Reasons For Tactical Caution Despite a Constructive Macro Backdrop (Core Strategy Rebalance)

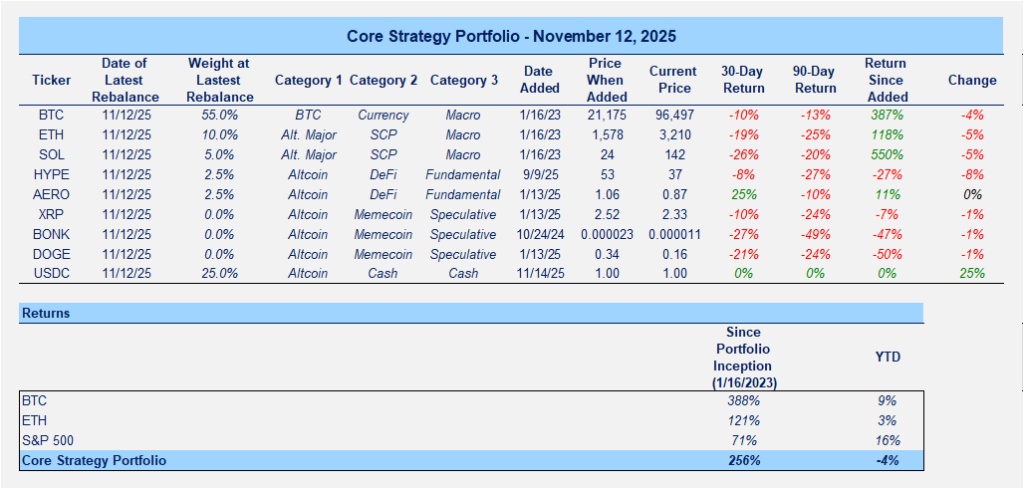

Core Strategy

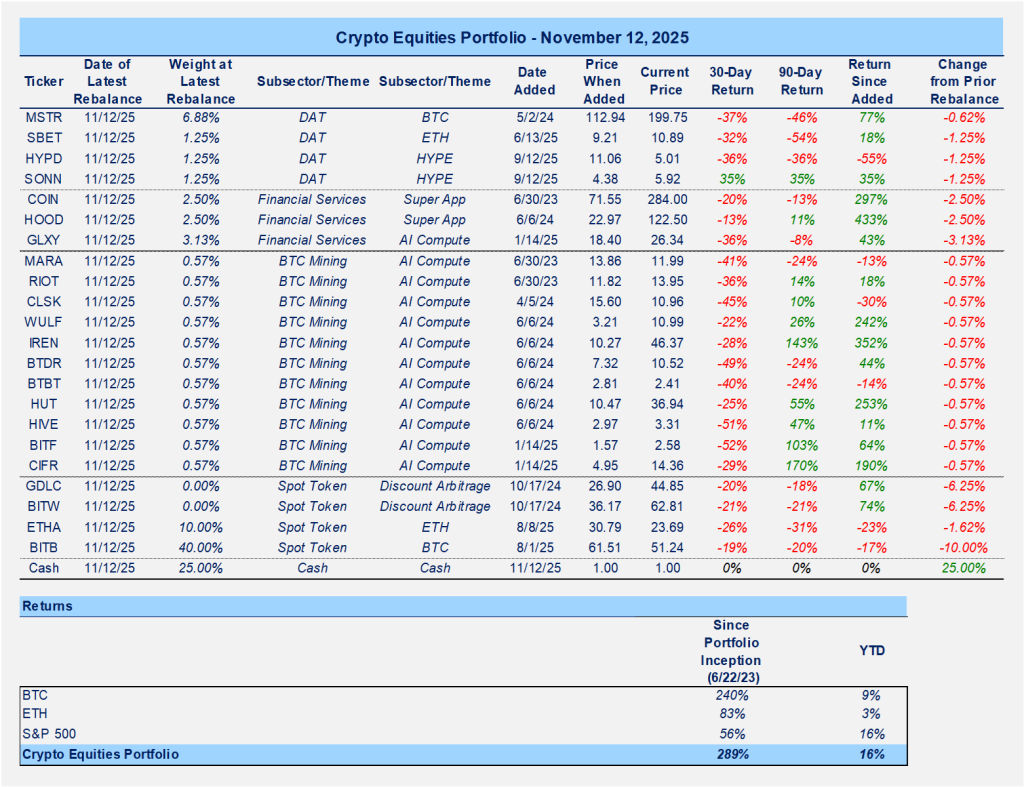

Crypto Equities Portfolio

I discuss the changes to both portfolios at the end of this note.

A Recap

Before explaining my tactical shift, it is worth revisiting why I entered Q4 with a constructive stance on crypto and why I have maintained that view in recent weeks:

- Policy Framework: As I have discussed since the summer months, the administration’s current playbook aims to (1) rebalance trade, (2) reduce fiscal deficits, and (3) lower the debt-to-GDP ratio. This relies on a combination of tariffs, a weaker dollar, and monetary easing. These are all generally good for crypto prices.

- Liquidity and Growth Tailwinds: The TGA should begin to be spent back into the private sector once the government reopens, easing overall liquidity conditions. QT is also set to end, which should, at the margin, further support liquidity.

- Fed Policy: The Fed is sending mixed signals ahead of the December FOMC meeting, but the balance of probabilities still leans dovish. Futures and prediction markets imply another 25-bps cut, and non-BLS jobs data continue to weaken.

- Economic Resilience: Growth remains steady. Earnings season has been solid, GDP forecasts are holding up, and while manufacturing continues to struggle as reflected in ISM Manufacturing PMI, the services sector returned to expansion in October.

- Seasonality: This is typically a favorable period for risk assets, with volatility trending lower in the second half of Q4 and fiscal flows turning positive.

- Sentiment: Investor sentiment remains weak. The Coinglass Fear and Greed Index has dipped back into “fear” territory, and options skew continues to reflect risk aversion.

Despite these supportive factors, price action has not validated the bullish setup. This divergence warrants a reassessment to navigate the coming weeks more prudently.

Reasons for Playing Defense

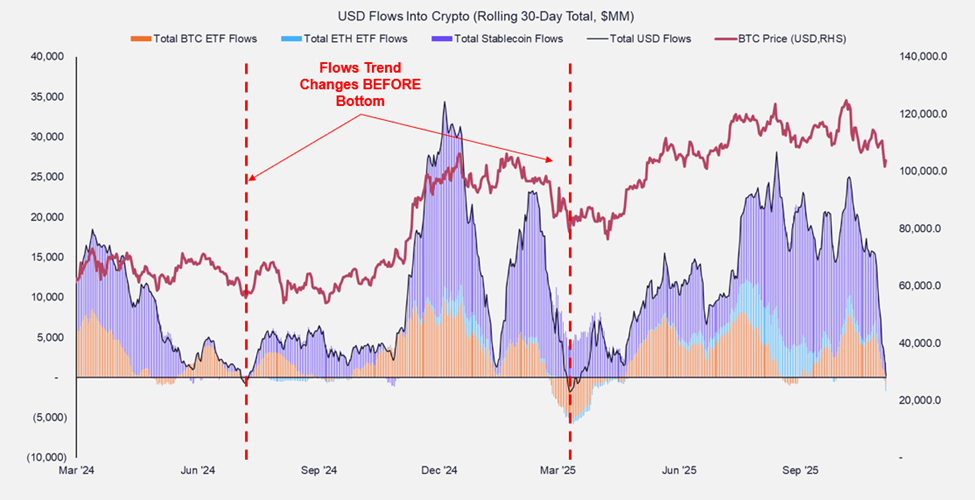

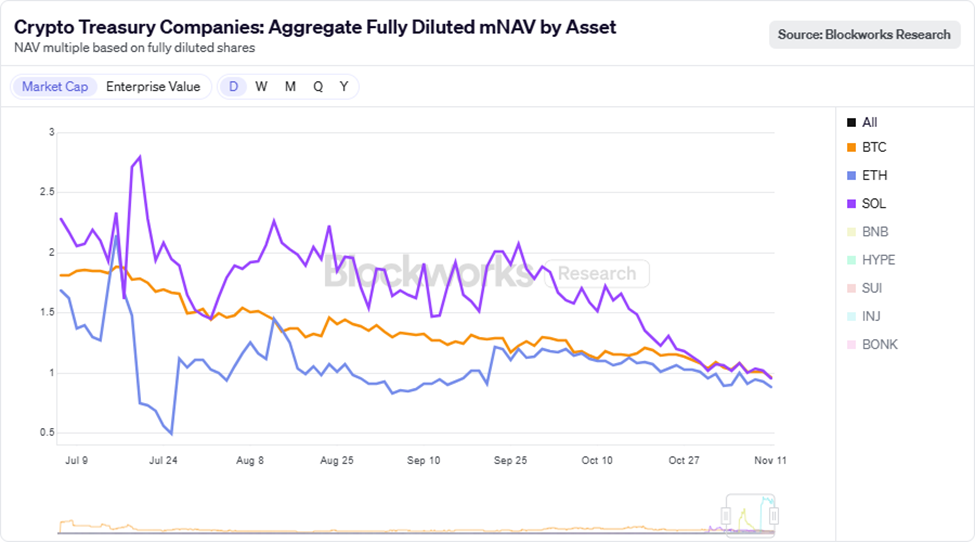

ETF, Stablecoin, and Treasury Flow Weakness: ETF inflows have slowed/reversed meaningfully, and digital asset treasuries (DATs) such as MSTR and BMNR, while still trading above NAV, have seen sharp compression in their premiums. Several smaller DATs are trading below NAV and have even begun selling treasury assets to repurchase shares. While I do not view this as a systemic risk, it does not help near-term sentiment.

The trend of USD outflows from ETFs and stablecoins is also concerning. The 30-day moving average of net flows continues to trend lower, and historically, this metric has turned higher before durable market lows are achieved.

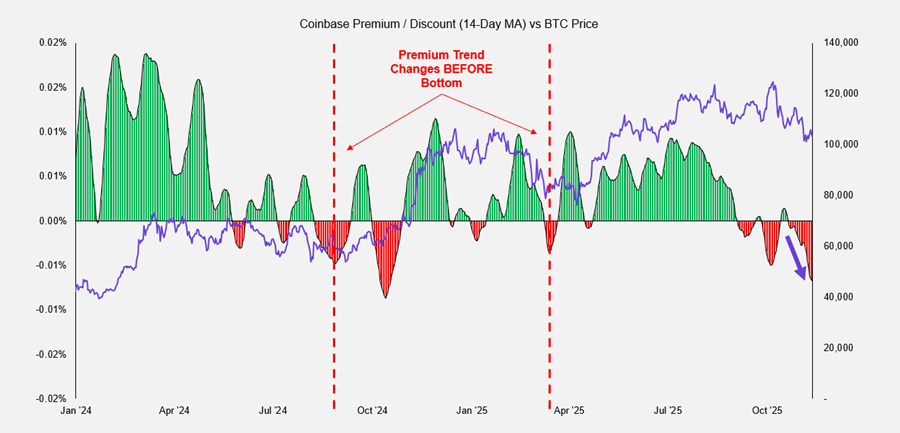

Meanwhile, the Coinbase/Binance spread, which is a good barometer for the appetite for BTC from US investors, has been in discount territory and continues to trend lower.

Momentum Breakdown: BTC is highly momentum-driven and attracts trend-following capital. When the trend turns, that capital leaves or the trend follows in the opposite direction. Mark can speak more eloquently on indicators such as MACD, but one need not be a technical analyst to see that BTC currently lacks momentum. The good news is that this can change quickly.

BTC is currently below both its 50-day and 200-day moving averages, thresholds under which it has historically experienced significant bouts of downside volatility. If momentum continues to deteriorate, this could compound downside pressure, particularly in altcoins.

Absence of a Catalyst: The market currently lacks near-term positive catalysts. The few that could matter include (1) MSTR’s potential addition to the S&P 500, (2) passage of the Clarity Act in Congress, and (3) a Supreme Court ruling that could overturn certain tariffs, creating a one-time fiscal stimulus via refunds to the private sector. However, we are still at least a month away from learning about (1) due to the government shutdown, (2) has likely been pushed into 1H of next year, and (3) may not occur until early next year. Moreover, the latter could ultimately produce an equal amount of volatility to the downside after a brief rally, as the administration still has multiple avenues to pursue sector-specific tariffs.

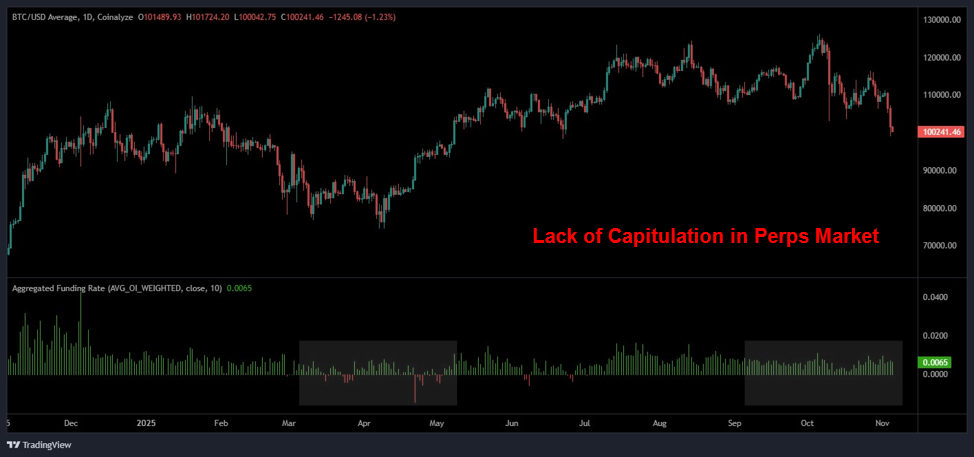

Absence of Capitulation: As I noted following the October 10th liquidations, the market still has not shown clear signs of capitulation among BTC investors. Funding rates in perpetual futures remain positive, which indicates that long positioning has not been fully washed out. While ETFs have seen net outflows, they have not approached the magnitude of redemptions seen in Q1, when that period of forced selling ultimately created the base for the next leg higher.

Liquidity Lag: While the government’s reopening should gradually improve liquidity conditions, that improvement has been delayed due to the duration of the government shutdown. The benefits of these changes in liquidity conditions may not be fully felt until later this month or into December.

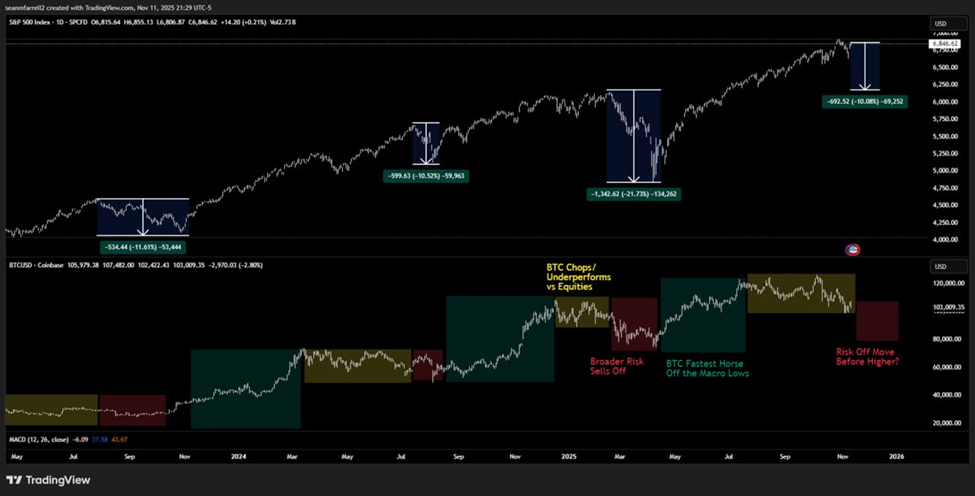

Price Action Divergence and Behavioral Dynamics: The price behavior on Tuesday was particularly concerning. After rallying off the lows on Sunday, crypto sold off sharply during U.S. trading hours on Tuesday despite the S&P 500 finishing the day higher. Wednesday showed a similar, though less severe, pattern. This decoupling from equities points to the presence of large structural sellers and a clear decline in buyer engagement across crypto.

Part of this can probably be explained by market psychology. As equities grind higher, investors begin to perceive diminishing incremental upside. For example, if the consensus year-end target for the S&P 500 is 7200 and the index reaches 6850, that only implies about 5% additional upside. As perceived reward shrinks, investors tend to de-risk from non-trending assets like BTC. I have seen this play out before: equities continue rallying while BTC churns, waiting for a broader risk-off move. Once that drawdown occurs and valuations reset, BTC often emerges as the “fastest horse” off the lows, attracting new flows as digital gold reclaims leadership.

Near-Term Outlook and Positioning

Looking forward, I see a few plausible paths toward resolving higher:

- An idiosyncratic catalyst hits the tape and reignites demand. See above for those potential catalysts.

- A broader risk-off event resets valuations and draws buyers back in. I think that a revisit to the low $90k range for BTC might be enough to do the trick here.

- A slow-motion melt-up unfolds as investors collectively raise their equity targets. I suspect if the hivemind starts to believe that the S&P could reach 8,000 by 1H, then crypto could start to catch a sympathy bid, but that would be a slower developing scenario and would still warrant being cautious of downside volatility in the near term.

Taken together, I believe there is additional downside risk in the immediate term, particularly among altcoins. I am not yet concerned about BTC, as my base bear case assumes any decline is limited to the low to mid 90ks. However, if BTC were to fall 10-15%, that would likely translate into roughly 20-30% drawdowns for altcoins. There is also a scenario in which we simply chop between 98k and 106k, which would also be suboptimal for altcoins.

Thus, for tactically minded investors, I think it is prudent to tilt exposure more heavily toward BTC, raise some cash, and wait for price confirmation before reengaging risk. Importantly, I continue to believe that we have another leg higher this cycle, but it may require a bit more patience. I should also note that this may be a period where allocations shift in quick succession, since the market can move fast. For those who prefer to avoid frequent turnover, seeking some downside protection via options may be the better approach. And if you are a long-term investor who is tolerant of volatility, feel free to ignore this guidance altogether.

Changes to Core Strategy

Changes:

- Increase BTC weighting as the risks are more balanced in the near term.

- Decrease weightings to altcoins, including majors, as the risks are less balanced in the near term.

- Raise cash represented by USDC in the strategy to buy a potential dip or add on a breakout.

- As it pertains to HYPE, much of the constructive thesis into Q4 relied on a constructive backdrop for the broader space, such that there would be ample demand to absorb unlock overhangs. I still view this as one of the better and more fundamentally sound projects in the space, but there may be some concerns around flow dynamics if the market does not turn in a favorable direction. Thus, I am decreasing its allocation to 2.5%.

- I am removing the memecoin constituents from the portfolio, as it is likely we are a ways off from these participating in a broader rally. We will keep them in our back pocket for when conditions improve.

Changes to Crypto Equities Portfolio

In mirroring the changes to the token portfolio, I am making the following adjustments:

- Increase BTC weighting as the risks are more balanced in the near term.

- Clean up the token allocations by removing BITW and GDLC. Part of the reason for their inclusion was their historical deviation from NAV, which has long closed, leaving them as little more than spot token exposure.

- Raise cash to buy a potential dip or add to longer tail assets on a breakout.

- Reduce exposure to HYPE DATs in line with the views above.

- The rest of the portfolio is adjusted pro rata based on these changes.