IOTA: Becoming an IoT standard could drive market adoption

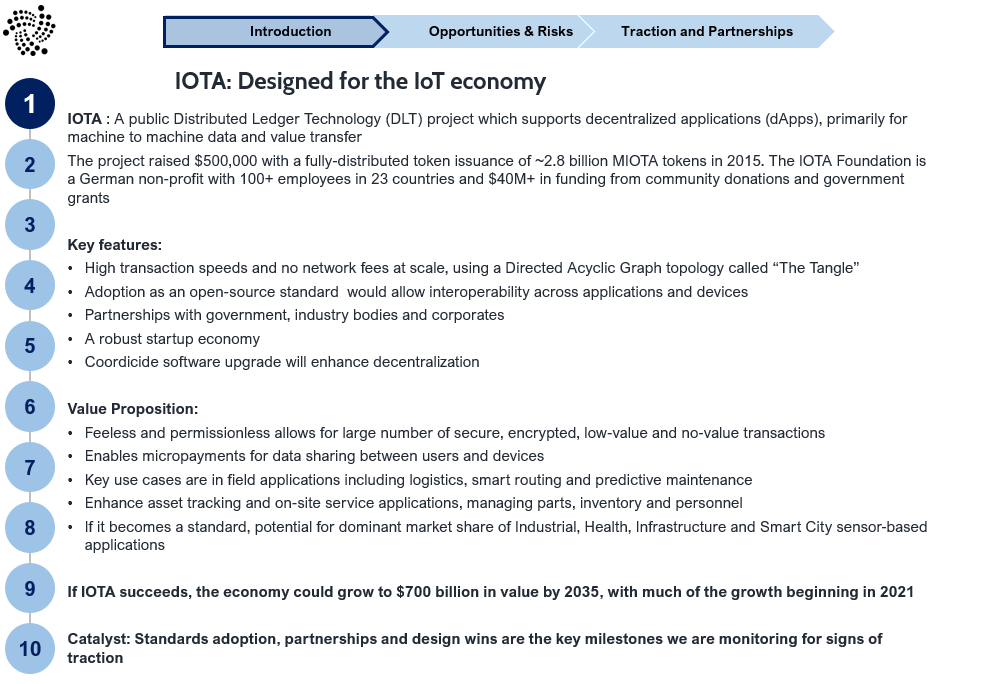

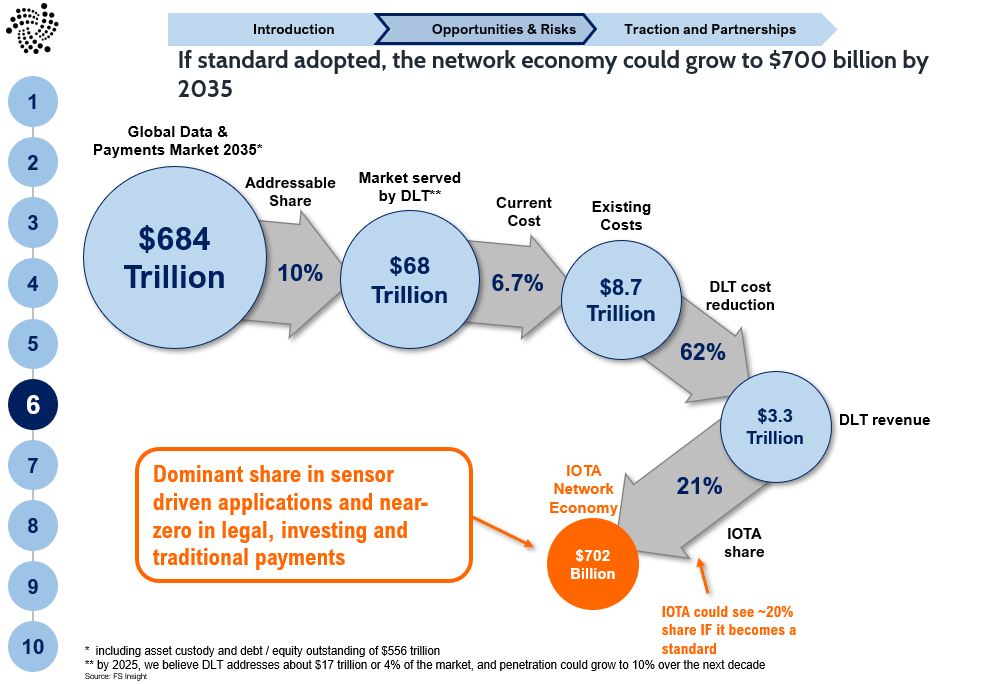

IOTA is an alternative Distributed Ledger Technology (DLT), which uses “The Tangle”, a Directed Acyclic Graph or DAG, to implement fast, feeless and secure decentralized transaction confirmations, primarily for the Internet of Things (IoT). Should IOTA become adopted as standard, the network could grow to $700 Billion in value, which translates to a 20% share of an eventual $3.3 trillion DLT market. As they work towards standardization, IOTA continues building applications on its network with large multi-national corporations and fortune 500 companies.

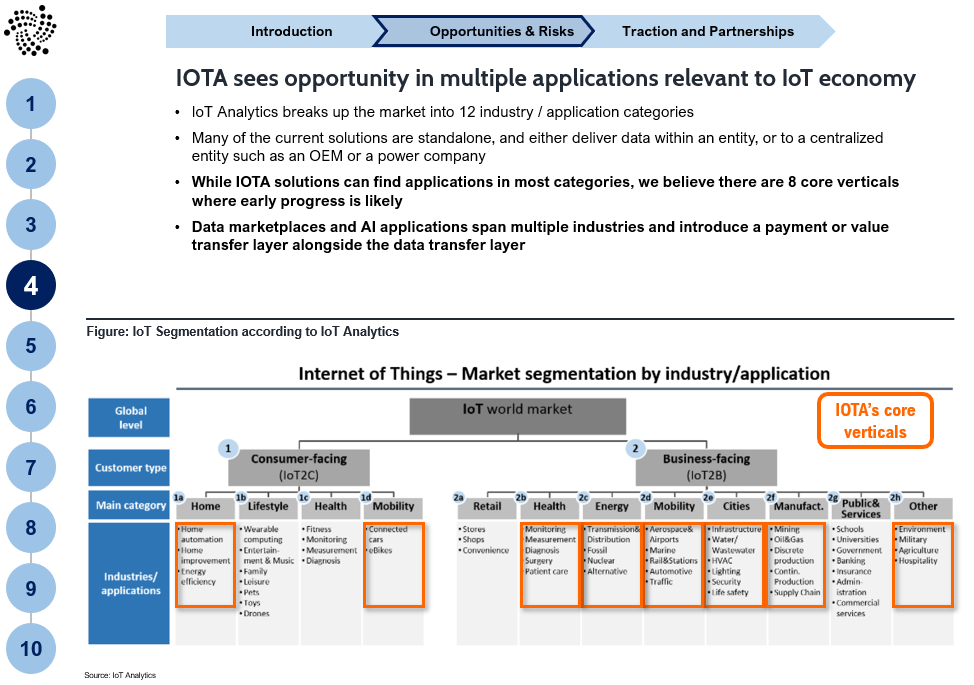

IOTA is leading IoT standard adoption which is critical for its success. Interoperability is key to realizing at least 40% of the estimated $11 trillion value of the IoT economy, per McKinsey. This leads to the need for industry standards around data communication, encryption and security. IOTA is in the process of establishing standards and contributing its open source code to a contributor network in partnership with the standards body Object Management Group (adoption process expected to be completed by late 2020). We believe the winning standard will have dominant market share.

Below we’ve highlighted three slides from our recent report on IOTA’s potential to become an IoT standard in the machine-machine economy. Please contact inquiry@fsinsight.com to find out how to access the full report.