Grayscale Investments

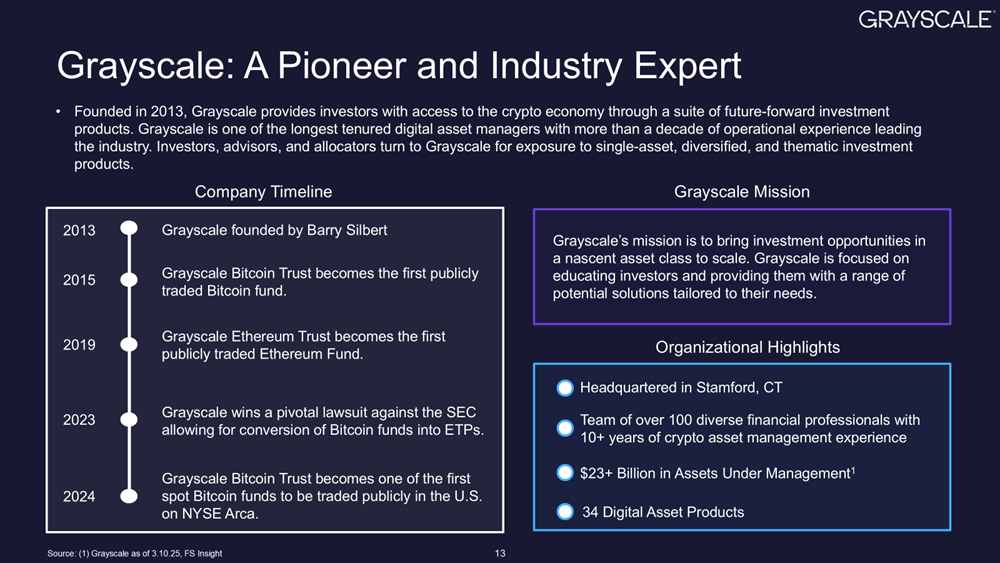

Founded in 2013, Grayscale provides investors with access to the crypto economy through a suite of future-forward investment products. Grayscale is one of the longest tenured digital asset managers with more than a decade of operational experience leading the industry. Investors, advisors, and allocators turn to Grayscale for exposure to single-asset, diversified, and thematic investment products.

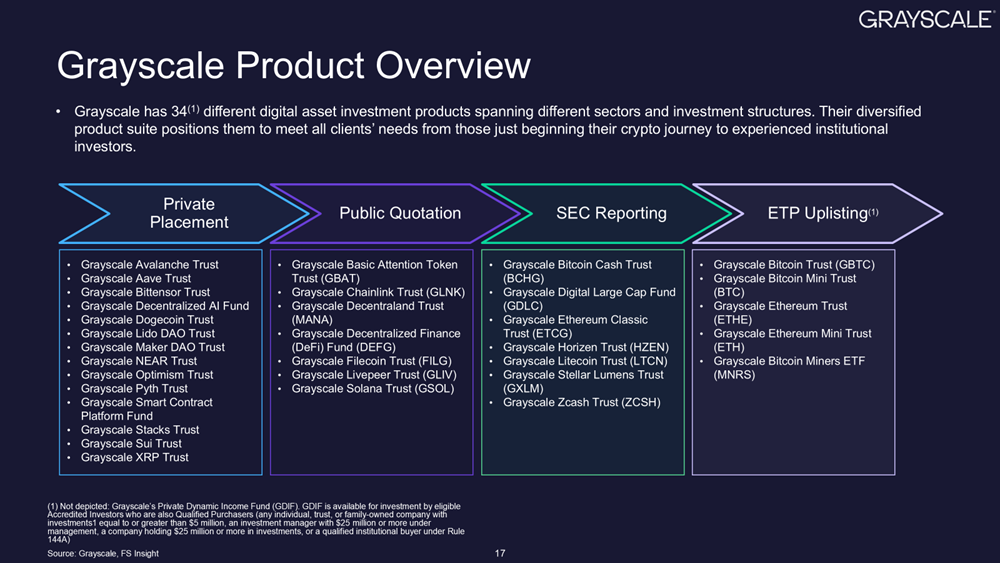

Grayscale has 34 different digital asset investment products spanning different sectors and structures. Grayscale’s diversified product suite positions them to meet all clients’ needs, from those just beginning their crypto journey to experienced institutional investors.

Click HERE for the full report:

Key Slides from This Report

Grayscale: A Pioneer and Industry Expert

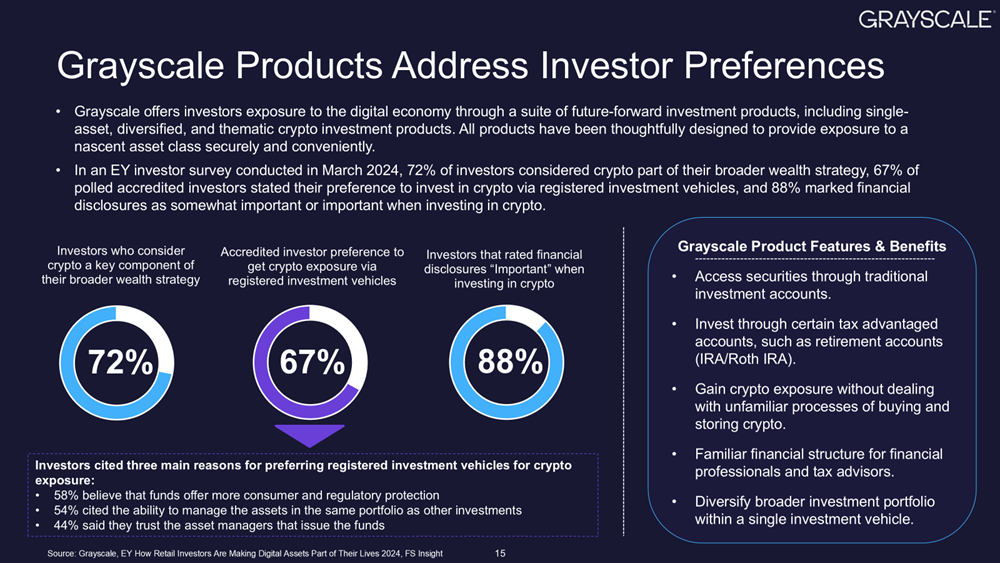

Grayscale Products Address Investor Preferences

Grayscale Product Overview

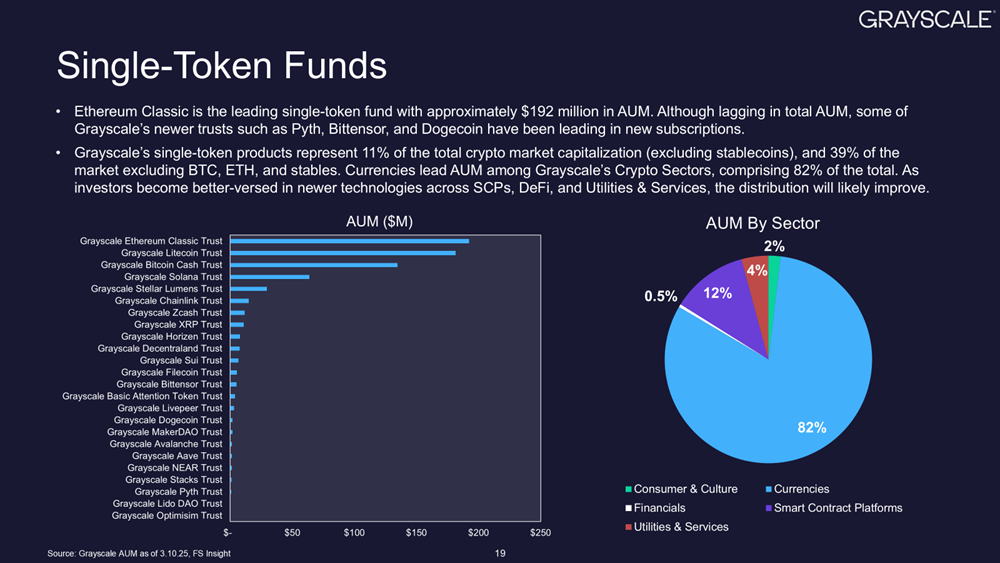

Single-Token Funds

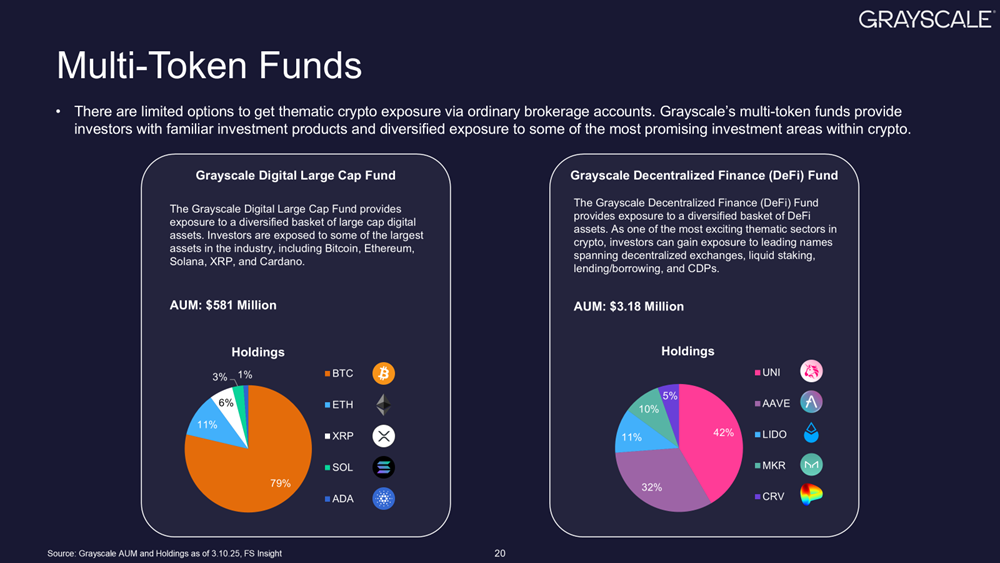

Multi-Token Funds

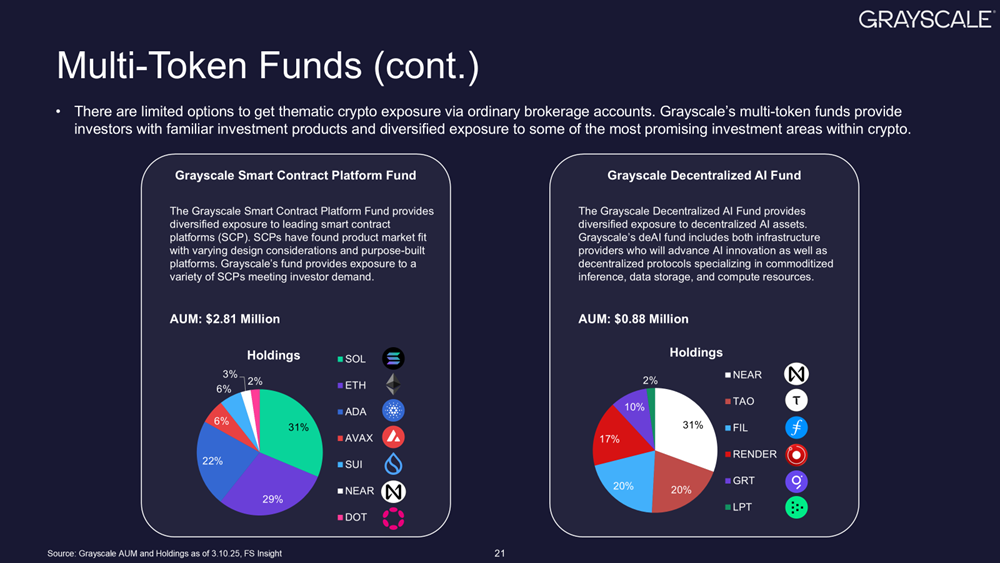

Multi-Token Funds (cont.)