Risk/Reward Has Shifted, Odds Favor a Bounce (Core Strategy Rebalance)

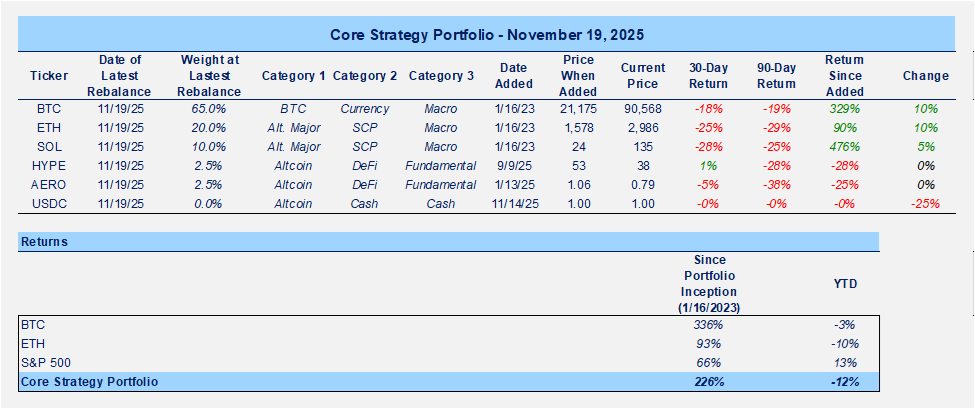

Core Strategy

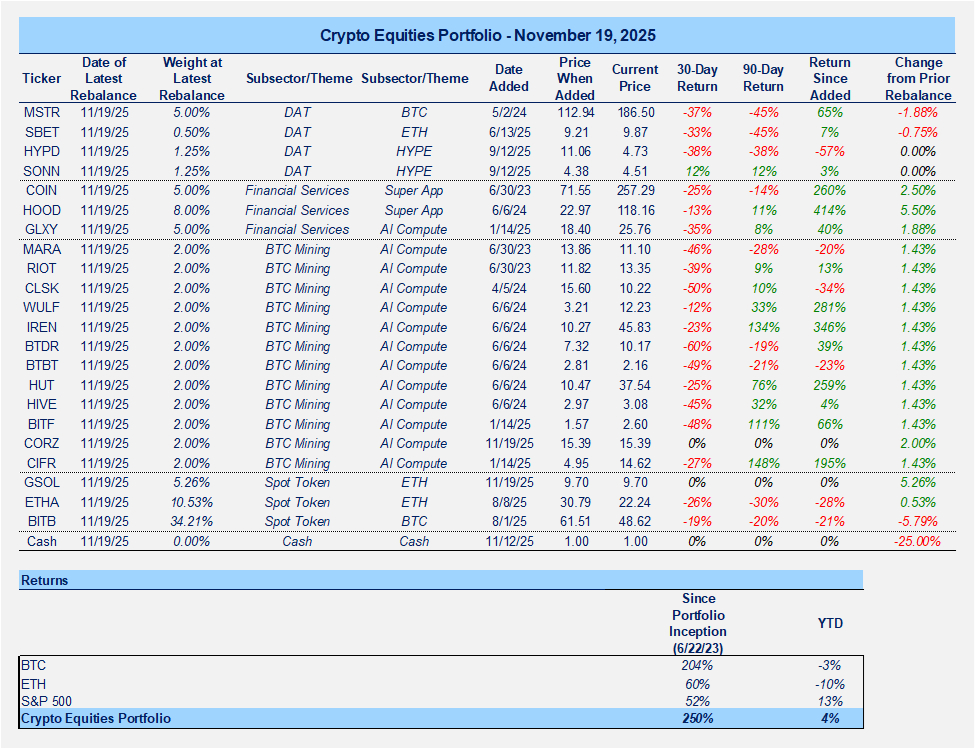

Crypto Equities Portfolio

I will discuss changes to both portfolios at the end of this note.

Why I Turned Tactically Cautious Last Week

Last week, I outlined several reasons for near-term caution in crypto and recommended raising some cash, tilting long exposure toward BTC, or seeking downside protection via options. Signals of deterioration were building, and the rationale for that stance is summarized below:

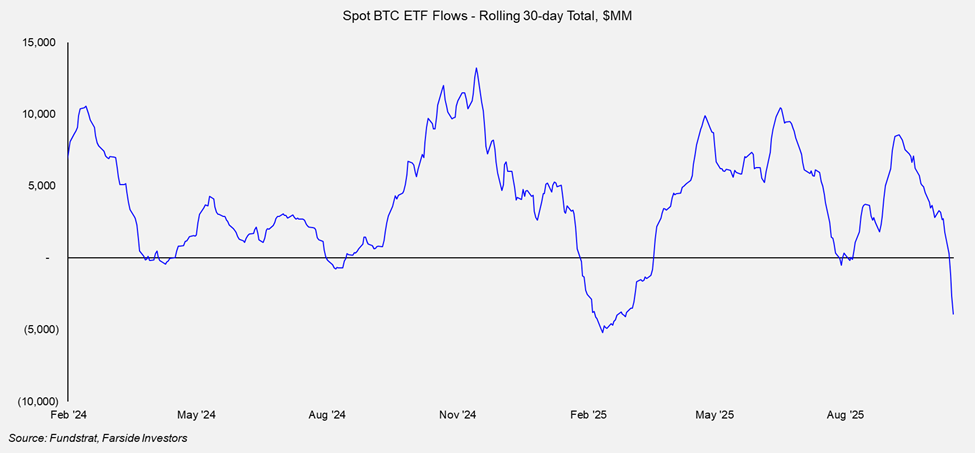

- Weak Flows: ETF flows had reversed, stablecoin issuance was contracting, and DAT premiums were compressing

- Momentum Has Turned: BTC had fallen below its 50-day and 200-day moving averages, and BTC had fallen out of favor for trend-following capital (in the bullish direction, at least)

- No Near-Term Catalysts: Potential drivers such as MSTR’s S&P inclusion, the Clarity Act, and the tariff ruling remained weeks or months away

- Lack of Capitulation: Funding stayed positive, and ETF redemptions were modest. Long positioning had not been flushed out the way it was during prior durable lows

- Delayed Liquidity Boost: The shutdown slowed the expected improvement in liquidity, with supportive effects likely not felt until later this month or December

- Weak Price Action vs Equities: BTC was selling off during U.S. hours even as equities rose, pointing to structural (possibly forced) sellers. With equities near perceived upside targets, investors were less willing to rotate into a non-trending asset

Damage Done, but Risk/Reward Has Shifted

Since last week, a fair amount of damage has been done. BTC briefly touched $88k, ETH dipped below $2.9k, and SOL fell just under $130. And while we may not be entirely out of the woods on longer timeframes, the near-term risk/reward now looks more balanced. Even if this is not a durable turning point, conditions at least favor the potential for a violent bounce.

I had highlighted a few plausible paths toward resolving higher:

- An idiosyncratic catalyst hits the tape and reignites demand

- A broader risk-off event resets valuations and draws buyers back in. I had thought that a revisit to the low $90k range for BTC might be enough to do the trick here. I revised those thoughts in my Monday video as signs pointed lower.

- A slow-motion melt-up unfolds as investors collectively raise their equity targets. I suspected that if the hivemind started to believe the S&P could reach 8,000 by 1H, then crypto could catch a sympathy bid, although this would likely develop more slowly and still require caution around downside volatility

We Took Path Two

In Monday’s video, with BTC trading near $92k, I noted that we had entered my initial area of interest (a potential “value zone”). I preferred to stay patient, given the absence of real capitulation. Equities were also beginning to slip, closing below their 50-day moving average for the first time since February, before the tariff-driven volatility of Q1 and Q2.

With positive NVDA earnings behind us, and after a revisit to the high $80k range, oversold signals are now starting to flash.

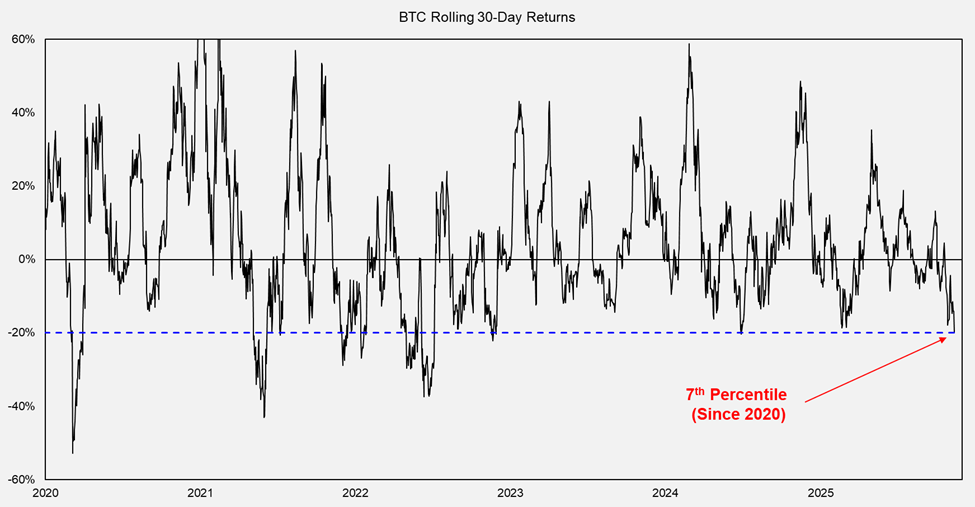

Rolling 30-day BTC performance shows a decline of about 20%. This ranks among the sharper sell-offs of the past five years. We are currently in the 7th percentile of 30-day returns since 2020.

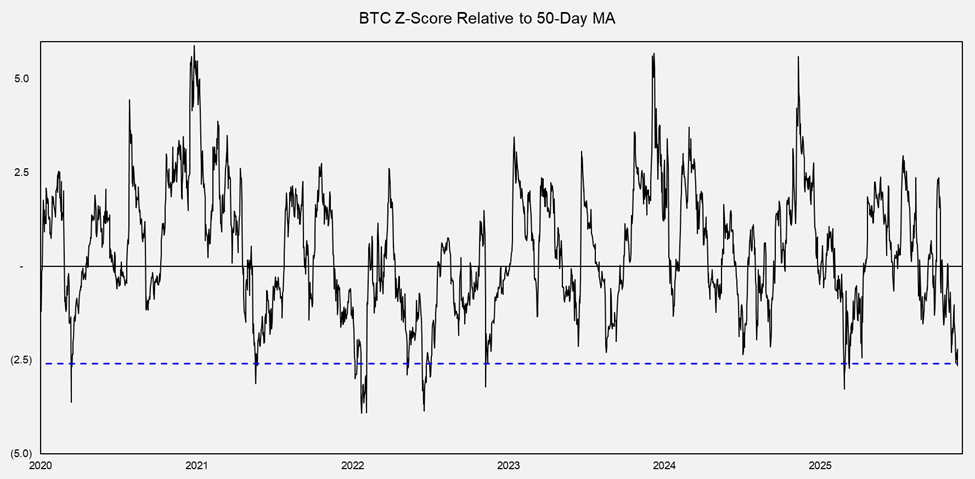

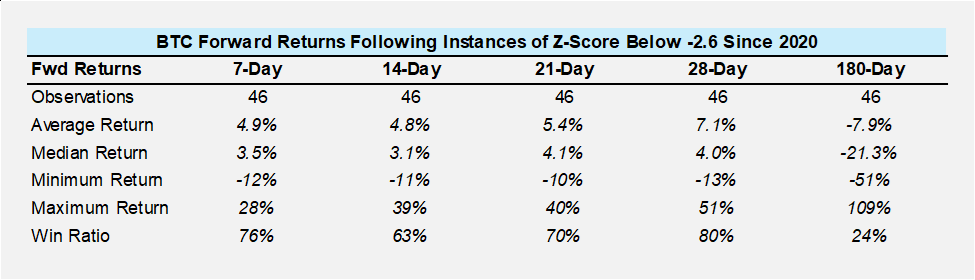

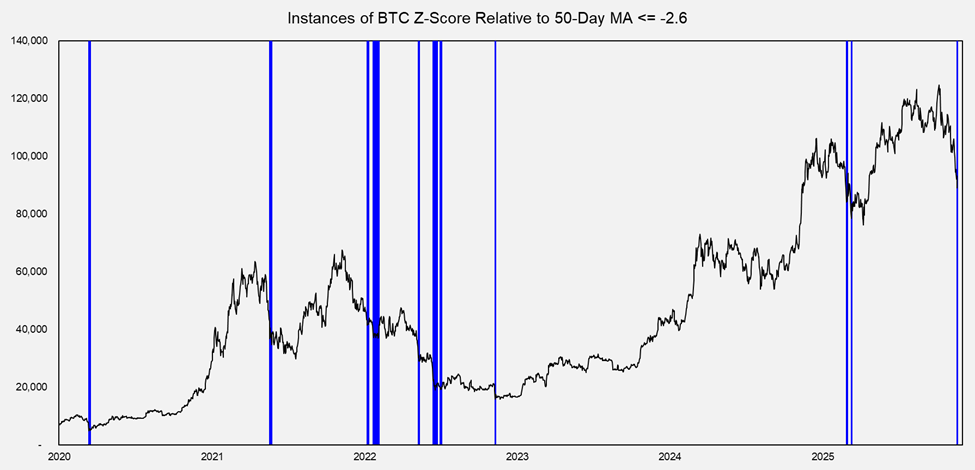

The chart below shows BTC’s Z-Score relative to its 50-day moving average, which recently reached roughly -2.6. That reading has been rare since 2020 and usually precedes a bounce.

Forward returns from similar instances are compelling and point to a likely rebound in the days ahead. It is worth noting that returns over longer timeframes are less convincing, largely because many of these observations occurred during bear markets. This is why it is important to remain flexible in the weeks ahead to assess whether we are seeing a durable regime change or simply a short-term oversold rally.

The one factor I continue to wrestle with is the lack of clean capitulation in the perps market. I define this as a large-scale liquidation paired with negative funding for a sustained period. We did see a brief dip into negative funding on Wednesday. Further, we have observed some capitulation among ETF investors, with IBIT posting its worst day of redemptions since inception on Tuesday, and the total outflows across all BTC ETFs for the preceding 30 days totaling nearly $4 billion.

Additional Signs Pointing Toward a Turn

In addition to us finding a potential “value zone,” we have also:

- Seemingly cleared the market of the forced/motivated sellers that were in the market last week, as BTC has shown beta to equities this week.

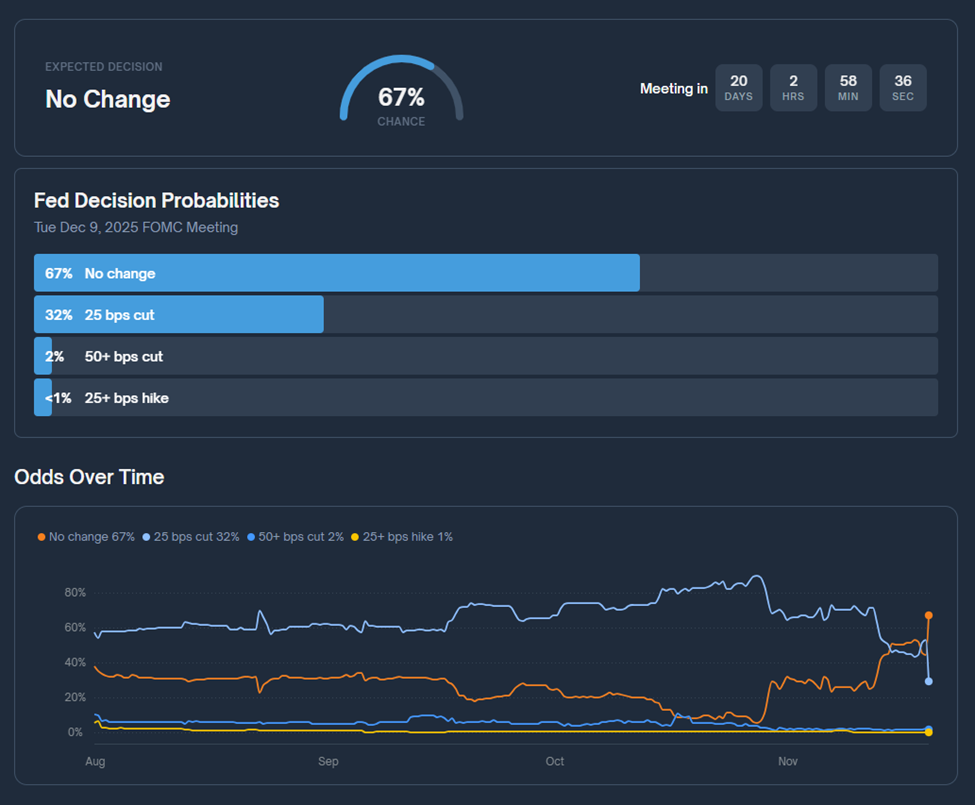

- Reset market expectations around the Fed’s posture on rate cuts, opening the door for softer labor data (which now is likely to come from private sources, as October BLS data is unlikely to be revealed prior to the December meeting) to move us back toward pricing in more cuts. The reaction from crypto prices on Tuesday after delayed claims data was released suggests that crypto will be responsive to changes in Fed posture going forward. We can consider this a quasi-catalyst in the market.

Changes to Portfolios

I view this as a good opportunity to buy the dip. As noted above, it is important to remain flexible in the weeks ahead, but the data suggests that this is a great place to take a shot. I am making the following changes to our token and equity strategies:

Core Strategy

- Reallocating the cash raised last week into BTC, ETH, and SOL within the token strategy.

Crypto Equities Portfolio

- Re-engaging with the AI and HPC miners. With conditions improving and fears around an AI bubble cooling somewhat, this looks like a good place to take another swing at the names that have been hit hard recently.

- Re-adding CORZ. Core Scientific was one of the top performers in our crypto equities basket in 2024. We removed it after its share price became anchored to the suboptimal acquisition price from Coreweave. That acquisition has since been struck down by shareholders, which gives the stock room to participate in any rally in the broader AI and HPC mining cohort. Given the major pullback across the entire AI complex over the past week, combined with strong Nvidia earnings, this is an attractive time to reintroduce the name.

- Adding GSOL (the Solana ETF) to add Solana exposure within the crypto equities basket. The allocations to BTC, ETH, and SOL inside the basket will broadly mirror the token strategy.

- Increasing weight in the financial services cohort (COIN, HOOD, GLXY), with the largest weight going to HOOD.