What next after BTC’s surge toward next resistance near 13.8K?

Oct 22, 2020

• 3

Min Read

Author

For a full copy of this report in PDF format click this link.

- After surging through resistance at the August highs near 12.5K over the past week, BTC is closing in on next major resistance near June 2019 highs at 13.8K. With short-term trading indicators pushing into overbought territory, traders are understandably questioning whether they should reduce exposure. We disagree. Sure, a near-term dip or pause is likely given the recent rally, BUT the longer-term term technical structure continues to improve suggesting pullbacks are likely to be short lived and relatively shallow. Based on the following bullets and accompanying charts, we remain bullish on BTC’s longer-term prospects and rather than attempting to micro manage trading position, maintain exposure using pullbacks and pauses to further increase exposure.

Key technical developments

- Improving long-term price structure following 2018-2020 consolidation – BTC’s price structure is incrementally transitioning into a new long-term uptrend following its very broad 2018-2020 consolidation above its long-term structural uptrend defined by the 200-week sma. BTC has reversed its 2018-2020 downtrend with a series of higher highs and lows following the March collapse in all risk assets. Bottom line: BTC’s price pattern is in the early stages of a new longer-term uptrend with the June 2019 highs at 13.8K its next key resistance hurdle followed by 20K. While a pause/consolidation between current levels and 13.8 is likely, our recommendation is for longer-term investors to stay focused on the improving longer-term technical structure and to not be unnerved by tactical pullbacks and consolidations. Slide 3

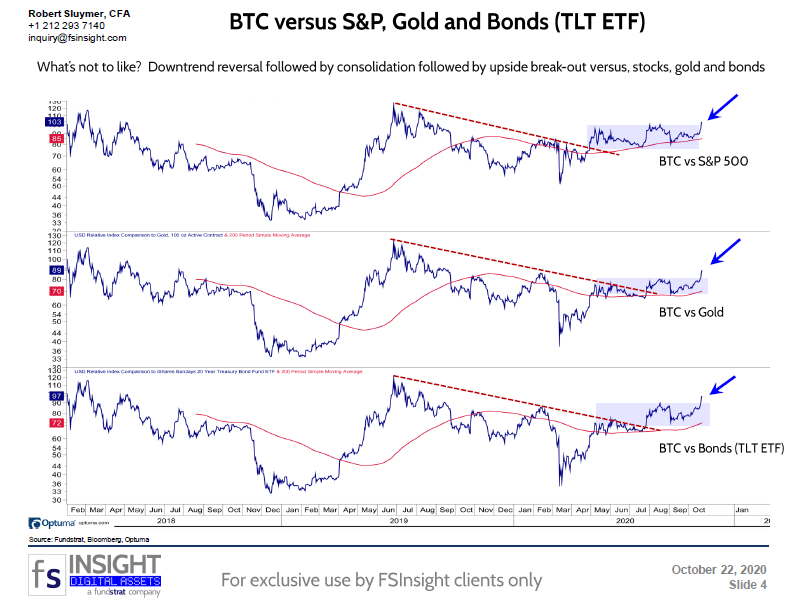

- Relative performance trends vs equities, golds and bonds is beginning to trend to the upside. In our opinion, the most more noteworthy chart for investors to focus on is BTC’s relative performance versus the S&P 500, Gold and the TLT Bond ETF. BTC is likely in the early stages of assuming leadership to all three asset classes. This appears to be an almost textbook perfect bearish to bullish transition as BTC emerges from 6-mnonth trading range/pause following its 2019-2020 downtrend reversal. Asset allocators take note! Slide 4

- Daily chart is becoming overbought but expect pullbacks to be shallow and short lived. Momentum indicators are becoming overbought on BTC’s daily chart but they are by no means extreme yet. Our expectation is that pullbacks are likely to be shallow given the bullish higher weekly time frame chart discussed above. Slide 5

- Intra-day 4 hour chart IS very overbought – Given BTC’s impressive surge over the past few days, it is hardly surprising its 4-hour RSI momentum indicators are very overbought. However, rather than attempting to micro manage the trade by selling in hopes of also identifying the exact pullback low, we recommend maintaining exposure at current levels and using near-term pauses and consolidations to further build BTC exposure. Slide 6

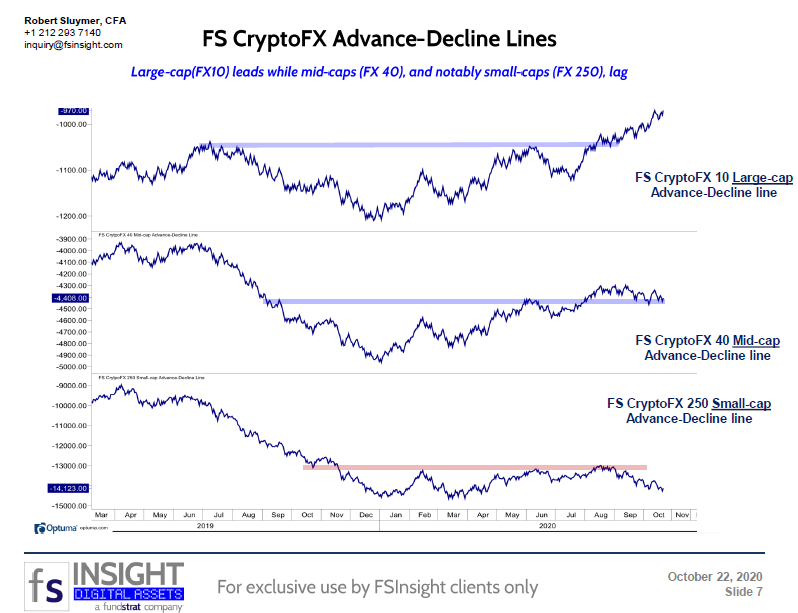

- Too early to rotate to small-caps – Participation remains concentrated in larger-caps – Our Fundstrat FS CryptoFX advance-decline lines for large-caps (FX 10), mid-caps (FX40) and small-caps (FX250) illustrate that upside participation is concentrated in larger-cap cryptos. As such, we recommend investors focus exposure in larger-caps, until we see breadth improve into smaller-caps. Slide 7

Resuming its longer-term uptrend – 13.8K next resistance (Slide 3)…

BTC emerging vs the S&P, Gold and TLT bond ETF (Slide 4)…

BTC – Overbought short-term – Expecting shallow pullbacks (Slide 6)…

Participation remains concentrated in large-caps (FX 10) (Slide 7)…