Digital Assets Weekly: Staying the course

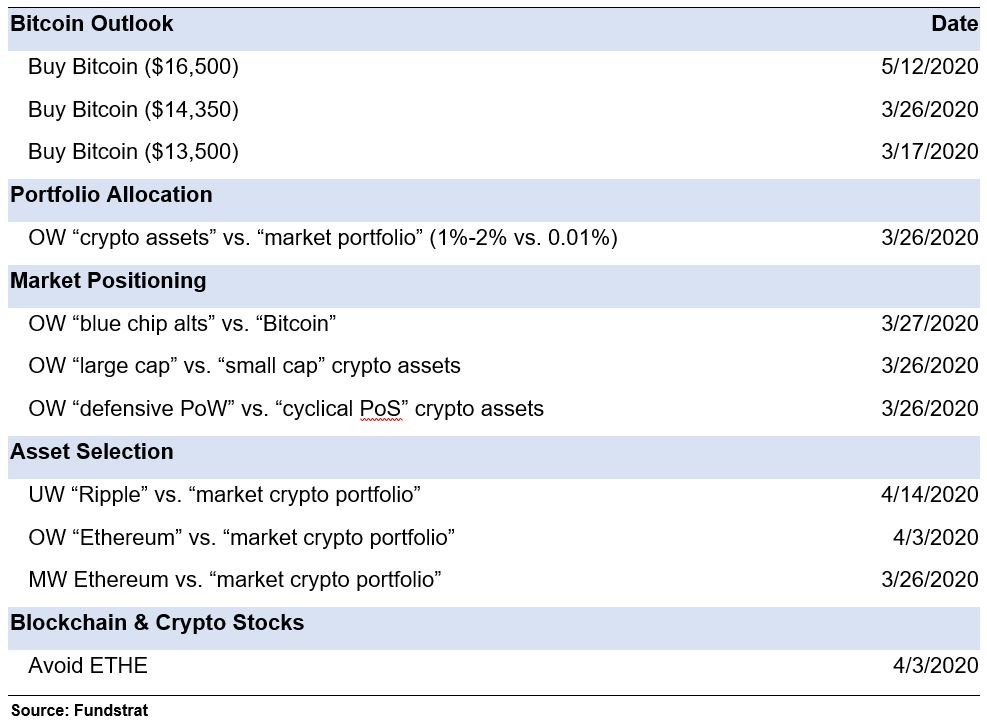

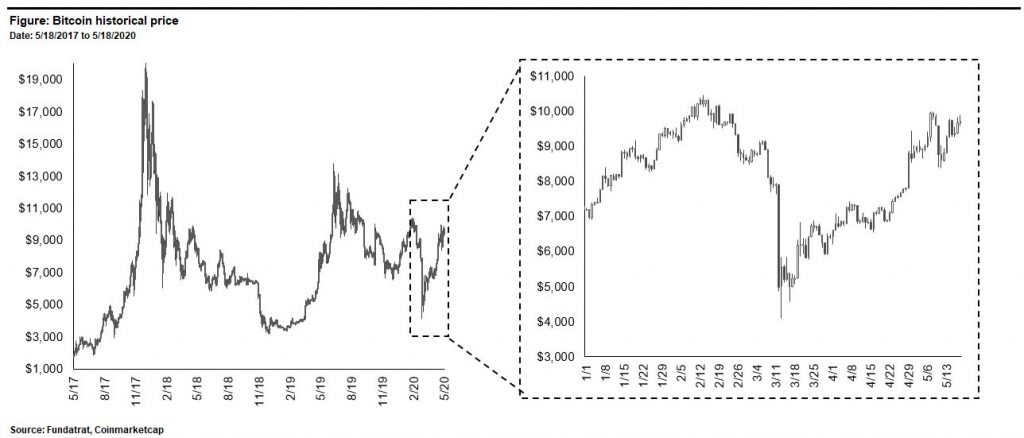

Our view on crypto markets has not changed since last week when we increased our FY 2020 Bitcoin price outlook to $16,500.

We saw a bit of bumpiness today when markets sold off after 50 BTC that had remained dormant since being mined in 2009 unexpectedly moved, spooking roomers of Satoshi selling coins. We’d dismiss this as an unlikely non-risk event and stay focused on the fundamentals.

Crypto still looks to be in the 2nd or 3rd innings of the next bull cycle. Market conditions broadly remain stable week-over-week, and thus our portfolio strategy recommendations for long terms investors remains unchanged.

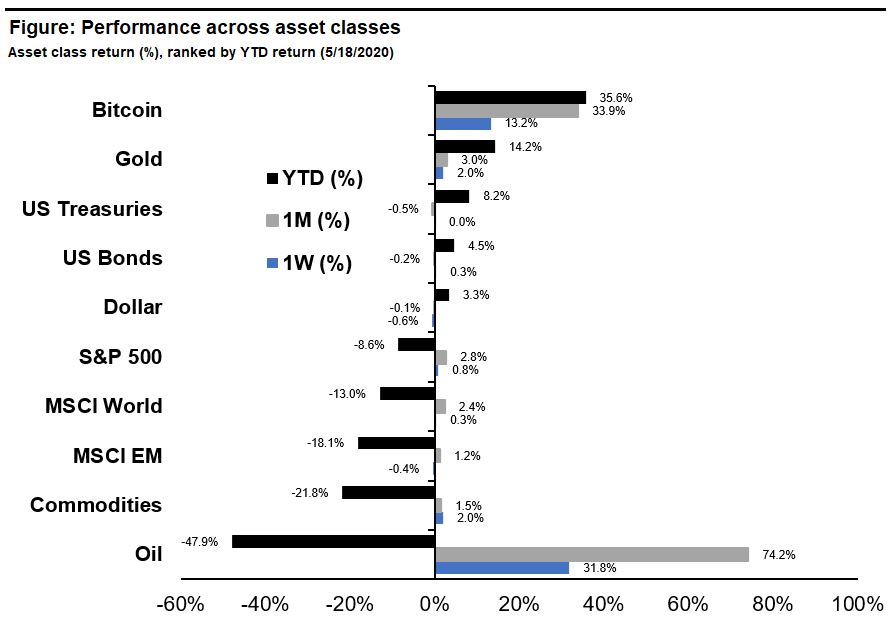

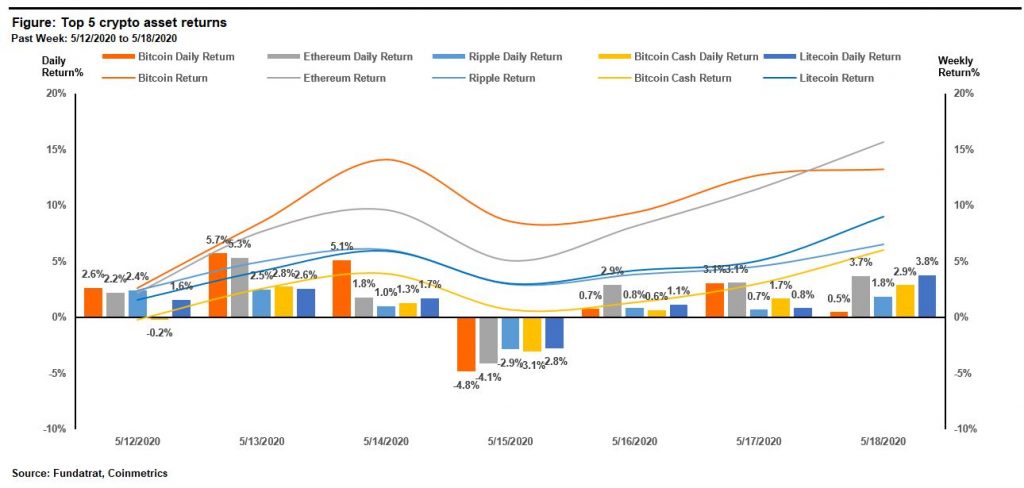

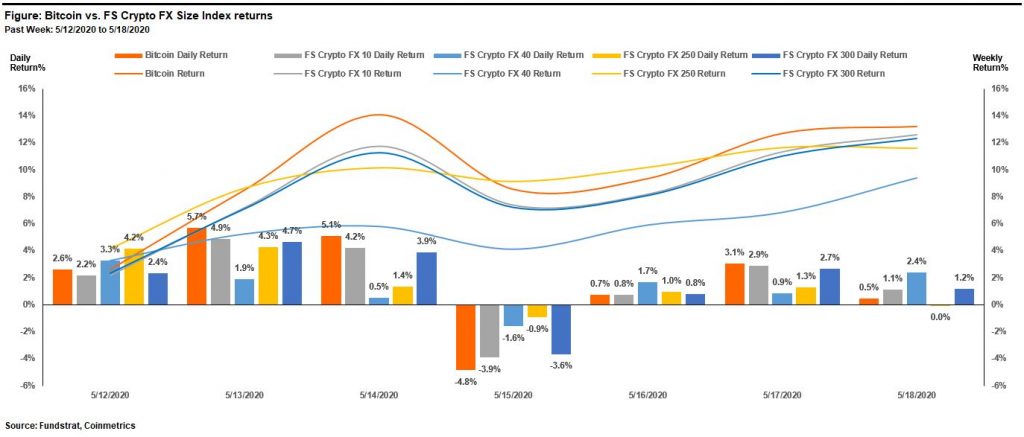

In contrast to last week’s 3% decline, Bitcoin climbed 13.2% over the period and closed at 9,727 Monday evening. Notably, there was no major price action immediately following the halving event.

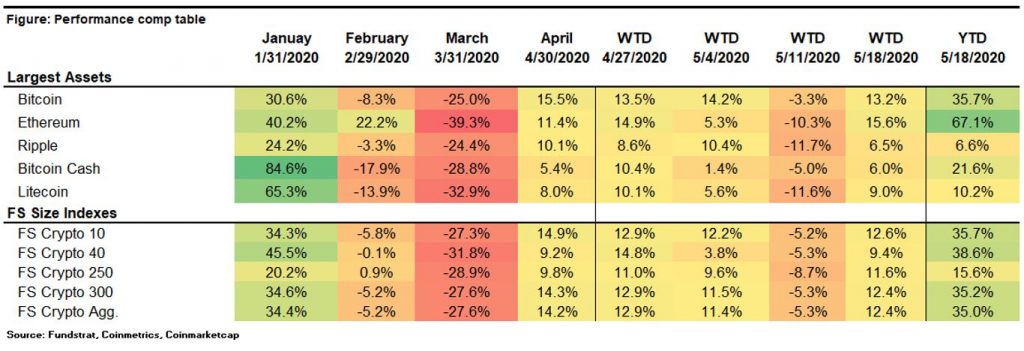

Bitcoin remains firmly ahead of gold as the best performing asset class on a YTD basis.

Ethereum edged out bitcoin as the top performing asset this week with a massive 15.6% return on the week.

Bitcoin outperformed all FS Crypto size-based indices over the past week. FS Crypto FX 40 was the worst performing index and lagged all other major indices by about 3%. Major contributors to the laggardship were Chainlink (LINK) and Dash (DASH) which lagged BTC by over 500bps.

The table below shows the returns of the largest assets and the FS Size Indexes over the year.

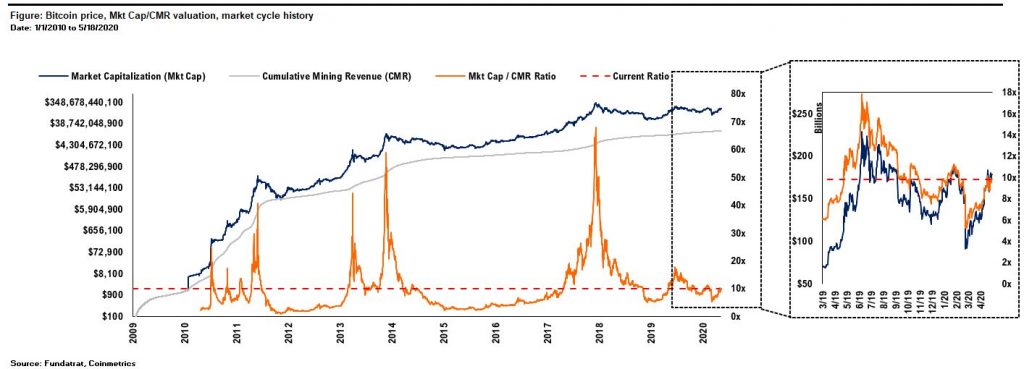

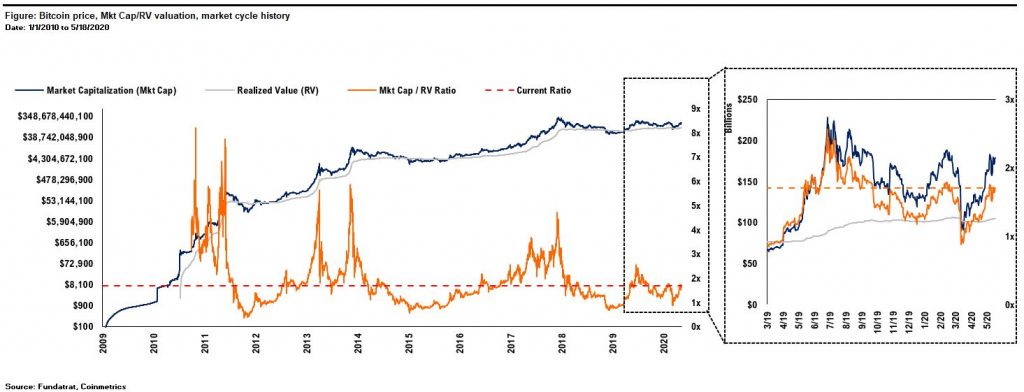

Fundamental Valuations

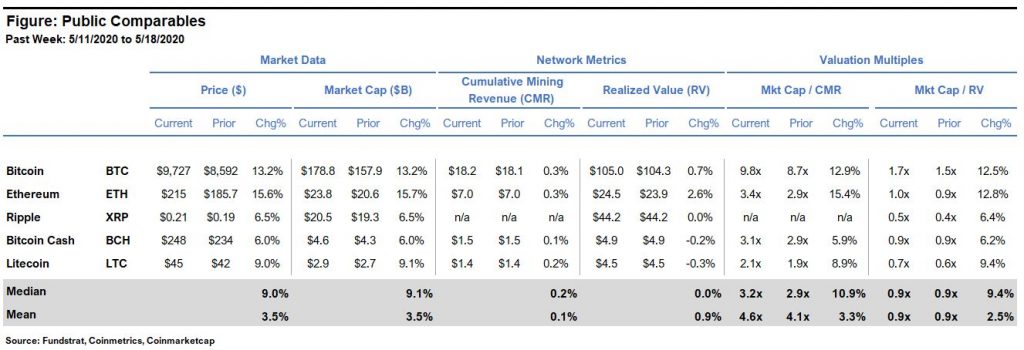

Bitcoin’s P/CMR valuation stood at 9.9x as of 5/18 vs 8.7x as of last week. This value is remains slightly below the levels from Mar-19 through present.

Bitcoin’s market cap to realized value (MV/RV) multiple was 1.7x as of 5/18 vs 1.5x last week.

The comp table for large cap crypto asset prices and fundamental valuations is shown below.

Blockchain & Crypto Stocks

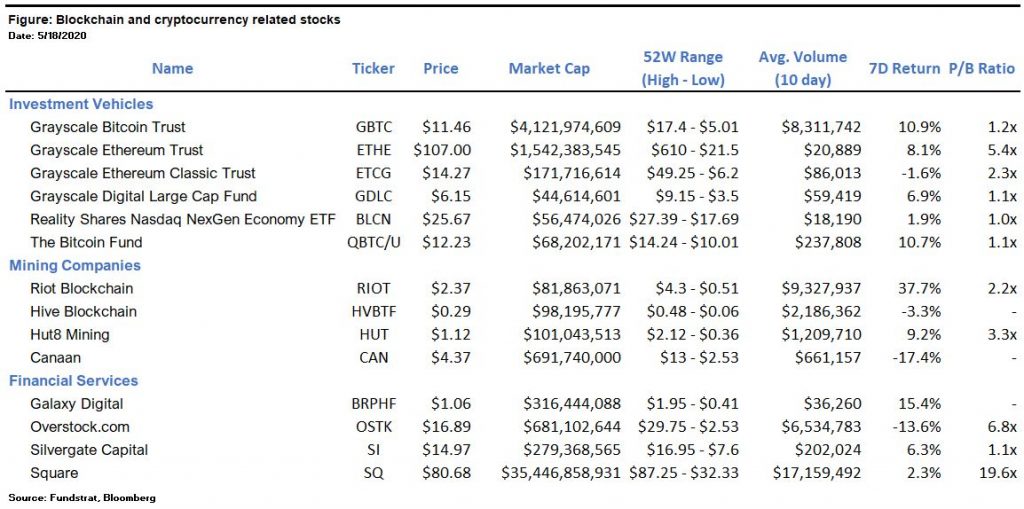

The table shows publicly traded blockchain and crypto related stocks, which offer a vehicle for investors who are constrained from owing underlying crypto assets themselves.

Noteworthy this week:

Mining Companies: In the first full week of trading following Bitcoin’s May 11th halving, performance was mixed across major mining companies. Following its earnings ‘beat’ on May 11th, (36% surprise to the upside), Riot Blockchain posted 38% gain over the 5-day period ending May 18th. Canaan will be releasing Q1 financial results on May 22nd 2020 and his seen its shares plummeted 17% over the period.

Winners & Losers

Winner: Square – Square’s Cash App now allows users to dollar cost average with added functionality for scheduled bitcoin purchases. In Q1 ’20, the company generated $306 million in bitcoin related revenue.

Loser: BlockFi – Crypto lender BlockFi says it experienced a data breach last week, but no customer funds were lost. The breach occurred on May 14, impacting less than half of the firm’s retail clientele and exposed account activity information as well as customer email and postal addresses.

Financing Activity

FalconX– The San Francisco based digital asset trading platform that provides clients best execution using data science, secured $17M in funding. Backers included Accel, Accomplice VC, Coinbase Ventures, Fenbushi Capital, Flybridge Capital Partners, Lightspeed Venture Partners, and Avon Ventures.

Blockdaemon – The New York-based blockchain node provider, has raised $5.5 million from investors including Hashkey, CoinShares, Blockchain.com, and Fenbushi Capital.The company is expected to use the funds to expand into Asian and European markets.

Minka – The Colombia based open banking platform announced it’s raised US$3 million in an investment round led by FinTech Collective. Other participants included Colle Capital Partners and Collaborative Fund.

Recent Research

Access Fundstrat’s recent crypto insights if you missed them by clicking below or visiting FS Insight.

- Tom Lee: Tom’s Take on Crypto: The Ten Rules of Bitcoin Investing: No. 3

- Robert Sluymer: Crypto Technical Analysis: The importance of 8K and 10K for BTC – Key levels for ETH and ADA

- Ken Xuan: Crypto Quant: Benchmark Crypto Indices Weekly Performance Review

- David Grider: Increasing Outlook: Sentiment & FY 2020 Forecast Support a “Non-Speculative” Bitcoin Price of $16,500