Bitcoin bouncing in the face of further China crackdowns signals the market is “bottoming on bad news”

Bitcoin and crypto markets have been hit with a wave of bad news headlines over the past couple months and prices have taken a sharp hit in response. China’s regulatory crypto crackdowns have been some of the largest contributors to the market action.

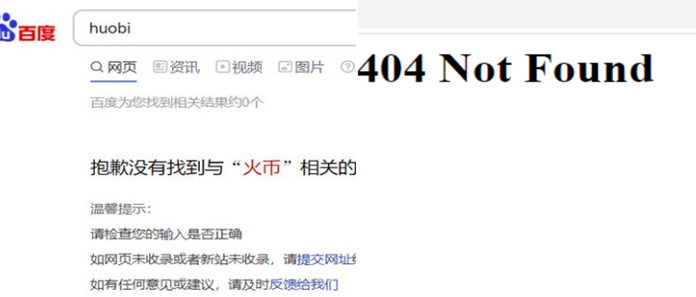

This morning, news of further crackdowns started circulating after the major Chinese internet service providers Baidu and Weibo started censoring searches for the three largest Asian crypto exchanges.

Source: Fundstrat, The Block

China blocking its citizens’ access to the major Asian crypto exchanges could be viewed as another bad news event for crypto markets.

Source: Fundstrat, FRX Research

However, instead of responding with further downward pressure as we’ve seen from similar negative headlines over recent months, crypto markets are rallying this morning with Bitcoin up roughly ~13% from yesterday’s low.

Source: Bloomberg

We think this is important because it signals crypto markets are now “bottoming on bad news.”