Who’s Been Selling All the Coins?

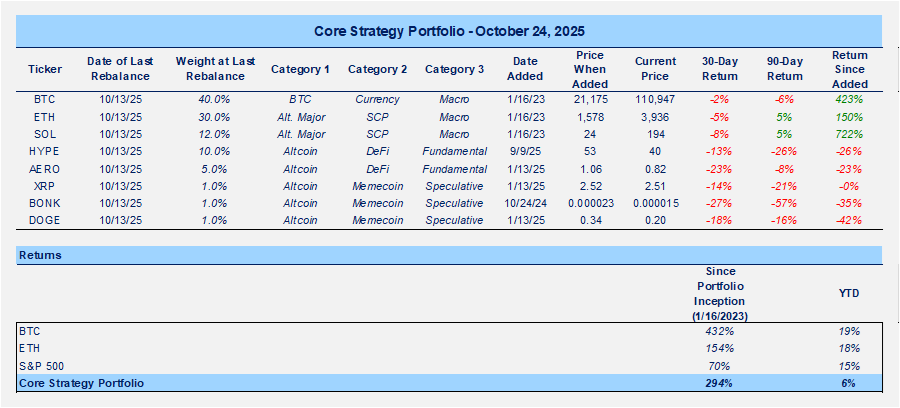

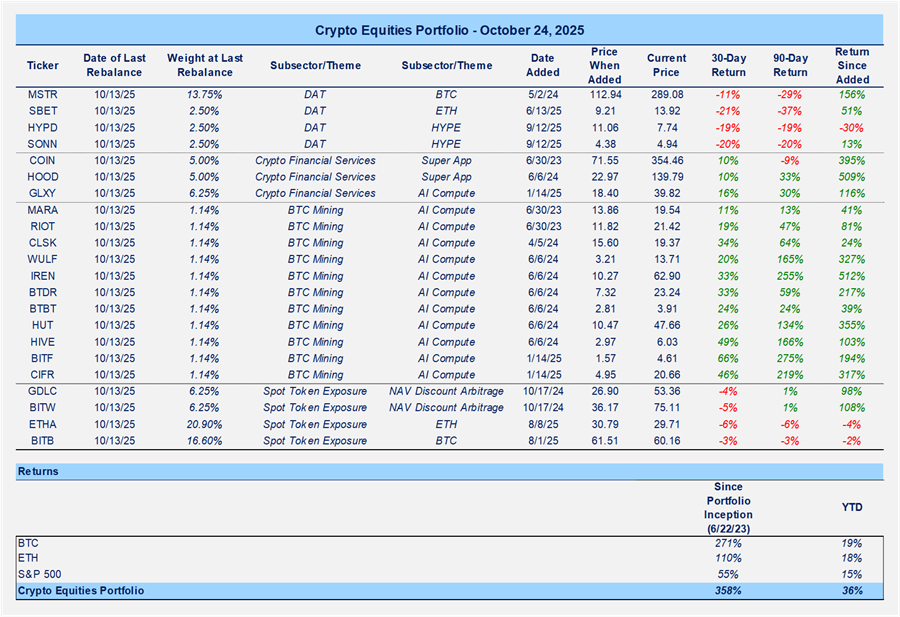

Token & Equity Portfolios

Old Whales & New Buyers

It seems like every other week, we are greeted with a headline along the lines of “Satoshi-era wallet moves $5B of BTC mined on a laptop back in 2011.”

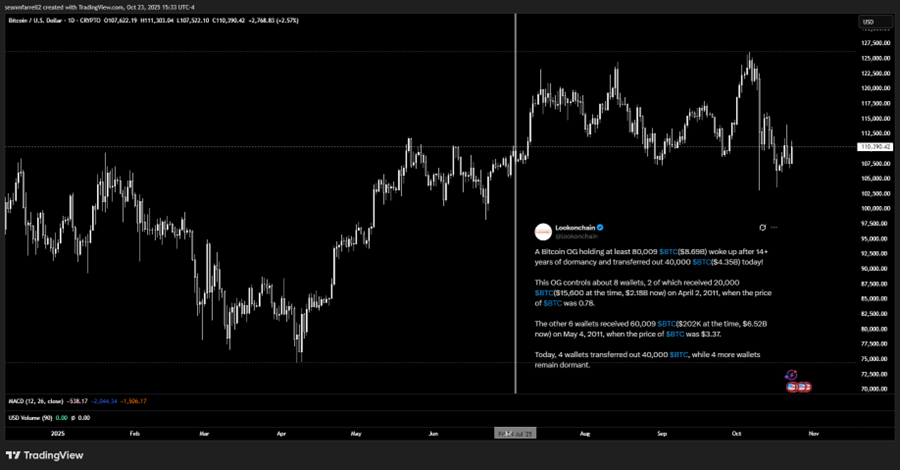

Recall the whale back in July that sold 80,000 BTC (>$9B) through Galaxy. The market flinched on the news but eventually absorbed this supply like it was nothing.

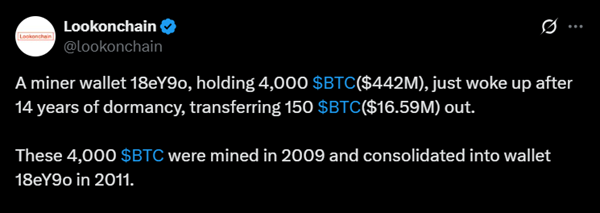

And just yesterday, we received a notification that an old wallet holding 4,000 BTC (~$440 million at today’s price) transferred part of its stack to a new address, presumably to be sold.

There are numerous examples that mirror these two. There is no question that old wallets have been selling into every rally this cycle at a rapid clip, with the sell pressure reaccelerating in recent months. While this is an occurrence every cycle, the age of these wallets and the persistence of their selling has been somewhat unique, as we will demonstrate via data below.

Many discuss the emergence of ETFs as a source of bitcoin’s dampened volatility. The ETFs have driven a massive increase in covered-call writing, which has certainly been a major contributor to the decrease in BTC’s realized and implied volatility. But the onslaught of sell pressure from old whales has also played a role, making clean range breakouts much harder to achieve.

Selling Pressure from Older Coins Has Been Relentless

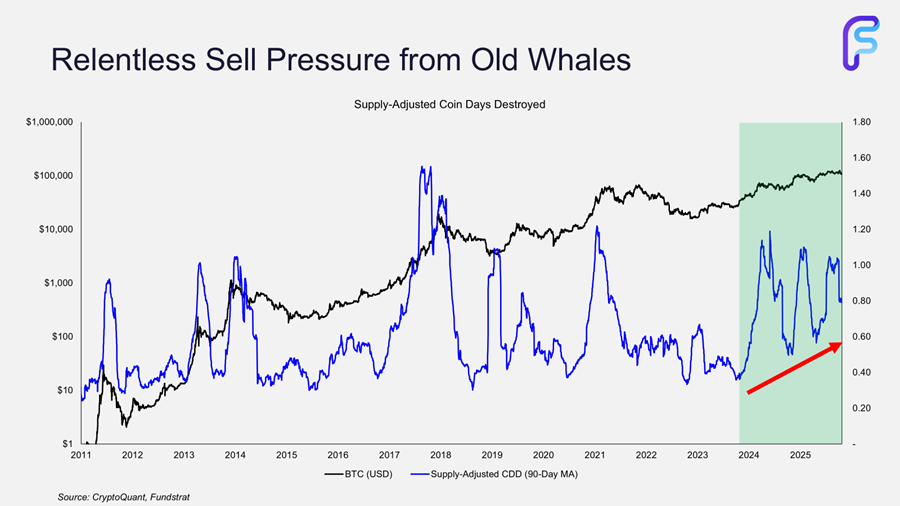

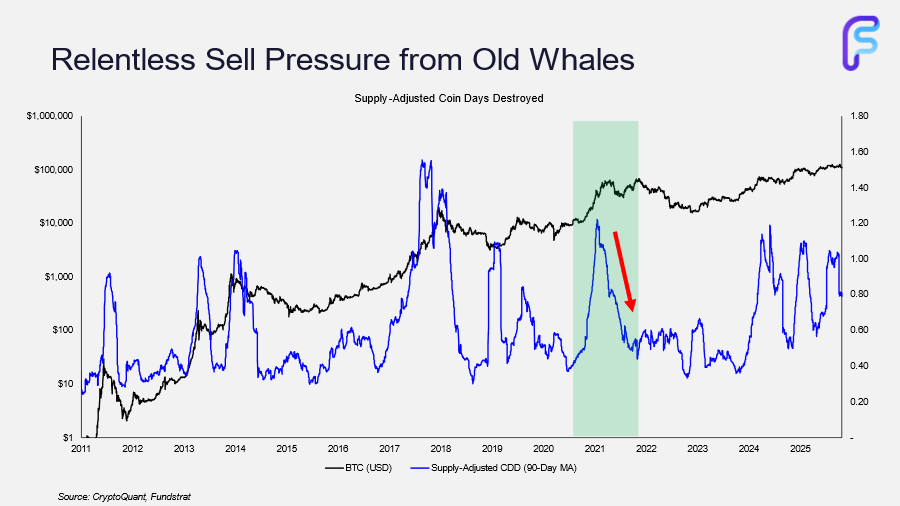

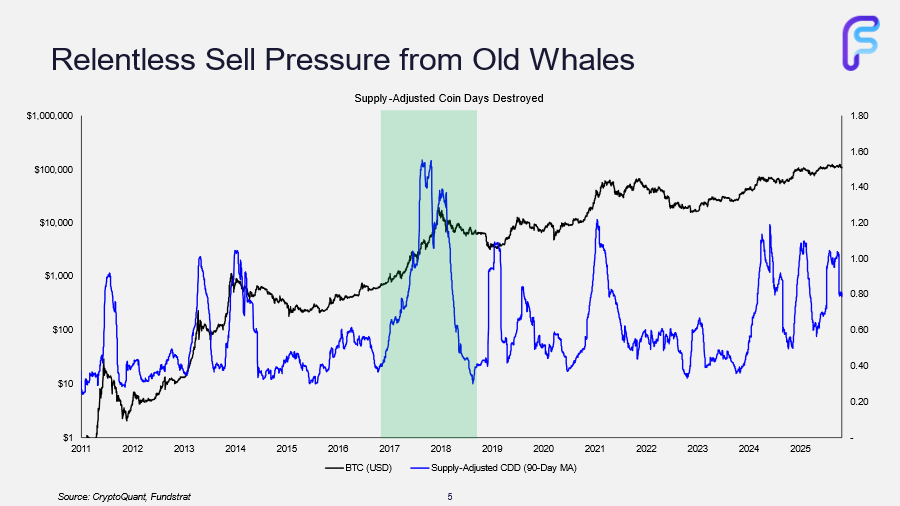

As mentioned, every cycle sees old whales come out of hibernation to sell into a rallying market. However, data suggest that this cycle has been markedly different.

Below, we look at Coin Days Destroyed (CDD), which measures the economic significance of on-chain activity by weighing each transaction by how long the coins had been held before moving. Spikes in this metric often signal that long-term holders are distributing, while low levels suggest accumulation or limited spending by older wallets.

You can see that there have been several instances of intense sell pressure from older coins since the beginning of 2024. There have been identifiable spikes, but whereas in prior cycles whales would eventually take their foot off the gas and CDD would normalize, CDD has remained elevated this cycle and has trended higher throughout the entire bull market.

Compare that to 2020 and 2021. There was a massive but short-lived spike in CDD during BTC’s initial run to new all-time highs, after which activity normalized. In fact, on Bitcoin’s second leg higher in the second half of 2021, we did not see older coins selling into the market at all.

The 2017 cycle also saw massive sell pressure from old coins, but it was still a single parabolic move. It is also worth keeping in mind that this bull run minted many billionaires as BTC rose nearly 20x within a 12-month period, and it marked Bitcoin’s first true moment in the mainstream. Retail access was expanding, and financial media attention was surging.

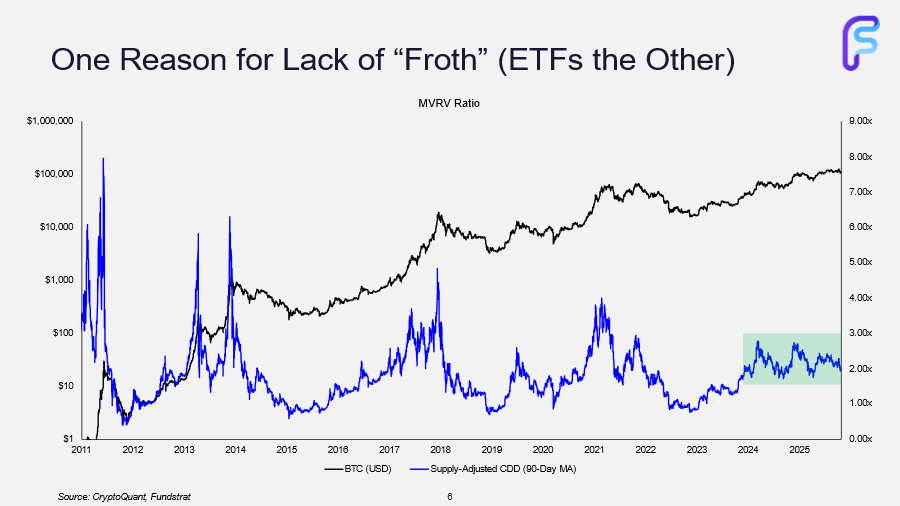

Another lens for viewing this transition of coins from old hands to new ones is MVRV, which measures the market value of the BTC network relative to the aggregate cost basis of holders. When holders are in profit, MVRV increases. In prior cycles, the metric tended to reach frothy levels (roughly above 3.5x) near all-time highs. This cycle, however, we have come nowhere close to these levels, partially due to this persistent whale overhang.

In dissecting the pattern of this cycle, the first bout of selling had a clear rationale: old wallets always sell into strength during the initial run to new highs, to reduce risk and eventually acquire at lower prices.

But the selling of old coins throughout this cycle has been remarkably persistent, especially over the past ~6 months. Why is this the case?

I think there are two possible reasons:

- Some early adopters were drawn to Bitcoin’s cypherpunk vision of operating outside traditional finance and government control. Now that BTC is being embraced by those same institutions, they are leaving the project (well in profit, I might add).

- Many early investors remain anchored to the idea of four-year cycles. With this being the supposed final year of the cycle, they are cashing out accordingly.

I think the whales are wrong on both fronts. There was never a realistic path to broad BTC adoption that did not involve traditional asset managers and government recognition. And the four-year cycle was always a myth. The past two halvings have had little influence on BTC flows, and there is no fundamental attribute of crypto that requires cycle peaks to be ~4 years apart. Yes, if everyone who invests in the asset class is of this mindset, it can be self-fulfilling, but crypto-native capital is no longer in the driver’s seat for crypto. The marginal buyers that drive upside performance for the broader crypto market are institutions.

The last cycle’s timeline merely coincided with liquidity and business cycles, which made the timing appear predictive. If the whales turn out to be right this time, it will not be because of some magical property that dictates four-year highs. It will be due to fundamental macro forces.

To summarize:

- Whales have been pouring cold water on BTC momentum, and by extension the broader crypto landscape, driven by some mix of disillusionment and misplaced cycle theory.

- Their sales have made breakouts harder to achieve and sustain, but BTC continues to consolidate and grind higher, supported by a new base of traditional financial market participants. These are the market participants that matter now.

- For every seller, there is a buyer. Heavy whale selling has reset the network’s cost basis: the average cost for 1 BTC is now about $55k (~51% of spot) compared to about $41k (~44% of spot) at the end of last year. This is what base formation looks like. If the bull case plays out, those buying here are likely to have higher price targets than those who were buying 25% lower.

- Cycles do matter, but the ones that do involve liquidity and economic output. The four-year crypto cycle has no logical or structural foundation. Crypto trades on macro conditions, not halving myths. If macro deteriorates in the coming months (not our view), cycle theorists may look “right” again, but only by coincidence, not reason.

The Setup Remains Constructive

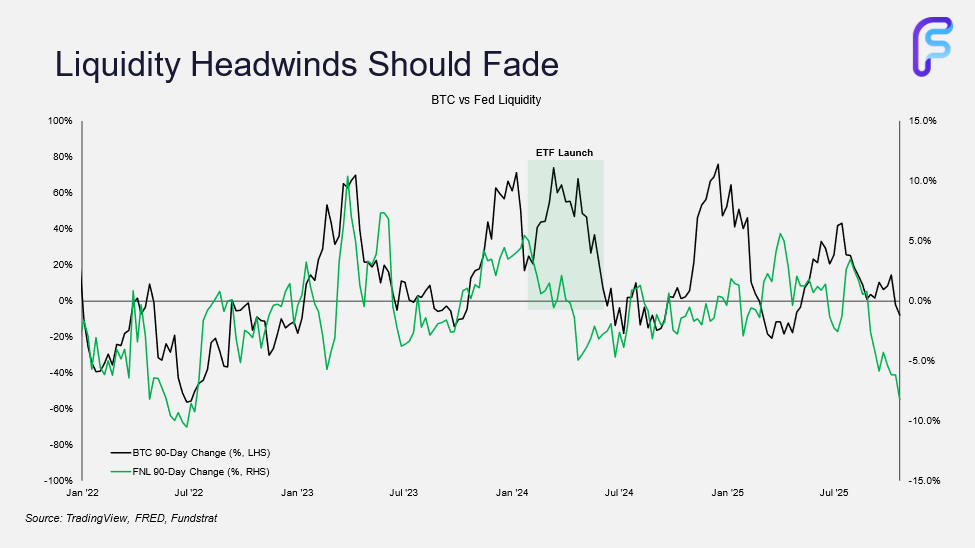

Recall that my macro view and its effect on the coins is that of a “run it hot” strategy from the administration. The Fed is ending QT and cutting rates into above-trend inflation and a solid economy.

This should continue to be a suitable environment for crypto.

Considerations in the near term

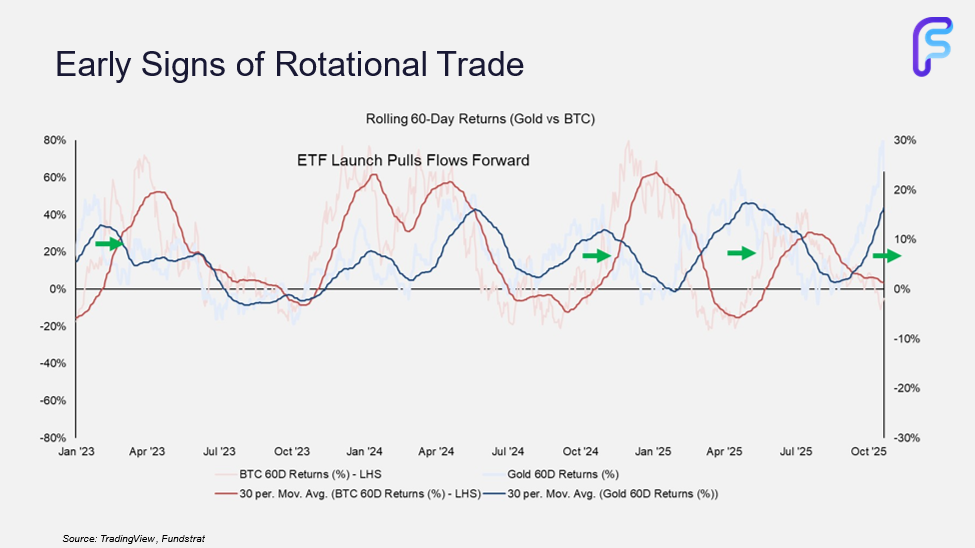

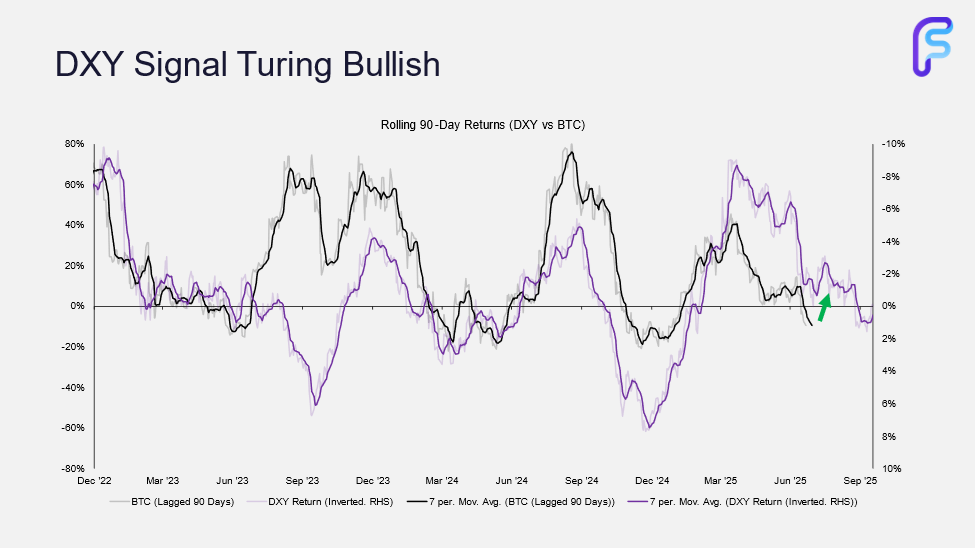

Gold, DXY, and BTC: We are beginning to see gold roll over as our DXY signal turns constructive. As discussed in recent videos, there is a short-term lead-lag relationship between the DXY and gold. Typically, falling real rates push gold higher and the DXY lower. Once easier financial conditions feed through and growth starts to be priced back in (often observable through DXY finding a low, gold rolling over, and improving equity market breadth) BTC tends to catch up to gold.

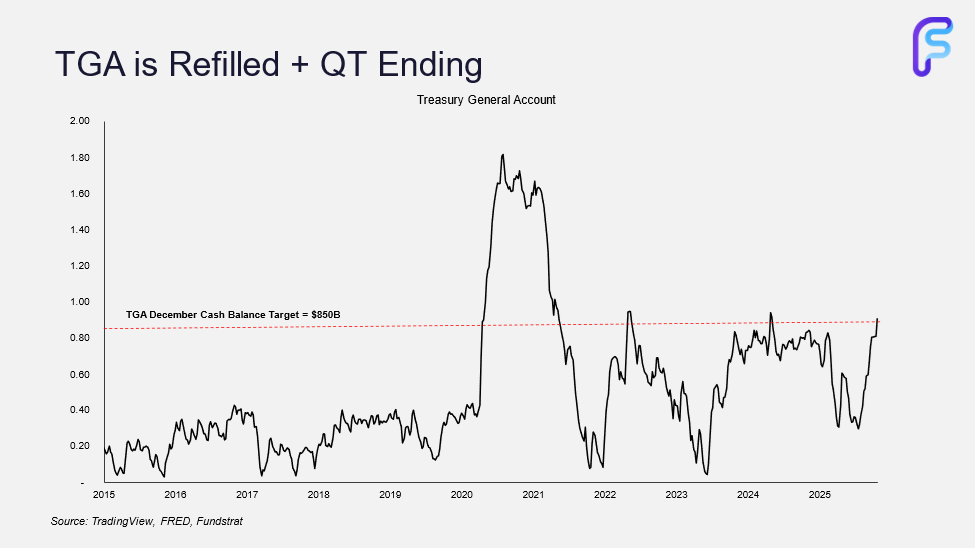

TGA Impact: The Treasury General Account is now full, meaning the prior source of liquidity-drain is no longer a concern for markets. While I do not anticipate Fed-sourced liquidity to become a major tailwind, removing this obstacle is likely to help crypto prices on the margin.

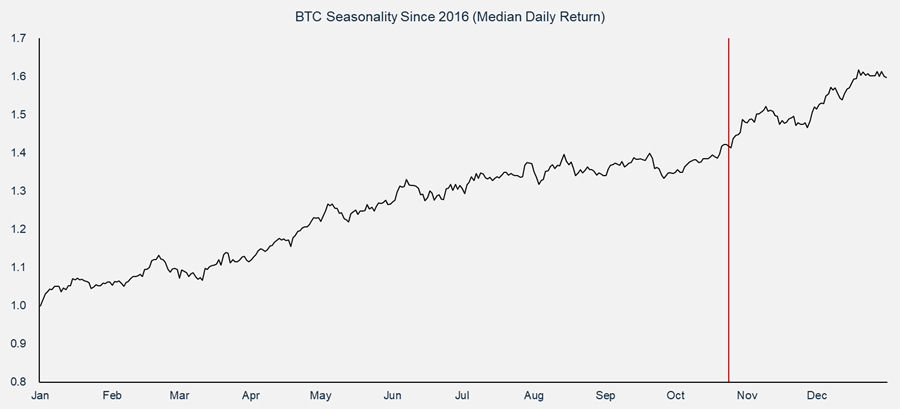

Seasonality: Despite the recent bumpiness, it is worth remembering that this is a seasonally positive period for the coins.

Leverage Reset: We saw a full leverage reset on 10/10. This is not a guarantee that prices must go higher, as there were plenty of leverage resets in 2022, but it removes cascading liquidation risk and cleared excess froth from the market.

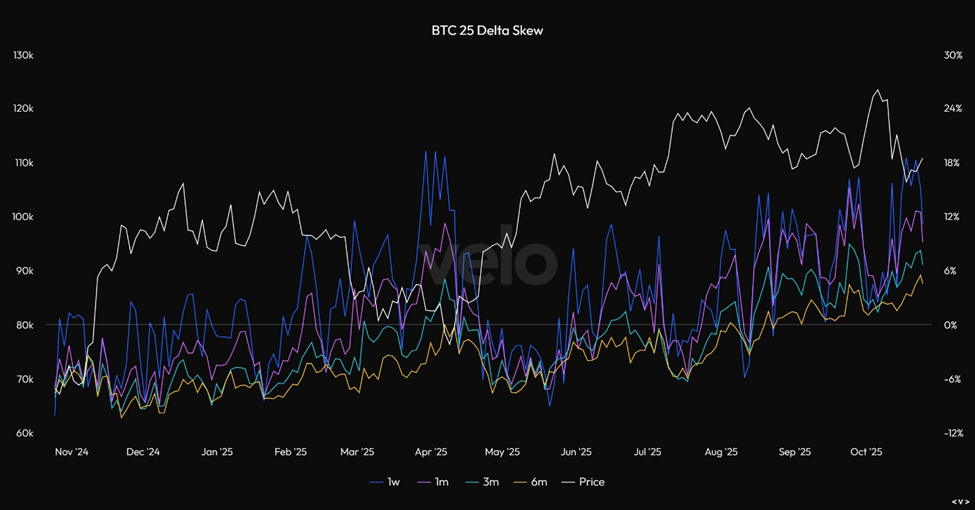

Sentiment: Market sentiment remains quite sour from my perspective. Conversations with long-time crypto market participants suggest many are doubtful that crypto can recover from the 10/10 liquidations, and some are blaming the weakness relative to equities on the magical 4-year cycle. While negative sentiment does not necessarily lead to higher prices, it does reduce positioning risk. The options market supports a view of a cautious market, with put/call skew still in extreme bearish territory across most tenors.

Key Risks:

- Government Shutdown: A prolonged shutdown could weigh on growth as a large share of the economy goes unpaid. However, this risk has a defined, well-understood conclusion, and the only variable here to consider is timeframe. I suspect that it will soon become politically unpalatable for both parties to remain at a standstill.

- U.S.–China Negotiations: The larger risk lies in the ongoing trade discussions between the United States and China. Extended tariffs of 155% on Chinese goods could trigger a meaningful growth scare by raising input costs, tightening financial conditions, and pressuring margins across manufacturing and retail sectors. This possibility should be respected. That said, the market remains conditioned to buy the “TACO trade,” and until there is clear evidence of deterioration, it makes sense to stay constructive. If my constructive Q4 outlook is derailed, it will most likely result from Trump and Xi failing to find a mutually beneficial deal, or a palatable bridge to further negotiations. When assessing the odds of a “deal,” it is important to weigh the constraints each side faces. China continues to struggle with weak domestic demand and a sluggish economic recovery, while the US faces two identifiable challenges: (1) recession risk and (2) the need for consistent buyers of U.S. debt. On balance, the United States remains in the stronger negotiating position given its demand leverage. However, timing considerations matter. With midterm elections roughly 12 months away, Trump is unlikely to risk a growth scare / recession that could undermine Republican control of Congress, negatively affecting his ability to advance his policy agenda. For that reason, I expect him to pursue a net favorable deal in his meeting with Xi that supports growth and will forego implementation of additional punitive tariffs. Such a deal could potentially involve concessions around Taiwan or semiconductor policy in exchange for meaningful (but well below 155%) tariffs and access to rare earth materials. While the details of any eventual deal are uncertain, the broader setup suggests a higher probability of a market-friendly compromise than a full rupture. A deal such as the one mentioned would likely allow the bull market to continue. The bear case is one in which Trump goes for the death knell now, finalizing a full economic split with China. Such a move would almost certainly weigh on crypto prices through year-end.