BTC stress tests its 2015-2020 uptrend at 7.7K. ETH tests key level at 180

Cryptocurrencies abruptly u-turned over weekend sending most back to key technical levels as global macro worries intensified. BTC is now testing important support at 7.5-7.7K that needs to hold to keep its longer-term uptrend intact, while ETH is also testing a key level at 180.

BTC – Benefit of the doubt as BTC is oversold short-term at long-term trend support.

Last week, we highlighted BTC was likely starting a short-term rebound only to promptly see BTC collapse through the weekend back to key support at its 2015-2020 uptrend and 62% retracement of the 2H 2019 rebound. Given daily and 4-hour RSI is suitably oversold, we recommend giving BTC the benefit of the doubt it will hold current levels. While the technical backdrop should support a bounce, BTC’s next meaningful directional shift will likely be dependent on whether the broader macro backdrop for traditional assets can stabilize or not. Our expectation is that it will. However, a break below 7.5K would jeopardize the longer-term bullish trend for BTC with next critical support at the prior lows in Q4 2019 near 6.5K, followed by the rising 200-week sma at 5.5K.

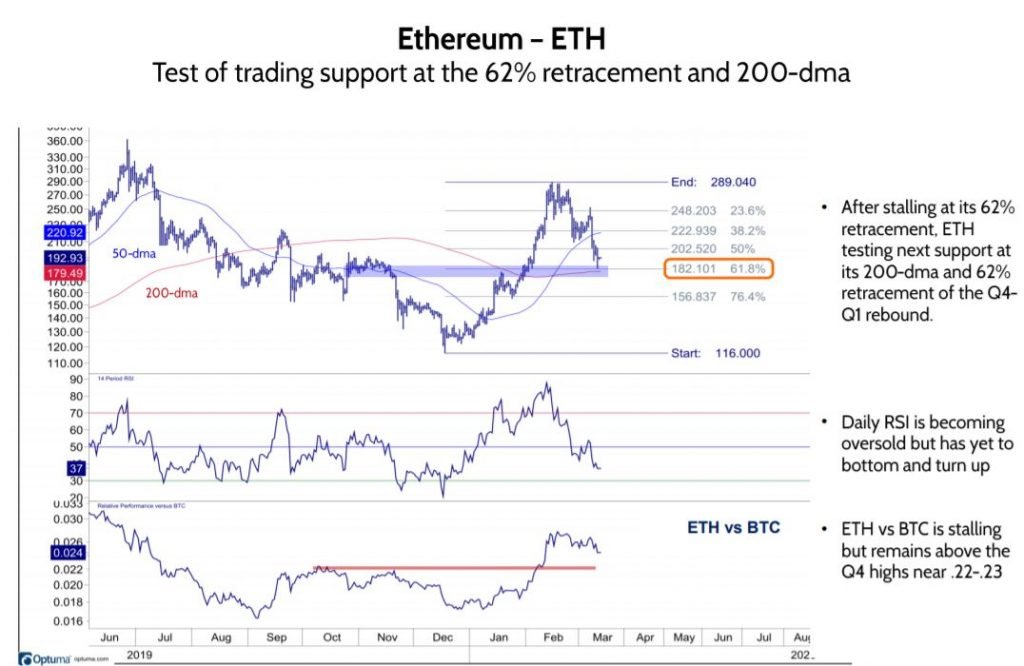

ETH is also testing next key support at a 62% retracement near its 200-dma.

Similar to BTC, ETH stalled just near the 62% retracement of its 2H 2019 correction and has now pulled back to support. Once again, a 62% retracement at 182 is in play as ETH retraces back to trading support at its 200-dma (179) with short-term/daily RSI oversold. We expect ETH to hold near current levels.

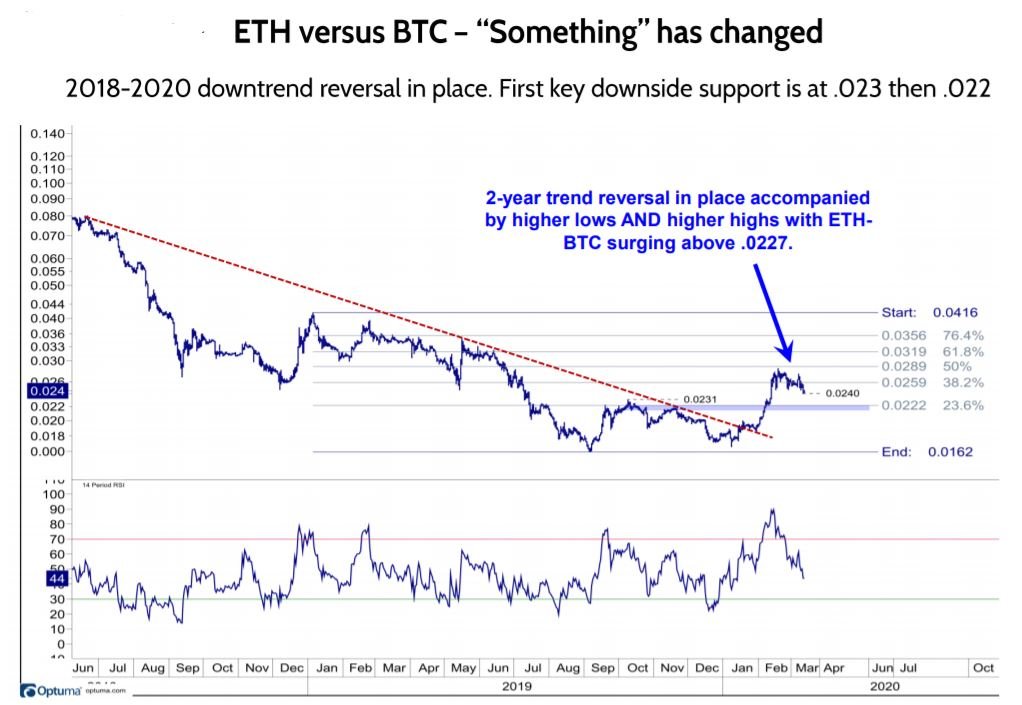

ETH-BTC

Relative performance of ETH vs BTC is pulling back to .024 with next important support at .023 followed by .022.

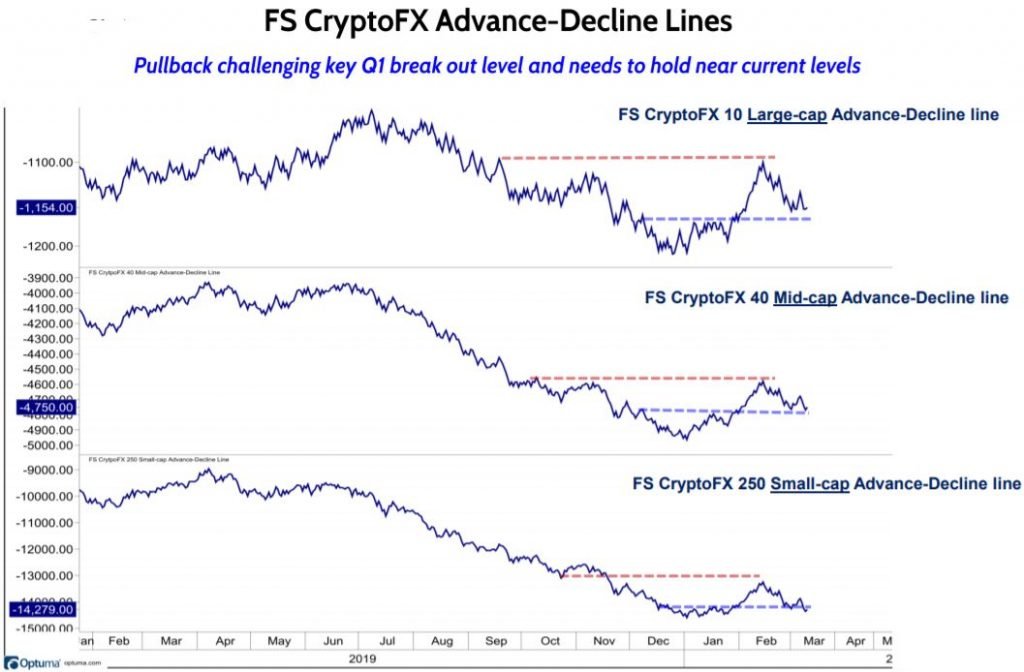

Fundstrat FS CryptoFX index highlights

A/D line pulling back to key levels that need to hold defined by the January break-out levels. Short-term/daily RSI momentum is oversold for most indices. Interestingly, the relative performance for the FX 250 Small-cap index vs the FX 10 Large-cap index is showing early signs of challenging its Q4-Q1 relative downtrend during the past week’s decline.