Raising Some Cash (Core Strategy Rebalance)

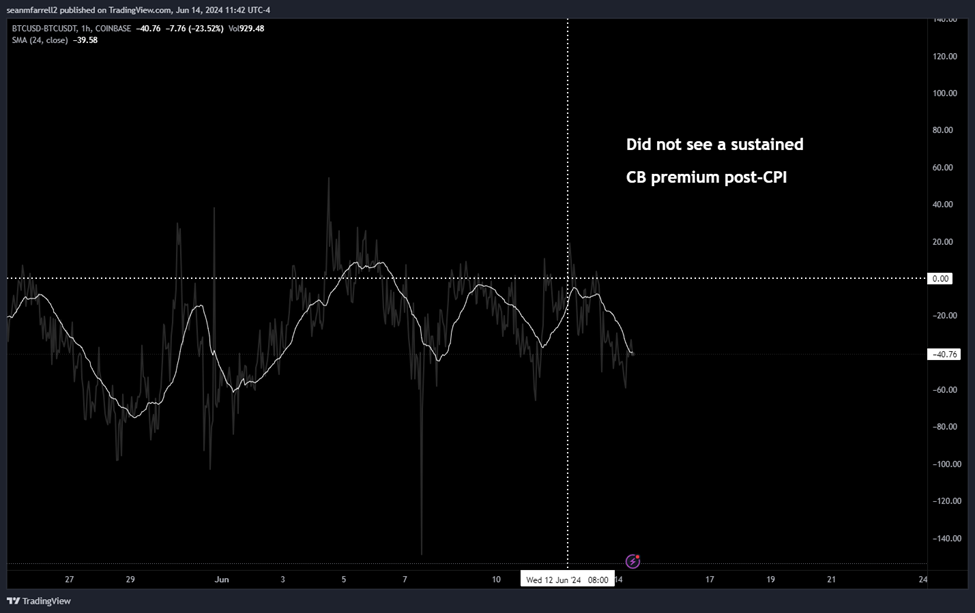

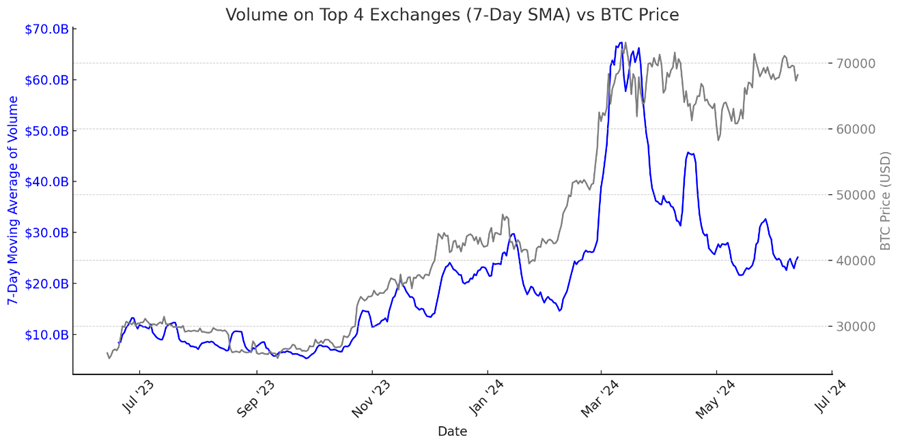

We wrote on Thursday about how the reaction to recent macro data has been quite underwhelming. Crypto broadly rallied in response to a cool CPI number, but indicators such as a muted Coinbase premium and low exchange volumes suggest animal spirits are still lacking. Muted volumes relative to market prices, and low social interest as proxied by Google search trends further evidence a lack of risk appetite in the market.

With the above in mind, we are selling some alts within our core strategy to raise cash and position for a potential dip over the next few weeks. To be clear, this is a more tactical view and is more about risk management than positioning for a prolonged bear market. For those that achieve their crypto exposure via equity markets, this would be a good time for the more tactically minded to take some gains in crypto equities, which have rallied quite impressively as of late.

The Muted Response to Falling Rates

Despite falling rates and rate expectations, we have seen BTC on Coinbase trade at a discount to Binance.

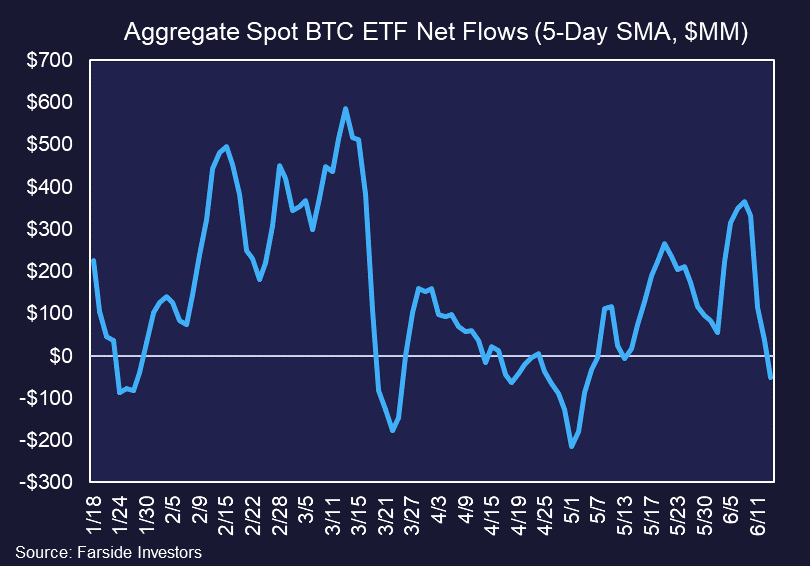

We have also witnessed net outflows over the past 5 days, with over $200 million in net outflows occurring yesterday.

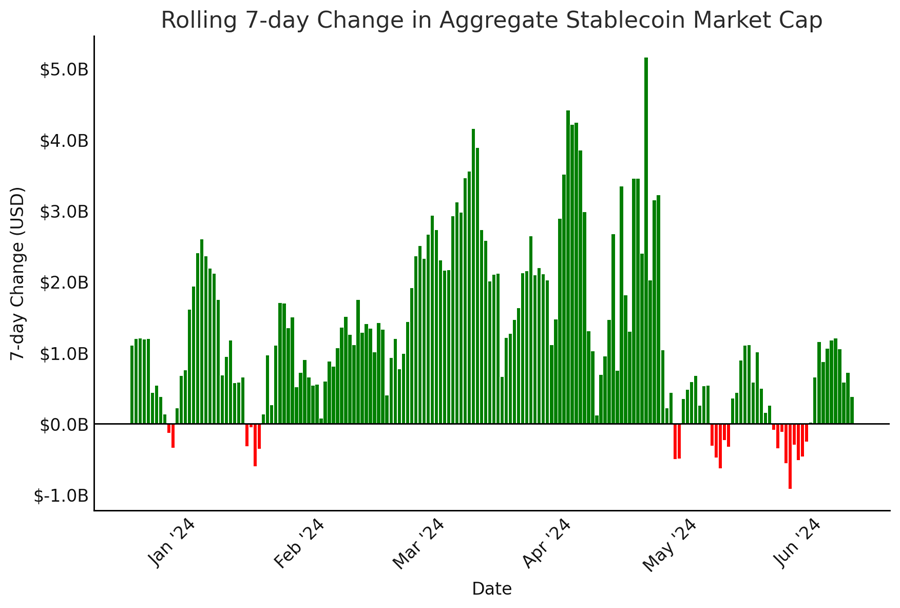

Stablecoins are also showing a net inflow over the past 7 days, but this metric is also trending lower.

Volumes across the major 4 exchanges continue to demonstrate a lack of participation from traders, as volumes are around where they were when BTC was trading in the $40-$50k range.

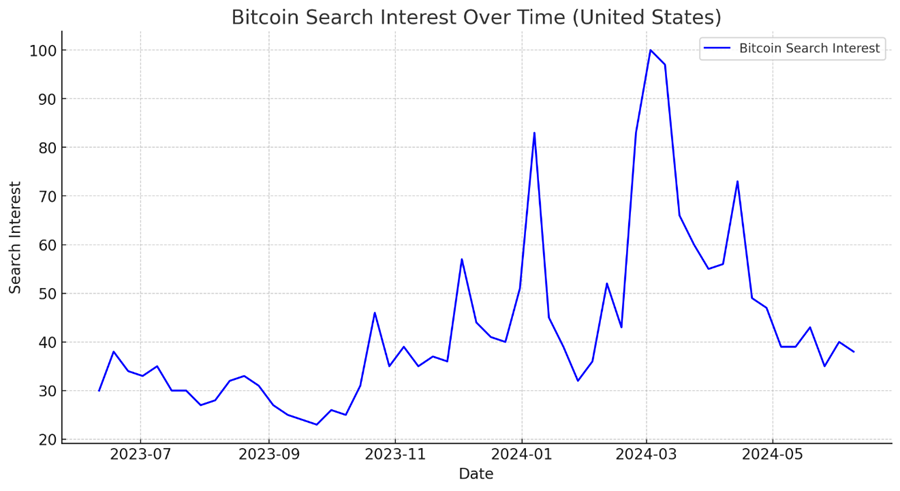

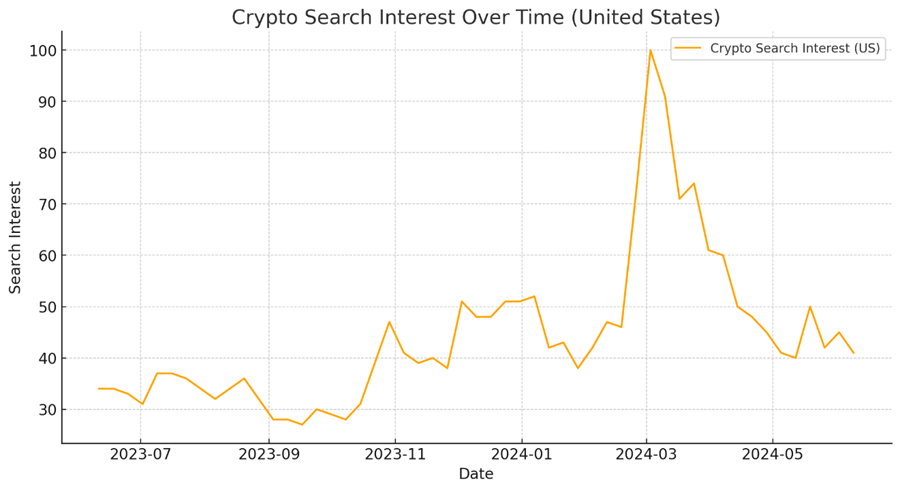

Google search results also demonstrate relative apathy, with searches for both bitcoin and crypto at 6-month lows.

While many are confused, given the rally in QQQ and SPX as of late, it is hard not to look at the lack of breadth in the equity market and conclude that most assets that are farther out on the risk curve that would otherwise be benefiting from lower rates and increased liquidity conditions are not receiving a bid due to the weakening economic data and the relative lack of dovishness from the Fed.

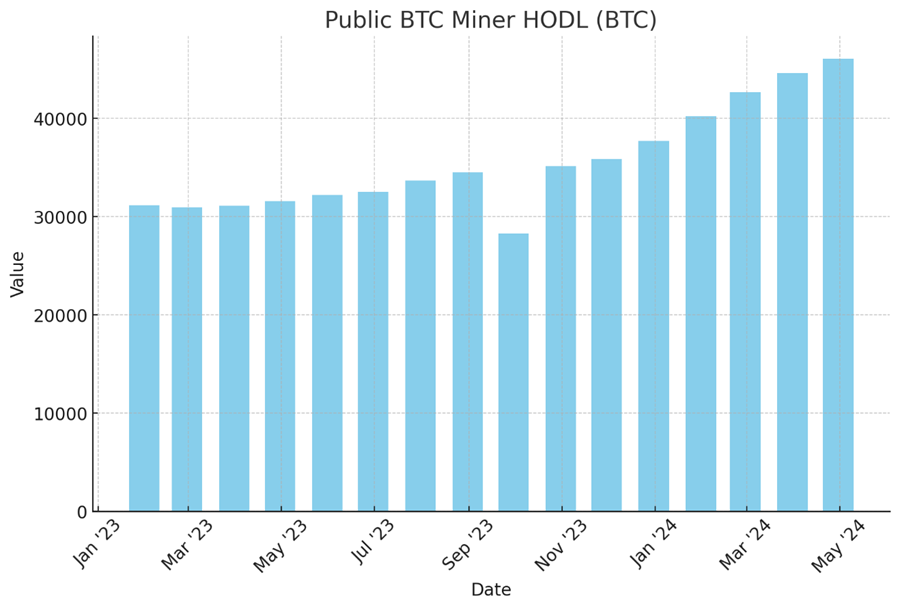

It is also possible that we have a structural seller in miners that, post-halving, are raising cash by selling their BTC held on balance sheet.

While on-chain data does not suggest that this is the case, with BTC balances in mining pools trending pretty steadily downward with no massive transfers to be found, it is possible that these BTC were already transferred to partner custodians a while ago and are being offloaded now. Unfortunately, on this front, we can only speculate, but will find out as miners announce their production results for June next month.