Healthy Pullback & Taproot Upgrade

Key Takeaways

- After Bitcoin reached a new all-time high of $69,000, we have seen a reset in futures funding markets, and spot demand start to waiver.

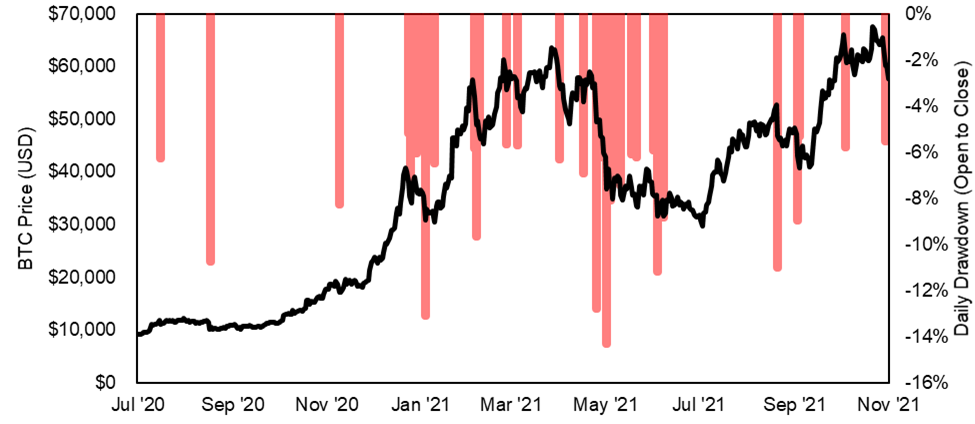

- These pullbacks are not uncommon in bull markets. Since June 2020, there have been 34 daily drawdowns (open to close) of over 5%, largest of which were 14% in May and 13% in January.

- On chain data further supports our view. As we noted last week, long-term holders have started to scale out of their positions into a strengthening market, with short-term holders re-entering the market at higher price ranges.

- On November 14, the Bitcoin network implemented the Taproot Upgrade, its first software upgrade in four years. The update is part of a larger effort by Bitcoin developers to improve the scalability, privacy, and composability of the network.

- Bottom Line: We view Bitcoin’s 17% pullback this week as a healthy market pullback from overbought conditions – nothing structural has changed. Having said that, we believe the volatility from the past week has presented good buying opportunities across the majors. The Taproot upgrade also presents a long-term bullish case for Bitcoin, as it minimizes unnecessary data collection in the network and enables more complex transactions.

Bitcoin Taproot Upgrade Note

On November 14 (at Block #709,632), the Bitcoin network implemented the Taproot Upgrade, its first software upgrade in four years. To put it simply, the Taproot Upgrade is an amalgamation of various technical strides throughout Bitcoin’s history into one upgrade. It is part of a larger effort by Bitcoin developers to improve the scalability, privacy, and composability of the network. At its current state, Bitcoin developers cannot simply increase block size limits without compromising on Bitcoin’s decentralization, which renders efficient allocation of block space to be the next frontier forward.

Since its first proposal by Greg Maxwell in 2018, the three Bitcoin Improvement Proposals (BIPs) that codified Taproot were written by Pieter Wuille, Tim Ruffing, A.J. Townes, and Jonas Nick. The Taproot upgrade is a soft fork to the network, which means it is backward-compatible and allows validators in older versions of the chain to perceive the new chain as valid. The fate of the network was sealed back in June 2021, when over 90% of miners voted in support. Node operators and miners have since upgraded to the latest version of Bitcoin Core, 0.21.1, exploring the transactions made possible with the upgrade.

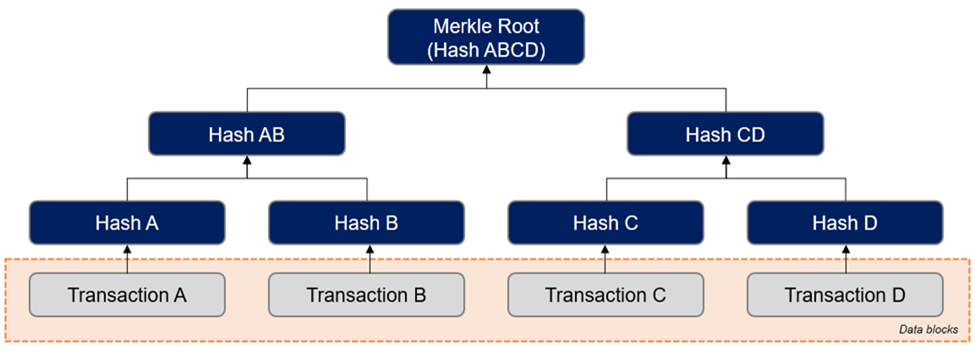

The first major component of the Taproot Upgrade is the introduction of Merkelized Abstract Syntax Trees (MAST), which improves privacy and reduces data storage requirements. MAST is an extension of Merkle Trees, which are a way to prove that single items (transactions) exist in a data structure with a minimal amount of information. They work by organizing data points (hashed versions of transactions/combinations of transactions) into a binary tree format, with the Merkle Root at the top of the tree. The Merkle Root is then included in block headers, publicly visible data that is embedded at the beginning of every block. To verify that a transaction is in a tree, a node only needs to provide the set of hashes that would be combined with the transaction to create the Merkle Root. This requires significantly much less data than 370GB+ of blockchain data in a Bitcoin full node, whilst the hashing at each stage enhances the privacy of said transactions.

MAST is essentially an extension of Merkle Trees in that it is applied to conditional payments, otherwise known as smart contract payments. The possible conditions that lead to a payout are structured in a Merkle Tree as above. To spend a bitcoin under these conditions, the spender merely shows the specific condition that leads to a spend, along with the hashes of its precedent “match-ups” in the tree.

MAST is an improvement from pay to script hash (P2SH) that ensures that a hash of the script is going on-chain. When tokens were being spent pre-Taproot, it was necessary to show all the possible conditions which could have been fulfilled, including those that weren’t met in the transaction. This made P2SH data-heavy and less private since anyone on the blockchain could investigate ways in which the funds were spent, and the type of wallets being used.

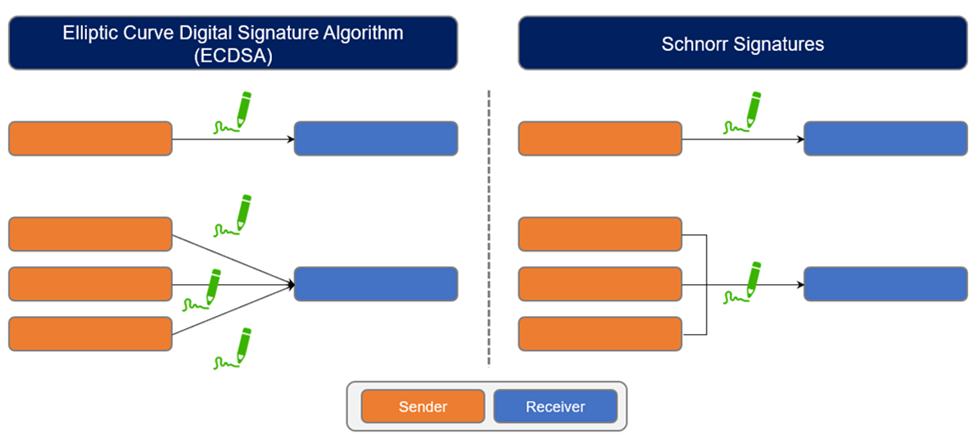

In addition, the Taproot upgrade implemented Schnorr Signatures, an algorithm that allows users to aggregate multiple signatures into one for transactions. Taking a step back, digital signatures allow users to send/spend bitcoins and nodes to verify the validity of transactions. As the size of wallets increased over time, multi-signature wallets grew in popularity to prevent bad actors from misappropriating pooled funds. This shift towards multisig wallets, however, came at the expense of block size.

Schnorr signatures mitigate this problem by combining multiple signatures into one, reducing the inherent visible difference between regular and multisig transactions. By combining signatures, the usage of MAST structures from the token or transaction at any time prior can be obfuscated. For example, multi-signature scripts, Lightning Channel closures, atomic swaps, and other smart contracts would all look like standard transactions using Schnorr.

Before Schnorr signatures, Bitcoin had been using Elliptic Curve Digital Signature Algorithm (ECDSA) for its “digital signatures” where a user signs a transaction with their private key to approve sending it somewhere else. Schnorr leverages the same Elliptic Curve Cryptography (ECC) technology that ECDSA does, but differ in that Schnorr signatures are linear, boosting Bitcoin’s transaction privacy and allow for more lightweight and complex smart contracts. Lastly, Schnorr signatures can boost the scalability of other technologies within the network. To illustrate, MuSig2 is a multisignature scheme developed by Blockstream researchers that requires multiple signatures for one transaction.

In many ways, the Taproot upgrade builds upon the previous Segwit upgrade that birthed the Lightning network. While SegWit was aimed to resolve transaction malleability and improve the scalability of the Bitcoin network, the Taproot upgrade is targeted to improve transaction efficiency, the privacy of the network, and its ability to support smart contract initiatives. After the Taproot soft fork, all transactions including simple, complex multisig and Lightning Network transactions will be treated equally on the network. This would unlock the true potential of the Lightning Network through increased efficiency and reduced discrimination on fungibility.

All in all, the Taproot upgrade minimizes unnecessary data collection in Bitcoin network’s transaction outputs without sacrificing security. By virtue of less amount of data collected and transferred, the benefits for the end-users will be seen in better privacy, more efficiency, and lower transaction fees.

A Note on Market Activity

After reaching a new all-time high last week of $69,000, we have seen long positions liquidated, and spot demand start to waiver. In all, we have experienced a 17% pullback, with the largest single-day red candle of 6% coming on Tuesday. That said, we think that this is a healthy market pullback, and nothing structural has changed.

Since June 2020, there have been 34 daily drawdowns (open to close) of over 5%. The largest of said drawdowns was 14% in May, and the second largest was 13% in January. We note that the latter preceded a 112% increase in price. These instances of daily price decreases are plotted on the chart below. Market pullbacks are a common occurrence, even in the healthy stages of a bull market.

As a reminder, for Bitcoin, volatility is a feature, not a bug. We are watching a new asset go to market in real-time on a global scale. While Bitcoin’s volatility has decreased since the Genesis block in 2009, it will continue to have days on which it posts large candles in both directions for quite some time.

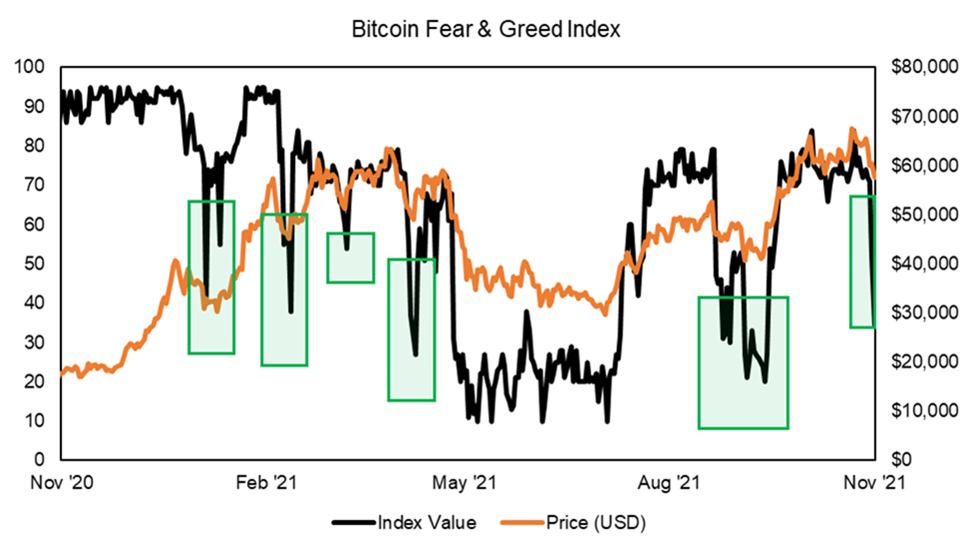

We can see that the Bitcoin Fear and Greed Index underwent a slight reset over the past week. While over time, there is not as much correlation between forward returns and index value as one would imagine, visually, we ascertain that periodic dips in this metric bode well for sustained bull runs.

Finally, we would like to review the chart below and briefly discuss the ongoing dynamic between long-term and short-term holders. This chart maps out the supply held by short-term holders (red) and long-term holders (blue) and distinguishes between supply in profit (dark-colored) vs. supply held at a loss (light-colored). As we noted last week, long-term holders have started to scale out of their positions into a strengthening market, and short-term holders have been providing them with ample exit liquidity.

As evidenced by the chart, whenever the entirety (or close to the entirety) of short-term supply is in profit, we see a market reaction. Essentially every BTC holder is in profit, thus increasing selling pressure and often leading to a subsequent drawdown. The circles represent zones in which nearly the entire circulating supply of BTC is in profit, and the black lines align with mid bull cycle drawdowns. We think that both long- and short-term holders have sought liquidity over the past week but have not been met with ample demand.

We think that demand will return to a much healthier market structure with a higher cost basis, and consequently, a higher ceiling. As you can probably tell, we view the recent volatility as a buying opportunity across Bitcoin, Ethereum, and other blue-chip layer 1 projects.