Crypto Weekly (Sept. 25th, 2019)

Weekly recap…

- The crypto market crashed and no one really knows why

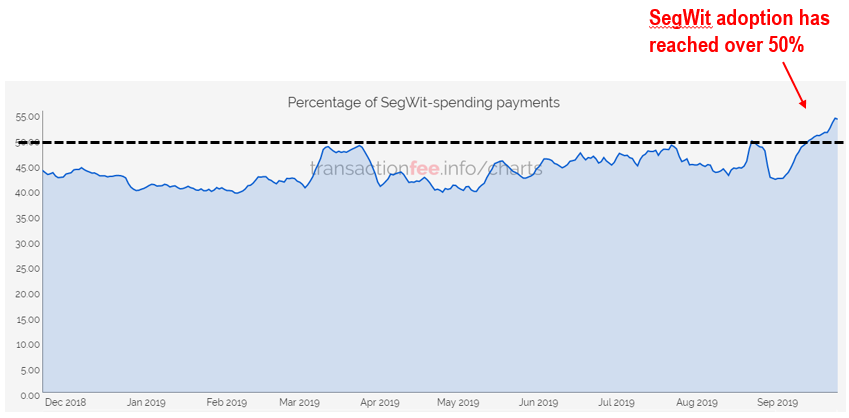

- BTC SegWit adoption jumped to >50% = network throughput improving

- With BTC below $9.3k support level, the next key support is now $7.5-8k

Center Story

1. The Four Horseman visited crypto

The Four Horseman of a crypto flash crash seen passing through

This was a rough start to the week for crypto brought on by a confluence of “risk off” events, but it’s hard to say what exactly sparked the crash.

Though, our Bitcoin Misery Index had been showing an overbought market and furthermore, our own Tom Lee has discussed the need for a a clear macro trend (S&P 500 breakout) before BTC performance improves.

These are at least four factors that we think contributed to the flash crash and destruction of the bull market that started in April (or least added fuel to the selling fire)…

1) The Bakkt launch, though a truly positive fundamental development for the space (first physically settled BTC futures contracts = improved liquidity and access to ), failed to bring a boost to the price that some may had been hoping for. This was an incorrect assumption based on the belief that institutions were simply waiting for a compliant product.

2) BitMEX margin calls may have exacerbated the selling.Data from DataMish and written up by CoinDesk shows that a “long squeeze” occurred with BTC falling an additional $1000 in the 30 minutes following.

3) Equity markets spooked by impeachment news. Recently, crypto has acted as more of a “risk on” than “risk off” asset. So when equity markets were spooked by impeachment proceeding announcement and went risk off, crypto suffered.

4) Technical weakness makes the old support level the new resistence. Prior support between 9-10K is now heavy resistance with the key trend reversal level at 15-dma (10,307), the summer downtrend (red trend line) now near 10.5K.

Network Monitor

2. Bitcoin SegWit adoption pushes above 50% of transactions

Despite the recent tumult in the crypto markets, the silver lining in Bitcoin’s cloud is that SegWit adoption touched above 50% for the first time after floating slightly above 45% since the second half of the year.

- Why does this matter? Higher SegWit adoption = greater network throughput. In the long run, this should effectively double transaction throughput (see here and here for detailed explanations).

- Despite the market’s current bearishness, growing SegWit adoption is an example of how BTC’s network fundamentals are continuously improving.

- Something that differentiates BTC from many alts is that its developers consistently deliver at the technical level.

Technicals

3. BTC Collapses < $9.3k support to next key level of support at $7.5-8k

While our expectation was incorrect for BTC to consolidate sideways through Q3 we had highlighted here last week the importance of 9.3k support adding that ….“while there are spike lows at 9049, we would expect a break below 9.3K to lead to quick drop to its next support band between BTC’s rising 200-dma at 8089 and 7500”

BTC collapses < $9.3k support to next key support at $7.5-8k

Oversold trading lows likely developing with $9-9.3k remains heavy resistance

- BTC is now testing/bouncing from that next support band between 7500 and 8000 at the 200-dma. With daily RSI back to oversold territory a trading bounce is likely.

- This week’s break-down leaves BTC technically damaged and likely to need weeks/months of consolidation before another upside acceleration can take hold

- Prior support between 9-10K is now heavy resistance with the key trend reversal level at 15-dma (10,307), the summer downtrend (red trend line) now near 10.5K.

Markets

4. Market Movers (over past 7 days)

Cryptocurrencies

Bitcoin -15.8% to $8620.57

Ethereum -19.4% to $168.11

XRP -17.5% to $0.235226

EOS -30.6%to $2.83

Litecoin -24.8% to $55.82

Bitcoin Cash -30.4% to $222.35

Binance Coin -23.5% to $16.07

Stellar -14.5% to $0.054504

TRON -23.8% to $0.012794

Dash -23.2% to $72.9

Fiat Currencies

Dollar Index (DXY) +0.40% to 98.96

EUR -0.71% to 1.1 USD/EUR

GBP -0.90% to 1.24 USD/GBP

JPY +0.65% to 0.0093 USD/JPY

CNY Onshore -0.64% to 0.1402 USD/CNY

CNH Offshore -0.64% to 0.1403 USD/CNH

CHF +0.72% to 1.0097 USD/CHF

Commodities

Gold +1.3% to $1513.29

WTI Crude -3.1% to $56.29

Brent Crude -2.4% to $62.05

5. Top Tweets

Education

6. Required Reading

Coinshares needs your help – Coinshares

The UK Financial Conduct Authority (FCA) is consulting on banning the sale, marketing and distribution of our main product, exchange traded notes (ETNs) referencing cryptoassets, to retail investors based in the UK. If implemented, this means you will no longer be able to trade such products.

We clearly disagree with these proposals…

The Coming Currency War: Digital Money vs. the Dollar – WSJ

The future of money might be a digital version of the cash that’s already in people’s wallets—potentially upending the currency system that the world has known for many decades…

More than 60% of Ethereum nodes run in the cloud, mostly on Amazon Web Services – The Next Web

Blockchains like Ethereum‘s are often pitched as self-sovereign money networks that operate independently of states, financial institutions, and corporations — but recent research shows this might not be reality.

Events

7. What’s happening in next week

Wednesday, September 25

Afridex South Africa

Thursday, September 26

Coinalts Fund Symposium

Friday, September 27

Fintech and Blockchain Summit

Monday, September 30

Voice of Blockchain

Avantpay Conference

Delta Summit

Tuesday, September 1

—

Wednesday, September 2

b.Tokyo Blockchain Conference