Crypto sells off with risk assets but is holding above first key support

Crypto sell off with most risk assets – Cryptocurrencies broadly sold off today along with most risk assets raising the question of whether a bigger correction is developing. While a deeper correction is always possible it is premature to technically conclude BTC’s May-June trading range is morphing into a downtrend.

Key technical levels for BTC – The long-term trend for BTC remains positive with a move above 10-10.5K resistance needed to signal a new upside acceleration taking hold. From a short-term trading standpoint, today’s reversal was obviously not encouraging, particularly given BTC, along with many Alts, were in the early stages of bottoming/rebounding from support following last week’s pullback. However, BTC remains in a broad sideways trading range between 10-10.5K resistance and a key support band at 8.6-9.1K. A break below 8.6K would be needed signal a breakdown and downside trend reversal by establishing the first lower low since the March bottom. Next support is at the 200-dma (8.3K) followed by the 50% retracement (7.1K) of the Q1 sell-off.

ETH sells off but also holds above first support – Similar to BTC, ETH reversed to the downside today after bottoming above a broad support band between 216-227 near its 62% retracement of the Q1 decline. We have expected ETH to break-out above 252, which will be needed to signal a new upside acceleration developing. Next resistance is at 289. However, should ETH break below support between 216-227, near its 50-dma at 221, a downside move to 188 is likely, coinciding with its rising 200-dma.

ETHBTC remains noteworthy as an emerging uptrend – ETHBTC has rallied back to resistance at .026, just above its 62% retracement level (.0253) of the Q1 sell-off. We expect ETHBTC to rally above .0265 with next resistance at .0285.

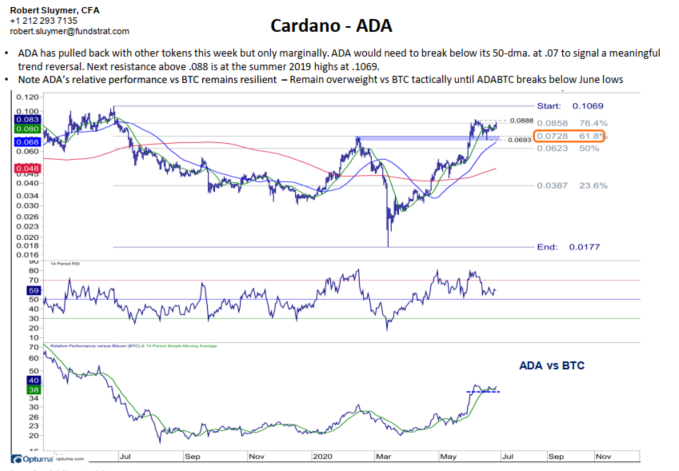

ADA remains resilient – ADA has pulled back with other most other tokens this week, but for ADA, only marginally so. ADA would need to break below its 50-dma at .07 to signal a meaningful trend reversal. Next resistance above .088 is at the summer 2019 highs at .1069. ADA’s relative performance vs BTC remains resilient supporting an overweight vs BTC.

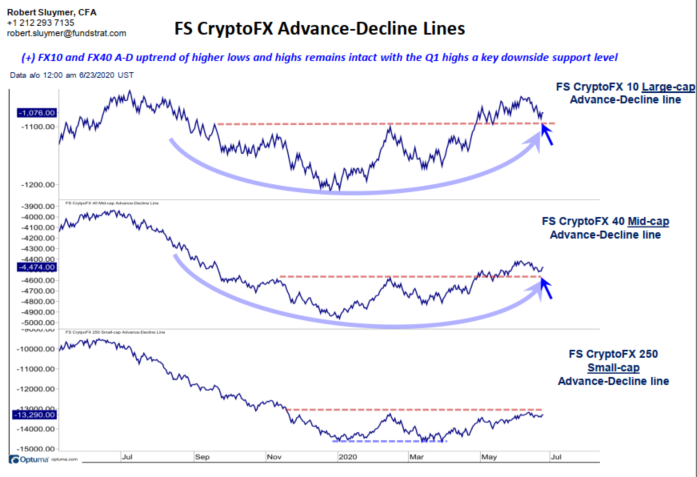

Fundstrat FS CryptoFX index highlights. The FS Crypto Advance-Decline line for the FX 10 large-cap and FX40 mid-cap indices has pulled back to the next key technical level near the April 2020 breakout highs. While it is early to conclude these A-D line are bottoming, doing so near current levels would be a bullish indication and reinforce the longer-term uptrend developing defined by higher highs and lows. In addition, the FS Crypto40 mid-cap index continues to show evidence of emerging in relative to the FS CryptoFX 10 large-cap index.