BTC surges > 200-dma toward resistance at 9K – Daily RSI overbought

BTC recaptures a key technical threshold accelerating above its widely monitored 200-dma. BTC surged above a key resistance level at its 200-dma toward its next resistance near 9K coinciding with a 76.4% retracement of the Q1 decline and the early March highs at 9.2K.

Given daily RSI and the 4-hour RSI have now moved into overbought territory, our expectation is for a short-term pause pullback to develop with first support near 8K near the 200-dma and 62% retracement zone.

Stepping back – The big picture: A broad basing profile rally from a longer-term rising uptrend – BTC’s 3-year chart profile remains in a downtrend from the 2018 highs with the Q1 2020 highs near 10-10.5K the key upside resistance band that will need to be exceeded to confirm a longer-term upside trend reversal. Recognizing the risks of pre-judging technical patterns before they resolve one way or another, we are viewing the incredibly volatile trading range since 2018 as a longer-term basing/consolidation profile that has bottomed near its long-term uptrend (200-week sma) and will likely resolve the bigger multi-year pattern to the upside over the coming 2-4 quarters.

ETH and ETHBTC – Similar to BTC, ETH has also extended its April uptrend and is likewise becoming overbought and due for a short-term pullback as it rallies through its 62% retracement near 112. Given daily RSI has now moved into overbought territory, we recommend waiting for near-term pullback before accumulating. Interestingly, while ETH has been outperforming BTC off the March lows (and January lows), it is beginning to stall short-term. Daily RSI for ETH-BTC has peaked suggesting a near-term pullback developing.

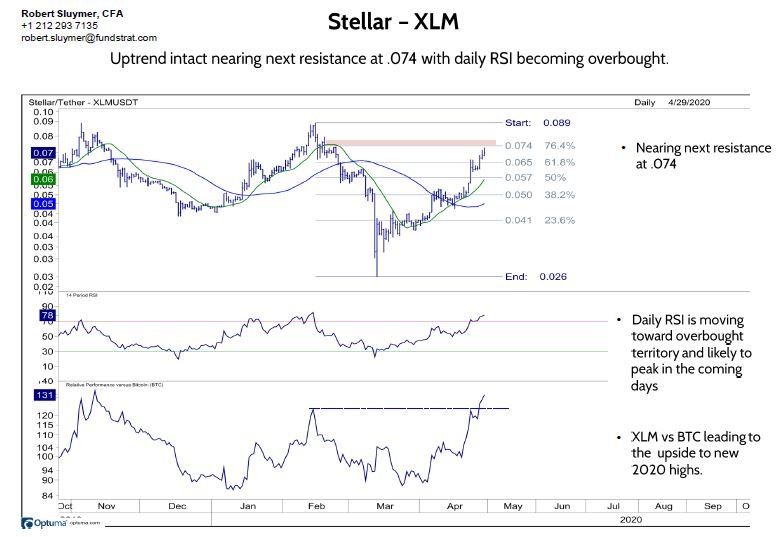

ALTS (XLM, ADA) – Last week we featured XLM as one example to illustrate the broader improvement taking hold within a growing number of Alts. XLM’s relative performance continued to positively diverge with price extending above the February relative highs. Given daily RSI is now moving into overbought territory, we expect to see a pullback and better long side entry points in the coming 1-2 weeks. ADA has also rallied into next resistance near its 62% retracement at .051 with its daily RSI moving into overbought territory and likely to peak in the coming week.

Fundstrat CryptoFX indices and A-D lines – Noteworthy: The FXCryptoFX 10 large-cap advance-decline line rallied through a key threshold at its February highs to a new 6-month high. This is an important development effectively confirming a new breadth uptrend in place for cryptos since mid 2019.