Crypto in a Tough Spot Until Someone Blinks (Core Strategy Rebalance)

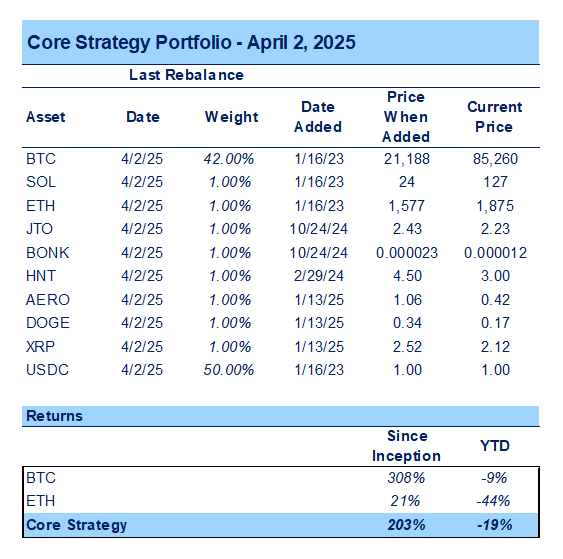

Despite improving liquidity conditions and favorable seasonality offering reasons for optimism, the ongoing trade war remains the dominant driver of crypto’s next move. As such, we believe it’s prudent to stay patient. We’re increasing our Core Strategy allocation to USDC to 50%, keeping altcoin exposure minimal as we assess the potential fallout from the Liberation Day tariff announcements. While this may seem discouraging, the roadmap has become more straightforward: we turn bullish if other countries concede (our base case) or if economic weakness results in a fiscal and/or monetary response.

Liberation Day

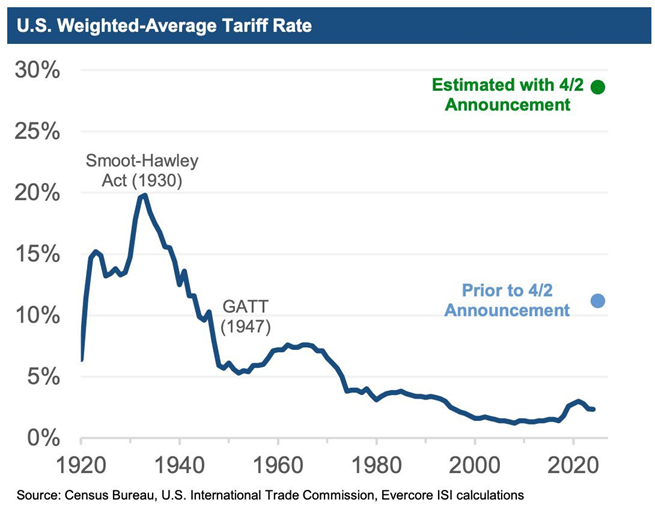

Liberation Day came and went. To put it bluntly, the tariffs announced by the White House were far more punitive than expected. Every country received a blanket 10% tariff, with higher reciprocal tariffs applied to those with steeper levies on U.S. exports. Some highlights include:

- China: 34% (in addition to an existing 20%)

- EU: 20%

- Vietnam: 46%

- Taiwan: 32%

According to the analysis constructed below, this would bring the weighted-average tariff rate to nearly 30%.

The market’s reaction was predictable: risk assets sold off hard. BTC held up relatively well for a time, but it’s now starting to show additional weakness.

With that in mind, we think it’s appropriate to raise more cash within our Core Strategy and brace for the possibility of further downside.

That said, the extreme nature of these tariffs simplifies our crypto outlook to some extent. It seems likely that there are two clear impending scenarios:

- Other countries “blink” in tariff negotiations and agree to place lower tariffs on the US (our current base case)

- Tariffs remain in place, and the U.S. enters a recession

Either outcome likely marks a bottom for crypto, but we need to reach that point before turning meaningfully bullish. The good news is that option (1) could happen at any point.

Is Anyone Else Going to Buy?

Over the past few weeks, there’s been a massive corporate bid supporting BTC:

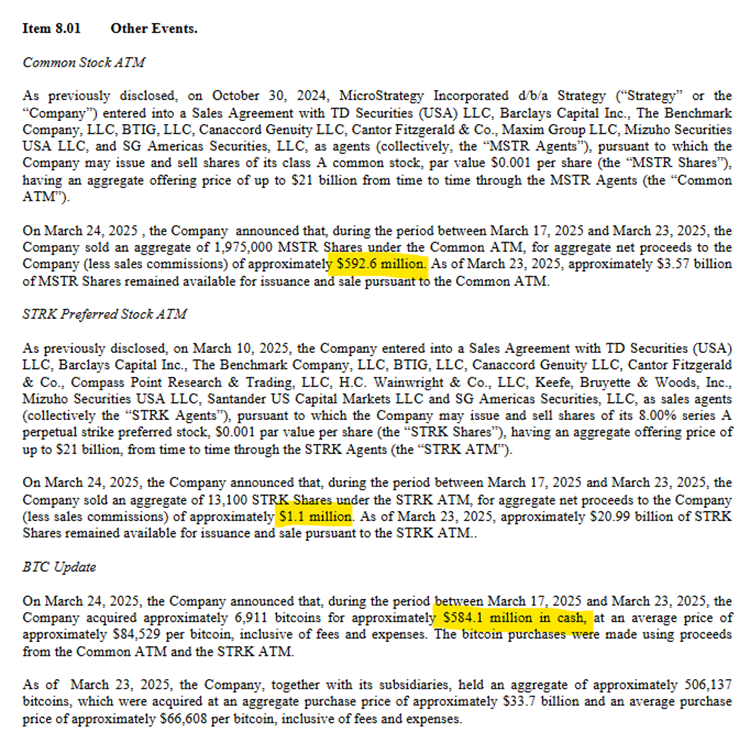

- 3/17 – 3/23: MSTR purchased $584 million worth of BTC.

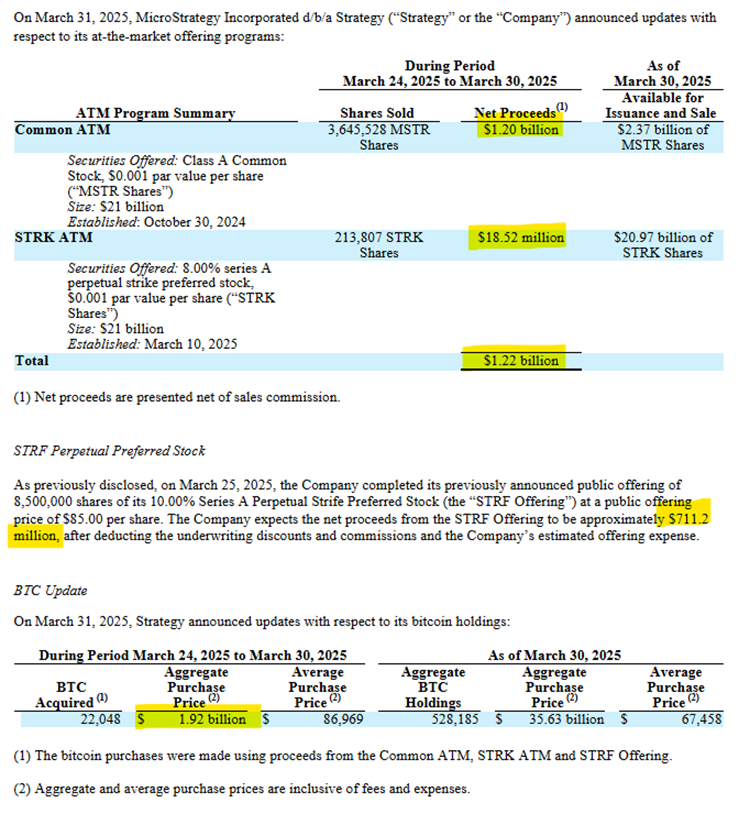

- 3/24 – 3/30: MSTR followed with a $1.92 billion BTC buy.

- 4/1: GME completed a $1.5 billion convertible note offering and likely began deploying capital into the market on Tuesday and Wednesday.

In total, we’ve seen roughly $4 billion of corporate capital flow into BTC in just a few weeks. For perspective, that figure represents 11% of all historical ETF net inflows.

Yet, despite this corporate wave, BTC has failed to hold any bounce attempts. Logic would suggest that, without this bid, BTC demand might be close to nonexistent.

Should GME run out of dry powder tomorrow, this may compound any weakness in global risk assets.

MSTR: Buys $584 million in BTC.

MSTR: Buys $1.9 billion in BTC.

GME: Raises $1.5 billion to buy BTC.

Core Strategy

Despite improving liquidity conditions and favorable seasonality offering reasons for optimism, the ongoing trade war remains the dominant driver of crypto’s next move. As such, we believe it’s prudent to stay patient. We’re increasing our Core Strategy allocation to USDC to 50%, keeping altcoin exposure minimal as we assess the potential fallout from the Liberation Day tariff announcements. While this may seem discouraging, the roadmap has become more straightforward: we turn bullish if other countries concede (our base case) or if economic weakness results in a fiscal and/or monetary response.