BitGo: A Cycle-Tested Crypto Infrastructure Platform with a Compelling Growth Story

Note: Unlike my standard strategy notes, this report is a deep dive into a single company. While this will not become a standing weekly format, I plan to publish company-specific work on a selective basis when I believe it adds incremental value to the broader strategy framework.

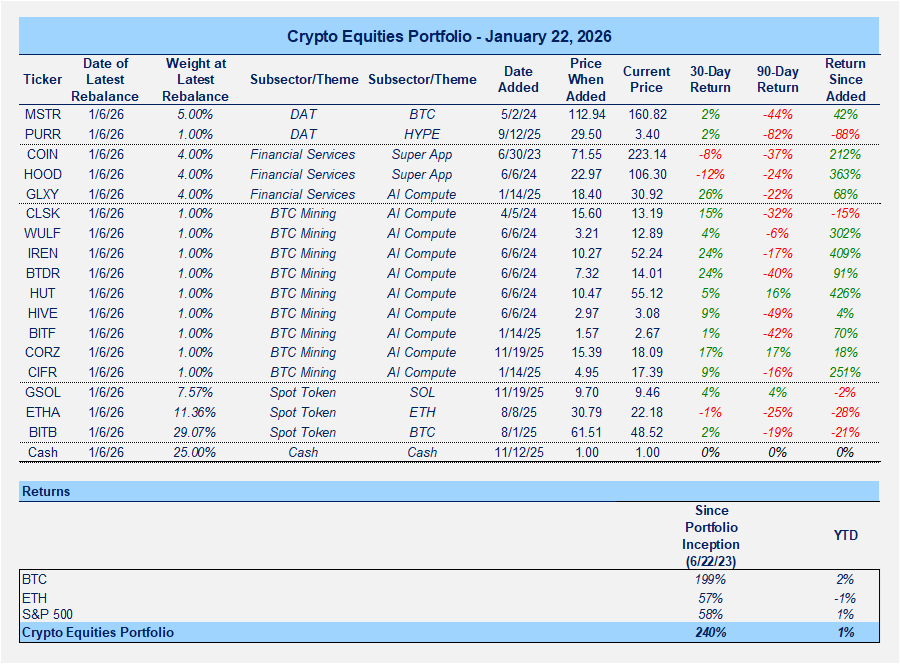

Separately, I plan to initiate a small BTGO position in the crypto equities portfolio. That update will come tomorrow. The exact allocation has not yet been finalized, but is expected to fall in the 2–4% range.

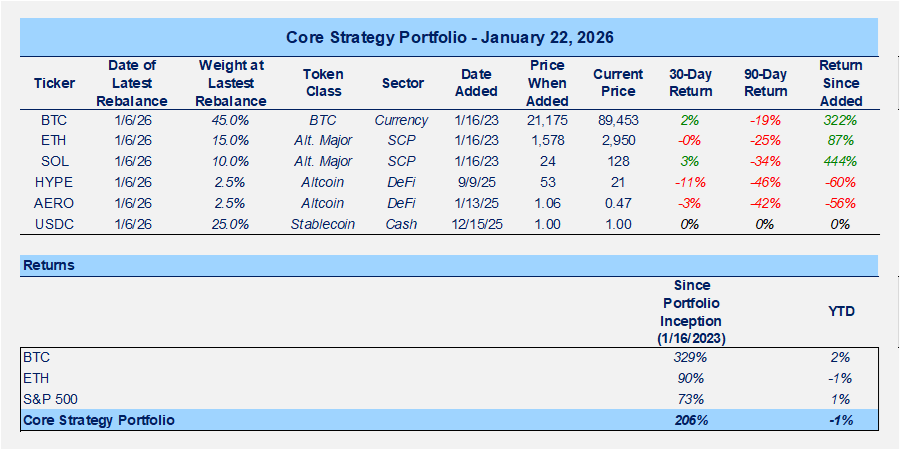

Portfolios

Executive Summary

- BitGo is a cycle-tested institutional crypto infrastructure platform, founded in 2013, with a custody-first, full-stack offering spanning qualified custody, staking, prime brokerage, settlement, and stablecoin infrastructure.

- The company went public on Thursday, raising approximately $200 million in primary proceeds at $18 per share, implying a ~$2.1bn market cap.

- BitGo uses qualified custody as a wedge to onboard institutional clients, then increases monetization per dollar of assets on the platform through higher-value services such as staking, prime brokerage, settlement, and payments.

- While custody is a lower-margin entry point, incremental products are more scalable and higher margin, creating a credible path to operating leverage over time.

- I view prime and services adoption, rather than trading margins, as the key driver of long-term value creation.

- I anchor valuation to 2027 and 2028 EBITDA, when operating leverage should begin to emerge as downstream products scale. Applying 20x 2027 EBITDA and 15x 2028 EBITDA in my base case, and probability-weighting bear, base, and bull outcomes, yields an illustrative target price of ~$25, representing ~40% upside from the IPO price.

- Key risks include competitive pressure, crypto market cyclicality, and execution risk in scaling prime services.

- Bottom Line: BitGo offers exposure to the institutionalization of crypto, with a cycle-tested, custody-led platform and a clear monetization roadmap. Despite competitive and cyclical risks, the current valuation provides an attractive risk-reward for a well-established infrastructure provider entering its next growth phase. With that in mind, I will be adding it to the crypto financial services basket within my crypto equities portfolio.

The Company

BitGo is an institutional digital asset infrastructure company founded in 2013 by Mike Belshe and Ben Davenport. Originally focused on multi-signature Bitcoin wallets, BitGo has evolved into a custody-first, full-stack platform designed to help institutions integrate crypto into traditional financial workflows.

Today, BitGo provides:

- Self-custody wallets

- Qualified custody through BitGo Trust entities

- Prime services, including trading, lending and borrowing, collateral management, staking, and settlement

- Infrastructure-as-a-service, including stablecoin issuance and management tooling

The core value proposition is that BitGo enables non-crypto-native institutions to outsource their entire crypto technology and operational stack, offering an off-the-shelf operating system built on institutional-grade custody. It has a strong core business that seeks to onboard and upsell clients to its broader suite of crypto infrastructure capabilities.

Product Stack Overview

Qualified Custody

BitGo views qualified custody as its institutional wedge product, addressing one of the most challenging hurdles for institutional adoption: holding client assets in a safe, compliant, and auditable manner. BitGo generates revenue through ongoing custody fees, typically assessed as a small percentage of assets under custody. While custody is a lower-margin business, it establishes trust, creates switching costs, and provides a foundation for cross-selling higher-velocity and higher-margin services.

Qualified custody is a gating requirement for RIAs, funds, ETFs, banks, and corporations with fiduciary obligations, which narrows the competitive field to a finite set of providers.

Key components of BitGo’s qualified custody offering include:

- Asset segregation and bankruptcy remoteness: Client assets are held at trust entities and segregated from BitGo’s corporate balance sheet, addressing counterparty risk and fiduciary/audit concerns.

- Compliance and controls: BitGo provides SOC 1 Type 2 and SOC 2 Type 2 audits, institutional-grade key management, and documented internal controls, satisfying the requirements of risk committees, auditors, regulators, and boards.

- Insurance: Assets held in qualified custody benefit from insurance coverage of up to $250 million.

Once assets reside on BitGo’s rails, institutions have already completed vendor risk, compliance, and legal diligence, resulting in a sticky relationship. From an economic perspective, customer acquisition costs are largely front-loaded toward winning custody mandates, while customer LTV expands as additional services are layered on.

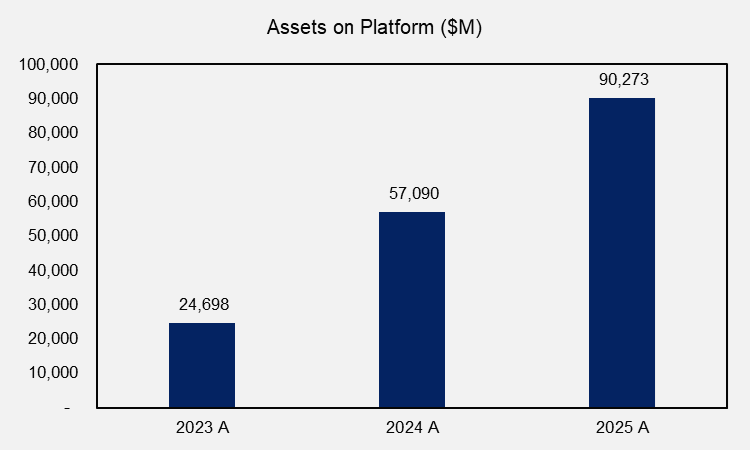

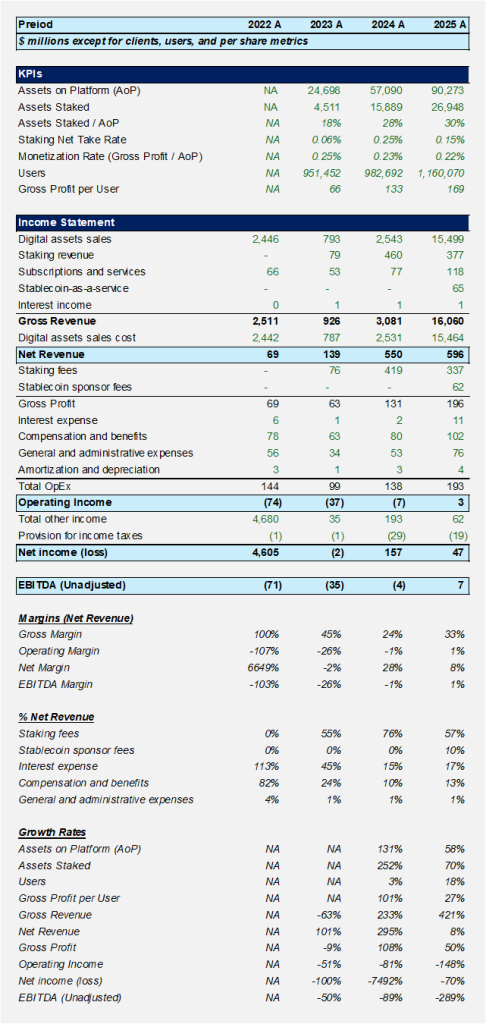

Management provides figures for Assets on Platform (AoP), which includes both custodied and non-custodied assets leveraging BitGo products. However, I believe that assets under custody is likely close to the stated AoP figures. The Company has grown its median AoP from $25B in 2023 to $90B in 2025 (260% growth). The Company’s total AoP amounts to ~2.6% of the total crypto market cap.

Staking

While BitGo does not operate a rigid product funnel, staking represents the first natural upsell following custody. It is a low-friction way to monetize assets under custody, allowing clients to earn protocol-level yield with minimal operational complexity. Staking can be enabled as a simple “toggle,” with rewards flowing directly back into qualified custody net of a fee paid to BitGo.

BitGo’s staking services include:

- Custody-native staking: Staking is integrated directly into qualified custody, keeping assets under BitGo’s control and governance without requiring clients to run validators or move funds to third-party providers.

- Delegated validator infrastructure: BitGo either operates validators directly or curates a whitelisted validator set. The firm manages uptime, protocol upgrades, slashing risk mitigation, and reward distribution.

- Broad asset coverage: Support spans major proof-of-stake networks, enabling consistent controls across assets.

Staking is one of BitGo’s higher-margin services and materially improves customer lifetime value once custody is established.

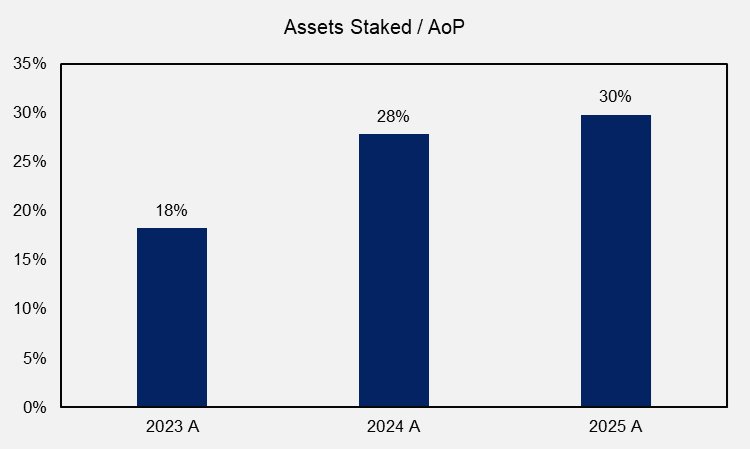

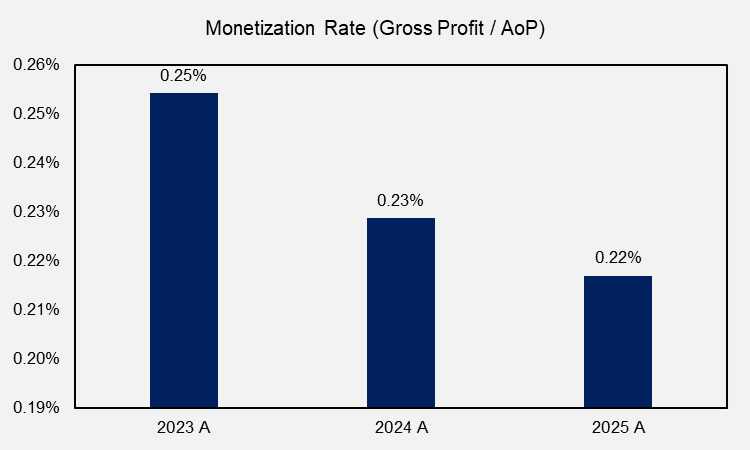

BitGo earns a portion of the rewards paid out to stakers. Its net take rate (measured as % of staked assets) on staking services in 2025 amounted to ~15 bps, down from 25 bps in 2024. This is in line with industry standards and is likely to remain around this level due to increasing competition in this vertical. However, they have been able to activate an increased percentage of their AoP over the past two years, with assets staked / AoP increasing from 18% in 2023 to 28% and 30% in 2024 and 2025, respectively. The performance of this business is closely tied to asset price performance among leading PoS networks.

Liquidity & Prime Layer

As clients deepen engagement through custody and staking, the next logical step in the product ladder is BitGo’s liquidity and prime services, which are best understood as delivering operational convenience on top of custody. I view this offering as their most significant growth vector.

Key elements include:

- Agency-style prime brokerage: BitGo operates as an agency prime broker rather than a balance-sheet trading firm. Unlike principal-based platforms such as Galaxy Digital, BitGo does not warehouse risk or operate a proprietary trading book. Instead, it routes trades to third-party exchanges, OTC desks, and liquidity providers. This model caps upside relative to balance-sheet-driven peers but offers capital efficiency and lower earnings volatility.

- Trading from custody: Clients can execute trades without moving assets out of qualified custody. Orders are routed externally, while settlement is coordinated through BitGo’s internal rails (the Go Network), enabling off-exchange settlement where counterparties participate. This reduces prefunding requirements, limits exposure to exchange hot wallets, and simplifies reconciliation.

- Consolidated access: BitGo Prime offers multi-venue access through a single interface, smart order routing, access to OTC venues and exchanges, and unified reporting. From the client’s perspective, multiple liquidity venues are accessed through one account, one custodian, and one control framework.

BitGo monetizes prime services through trading fees, routing or spread-sharing arrangements, service fees, and ancillary fees tied to settlement, reporting, and collateral workflows. While margins are thin and cyclical, prime materially increases customer retention and lifetime value by embedding BitGo deeper into institutional workflows.

There are a couple of metrics we could look at to determine the success of their prime layer. One is the overall monetization rate, but this is clouded by thinning margins on trading services and also includes their custody and staking services. This metric has declined over the past two years. However, again, I believe this metric is negatively skewed by the maturation of the industry and non-prime services being included.

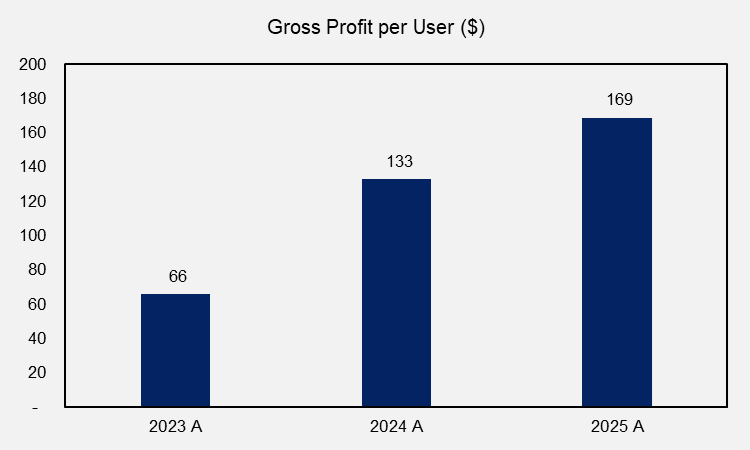

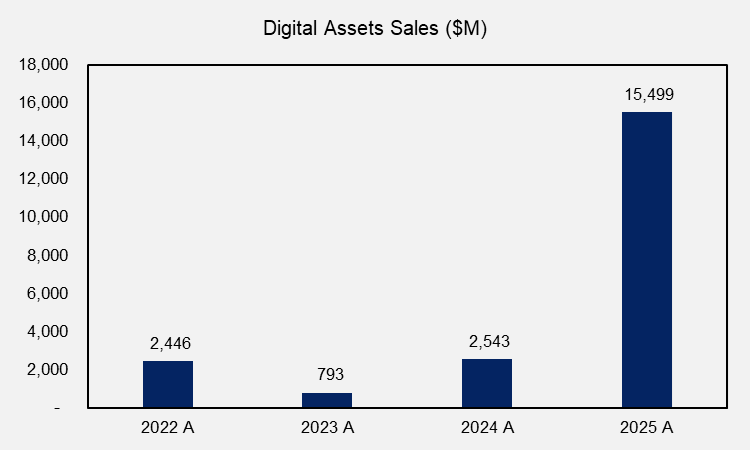

Another two, perhaps more informative, metrics that I think are worth paying attention to are digital asset sales and average gross profit per user (AGPU).

AGPU increased by 101% in 2024 and a further 27% in 2025.

Digital asset sales, which represent the gross trading volumes executed through BitGo’s prime brokerage platform, grew 6x in 2025.

Although this is a low-margin business, it reflects an increasingly active and sticky user base that has embedded BitGo into its workflows.

Stablecoin & Payment Rails

Once custody, trading, and internal settlement are established, BitGo can layer on stablecoin and payment rail services, enabling institutions to use cash-like instruments that move with crypto-native efficiency.

Offerings include:

- Stablecoin-as-a-Service: BitGo provides issuer-agnostic stablecoin infrastructure for institutions that want to issue, manage, or integrate stablecoins without building a full stack. Services include reserve custody, mint/burn functionality, on-chain issuance and redemption workflows, compliance and reporting, and integration with BitGo custody and settlement.

- goUSD: goUSD is a USD-backed stablecoin designed to integrate tightly with the Go Network and demonstrate BitGo’s end-to-end infrastructure capabilities. Importantly, BitGo’s strategy does not rely on goUSD becoming dominant. Third-party stablecoins can operate on the same rails.

- Payments and real-time cash movement: BitGo extends its settlement logic to tokenized cash, enabling real-time, 24/7 transfers of stablecoin balances, closed-loop settlement between BitGo clients, and API-driven payments integrated into trading, margin, and collateral workflows. A common analogy is SEN or Signet, but using tokenized cash instead of bank deposits.

Monetization might include infrastructure fees, transaction fees, account and platform fees, and balance-based economics. While this business is currently small, it represents a potentially high-margin, high-optionality opportunity as volumes and network participation grow.

The company currently has one stablecoin-as-a-service client that provided $2.7 million in gross profit in 2025. It is a small business, but it could provide some upside optionality.

Recap: The Full BitGo Stack

BitGo’s product stack is designed to meet institutional clients where they are in the crypto adoption lifecycle. The platform begins with qualified custody, a thin-margin but highly sticky entry point, and expands into staking, prime, settlement, and payments as client engagement deepens. Each layer increases customer lifetime value, with acquisition costs largely front-loaded at the custody stage.

The Product Ladder

- Qualified Custody: “Who can safely and compliantly hold these assets for me?”

- Staking: “How do I earn yield on idle assets without moving them or adding risk?”

- Prime / Trading: “How do I trade efficiently without fragmenting my assets, venues, and operations?”

- Stablecoins & Payments: “How do I move non-crypto assets just as efficiently as I move crypto?”

Target Market and Client Base

BitGo’s client base spans a wide spectrum, but the core strategic focus is institutional. The platform serves both crypto-native companies that leverage BitGo’s self-custody wallet technology and non-crypto-native institutions that embed BitGo’s licensed custody, staking, trading, and settlement capabilities directly into their products and workflows.

As of December 31, 2025, BitGo supported over 5,100 clients and 1.2 million users across more than 100 countries, with approximately $104bn in assets on the platform and support for over 1,500 digital assets.

Clients include digital asset ecosystem participants, financial institutions, technology platforms, corporations, government agencies, and high-net-worth individuals.

While BitGo continues to serve crypto-native users, the business is increasingly oriented toward traditional financial services firms, platforms, and issuers that want to outsource the complexity of crypto infrastructure. For these clients, BitGo functions less as a point solution and more as an off-the-shelf operating system for custody, yield, liquidity, and payments.

Competitive Landscape: Fragmented Market, Intensifying Competition

A major risk to the BitGo story is the competitive landscape. BitGo operates in a highly competitive and evolving institutional digital asset infrastructure market that spans qualified custody, prime brokerage, staking, settlement, and stablecoin infrastructure.

That said, there is no real pure-play comparable public company to anchor our analysis to. Competition comes from both crypto-native firms expanding laterally and traditional financial institutions entering selectively, creating ongoing pricing and execution risk.

Qualified Custody

- Coinbase Custody – Largest incumbent by AUC, strong brand trust

- Anchorage Digital – Federally chartered crypto bank with qualified custody and staking, but narrower product breadth

- Kraken Financial – Wyoming-chartered SPDI offering qualified custody

- Gemini Custody – New York trust company with a compliance-first posture

- Fidelity Digital Assets – Strong institutional credibility, limited product scope, and slower pace of innovation

- BNY Mellon – Institutional credibility but early-stage crypto capabilities

Prime Brokerage & Trading

- Coinbase Prime – Strong liquidity access

- Galaxy Digital – Institutional prime services, but balance-sheet intensive

- FalconX / Hidden Road – Execution-focused prime brokers without native qualified custody

Staking & Yield

- Anchorage, Coinbase, Figment – Competitive on validator quality

Stablecoin Infrastructure

- Circle – Strong transaction rails but not full custodians or balance-sheet operators

One thing to keep in mind when considering the competitive landscape: many operators in the space consider it best practice to use 3+ custody providers to eliminate single points of failure. Thus, there will be room for multiple players in the space. Leadership will be determined by each company’s ability to leverage custody relationships to cross-sell other products and services.

Historical Financial Performance

Building off the metrics discussed above, traction across BitGo’s KPIs has translated into net revenue growth of 101%, 295%, and 8% from 2023–2025. For clarity, I calculate net revenue by netting digital asset sales costs against gross revenue. Some analysts may also net staking fees and stablecoin sponsor fees, though I capture that adjustment at the gross profit level.

Gross profit margins expanded from 24% in 2024 to 33% in 2025, driven by a more favorable revenue mix. This resulted in 50% gross profit growth in 2025, significantly outpacing the 8% growth in net revenue over the same period.

Operating margins remain thin at 1% in 2025, though this represents the company’s first full year of operating profitability. As the revenue mix continues to shift toward higher-margin, more scalable lines of business, I believe BitGo is positioned to begin demonstrating meaningful operating leverage over time.

Below, I outline my forward-looking framework for the business.

Scenario Framework: Bear, Base, and Bull

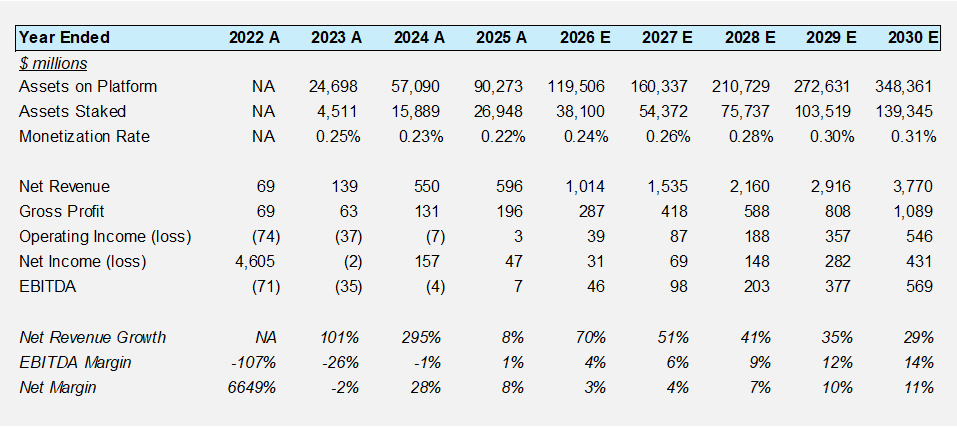

Base Case (probability weight = 75%)

My base case assumes BitGo continues to scale alongside the broader crypto market while modestly improving monetization through deeper product adoption, particularly across prime brokerage, settlement, and staking services.

Assets on the platform grow to ~$350bn by 2030, driven by mid-teens crypto market growth and a gradual increase in BitGo’s institutional market share. Monetization (defined as gross profit/assets on platform) improves from 22 bps in 2025 to 31 bps by 2030, reflecting higher utilization of value-added services rather than pricing expansion.

The revenue mix steadily shifts toward less cyclical, higher margin streams such as complex prime services, staking, and stablecoin-as-a-service, improving revenue quality and visibility. Net revenue reaches ~$3.8bn by 2030.

Operating leverage emerges gradually as the platform scales, with compensation and G&A declining as a percentage of net revenue. That said, I do not assume aggressive cost cuts. As a result, EBITDA margins expand to ~14% by 2030, representing a structurally profitable business.

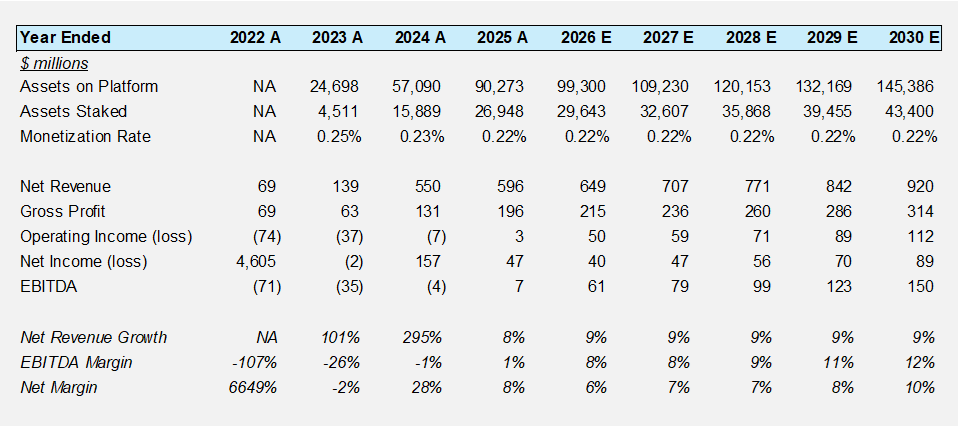

Bear Case: Scale Without Monetization (probability weight = 10%)

The bear case reflects a scenario where BitGo benefits from crypto market growth but fails to meaningfully improve monetization or product mix.

Assets on the platform grow more modestly to ~$145bn by 2030, with aggregate monetization remaining flat at ~22 bps. Prime brokerage and settlement adoption is limited, keeping subscriptions and services revenue largely proportional to asset growth rather than accelerating.

While the business remains profitable, margin expansion is constrained. EBITDA margins slowly reach 12% by 2030, and BitGo increasingly resembles a scaled custody and infrastructure provider with limited operating leverage.

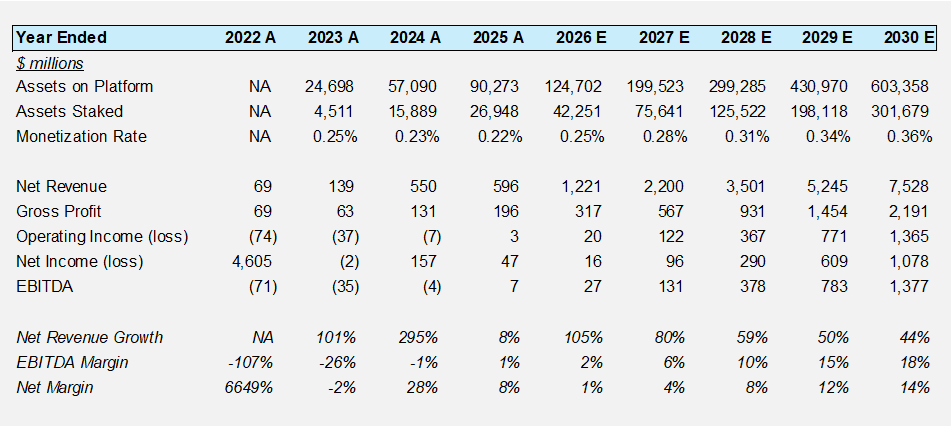

Bull Case: Monetization Unlock (probability weight = 15%)

In the bull case, BitGo successfully executes its vision as a full-stack crypto prime platform, driving both strong asset growth and a material increase in monetization.

Assets on platform exceed $600bn by 2030, supported by strong crypto market growth and meaningful gains in institutional market share. Monetization rises to ~36 bps, driven by higher activity per asset and broader adoption of prime, settlement, staking, subscriptions, and stablecoin services.

Net revenue reaches ~$7.5bn, with continued mix shift toward higher-margin services enabling EBITDA margins to approach the high-teens.

Conclusion

BitGo raised approximately $200 million in its IPO on Thursday, excluding secondary share sales, pricing at $18 per share and implying a market cap of roughly $2.1 billion. After modeling the bear, base, and bull scenarios outlined above, I anchor my valuation framework to 2027 and 2028 EBITDA, which I view as the most relevant reference years for assessing the company’s medium-term earnings power. While 2028 may feel extended for some public market investors, this is the period in which I expect BitGo to begin demonstrating meaningful operating leverage as it scales downstream offerings such as prime brokerage and stablecoin-as-a-service on top of its core custody platform.

In my base case, I apply a 20x multiple to 2027 EBITDA and a 15x multiple to 2028 EBITDA. While these multiples may appear elevated, I believe they are reasonable if BitGo delivers revenue growth as projected, particularly given the improving margin profile implied by increased monetization of assets on the platform. These multiples are broadly consistent with crypto financial services peers such as COIN, GLXY, and HOOD. For the bull case, I expand the applied multiples by five turns, while in the bear case, I compress them by five turns, reflecting materially different growth and monetization trajectories across scenarios. I weight the base case at 75%, the bull case at 15%, and the bear case at 10%.

This approach results in a blended illustrative target price of approximately $25, representing ~40% upside relative to the IPO price.

I plan to add BitGo to my crypto financial services basket within the crypto equities portfolio, while recognizing that, like other crypto-linked financial services businesses, the company remains exposed to cyclicality tied to crypto asset prices. Over time, BitGo could reduce this cyclicality as its service offerings scale and revenue becomes more recurring, though I am not underwriting that outcome today. In addition to macro and execution risk, competitive dynamics remain an important consideration, as discussed above. That said, as the industry moves deeper into an institutional phase, adding a cycle-tested digital asset infrastructure provider with a credible growth pathway makes sense to me.