing it by the annualized Dormancy in dollar terms. The resulting metric is Dormancy Flow which was first put forward by David Puell and does a great job gauging investor capitulation.

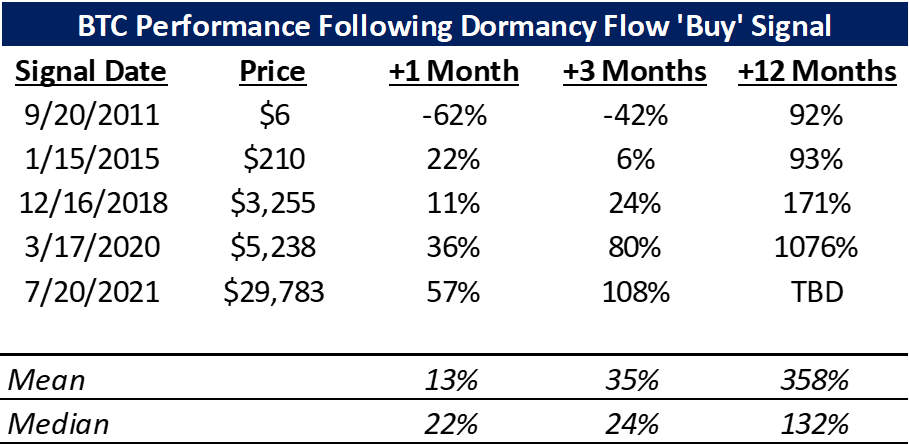

Dormancy Flow has only confirmed a buy signal five times in the history of the network – until this past week. Below we’ve plotted the five times Dormancy Flow has reached below the current level and the subsequent price rallies, averaging a mere 2,488%.

We’ve also calculated the forward 1-month, 3-month, and 12-month returns, which are similarly impressive.

There’s little doubt that Bitcoin’s price action has been largely dominated by the macro backdrop and derivatives markets as of late. However, the above on-chain metrics paint a more constructive picture for those taking a longer-term buy-and-hold approach. Barring any significant further deterioration in the macro backdrop, an increase in spot demand to go alongside the favorable on-chain metrics would go a long way to improve short-term confidence.

Bottom Line

Bitcoin and the broader crypto market remain subject to whims of macro headwinds, but there are early signs of seller exhaustion. We still think it is possible that we see a short-term rally in late January, but overall maintain that monetary tightening might continue to present choppy waters for crypto through Q1 and into Q2. As more supply shifts to long-term holders, this is a wise time for the long-term Bitcoin investor to accumulate. As outlined above, we think there is a convincing macro thesis for Bitcoin and crypto to thrive in 2022, despite near-term risks.