Soft Landing Back on the Table, Seasonal Headwinds Worthy of Attention

Key Takeaways

- A combination of non-recessionary yet disinflationary data over the past two weeks has led to the probability of a soft landing being priced back into asset markets.

- The VIX has dropped sharply in the past week, signaling increased investor confidence and less defensive positioning. However, the MOVE index remains somewhat elevated, and further declines would provide additional support for crypto prices.

- We are entering a historically negative seasonal period for Bitcoin, and investors should remain aware of this. While seasonal factors matter, they should not overshadow macro and crypto-specific drivers.

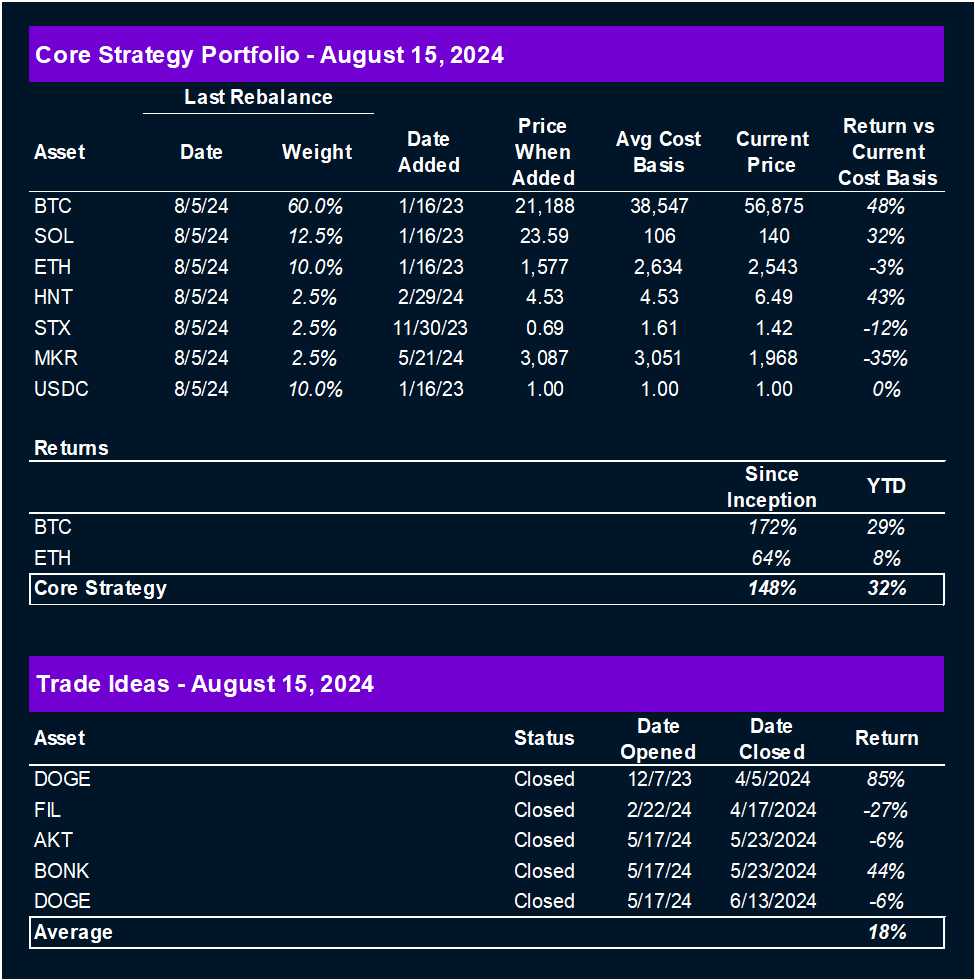

- Core Strategy – We are optimistic about the outlook heading into year-end and view a market moving toward a soft landing as constructive for crypto. Our focus remains on the majors, with selective exposure to altcoins, while keeping some dry powder on hand to account for geopolitical and seasonal risks. As a reminder our Core Strategy allocation model is featured at the end of each note along with our crypto equity baskets and trade recommendations.

Macro Data Points to a Soft Landing

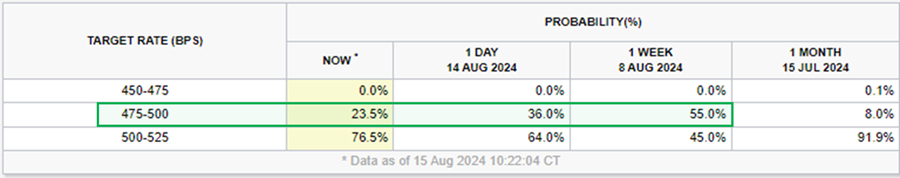

The global deleveraging event last week was driven by weakening economic expectations and rising fears of a potential policy error by the Federal Reserve. At the height of this uncertainty, the market priced in a 50 bps cut for September, as recession risks took center stage.

However, in just a few days, the narrative has shifted. The market is now leaning back towards a soft-landing scenario rather than one driven by recession fears. Recent economic data has supported this pivot, showing signs of disinflation without signaling an imminent downturn:

- ISM Services PMI: 51.4 vs. 51 forecast

- PPI: 0.1% vs. 0.2% forecast

- Core CPI: 0.17% vs 0.19% forecast

- Retail Sales: 1% vs. 0.3% forecast

As a result, fed funds futures have recalibrated, reducing expectations for cuts from 50 bps to 25 bps.

This suggests that while the Fed is still expected to ease policy, it can afford to do so more gradually. The economy remains stable, inflation is easing, and the urgency for aggressive cuts has lessened.

This is good news for the crypto market. A soft landing implies looser monetary conditions, which in turn expand liquidity and support speculative investments. As we move toward this softer outcome, we believe the conditions are ripe for crypto to thrive.

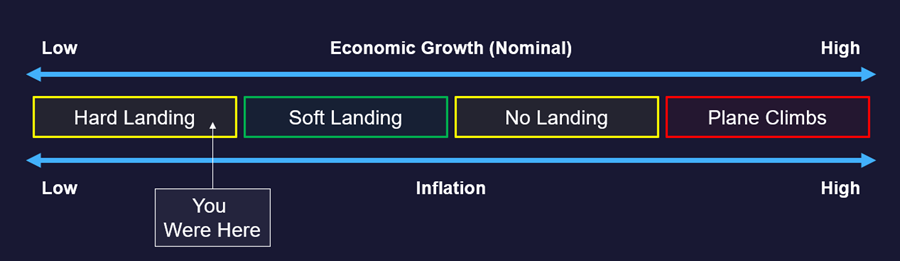

Landing the Plane

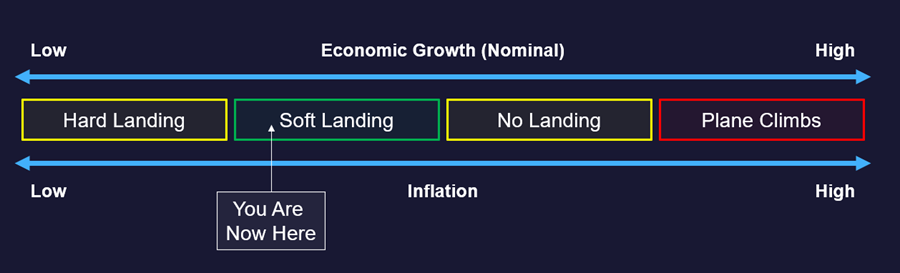

As the Fed continues to approach the runway, we put together a handy manual below to help make sense of ongoing changes in crypto market behavior. Consider the following framework:

- Green: Positive for crypto – Soft landing with easing financial conditions and robust real growth.

- Yellow: Cautionary for crypto – A hard landing or no landing scenario where outcomes are more mixed.

- Red: Negative for crypto – Reaccelerating inflation prompts further monetary tightening alongside subpar real growth (stagflation).

Before the deleveraging event, markets were teetering toward a hard landing, which we flagged as yellow. We believe it is almost a sure thing that a hard landing would result in correlations rising to 1 and all risk assets selling off in an acute manner. However, we did not flag it as red because recessionary pressures typically lead to easier financial conditions once central banks step in and intervene, making crypto the preferred asset to own on any rebound (higher volatility, but higher eventual upside).

Since the start of this week, the trajectory has shifted back toward a soft landing – the ideal scenario marked in green. A soft-landing offers Goldilocks-like conditions where financial conditions ease while real growth remains strong. In this environment, both monetary debasement hedges and speculative assets like crypto stand to benefit.

Another scenario to monitor is the no landing scenario, marked in yellow. In this situation, growth remains strong, and inflation stabilizes but remains stubborn. We saw this play out in Q2, when rate-sensitive assets underperformed while larger growth stocks continued to rally on earnings strength.

Finally, the red scenario represents the plane taking off again, where inflation accelerates, real growth diminishes, and the Fed resumes tightening. This stagflationary environment should prompt crypto investors to de-risk.

In the near term, we anticipate continued oscillation between hard, soft, and no landing scenarios as markets react to economic data and Fed policy cues.

For now, however, the soft landing seems the most likely path, setting the stage for crypto to perform well.

VIX Lower is Great for Risk, Want to See More Progress on MOVE Index

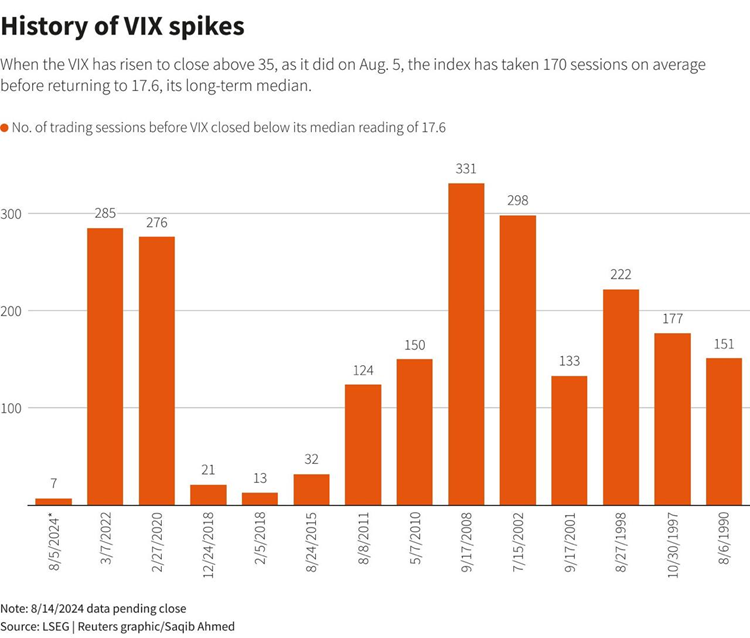

As risk gradually reenters the market, it’s essential to examine key gauges of fear, like the VIX. Last Monday, the VIX spiked above 60, only to retreat sharply to nearly 15 in just a week. This rapid decline in the price of market insurance was unexpected by many market participants.

Typically, a falling VIX bodes well for risk assets, including Bitcoin, as it serves as a reliable signal of improving trader sentiment and positioning. The speed with which the VIX returned to lower levels is particularly remarkable. Historically, every time that the VIX has closed above 35, it has taken an average of 170 trading sessions for it to revert to its long-term median. However, this time, it accomplished that in just 7 trading sessions.

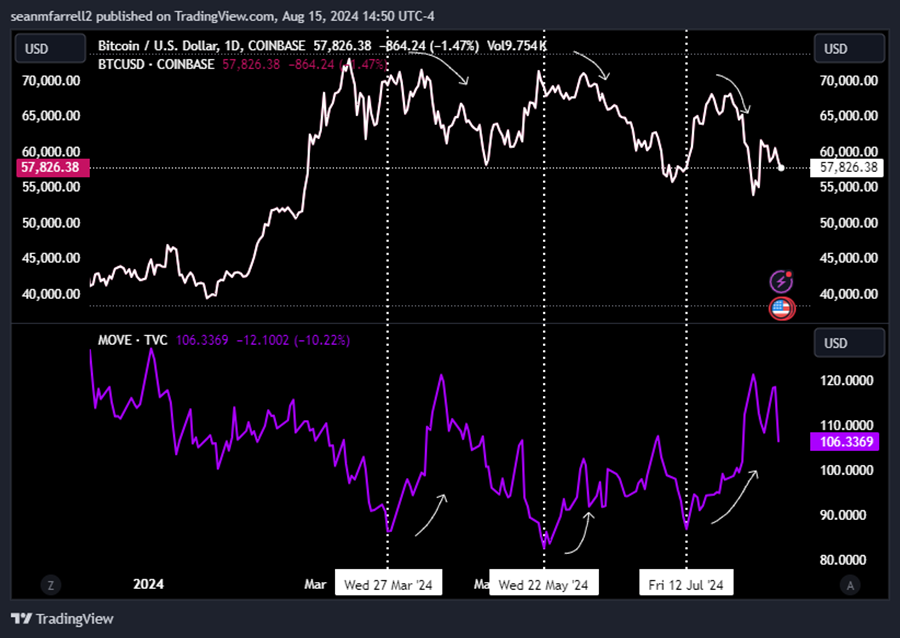

One area where we would like to see further improvement is bond market volatility, as represented by the MOVE index. Lower bond market risk would improve lending conditions, as more stable collateral in the banking system enhances reliability. Over the past year, spikes in the MOVE index have often coincided with Bitcoin price declines, as shown in the chart below. Reducing bond market volatility would create a more favorable environment for risk assets.

Be Cognizant of Seasonal Weakness, But Let Macro Do the Driving

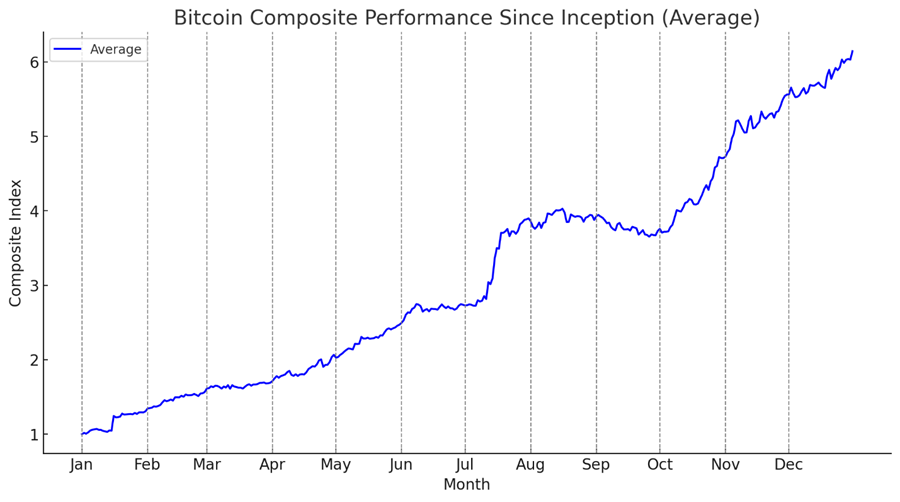

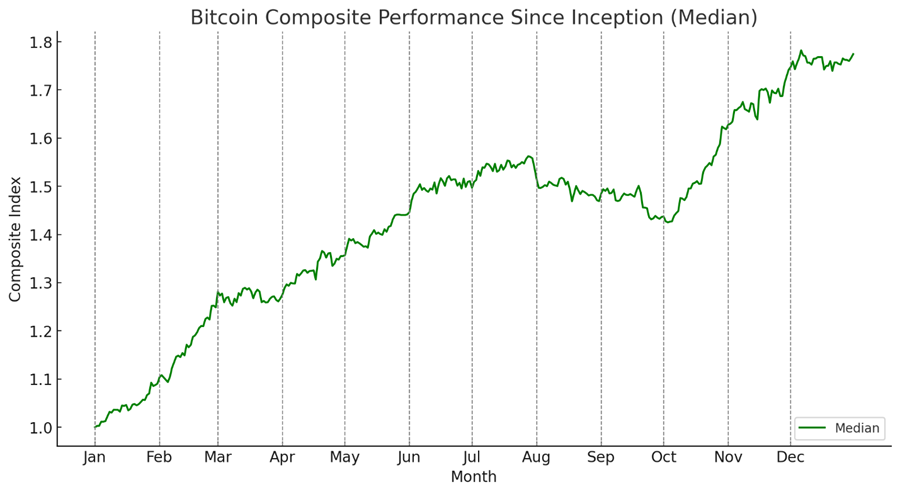

The final topic we would like to address today is seasonality in the crypto market. The common refrain among investors is that Bitcoin tends to perform poorly in the summer months. While this is true to some extent, the data shows that the real period of weakness typically emerges from mid-August through September. Historical seasonality analysis, using the average return per calendar day for Bitcoin, clearly shows a plateau followed by a downward inflection around mid-August.

When we examine the median daily return per calendar day, the downtrend in Bitcoin’s performance from August through September becomes even more pronounced.

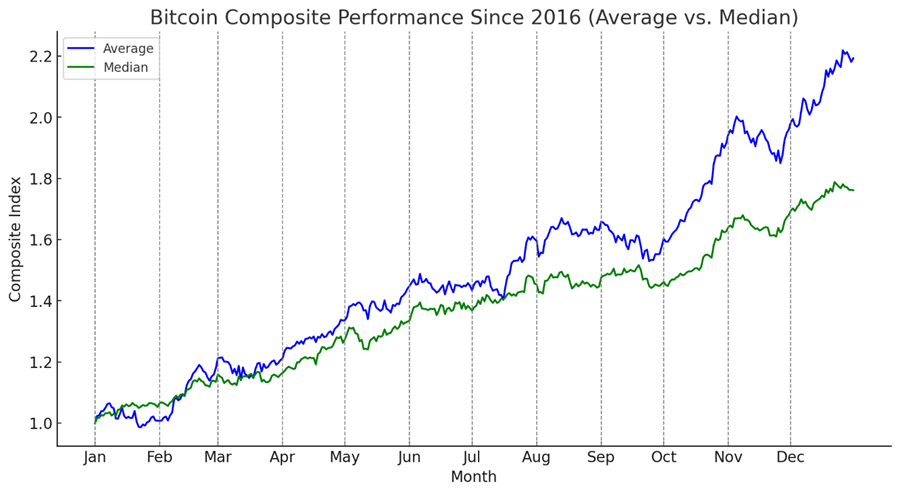

However, it’s important to contextualize these results. Early data, from the years when Bitcoin’s market cap was below $10 billion, may not be as representative of the asset’s behavior in its more mature years. Therefore, we also analyzed composite returns starting from 2016. The findings were consistent with the seasonal trends using data from inception, though August was generally flat in this more recent period.

It’s worth noting that seasonality describes price behaviors tied to the calendar year, often influenced by complex, multifaceted drivers that investors are unable to discern. Given these dynamics, seasonality should never overshadow favorable/unfavorable macro conditions or specific catalysts within the crypto space that could shift the market.

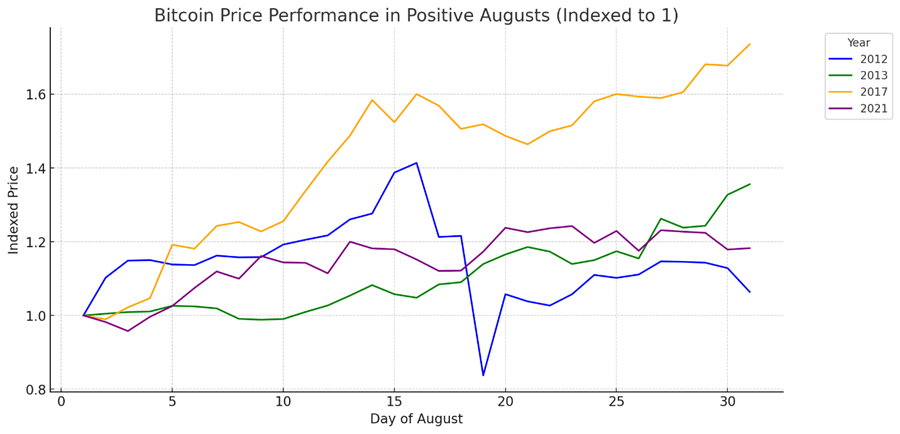

Furthermore, while August and September have historically been challenging months for Bitcoin, there are notable exceptions. For example, in August 2017, Bitcoin surged over 60%, and just last year, Bitcoin had a positive September that eventually led to its rally to all-time highs in March.

In summary, while historical seasonal trends suggest a period of potential weakness from mid-August through September, we still view upside risk as greater than downside risk in the immediate term.

If the market begins to price in a soft landing, we could see renewed buying interest, overriding any seasonal headwinds.

Core Strategy

We are optimistic about the outlook heading into year-end and view a market moving toward a soft landing as constructive for crypto. Our focus remains on the majors, with selective exposure to altcoins, while keeping some dry powder on hand to account for geopolitical and seasonal risks. As a reminder our Core Strategy allocation model is featured at the end of each note along with our crypto equity baskets and trade recommendations.