Crypto Showing Signs of Seller Exhaustion as MSTR Returns to Market and Shutdown Resolution Likely Nears

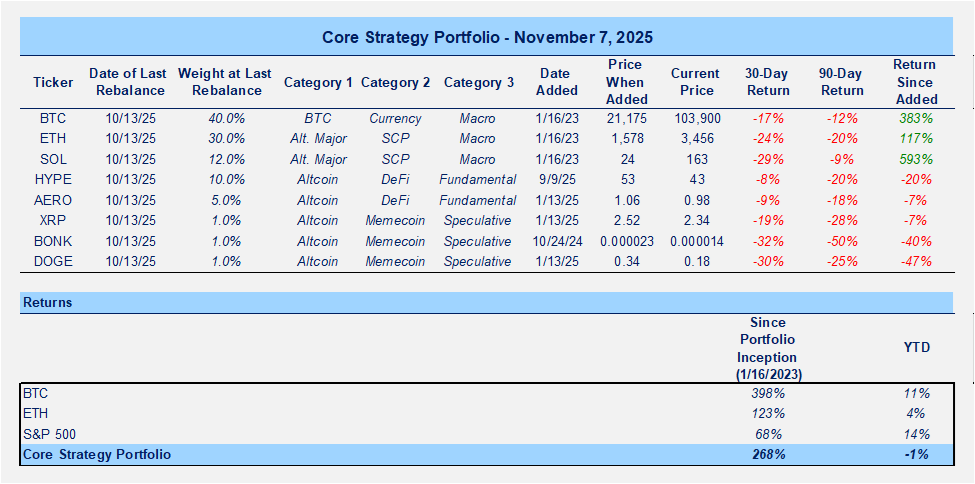

Core Strategy

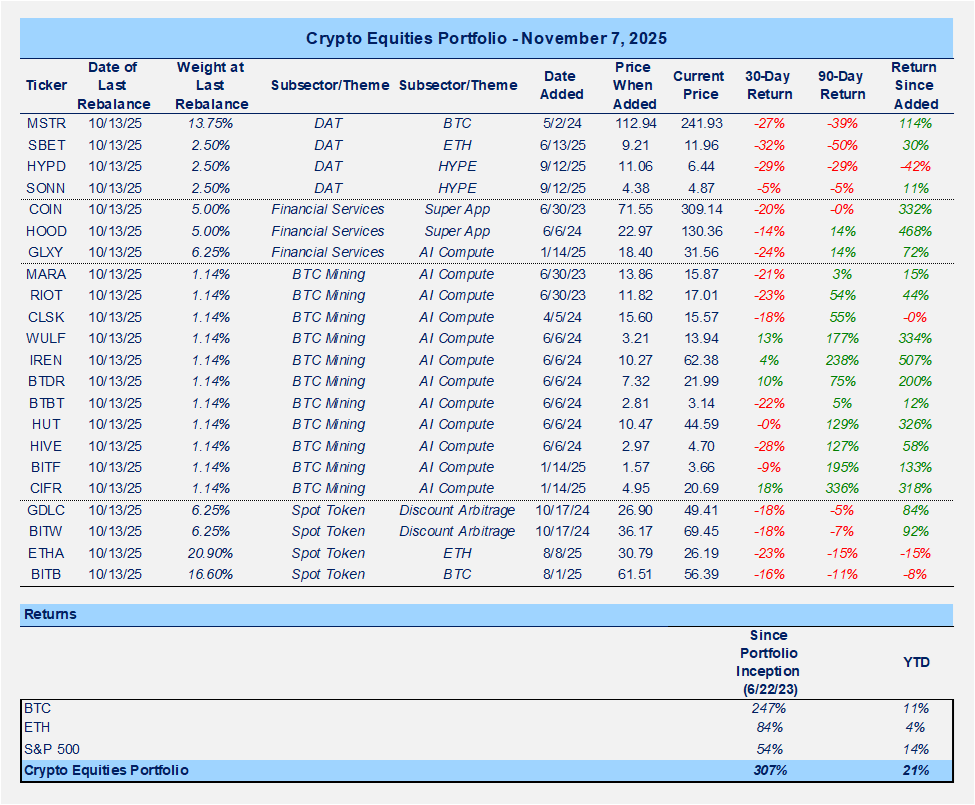

Crypto Equities Portfolio

Liquidity & Growth Pressures Persist

The Treasury’s need to refill its reserves has led to roughly $700B in issuance over the past several months, with no corresponding fiscal outflows back into the economy. This has tightened bank reserves and liquidity conditions and likely reduced passive flows into equities, since a portion of those Treasury payments would have otherwise found their way into brokerage accounts and 401(k)s. The result has been weaker participation across risk markets outside of the AI complex. For instance, RSP, a better proxy for broad equity participation, has gone nowhere since July.

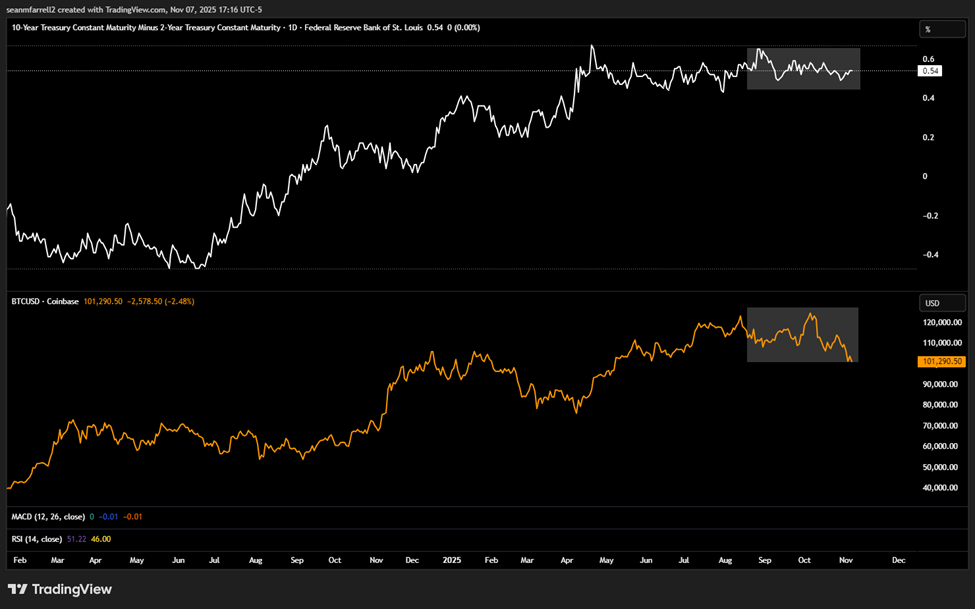

At the same time, the market appears increasingly skeptical of economic growth prospects into year-end. The 2s10s spread has been flat to lower since August, roughly when BTC momentum began to fade. Meanwhile, labor data is adding to investor anxiety. Thursday’s Challenger job cuts report showed the largest increase in layoffs since Q1, when tariff-related uncertainty weighed on risk assets.

Both growth and liquidity are also being constrained by the ongoing government shutdown, which is preventing the federal government from recycling funds back into the private sector. This is amplifying liquidity and passive flow concerns while adding further drag on jobs and growth.

Thus, the end of the shutdown should be viewed as a potential turning point for risk assets, and by extension, crypto in the near term.

The Shutdown

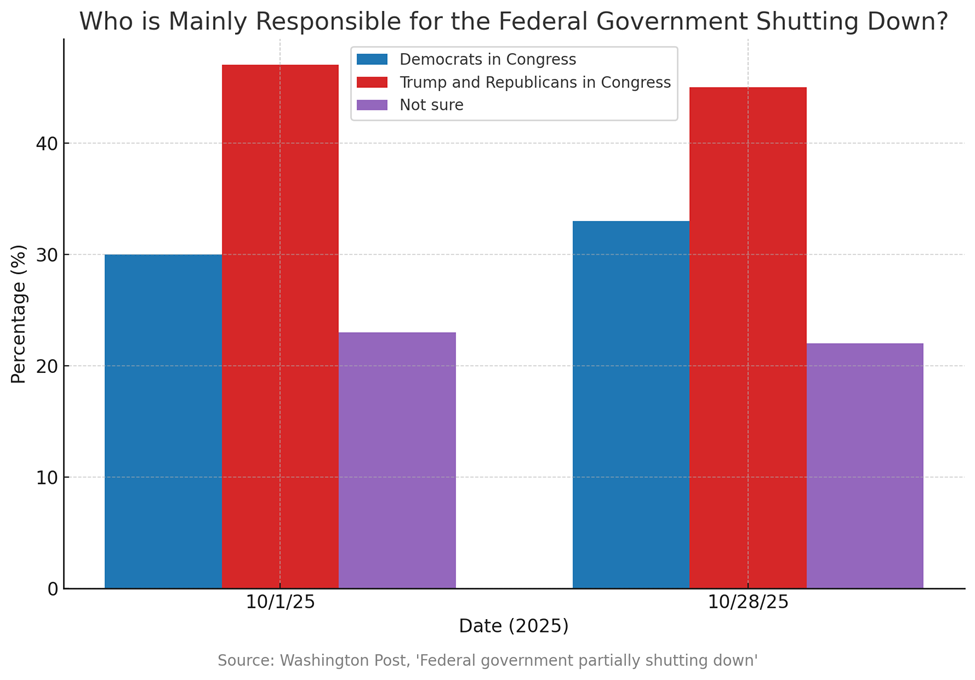

The political dynamics are complicated. A Republican-controlled Congress is facing a Senate with enough Democrats to block the GOP’s preferred resolution. From my perspective, Democrats appear emboldened by recent wins in state and local elections, as well as polling that suggests Republicans are being blamed for the shutdown. That dynamic raises the risk that the standoff drags on.

Still, pressure is mounting ahead of the holidays. With Thanksgiving only a couple of weeks away and the shutdown already causing chaos at airports across the country, public frustration is likely to intensify. While it’s possible the impasse could persist longer, voters will not tolerate widespread travel disruptions over the holiday season. Equities remain vulnerable to further downside until the government reopens, which should give the GOP incentive to reach an agreement soon.

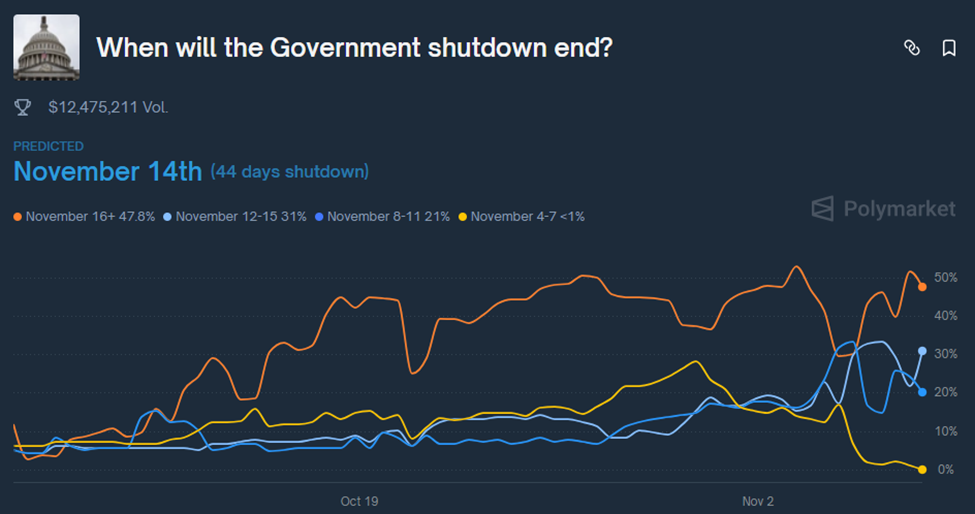

Polymarket odds currently point to the shutdown ending on November 14th. I would take the under on that.

Crypto Leading Risk Higher?

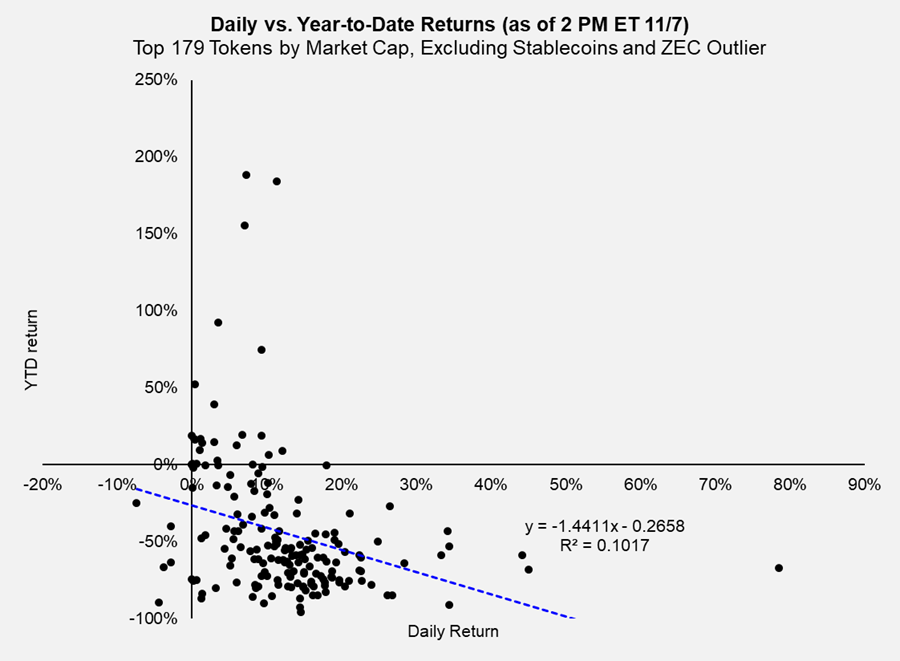

One encouraging development was Friday’s price action. As this note is being written, markets have not yet closed, so a late-session reversal could lessen the significance of this observation. Still, it was notable that crypto has outperformed equities by a wide margin, with coins that have underperformed the most this year leading the way higher.

There are a couple of key takeaways from this:

- Crypto tends to lead equities, and this may signal that sellers have been largely exhausted. Buyers have defended the $100k BTC level with conviction, and as a result, sellers may be conceding ground to the bulls. That said, a rally like this (with low quality names rallying) could still prove to be a dead cat bounce without a structural improvement in macro conditions, so confirmation via follow-through in the coming days will be important.

- The October 10th liquidations left the market extremely illiquid, amplifying bidirectional swings. This was clear in long-tail altcoin price action today, many of which surged 30–50%.

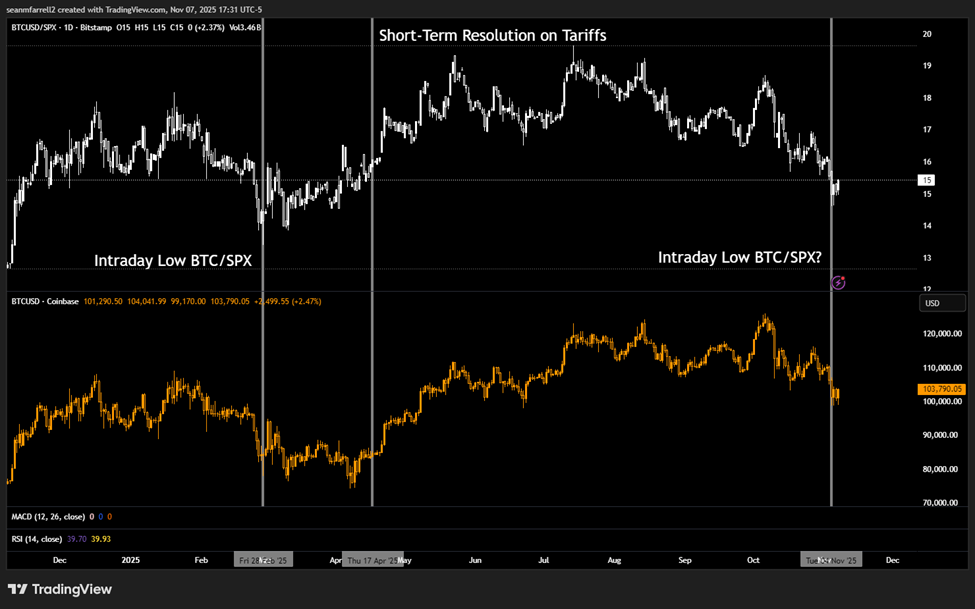

As further evidence that crypto tends to add and clear risk capital ahead of equities, consider the tariff tantrum in the first half of the year. BTC topped well before equities, and BTC relative to the S&P 500 bottomed well before either market found an absolute low.

It is possible that we saw a similar pattern play out today, and perhaps neither asset needs to make new absolute lows if the shutdown is resolved in short order. Either way, on a relative basis, BTC looks considerably more constructive here.

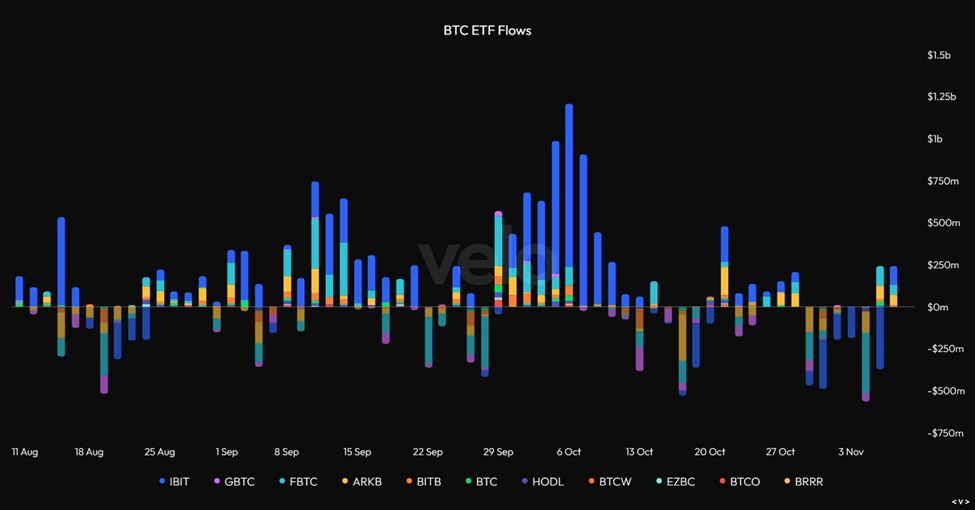

One data point that supports the idea of a genuine rotation into crypto, rather than a simple dead cat bounce, is the late-week reversal in ETF inflows. Alongside flows into DATs and the subsequent outflows from those vehicles into coins, these are among the most important capital flows in the space.

We saw net inflows into BTC, ETH, and SOL ETFs on November 6th. While a single data point should not be overemphasized, it is an early sign of capital starting to re-enter the crypto ecosystem.

MSTR Returning to the Market

MSTR will likely be back in the BTC spot market soon. The company is raising roughly $715 million through its new 10% Series A Perpetual Stream Preferred Stock (STRE), doubling its initial target amid strong investor demand. The preferred shares are priced at €80 with a €100 par value and pay a 10% annual dividend, which can rise to 18% if payments are deferred.

STRE extends the firm’s preferred-stock program, following prior issuances such as STRC, STRF, STRK, and STRD, which have built a capital framework for ongoing bitcoin accumulation without relying on at-the-market equity issuance. While common shareholders could face dilution when dividends are eventually paid, the structure allows continued BTC purchases without immediate equity issuance.

Given the market’s current illiquidity, this new capital could provide an outsized boost to BTC and, by extension, the broader crypto ecosystem in the coming days.

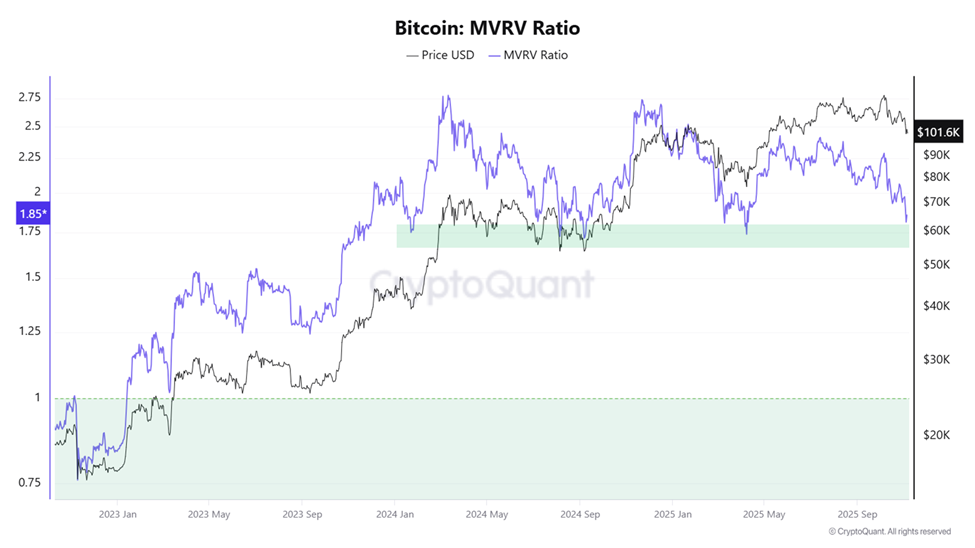

We Are Near Fundamental Support

As discussed in Thursday’s video, there are fundamental reasons to believe that BTC has either reached or is nearing a local low. The Market Value to Realized Value (MVRV) ratio compares Bitcoin’s current market capitalization to its aggregate cost basis, or “realized value,” which reflects the price at which each coin last moved on-chain. In simple terms, it measures how far current prices deviate from the average cost basis of all BTC holders.

Historically, an MVRV above 3.5–4.0x has coincided with overheated conditions and cycle peaks, where most holders are sitting on significant unrealized gains and speculative excess is high. Conversely, readings below 1.0x have typically marked deep undervaluation zones, where the average investor is underwater and capitulation has largely taken place.

The mid-cycle range around 1.5–2.0x tends to represent a neutral-to-accumulation zone within ongoing bull markets. These are areas where traders historically begin adding exposure following intra-cycle corrections.

With Bitcoin’s MVRV now hovering around 1.7–1.8x, it suggests the market has largely reset from mid-year excesses. This level has repeatedly served as a launching point for renewed advances throughout the current cycle. While not an immediate timing tool, it indicates that downside risk is becoming increasingly limited relative to upside potential as valuations compress toward medium-term support, particularly if one assumes, as I do, that we remain in a broader bull market.