AI/HPC Miner Basket a Good Risk/Reward Ahead of NVDA Earnings

Key Takeaways

- Last week, we noted mid-August to September's negative seasonality but stressed that macro trends and crypto-specific factors should guide risk assessment.

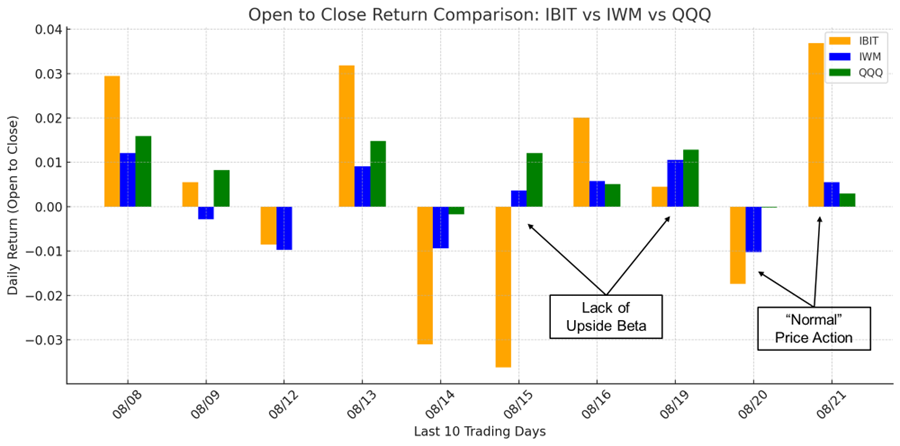

- Since last week's CPI, favorable conditions (falling yields/DXY in a risk-on environment) boosted rate-sensitive assets, yet BTC underperformed, lacking expected upside beta.

- We attribute this underperformance to the sale of 10k Silk Road BTC on Coinbase Prime last Wednesday, evident in the US market hour disconnect. Tuesday and Wednesday’s "normal" price action suggests the orderbook imbalance has likely cleared.

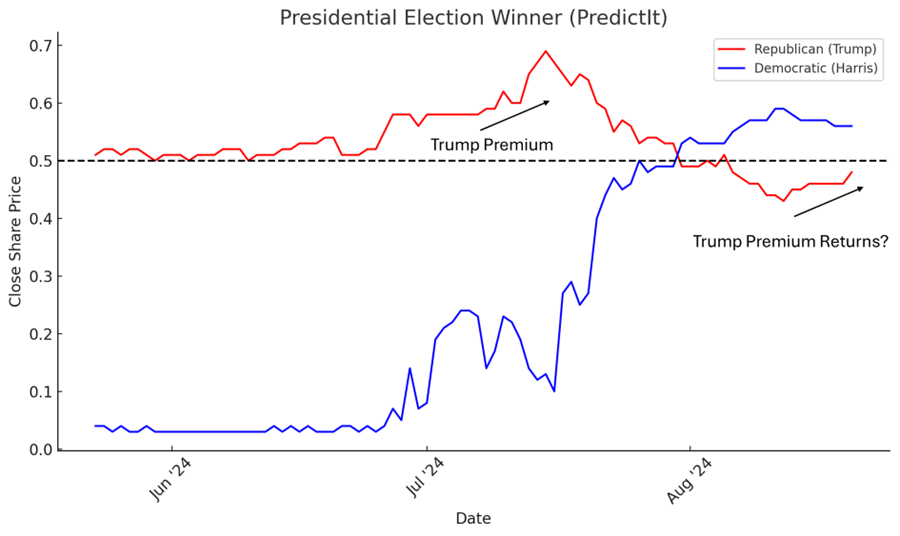

- A trend reversal in prediction markets has reintroduced the possibility of a “Trump Premium” being priced back in. Prospects of RFK, Jr. dropping out of the race on Friday could accelerate this.

- Falling rates and a possible NVDA rally into and post-earnings (8/28) make our AI/HPC miner equities basket an attractive near-term risk/reward.

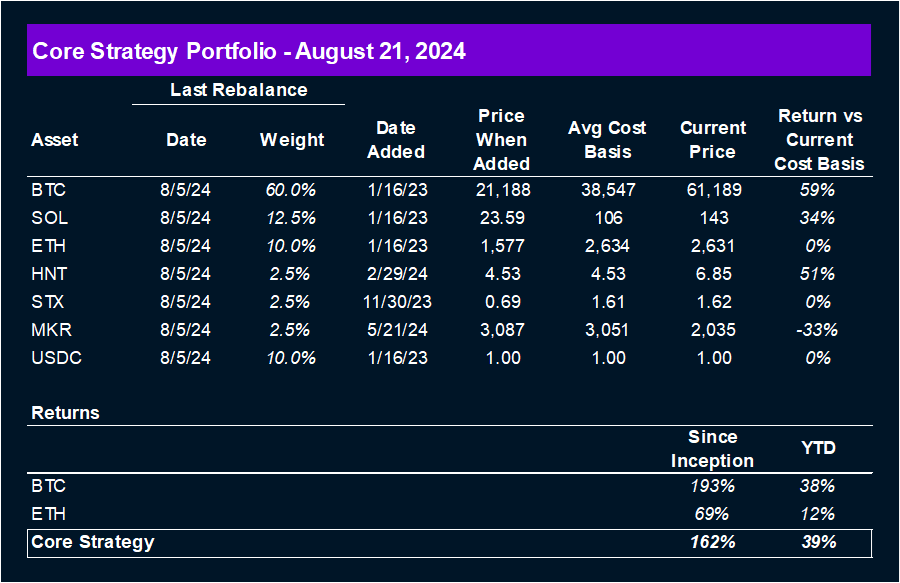

- Core Strategy – We are optimistic about the outlook for crypto heading into year-end and view a market moving toward a soft landing as constructive for prices. Our focus remains on the majors, with selective exposure to altcoins, while keeping some dry powder on hand to account for geopolitical tail risks and negative seasonality. As a reminder our Core Strategy allocation model is featured at the end of each note along with our crypto equity baskets and trade recommendations.

Government Selling Seems to be Complete

Last week, we highlighted the negative seasonality from mid-August through September but emphasized that macro trends and identifiable crypto-specific factors should take precedence in assessing risk.

Since last week’s CPI print, conditions have been favorable for crypto – yields and the DXY have fallen in a non-recessionary manner (more Goldilocks than risk-off), and rate-sensitive assets like IWM and RSP have rallied.

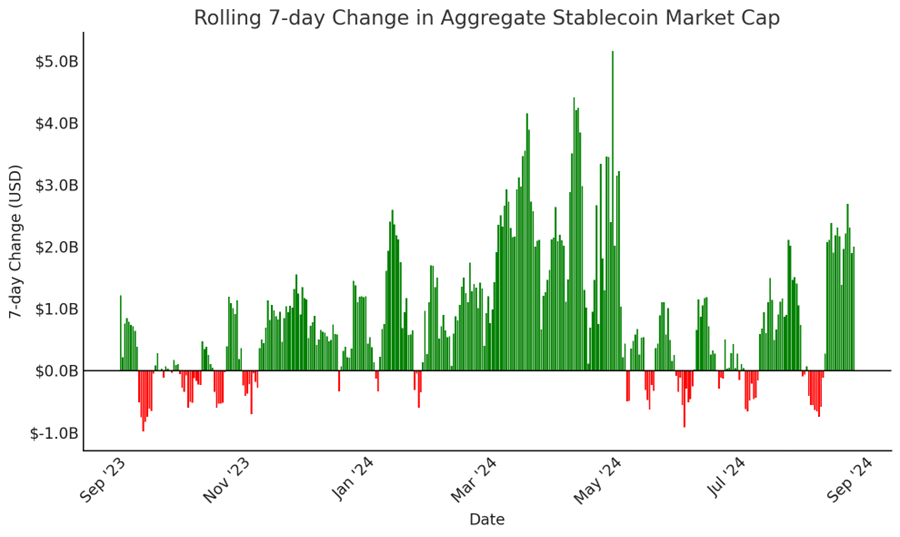

Stablecoin inflows have also surged over the past couple of weeks – normally a very bullish sign for the wider crypto market.

Yet, BTC has underperformed, lacking the upside beta we would typically expect given such a conducive macro setup.

We attribute much of this underperformance to the selling of 10k Silk Road BTC, which was transferred to Coinbase Prime last Wednesday. We shared the chart below in our Crypto Comments video on Tuesday. This displays an apparent disconnect in performance during US market hours vs the rest of the world, starting with the transfer of the Silk Road coins to Coinbase Prime last Wednesday. To us, this suggests that this supply overhang has been a key factor contributing to the capped upside in BTC.

However, price action on Tuesday and Wednesday appeared “normal,” supporting the idea that the orderbook imbalance might be behind us.

It is also worth noting that there were only 10k BTC in this sum, which all things considered isn’t an enormous amount, especially considering the German government were at one point selling 8-11k BTC per day into the market. Granted, this was during a time in early-to-mid July when the market was excited about an emerging soft-landing narrative coupled with an increasing “Trump Premium,” but regardless we think that moving 10k BTC should not take more than a few trading days.

Prediction Markets Swinging in Crypto’s Favor

In addition to the potential cessation of Silk Road sales, and favorable macro conditions in the near-term, we are also seeing some regression to the mean in election prediction markets.

PredictIt has had Trump moving closer to even odds over the past week, while Polymarket has seen Trump already surge to 52% likelihood of victory in November.

A key variable that could accelerate Trump’s odds in prediction markets and polls is the fact that RFK, Jr. seems poised to drop out of the Presidential race and endorse Trump on Friday. This could lead to a meaningful shift in election odds as it seems that RFK voters are comprised of mostly swing voters that, if persuaded by RFK, could move toward Trump’s side of the aisle.

This would intuitively lead to a reintroduction of the Trump Premium that we saw in July.

Near-Term Risk/Reward for AI/HPC Miners Looks Favorable

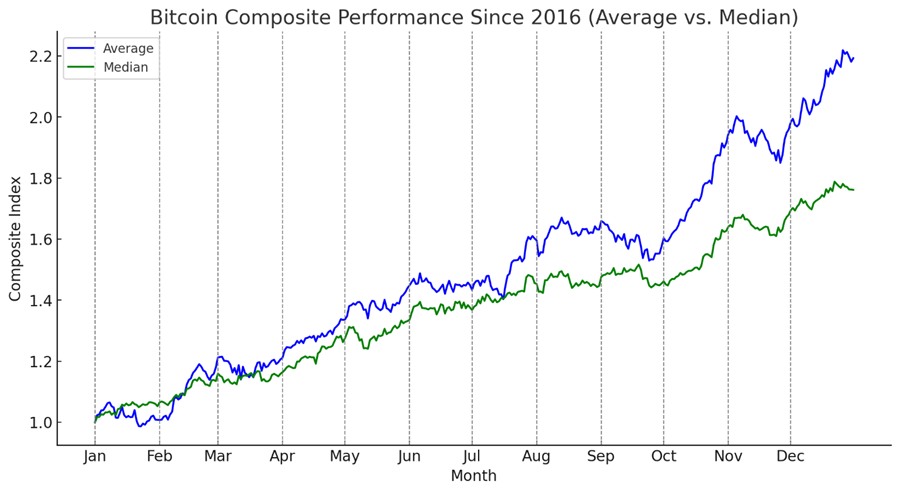

Historically, BTC miners generally trend based on two key variables:

- BTC Price: This is the more straightforward driver. Miner revenue is denominated in BTC, so when the price of BTC rises in dollar terms, miner equity prices benefit due to operational leverage. Typically, miner equities provide beta to BTC price movements.

- Interest Rates: Unlike BTC, which is a digital commodity, miners have a cost of capital. Rising interest rates increase this cost, often pressuring their share prices. In a post-ZIRP world, it’s essential to monitor interest rates in addition to BTC prices. As shown in the chart below, the WGMI miner ETF tends to outperform BTC during periods of falling interest rates. While BTC itself often rallies during these periods, there are exceptions, such as Q1 this year, when BTC rallied despite elevated rates. Thus, interest rates remain a key factor alongside BTC price.

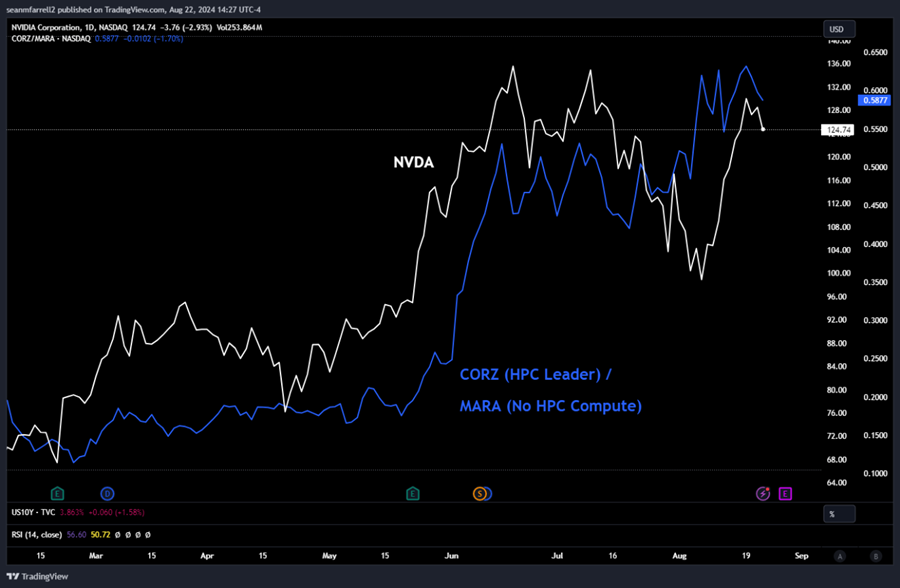

Since Q1/Q2 this year, a third variable has entered the equation – AI/HPC Compute Demand. While data center capacity and chips aren’t entirely fungible (miners can’t simply redirect from BTC mining to AI/HPC compute services at a moment’s notice), many miners already possess infrastructure and energy contracts sought after by hyperscalers and other sources of AI training demand.

The energy allocated to these services often generates higher value per kWh than BTC mining on average. Therefore, when the AI narrative gains traction in traditional markets, miners involved in AI/HPC compute tend to attract more attention (we previously explored this on June 6th – feel free to revisit that note for further context on the HPC miner narrative).

NVDA Earnings Next Week = Investor Attention on AI Demand

Given that interest rates have now fallen to YTD lows and with NVDA near all-time highs ahead of its upcoming earnings report, we believe this shifts the risk/reward outlook for AI/HPC miners in a more favorable direction.

BTC price remains a critical variable (and we view the current risk asymmetry to be to the upside) but it undoubtedly carries greater uncertainty in the near-term compared to interest rates and AI demand.

A good example of how these miners trade with NVDA and the AI narrative is seen below. This is the performance of CORZ (leader in HPC compute among miners) relative to MARA (no HPC compute).

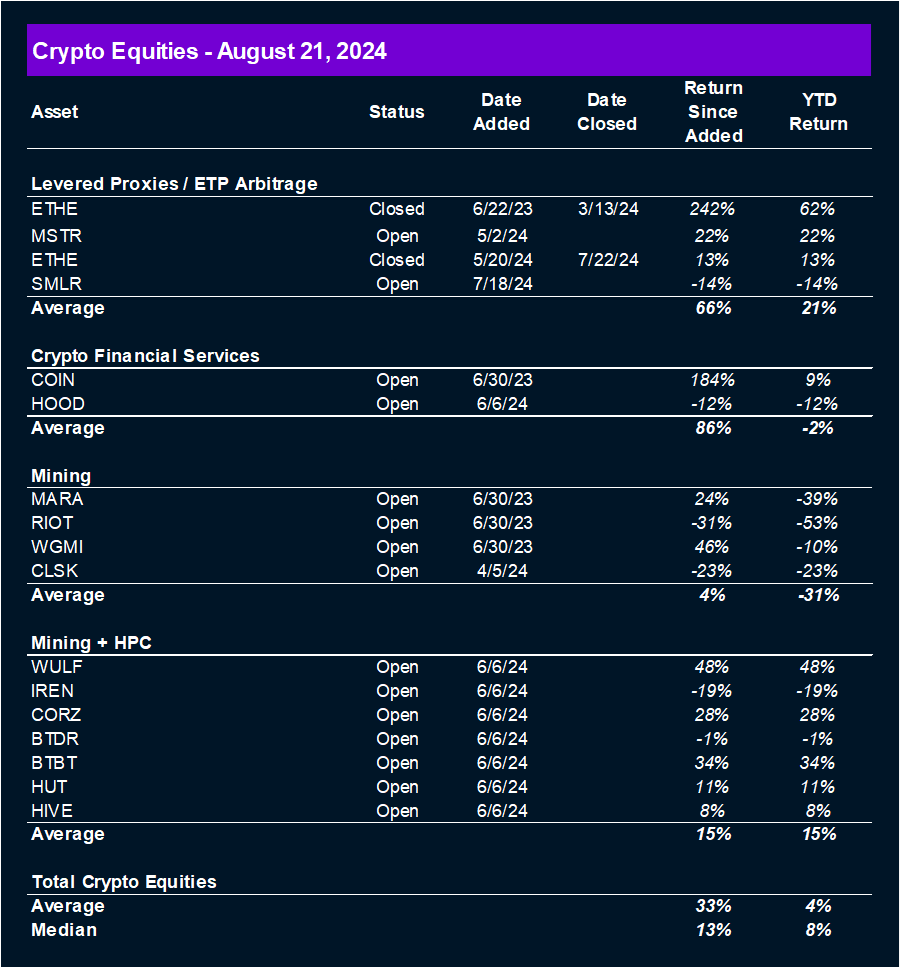

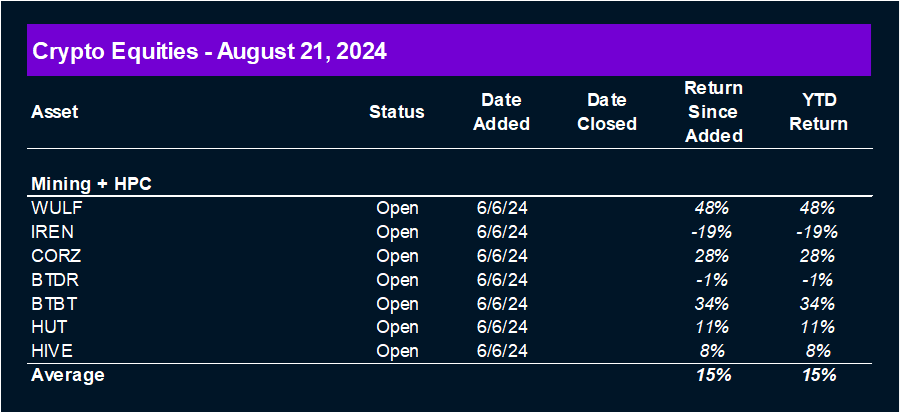

Below is our HPC miner basket, comprising miners that either have existing capacity directed toward HPC or are well along in redirecting capacity to HPC services.

Core Strategy

We are optimistic about the outlook for crypto heading into year-end and view a market moving toward a soft landing as constructive for prices. Our focus remains on the majors, with selective exposure to altcoins, while keeping some dry powder on hand to account for geopolitical tail risks and negative seasonality. As a reminder our Core Strategy allocation model is featured at the end of each note along with our crypto equity baskets and trade recommendations.