Tactical Window Narrowing, Temporary Relief Valves Emerge

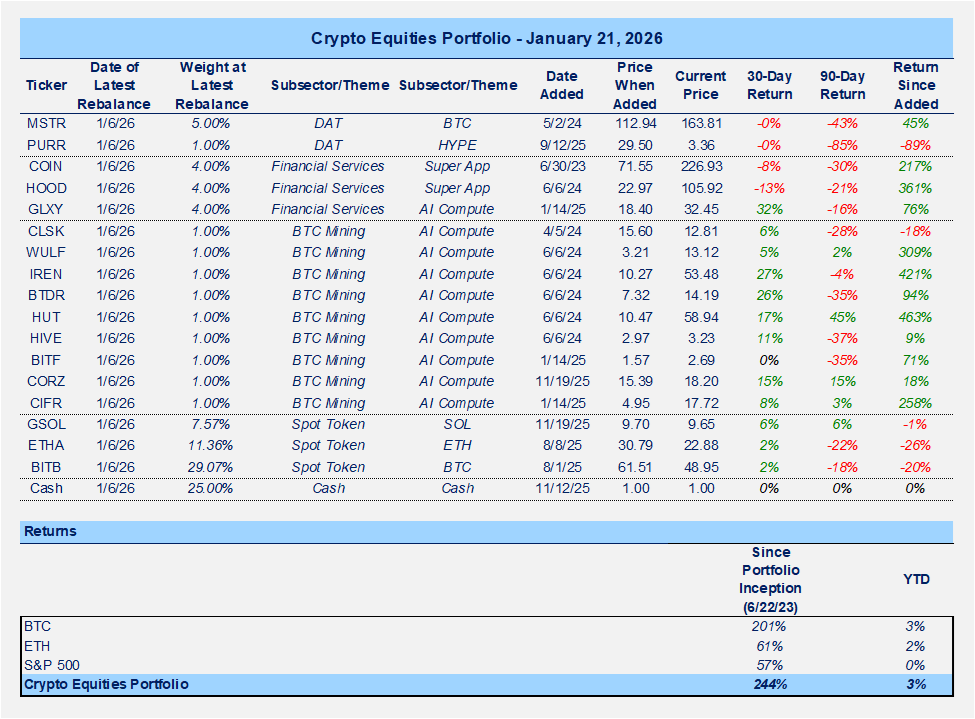

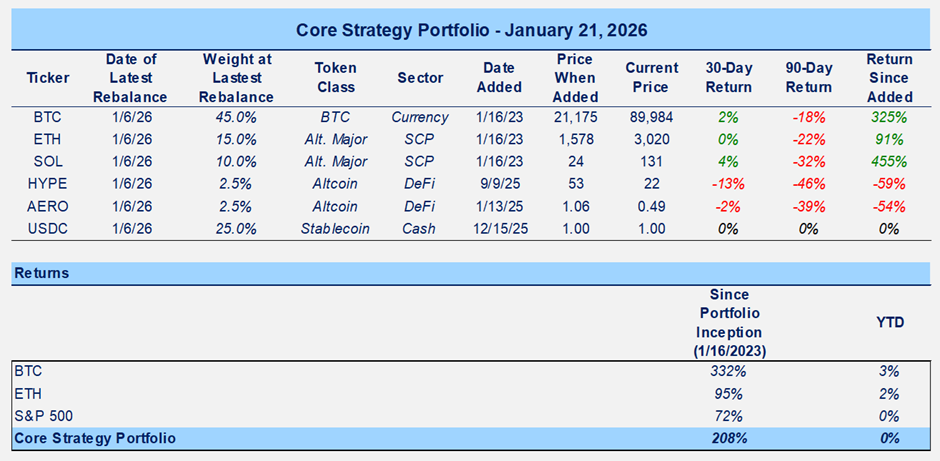

Portfolios

The Breakdown

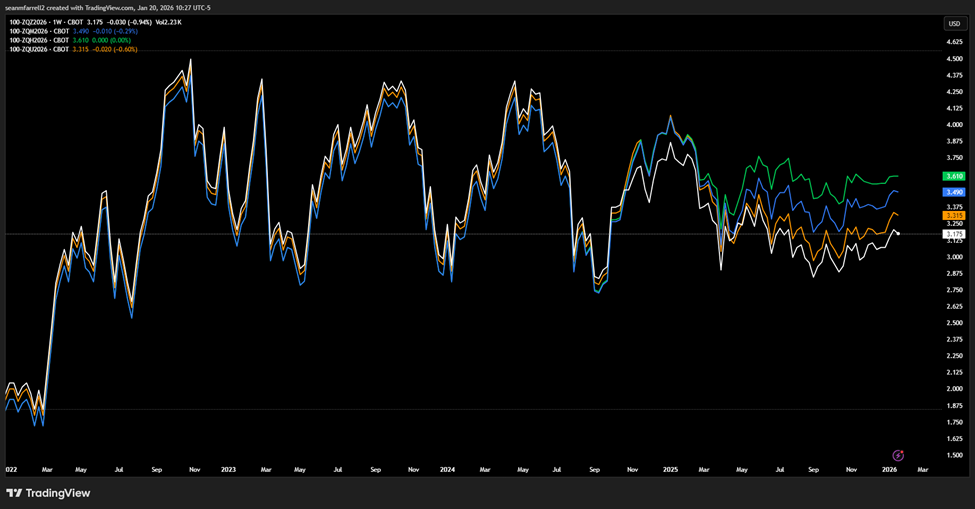

Entering January, my view on crypto was still measured from a cyclical perspective, but tactically constructive. In my January 6th strategy note, I argued that while the broader setup for 2026 still pointed to a choppier first half and a more compelling accumulation opportunity later in the year, the near-term risk reward had begun to skew favorably. The key drivers behind that view were straightforward:

- Liquidity conditions were turning supportive, driven by Fed balance sheet dynamics and a drawdown in the Treasury General Account

- The dollar’s 2H weakness suggested a currency-led liquidity impulse for BTC as well.

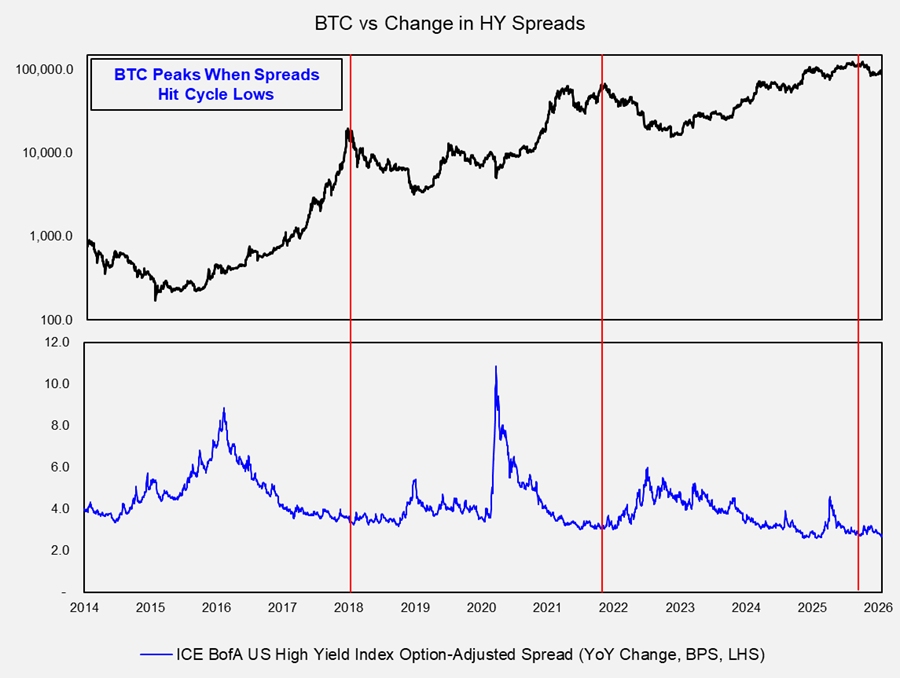

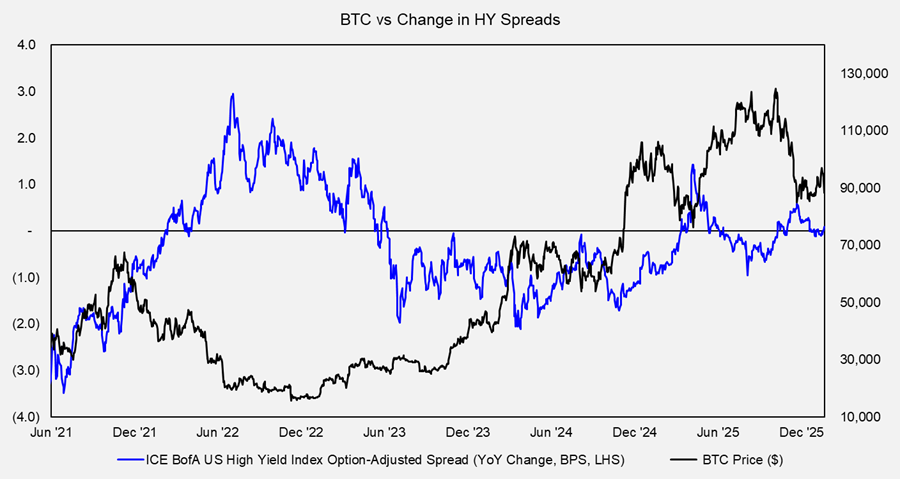

- Credit markets were behaving constructively, with spreads tightening once again, historically a favorable backdrop for crypto.

- Early signs of improving flows suggested that new money was entering the market amidst an environment that had become increasingly illiquid.

Price action initially validated that tactical framework. Bitcoin decisively cleared the ~94k resistance level that had capped price action multiple times over the prior two months, and it did so in a way that was notably healthy:

- The move was spot led rather than driven by leverage

- Funding rates were negative into the breakout, indicating complacency among bears

However, in recent days, we have witnessed a swift drawdown in crypto and a plethora of new data to chew on. Taken together, I believe the following suggests that the window of opportunity for a rally to >$100k near-term is closing, but a pair of developments (Greenland deal, JGB intervention) suggest that the window is not closed yet. Below are the key factors I am considering in my analysis. I dive deeper into each one throughout the rest of this note.

- No Follow-Through: The market exhibited a clear lack of follow-through following ~$3.4B in price-insensitive spot buying from MSTR, despite breaking through key resistance.

- No Clarity (Yet): Despite a market structure bill remaining on the table for 2026, there is clear friction between the Senate’s current draft and the industry. Further, there are still a number of steps remaining before the bill gets to the President’s desk. Both of these factors make it challenging to view this as an immediate-term catalyst.

- Rate Expectations Rising: U.S. growth remains strong, and uncertainty around Fed leadership and post-Powell FOMC composition is rising. Both of these factors are pushing rate expectations higher, tightening financial conditions at the margin.

- Gold Booming: Gold’s continued outperformance reflects structural tailwinds such as sovereign demand and geopolitical hedging that do not currently apply to Bitcoin, leaving the gold-Bitcoin ratio biased higher despite recent optimism around a rotation. (Yes, I do maintain that this is long-term bullish for BTC).

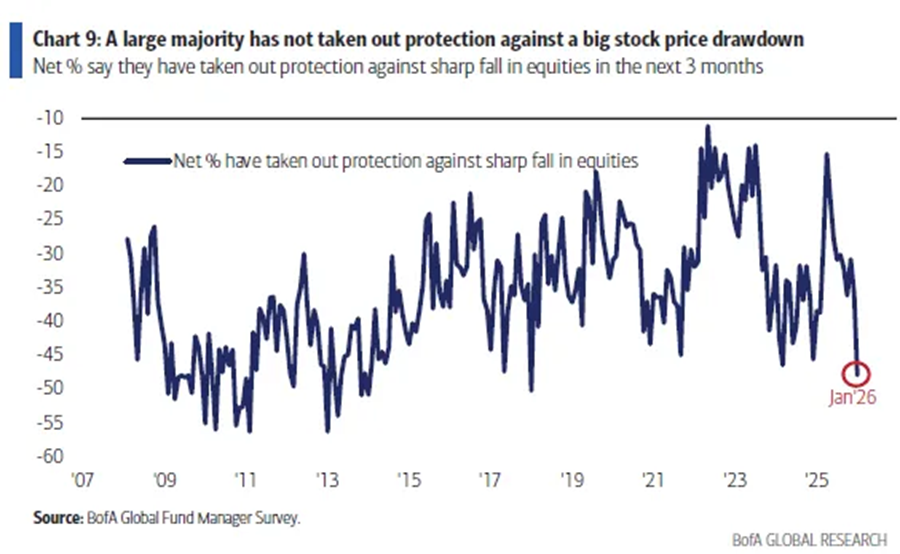

- Positioning a Key Concern: Risk indicators (HY spreads, MOVE) and investor positioning (BofA Survey Data) suggest complacency remains elevated.

- JGB Intervention: The sell-off in JGBs was a primary driver of the risk-off price action in crypto this week. Japan does not appear willing to abandon its fiscally accommodative posture, and thus, bouts of JGB-driven volatility are likely to reoccur. That said, intervention from major domestic banks may temporarily stem the tide.

- Good News on Greenland: Escalating tariff threats tied to the Greenland dispute likely compounded JGB-driven volatility, with simultaneous weakness in Treasuries, the dollar, and broader risk. However, the agreement reached on Wednesday between President Trump and NATO should remove this particular source of downside risk.

- Bottom Line: The lack of follow-through despite strong spot buying, rising macro uncertainty, and still-bullish positioning suggests the near-term tactical opportunity is waning. However, given the temporary relief provided by Japanese bank intervention in the JGB market and the positive resolution around Greenland, it is reasonable to allow for the possibility of near-term stabilization and assess whether Wednesday’s intraday rebound can sustain follow-through.

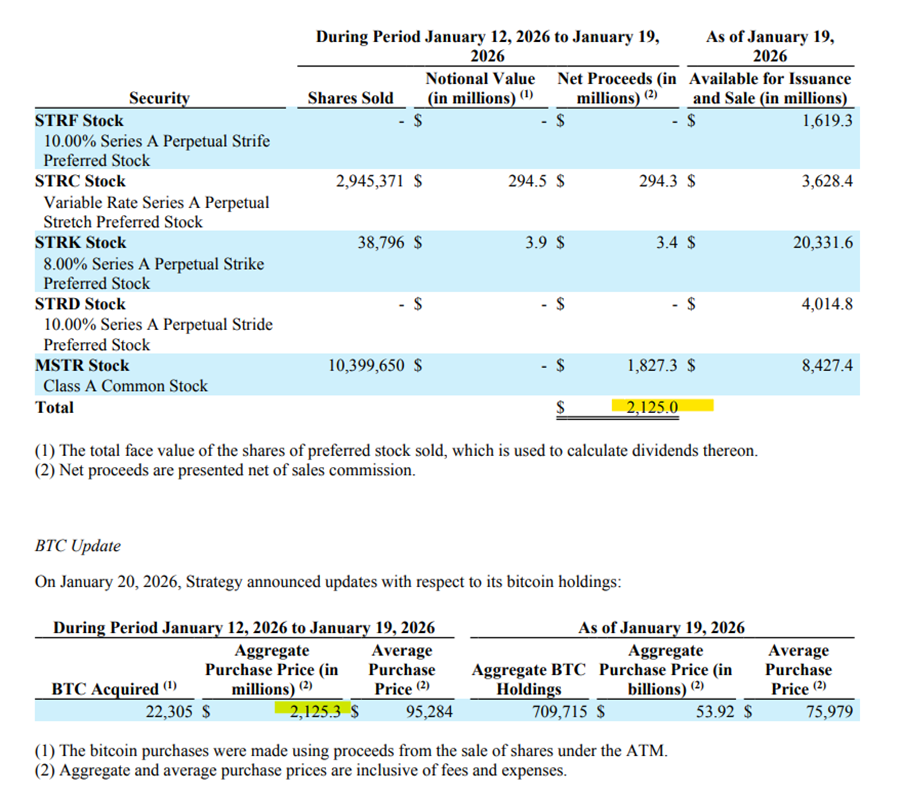

The Market Fades $3.4B of Buy Pressure

Over the past two weeks, Strategy meaningfully stepped up its Bitcoin purchases, acquiring 35,932 BTC for roughly $3.4 billion. This marks one of the firm’s most aggressive accumulation phases in over a year and comes during a period of relatively illiquid market conditions.

Despite the presence of a large, price-insensitive buyer absorbing significant supply, BTC was unable to sustain momentum above ~$95k. That dynamic is notable. The lack of follow-through suggests that incremental supply remains readily available, and/or that marginal demand elsewhere in the market is weakening.

In the near term, this is not a particularly encouraging signal for market structure and supports the view that additional clearing may be required before a more durable low can form.

Key Takeaway: The market exhibiting a lack of follow-through following ~$3.4B in price-insensitive spot buying despite breaking through key resistance is not a great sign for bulls.

Clarity Delayed

While assets can often develop retrospective narratives explaining why they rallied after the fact, it is typically more constructive when a clear catalyst emerges as price action improves. We saw a glimpse of that dynamic last week, as crypto began to show signs of life amid growing optimism around the market structure bill, following the release of a draft by the Senate Banking Committee last Monday.

However, by Wednesday, controversy had emerged around the industry’s assessment of the draft, cooling enthusiasm. To recap where things stand:

- The House passed its version of crypto market structure legislation in 2025, building on earlier FIT21 efforts.

- In the Senate, a draft was introduced around January 13, 2026, aimed at clarifying regulatory jurisdiction (SEC vs. CFTC), defining when tokens are securities versus commodities, and addressing stablecoins, DeFi, and related issues, including proposed restrictions on certain interest or yield payments.

- A planned markup in the Senate Banking Committee was postponed last week following significant industry pushback, most notably from Coinbase, after CEO Brian Armstrong withdrew support, calling the latest draft potentially “worse than no bill.” Key concerns included stablecoin yield restrictions and provisions perceived as favoring banks or limiting crypto innovation.

- The Senate Agriculture Committee, which oversees commodities-related aspects, also pushed its markup to late January.

- Bipartisan discussions remain ongoing, with some Democratic senators engaging industry stakeholders and emphasizing that the bill is “not dead.” That said, meaningful hurdles remain, particularly around stablecoin rules, DeFi treatment, and vote count arithmetic.

- While some observers, including SEC Chair Paul Atkins, have expressed optimism that a comprehensive bill could advance toward the President’s desk in 2026, timelines remain highly uncertain and could slip into late 2026 or beyond if negotiations drag on.

In summary, while the bill could ultimately make it to the President’s desk in 2026 (if I had to place a probability on the likelihood of Clarity passing this year, I would say 60%), we appear no closer to that outcome than we were last week. If anything, industry pushback and competing priorities within the administration, particularly during a midterm election year where affordability and trade dominate the agenda, suggest incremental progress has become more challenging.

Even if Senate markups proceed successfully, the bill would still need to clear a Senate floor vote, move to the House for further consideration, and only then advance to the President, assuming no material revisions are required. Taken together, this likely pushes any final resolution well into Q2 at the earliest.

Key Takeaway: Despite a market structure bill remaining on the table for 2026, there is clear friction between the Senate’s current draft and the industry. Further, there are still a number of steps remaining before the bill gets to the President’s desk. Both of these factors make it challenging to view this as a near-term catalyst.

Strong Growth and Fed Leadership Uncertainty Are Pushing Rate Expectations Higher

While I continue to believe that economic prosperity remains unevenly distributed (a “K-shaped” economy), there is little doubt that, in aggregate, the economy continues to hum. Initial estimates from the BLS suggest Q3 real GDP growth of 4.3%, while the Atlanta Fed’s GDPNow model is estimating Q4 real GDP growth of more than 5%.

Although the accuracy of the GDPNow model is often debated, November retail sales of 0.6% versus 0.4% expected appear to confirm the direction of travel implied by the model. Taken together, the data continue to point to a notably strong growth backdrop.

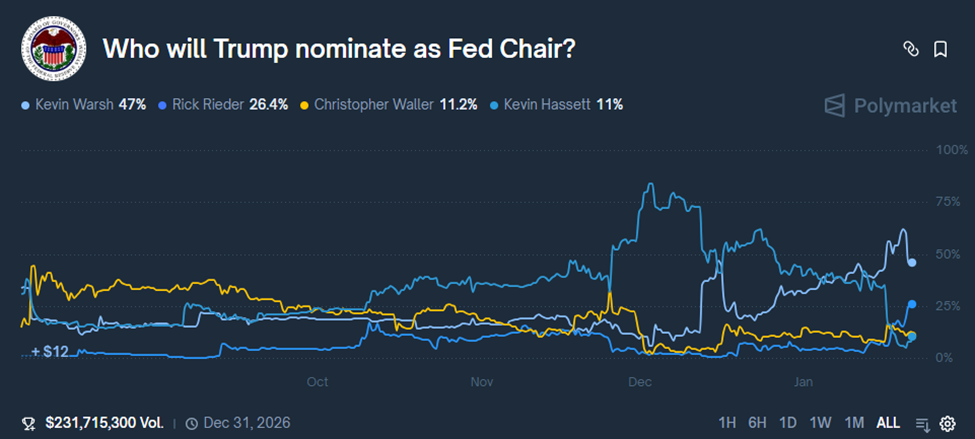

At the same time, uncertainty is rising around both who the next Fed Chair will be and what the ultimate composition of the FOMC will look like.

- Kevin Hassett, previously viewed as the market favorite, now carries only an 11% implied probability of being nominated. Hassett was widely seen as the most dovish and the most closely aligned with the White House.

- By contrast, Kevin Warsh now holds a commanding lead at roughly 47% probability. While it is hard to envision a scenario in which President Trump nominates a Chair unwilling to cut rates, Warsh’s reputation as a hawk introduces uncertainty around the degree of future dovishness.

Questions around the broader FOMC composition are also contributing to uncertainty. Investors are likely debating the futures of Lisa Cook and Jerome Powell.

- The Supreme Court is set to hear a case related to Cook (a hawk in this context) that could determine whether allegations of mortgage fraud provide grounds for her removal.

- Meanwhile, there is a growing debate over whether Powell will remain on the FOMC after his term as Chair expires. Some interpret his increasingly defiant posture as an implicit signal that he may be willing to stay on the Board as leverage to influence the nomination of a less White House-aligned successor (I should note that this is more speculative in nature).

While inflation expectations remain broadly anchored, the combination of a hot economy, uncertainty around the next Fed Chair’s policy bias, and questions surrounding the future composition of the FOMC are pushing forward rate expectations higher. Markets are currently pricing in roughly two rate cuts this year, with December fed funds futures implying a 3.00%–3.25% policy rate and no cuts expected before the June meeting. In my view, this shift in rate expectations is likely contributing to ongoing pressure in crypto markets.

Key Takeaway: U.S. growth remains strong, and rising uncertainty around Fed leadership and FOMC composition is pushing rate expectations higher, tightening financial conditions at the margin and weighing on crypto.

Is the Japan Anchor Shifting?

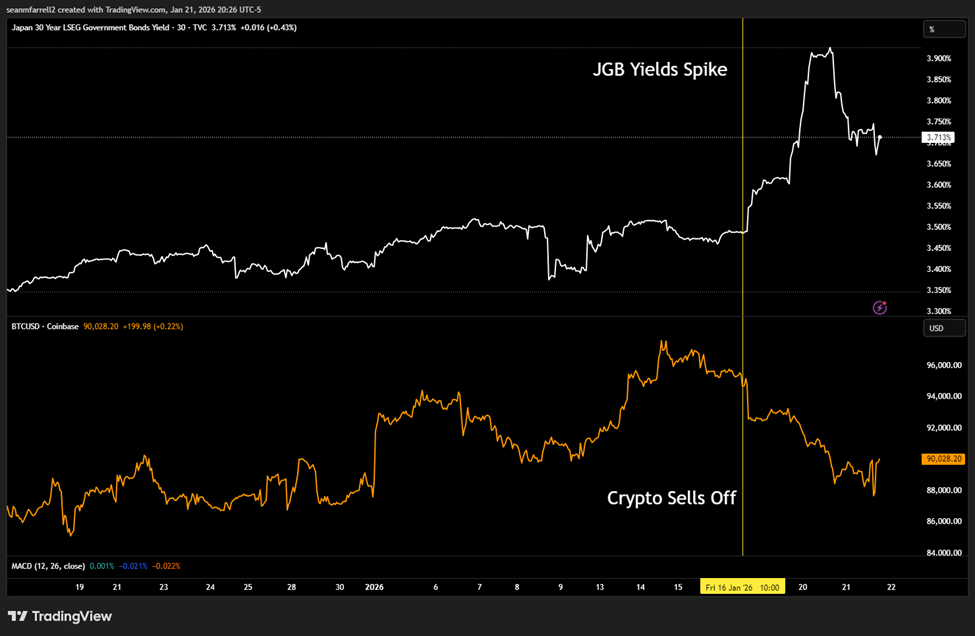

One macro dynamic that has become increasingly relevant to crypto is the rise in Japanese government bond yields, with the 10-year now around 2.3%. Japanese yields have been on the upswing for a while now, but accelerated on Monday due to rising fiscal concerns. For decades, Japan acted as a quiet anchor for global interest rates, supplying cheap funding and absorbing foreign duration risk. As that anchor shifts, the implications are less about Japan in isolation and more about how global liquidity and funding conditions are adjusting at the margin.

Higher JGB yields increase the cost of yen-funded leverage, encouraging the unwind of carry trades and periodic repatriation flows. In practice, this tends to pressure high-beta, highly liquid assets first, including crypto, and can lead to persistent “sell-the-rip” behavior even in otherwise constructive environments. I believe that this was a significant factor contributing to the selloff on Monday and Tuesday this week.

It is also worth revisiting the dominant narrative around the recent pullback in risk assets. While much of the weakness was initially attributed to controversy surrounding Greenland, crypto’s muted response to the subsequent compromise reached between President Trump and NATO officials on Monday suggests that geopolitics may not have been the primary driver (IBIT was up 0.69% vs SPY up 0.72%).

In my view, this reaction, or lack thereof, points to a different marginal catalyst. The sharp rise in JGB yields that occurred Sunday night (ET) better aligns with the timing and cross-asset behavior we observed, particularly given crypto’s sensitivity to global funding conditions. At the margin, this suggests the sell-off was driven less by headlines and more by a tightening in global liquidity originating abroad.

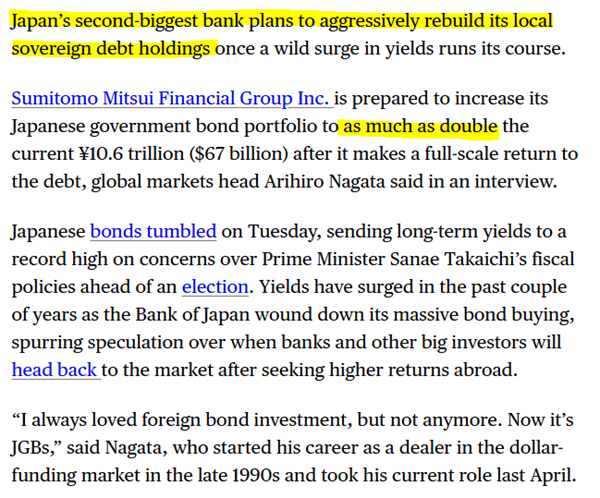

The “Good” News: The tactically positive variable to consider is that on Tuesday, Japanese banking giant Sumitomo Mitsui announced that it plans to increase its Japanese government bond portfolio to as much as double the current ¥10.6 trillion after yields run their course. In my view, this is essentially a sovereign YCC implemented through an ostensibly private company.

Key Takeaway: Japan does not appear willing to abandon its fiscally accommodative posture, and thus JGB-driven volatility is likely to persist. That said, intervention from major domestic banks may temporarily stem the tide.

Good News on Greenland

A large, remote island in the North Atlantic has unexpectedly moved to the center of recent geopolitical debate. President Donald Trump has publicly expressed interest in purchasing Greenland from Denmark. Without weighing the merits of either position, Greenland is clearly a strategically important asset, largely due to its geographic proximity to Russia & China.

Tensions escalated on January 17th, when President Trump announced 10% tariffs on eight European countries, set to take effect on February 1st. The policy reportedly included a provision that would raise tariffs to 25% by June 1st if a purchase agreement for Greenland was not finalized. In response, European-led NATO forces reportedly moved into Greenland for military exercises.

These developments likely exacerbated the JGB-related headwinds discussed above, as Treasuries sold off alongside the dollar. This pattern is reminiscent of last year’s tariff-related volatility and typically signals capital rotating away from U.S. assets.

Fortunately for crypto, President Trump announced on Wednesday that, following discussions with NATO officials, an agreement had been reached under which the U.S. would achieve sovereignty over portions of Greenland in exchange for the aforementioned tariffs being rescinded. Crypto bounced on the news.

Key Takeaway: Escalating tariff threats tied to the Greenland dispute likely compounded JGB-driven volatility, with simultaneous weakness in Treasuries, the dollar, and broader risk. The agreement reached on Wednesday should remove this particular source of downside risk.

Gold Rotation May Need to Wait

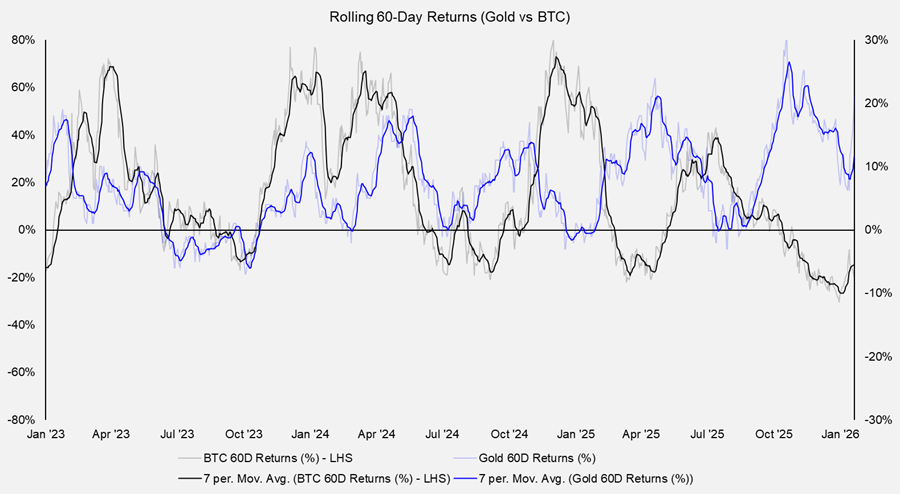

With the above dynamics in mind, it should come as no surprise that gold and other precious metals continue to perform well. Both gold and silver posted strong gains in Tuesday’s session, benefiting from sovereign demand, rising multipolarity, and the same macro headwinds that pressured risk assets.

As many of you know, I often look for signs of rotation from gold into Bitcoin as a way to assess the prevailing market regime. While I was somewhat optimistic last week that such a rotation might be beginning, gold’s renewed push higher, continued strength, and superior risk-adjusted returns make it difficult to argue that investors are ready to shift from analog to digital gold. Put simply, gold’s structural tailwinds, stronger momentum, and ongoing outperformance suggest the gold/Bitcoin ratio still has room to run.

Key Takeaway: Gold’s continued outperformance reflects structural tailwinds such as sovereign demand and geopolitical hedging that do not currently apply to Bitcoin, leaving the gold-Bitcoin ratio biased higher despite recent optimism around a rotation.

Positioning Remains a Concern of Mine

These factors should be viewed alongside a market that remains positioned quite bullishly, in order to assess the true level of risk aversion. I continue to monitor indicators such as the VIX, credit spreads, and the MOVE Index, which tracks bond market volatility.

While the VIX rose meaningfully on Tuesday, it remains below levels typically associated with peak fear. Credit spreads, as discussed last week, remain historically tight with little room to compress further. The MOVE Index, meanwhile, is still near cyclical lows, despite rising from roughly 57 to around 66 on Tuesday.

The latest Bank of America Fund Manager Survey reinforces this view of complacent positioning. The survey shows that a large majority of investors have not added protection against a sharp equity drawdown. In fact, the net percentage of investors hedged against a significant decline in equities is at its lowest level since 2018, suggesting a notably sanguine market backdrop.

As outlined in my outlook, I would feel more constructive on crypto’s prospects if this elevated level of bullish positioning were to clear.

Key Takeaway: Risk indicators and investor positioning suggest complacency remains elevated.

Final Thoughts

As detailed above, a number of factors are working to close the tactical window for crypto that I was optimistic about at the start of the year. However, stabilization in JGBs and a resolution around Greenland could still provide another near-term opportunity.