Pullbacks from 50-62% retracement resistance beginning to bottom

BTC’s long-term profile remains positive

Despite BTC’s volatile swings through 2018 into 2020, the longer-term chart profile remains positive with BTC in narrowing consolidation above its long-term uptrend. Granted, a series of lower highs (12/2018, 06/2019, 2019, 02/2020) remains in place and break below BTC’s 2015-2018 uptrend (7.7-8K) would be an obvious technical concern/problem. However, a break has yet to develop and a move above the 10-11K resistance band would be an important positive technical development establishing a higher high and increase the likelihood BTC is resuming its longer-term uptrend.

Another tactical opportunity to accumulate developing

Another short-term low is likely developing following BTC’s pullback from a resistance band coinciding with 50-62% retracements of its 2H 2019 declines. The February pullback is now showing evidence of bottoming at the upper end of the 8.1-8.4K support band which coincides with 50% retracement of the December-February decline. Daily RSI is suitably oversold to support increasing exposure.

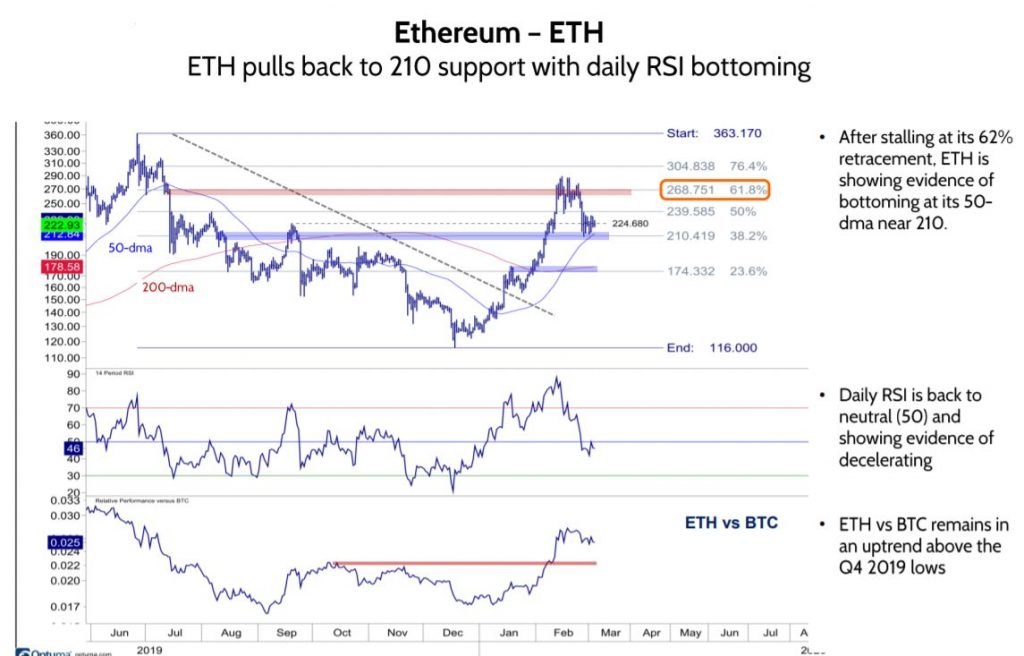

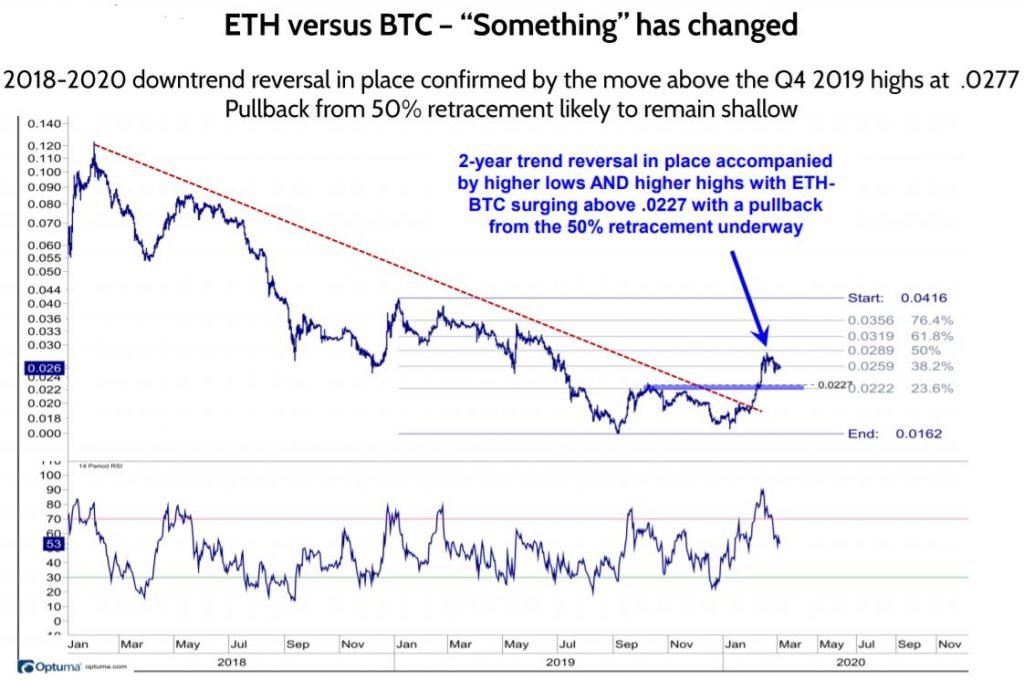

ETH – Similar to BTC, tactical trading lows developing following a pullback from resistance

ETH stalled just above a 62% retracement of the 2H 2019 decline near 270 and is now back to first trading support near its 50-dma and showing early evidence of bottoming. Daily RSI has unwound from overbought levels, and while not at deeply oversold levels, it is showing early signs of stabilizing/bottoming.

Compared to BTC, the relative performance of ETH to BTC has stalled near a 50% retracement of its entire 2019 decline and appears to be in a healthy shallow consolidation. Daily RSI is nearing neutral, and while not deeply oversold, we would be using the current pullback to accumulate.

Fundstrat FS CryptoFX index highlights

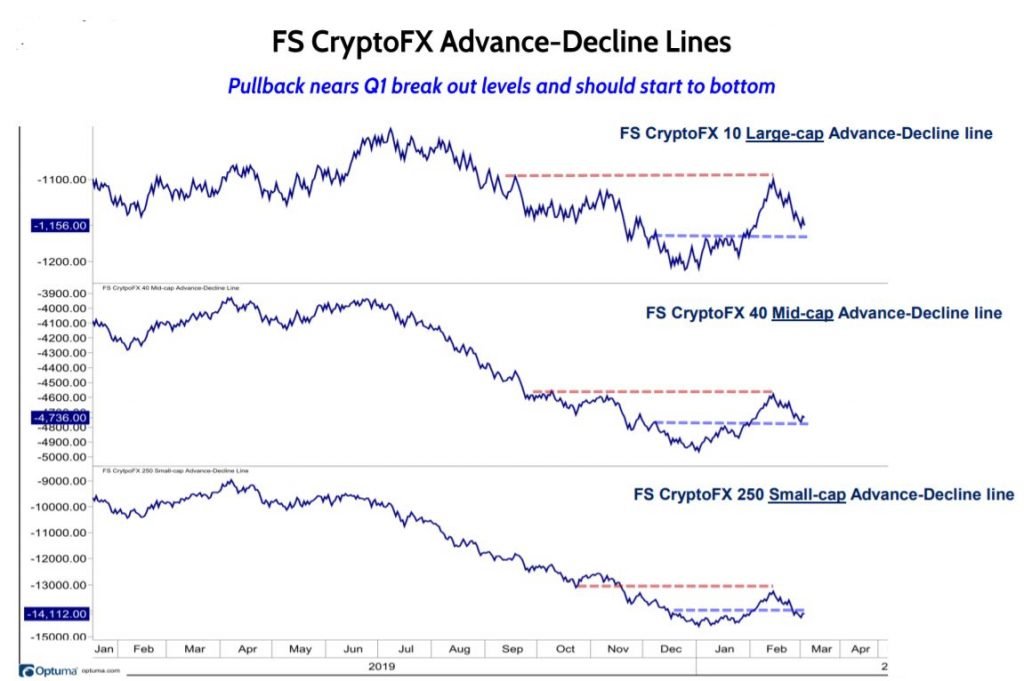

(+) A/D line pulling back to January break-out levels and are in the early stages of bottoming.

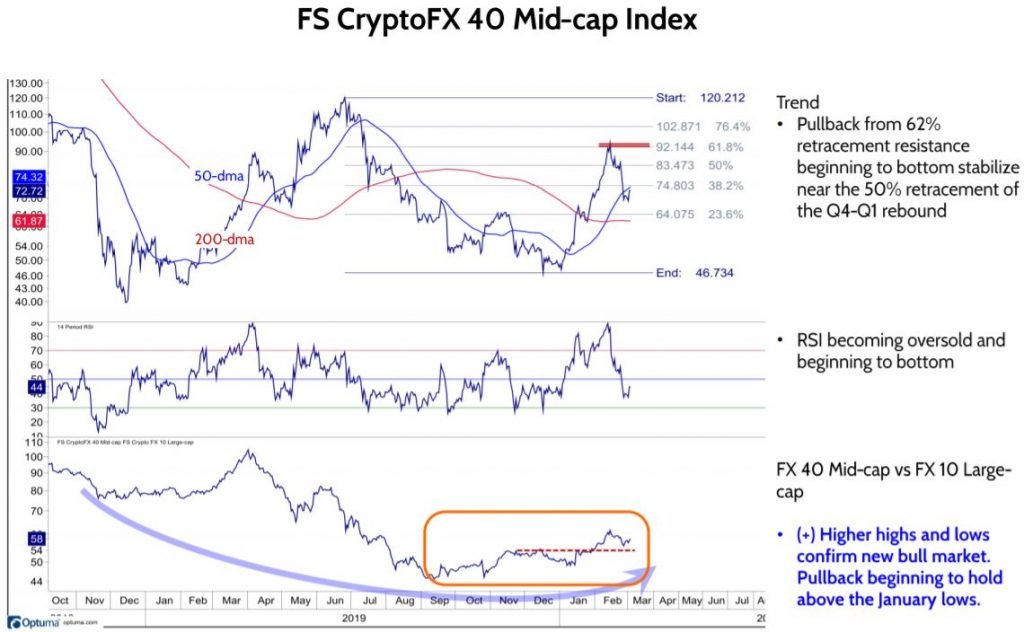

(+) The FS CryptoFX 10 large-cap and FX40 mid-cap indices are showing early signs of bottoming short-term with the FX 40 Mid-cap index continuing to building positively versus the FX10 large-cap index from the lows established in Q3/Q4 2020.