What the Fed, inflation, tapering & rising rates could mean for the price of Bitcoin

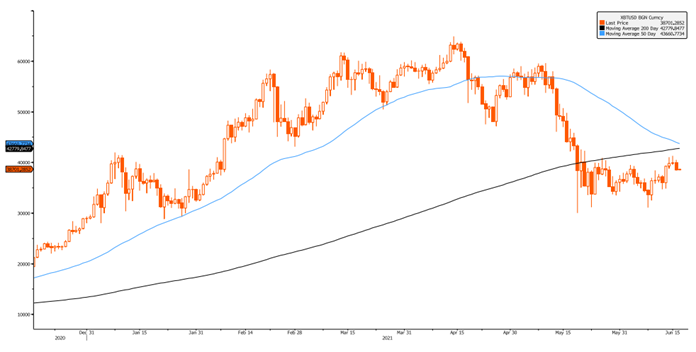

After bottoming on bad news a week ago, Bitcoin and crypto had been rallying heading into yesterday’s Fed meeting, but crypto markets fell slightly alongside other major asset classes following the Fed policy statement, and have remained roughly flat this morning.

Source: Fundstrat, Bloomberg

The Federal Reserve spooked some market participants with its commentary around inflation expectations, tapering and rising interest rates.

Source: Fundstrat, CNBC, New York Times

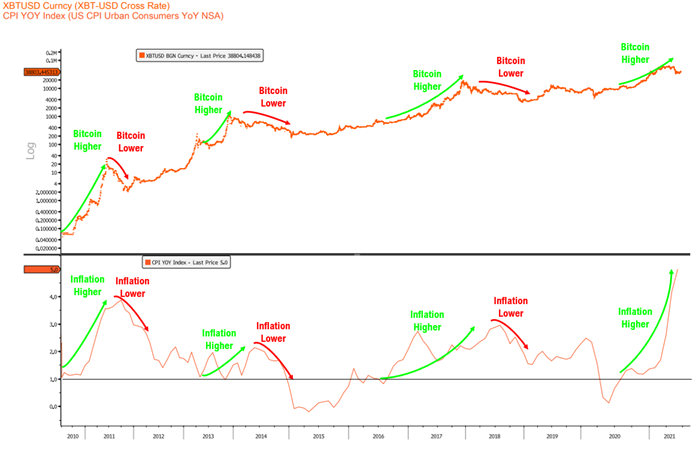

Inflation has been hot on the markets mind as of late. Recent CPI reports came in higher than some expected, and investors have been worried the latest numbers could cause the Fed to tighten policy sooner than anticipated.

Many investors view Bitcoin and crypto as a hedge against inflation. And, although we recognize that some analysts will debate this thesis, we do think there is a relationship here worth watching. Past Bitcoin bull market cycles have tended to occur alongside year over year increases in the Core CPI Index and bear market cycles have come as CPI has rolled over.

Source: Fundstrat, Bloomberg

Does this mean we think Bitcoin is an inflation hedge like gold or a safe haven like treasuries? Not really. We think this is more a result of Bitcoin and crypto being risk-on assets that benefit from looser monetary policy that’s occurred around periods of higher inflation.

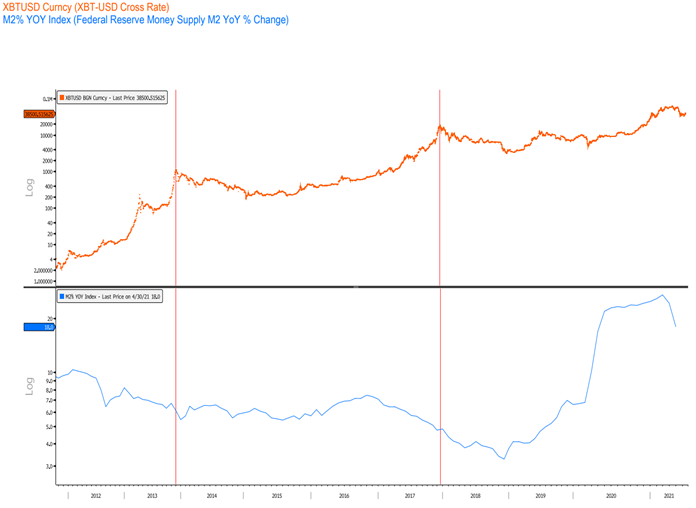

The Fed holds the view that the recent inflation is transitory and remains focused on achieving higher labor market participation. But we may be getting closer to Fed tapering the asset purchase programs that have been in place since the start of the COVID pandemic. This reduction in liquidity would cause a further slowing of the rate of monetary growth, which some bears may point to as a reason to reduce their risk-on positions.

Our view is, the Fed remains highly accommodative, and Bitcoin has been able to sustain past bull market rallies in the face of slower year over year money supply growth. Looking back to the 2013 and 2017 bull market cycles, the Bitcoin rally didn’t top until the YoY M2 growth fell below ~6%. The COVID crisis has resulted in an unprecedented amount of support and YoY M2 growth at 18% is currently at 3x the level of the two prior cycle tops.

Source: Fundstrat, Bloomberg

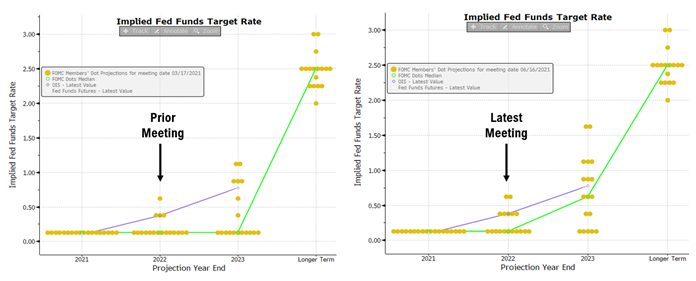

The news that gave market participants most concern was the Feds revised DOT plot for the fed funds target rate. We saw an increasing number of members signaling for sooner rate increases which some investors interpreted as the Fed taking a bit more hawkish stance.

But the two reasons we think crypto investors shouldn’t be over concerned with the revised DOT plot are 1) Chairman Powell walked this back during the press conference by saying that the forecasts for future rate increases should be taken with a “grain of salt” and 2) these DOT plots are not an indication of what rates will be since the Fed is going to remain data dependent.

Source: Fundstrat, Bloomberg

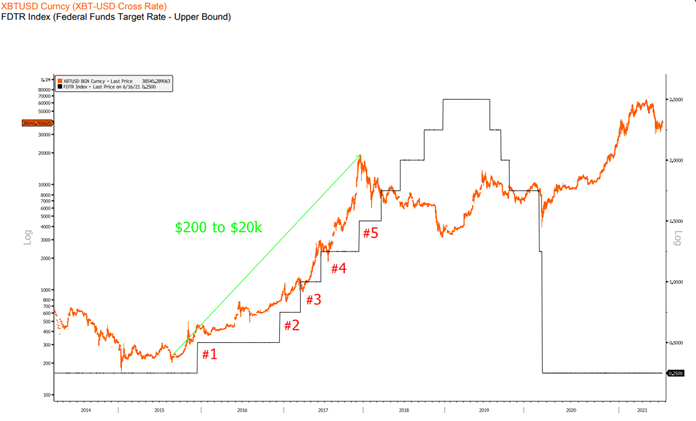

Even if we were to see a rate lift off in 2022 with two hikes, it’s worth keeping in perspective how Bitcoin and crypto markets reacted during the last (and only) period of Fed rate increases. During the prior bull market cycle, Bitcoin continued to rally until the Fed raised rates 5 times (5 times!) as prices went $200 to $20,000.

Source: Fundstrat, Bloomberg

On balance, we think many crypto investors are viewing yesterday’s Fed meeting as neutral. If the prior market cycle is any indication of how the market could react this time around, the current Fed guidance seems to signal this crypto bull market could have room to continue higher.

In our view, the recent correction was a mini “crypto credit crisis” that resulted from deleveraging, the digital economy is entering the second wave of its medium-term growth cycle, and crypto remains in a longer-term secular bull market.

Our 2021 mid-year outlook is coming up next Wednesday where we’ll dive deeper into why we think this, and we encourage investors to tune in.

Details and Specifics

Date: Wednesday, June 23, 2021

Time: 3:00 PM ET

Duration: 45-60 minutes (including live Q&A)