Cryptocurrency Technical Review

Key Takeaways

- Cryptocurrency rally looks to have temporarily stalled out after a sharp three-week rally. Ethereum has stalled out in its relative performance vs Bitcoin, and for now, Bitcoin is an outperformer over Ethereum and should be favored.

- Weekly momentum remains negative and Cycle composites start to turn lower in early March into April/May, so given low retail interest and not many inflows, this could limit the larger rally continuing to all-time highs in 1H 2022. A Spring low looks likely.

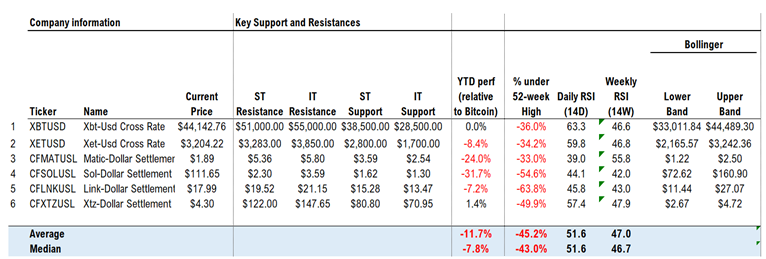

- BTC, ETH, MATIC, SOL, LINK and XTZ analyzed along with support/resistance

Support/Resistance and Technical Data

Bitcoin (BTCUSD ) Bullish, but rallies likely encounter resistance into late February. Bitcoin remains in a near-term uptrend following 2/4’s move back up above 39,558 which turned trends positive. This was a constructive development technically speaking, with prices having recouped former lows from 1/10/22 along with surpassing the downtrend line that has been ongoing since early November. Moreover, the degree of positive correlation with Bitcoin to US Equities looks to be ongoing and both began to turn back higher in late January. Key resistance on gains in the weeks ahead lies near $51k which lines up with former peaks from late December. Above that level might allow for a brief test of $55k before prices stall out. Bitcoin’s weekly cycles look to exert a downward influence on price starting in March which might allow for a deeper retracement into April/May before a meaningful low. However, weakness should be something utilized to buy dips, with first meaningful support near $38.5k and then $32,950. While not immediately expected, breaks of that level have little support until 28.50-29k which line up with last Summer’s lows. Bottom line, while near-term trends are positive, the lack of retail participation and/or Wallet growth being subdued casts some doubt on the ability to continue this recent rally throughout the year without pulling back into Spring 2022 to form a more meaningful low.

Weekly Logarithmic charts of BTC show a quite constructive longer-term uptrend still very much intact, with the key areas on the chart being 2017 peaks, and then the 2020 breakout of those former highs. Thus, this decline from last November as well as last Spring barely registers as anything more than consolidation after BTCUSD’s runup. Pullbacks down to test last Summer 2021’s lows certainly cannot be ruled out as weekly momentum is still negative and the bounce from late January has not registered to turn this positive.

Following an intermediate-term period of weakness into Spring 2022, I anticipate a push back higher to new all-time highs should get underway, with areas at 65-69k being likely a necessary first resistance to gains given current chart patterns. While last Summer’s 28,600 lows aren’t likely to be taken out on a retest in the months ahead, if this were to happen, it would project down to near 20k from late 2017 which should be an excellent risk/reward to buy dips on weakness.

Bitcoin’s Dominance chart shows some clues of relative strength in Bitcoin after bottoming near key support. Trading view publishes Bitcoin’s Dominance index, which is the ratio of Bitcoin’s market capitalization compared to the entire Cryptocurrency market capitalization. Typically, uptrends in the Dominance index can show times when its preferable to be invested in Bitcoin vs Alt-coins. In the chart below, we see a near perfect bottoming in this Dominance index right near prior lows from September as well as Spring of 2021. The fact that this bottomed at such a critical and common area is remarkable and also something to continue to pay close attention to. BTC’s uptrend lately has been stronger than many Alt-coins and this Dominance index still looks bullish technically, showing signs that further strength can happen in the weeks to come. Thus, Bitcoin still looks right to be favored vs Alt-coins.

Ethereum looks to have hit initial resistance on its rally. Looking at daily ETHUSD charts, ETH has enjoyed nearly a 50% rise off its late January lows, gaining ~1000 points from 1/24/22 intra-day lows, to an area of important trendline resistance. While momentum did manage to turn positive on daily charts given this recent bounce, weekly momentum, (Per MACD) remains negatively sloped and prices are still within downtrends of the peak from early December 2021. To have confidence of absolute price gains in the weeks to come, a move back over 3283 looks essential. Meanwhile pullbacks will need to hold 2800-10 on weakness. Any break of this level into March would argue for a retest of late January lows at 2160 which will be very important to hold, and underneath lies last Summer lows at 1700. Conversely, getting back above 3285 allows for some meaningful strength that should reach 3850 initially.

ETHBTC- This relative chart shows Ethereum stalling out vs. Bitcoin after its three-week bounce. The chart below shows a ratio of ETH to BTC over the last year which has been complete with periods of both outperformance and underperformance. As can be seen, while October to December showed better relative strength in ETH, the last two months has favored Bitcoin, as ETH has lagged and the ratio chart turned down into 1/24. Since that time, ETH has actually shown better strength than Bitcoin, but yet again, this seems to be fading quickly given the stallout near this important downtrend. Moreover, Friday 2/11/22’s decline saw far greater weakness in ETHUSD which pulled back to multi-day lows in this ratio and suggests that the downtrend in ETH vs BTC from early December remains in place. Until/unless this two-month downtrend can be exceeded, it will be right to favor Bitcoin over Ethereum.

Tezos has made some constructive price action during its recent bounce, regaining prior lows from early January along with having exceeded the four-month downtrend which has been in place since October 2021 peaks. Additional near-term gains look likely to $5.36 to test the highs from early January which also line up with a 38.2% Fibonacci retracement of the four-month decline, and above that should help this advance to 5.80 which should represent stronger resistance to this first push off the lows. Momentum indicators like RSI still haven’t reached initial overbought levels in XTZUSD even after a 70% lift off the lows since 1/24. Overall, this looks like a good risk/reward for additional technical strength into the end of February. Dips should find support at $3.59 on any weakness which should represent an attractive area to add to longs.

Polygon looks attractive technically given this past week’s push back up above key trading resistance at $1.90, representing 1/8/22 lows. This represents a structural improvement for MATICUSD, suggesting the entire pullback from late December was merely an Elliott-wave based three-wave decline. Momentum is positively sloped in the short-run and not overbought. While some minor consolidation has gotten underway in recent days given US Equities and Cryptocurrencies weakening on geopolitical worries, a rally back to new all-time highs is likely in the weeks/months to come. Technically resistance should come in initially near $2.30, then all-time highs at $2.91. The ability to exceed this would open up the door for rallies up to $3.59. Pullbacks down to $1.62 represent appealing opportunities to add to longs, technically, expecting further rallies into late February, time-wise. Only a weekly close under 1.30 would postpone the rally, which for now, appears premature.

Chainlink has attempted its first major move off the lows in the last couple weeks following a successful retest of July 2021 lows at $13.50. Daily LINKUSD charts show the weakening from November 2021 to have found good initial support and prices managed to push back above prior lows from December just in the last couple weeks. While this has stabilized at an area it needed to, further strength will be necessary to have confidence that this is beginning to turn back higher. Initially, this will require LINK to recoup levels at $19.46 on a weekly close, which should drive this higher to $21.15 and then $23.50. Overall, LINK looks like an attractive risk-reward and longs are favored barring a move back under 13.47 which would postpone the rally, and allow for additional weakness.

Solana continues to be under pressure and its pullback from November 2021 highs does not yet look complete. Following an extraordinary 1000% four-month runup from July to November 2021, SOLUSD has given up more than 75% of this rally. Its rally looks to have stalled out near $122 which hits the downtrend, and now has pulled back to multi-day lows to end the week. Additional near-term weakness is likely in the short run, with $80.80 being important support to hold. Momentum is positively sloped on daily charts, but negative on weekly and neither overbought nor oversold. To have conviction that SOL might be ready to turn back higher, a weekly close back over $122 is necessary. Until that time, this has an above-average chance of weakening back to the lows into April, a time when most of the weekly Cryptocurrency cycles look to be bottoming.

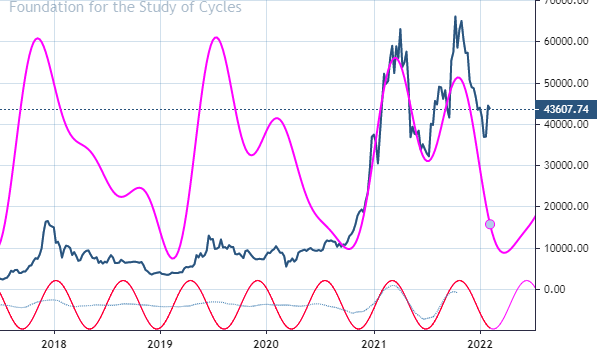

Bitcoin’s weekly cycles, when plotted in a composite going back over the last five years, look to still be in a period of weakness that might not let up until April/May of this year. This same composite was successful in projecting highs in late 2017, highs in 2019, and Spring, Fall of 2021. Now this weakens into April before bottoming. Thus, it’s tough to put too much credit in the current bounce as being able to get back to highs given a lack of retail interest when weekly cycles seem to be early in bottoming out. The daily cycles show possible peaks in price by the first week of March given a composite of the three strongest cycles under 100 days in length. Meanwhile when plotting a composite of 91-week, 42-week and 30-week cycles, most of these show a Spring 2022 low.

Reports you may have missed

Bitcoin looks to strengthen relatively speaking after nearly a month of lagging

Bitcoin (BTC) broke out of its triangle pattern today, Monday 11/8, and could set a new all-time high close above 65,990.31.Relatively speaking, BTCUSD should begin to gain in relative strength based on a minor breakout in its Dominance chart which should help its market capitalization start to pick up speedLTCUSD, ALGOUSD, and LINKUSD all should be favored for gains in the weeks ahead as these are making favorable technical breakouts...

Articles Read 1/2

Enjoyed the read? Subscribe now for unlimited access!

Get invaluable analysis of the market and stocks. Cancel at any time.

Already have an account? Sign In b43892-913e22-9656b2-321553-41919d

Already have an account? Sign In b43892-913e22-9656b2-321553-41919d