Tactical Window Narrows, Preserving Dry Powder (Portfolio Rebalance)

Portfolios

Note: Changes to both portfolios are discussed at the end of this note.

The Breakdown

Entering January, my view on crypto remained measured from a medium-term perspective but tactically constructive. In my January 6th strategy note, I argued that while the broader setup for 2026 still pointed to a choppier first half and a more compelling accumulation opportunity later in the year, the near-term risk-reward had begun to skew favorably.

The key drivers behind that view were straightforward:

- Liquidity conditions were turning supportive, driven by Fed balance sheet dynamics and a drawdown in the Treasury General Account

- The dollar’s 2H weakness suggested a currency-led liquidity impulse for BTC

- Credit markets were behaving constructively, with spreads tightening once again, historically a favorable backdrop for crypto

- Early signs of improving flows suggested new money was entering the market amid an environment that had become increasingly illiquid

Price action initially validated that tactical framework. Bitcoin decisively cleared the ~$94k resistance level that had capped price action multiple times over the prior two months, and it did so in a notably healthy manner:

- The move was spot-led rather than driven by leverage

- Funding rates were negative into the breakout, indicating complacency among bears

However, in recent days, we have witnessed a swift drawdown in crypto alongside a growing set of conflicting signals. On Wednesday, I suggested that the window for a near-term rally above $100k was narrowing. While a pair of developments (the Greenland agreement and JGB intervention) argued against declaring that the window is fully closed, they did not negate the broader deterioration in near-term risk/reward. Below are the key factors I considered in that assessment. For additional details, please refer to my note from Wednesday.

- Lack of Follow-Through: The market exhibited a clear lack of follow-through following roughly $3.4B in price-insensitive spot buying from MSTR, despite breaking through key resistance.

- No Clarity (Yet): While a market structure bill remains on the table for 2026, there is clear friction between the Senate’s current draft and the industry. Moreover, several procedural steps remain before the bill could reach the President’s desk, limiting its usefulness as a near-term catalyst. In recent days, it also seems that the Senate has shifted its priorities from crypto to housing policy.

- Rate Expectations Rising: U.S. growth remains firm, while uncertainty around Fed leadership and the post-Powell FOMC composition has increased. Together, these dynamics are pushing rate expectations higher and tightening financial conditions at the margin.

- Gold Booming: Gold’s continued outperformance reflects structural tailwinds such as sovereign demand and geopolitical hedging that do not currently apply to Bitcoin. As a result, the gold-Bitcoin ratio remains biased higher, despite optimism around a potential rotation. While I remain long-term bullish on BTC in this context, that rotation has yet to materialize.

- Positioning a Key Concern: Risk indicators (HY spreads, MOVE) and investor positioning metrics (BofA survey data) suggest complacency remains elevated.

- JGB Intervention: The sell-off in JGBs was a primary driver of this week’s risk-off price action in crypto. Japan does not appear willing to abandon its fiscally accommodative posture, suggesting bouts of JGB-driven volatility are likely to recur. That said, intervention from major domestic banks may temporarily stem the pressure.

- Good News on Greenland: Escalating tariff threats tied to the Greenland dispute likely compounded JGB-driven volatility, coinciding with weakness in Treasuries, the dollar, and broader risk assets. The agreement reached on Wednesday between President Trump and NATO removed this particular source of downside risk.

Overall takeaway as of Wednesday: The lack of follow-through despite strong spot buying, rising macro uncertainty, and still-bullish positioning suggested the near-term tactical opportunity was waning. However, given temporary relief from Japanese bank intervention in the JGB market and the positive resolution around Greenland, it was reasonable to allow for the possibility of near-term stabilization and assess whether Wednesday’s intraday rebound could sustain follow-through.

Friday’s view: While BTC attempted a move toward $91k, it appears likely to finish the week roughly unchanged relative to the S&P 500 from Wednesday’s lows. I would characterize this as a lukewarm rebound. Additionally, a new liquidity-related concern emerged in the form of rumors around potential Japanese Ministry of Finance intervention in the yen.

- More on the Yen: The yen’s sharp one-day rally on Friday (its largest in 6 months) was driven by market speculation that a New York Fed “rate check” signaled potential coordinated FX support from Japanese authorities. I should note that the actual intervention was not confirmed.

Reducing risk in portfolios: I am taking steps to reduce risk here / preserve dry powder for two reasons: (1) the crypto market’s response to JGB intervention and the positive Greenland news has been underwhelming, and (2) renewed speculation around yen intervention could further tighten global liquidity conditions in the near term if a major funding currency strengthens. The good news is that on the back end of any intervention, we will be operating in a weaker-dollar regime.

Looking Ahead: Going forward, I am looking for BTC to reach a clearer value zone, for a new catalyst to emerge, or for broader positioning to clear before redeploying dry powder.

Adding BTGO to the equities portfolio: Yesterday, I circulated a note outlining my rationale for adding BTGO, the crypto infrastructure company that went public on Thursday, to our crypto financial services basket. While it may appear counterintuitive to add a name to the crypto equities portfolio while simultaneously reducing net exposure, these actions reflect two distinct objectives: security selection and exposure management. The former is about owning companies positioned to outperform under favorable conditions, while the latter is about managing macro-driven risk in the near term.

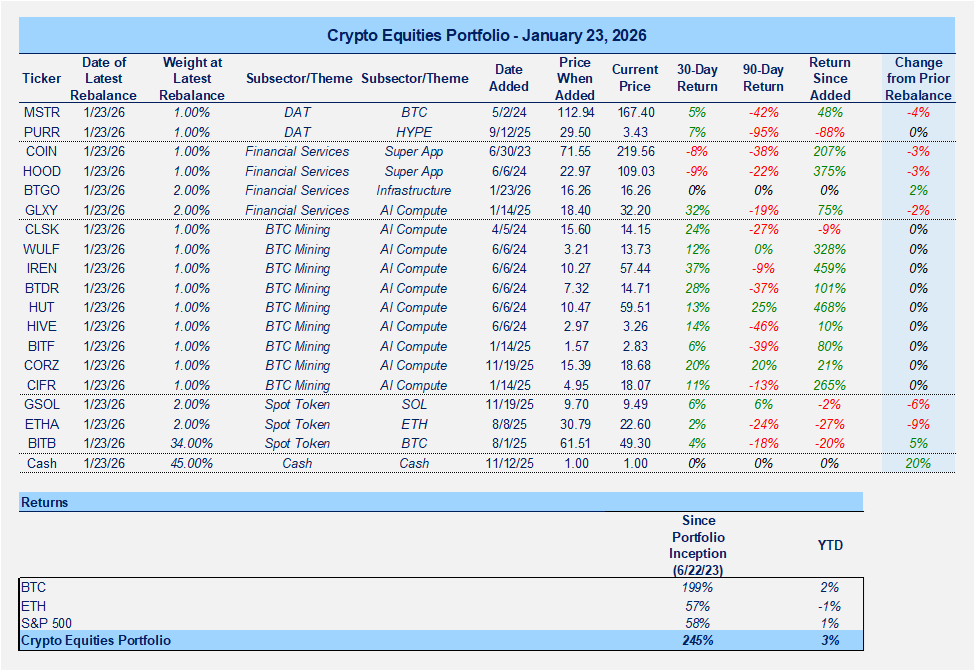

Changes to Crypto Equities Portfolio:

- Reverting to pre-January framework: I am largely reverting the crypto-equities portfolio to its pre-January allocation framework, with a few targeted adjustments reflecting valuation and crypto sensitivity.

- Adding BTGO: I am initiating a 2% position in BTGO, reflecting its role as a core crypto infrastructure provider leveraged to institutional adoption.

- Funding from HOOD: The BTGO position is funded by a 2% reduction in HOOD, which remains the most expensive name within our crypto financial services cohort.

- Maintaining miner exposure (1%): I am maintaining a 1% allocation to miners, which have become less sensitive to crypto prices and increasingly trade on AI and data center optionality.

- Reducing GLXY to 2% (from 4%): I am reducing GLXY from 4% to 2%, which is higher than its 1% pre-January allocation, as the stock has recently traded more in line with data center peers than with crypto price performance.

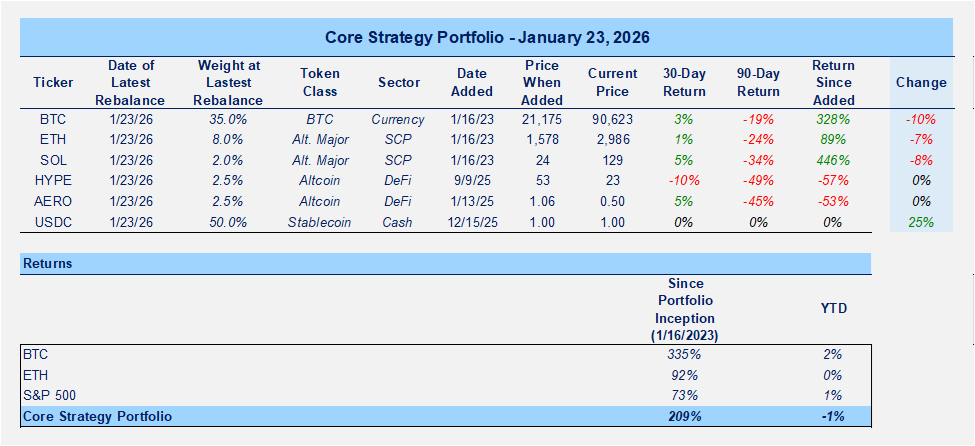

Changes to Core Strategy Portfolio:

- Reverting to pre-January framework: I am reverting the Core Strategy portfolio to its pre-January allocation framework