Buyers On Strike, But Leaning Bullish into Next Week

Key Takeaways

- This week is a continuation of last, with the crypto market still undecided on its next big move. We see signs of a buyers’ strike, evidenced by decreasing OI, implied volatilities, and ETF inflows.

- Our base case remains that next week the Treasury will favor bills vs coupons in its QRA, and that the Fed will taper QT. This has led us to adopt the mantra – Buy in May and Go Away.

- The recovery of memecoins since the deleveraging event a couple of weeks ago suggests that they will have staying power this cycle. We consider memecoins to be call options (without expiry) on speculative flows increasing.

- It appears that Mt. Gox is finally preparing to distribute approximately 138k BTC and 143k BCH to creditors, potentially by late May or early June. We currently discount the magnitude of this risk to BTC due to the seasoned nature of Gox claimants. That said, BCH is likely a name to avoid.

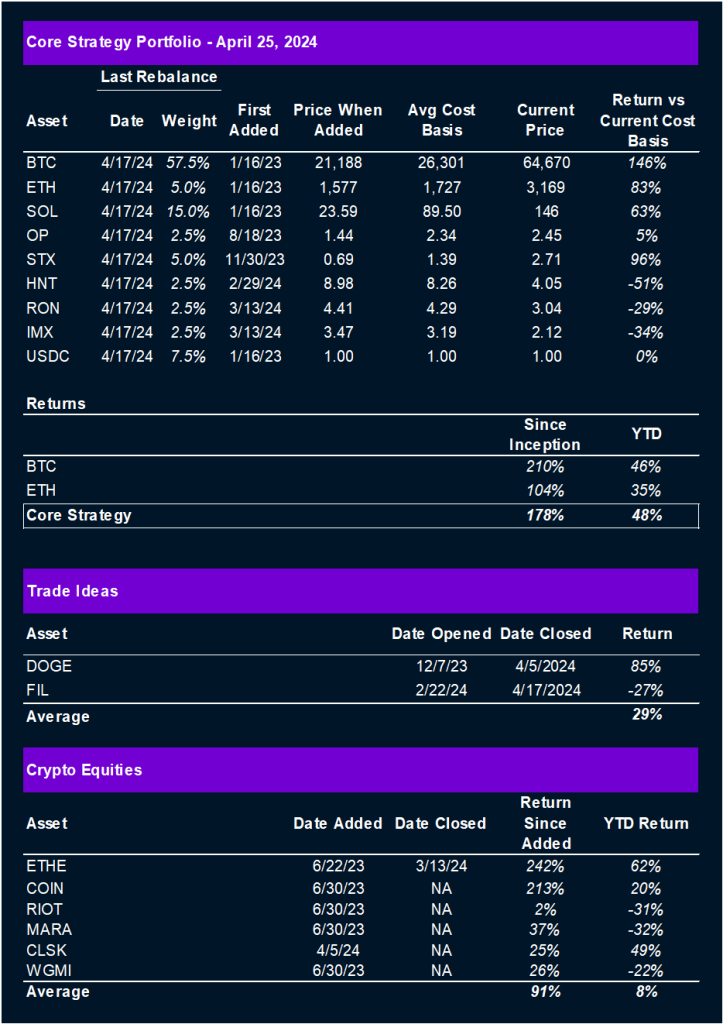

- Core Strategy – Over the intermediate/long-term, recent weakness will prove to be a great buying opportunity. We think it is right for investors to view the QRA and FOMC meeting at month-end to be a potential turning point for crypto markets. As a reminder, performance and changes to the Core Strategy are detailed at the end of every strategy note.

Buyers On Strike

Last week, we discussed our immediate-term cautious approach to the crypto market, highlighting recent geopolitical tensions, tax-related selling, negative fiscal flows, and the persistent rise in real yields as reasons for a more risk-averse positioning (albeit relative, as holding 7.5% in cash and the rest in crypto is hardly considered risk-averse in most circles). This uncertainty has persisted into this week, evidenced by what we consider an apparent “buyer’s strike.”

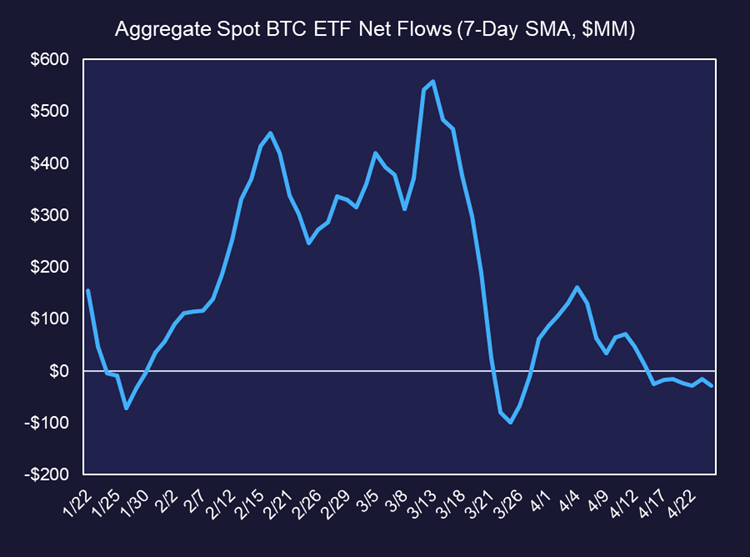

One of the clearest indicators of this buyers’ strike is the 7-day moving average in ETF flows, which has turned slightly negative.

Additionally, there has been a decline in CME open interest and average trade size, suggesting that larger, institutional market participation has waned in the past couple of weeks.

Also, the apparent drawdown in implied volatility, as demonstrated by the Bitcoin Volmex Implied Volatility Index (BVIV), suggests a lot of selling of volatility, meaning that most traders are expecting both upside and downside to be capped in the near-term.

This does not necessarily indicate a strong long-term bias in either direction. Rather, as we outlined last week, we believe the market is in a wait-and-see mode for next week when the Fed meets and announces its latest thoughts on monetary policy, and the Treasury releases its quarterly refunding announcement, which details the amount and composition of funding sources for the rest of this quarter and next.

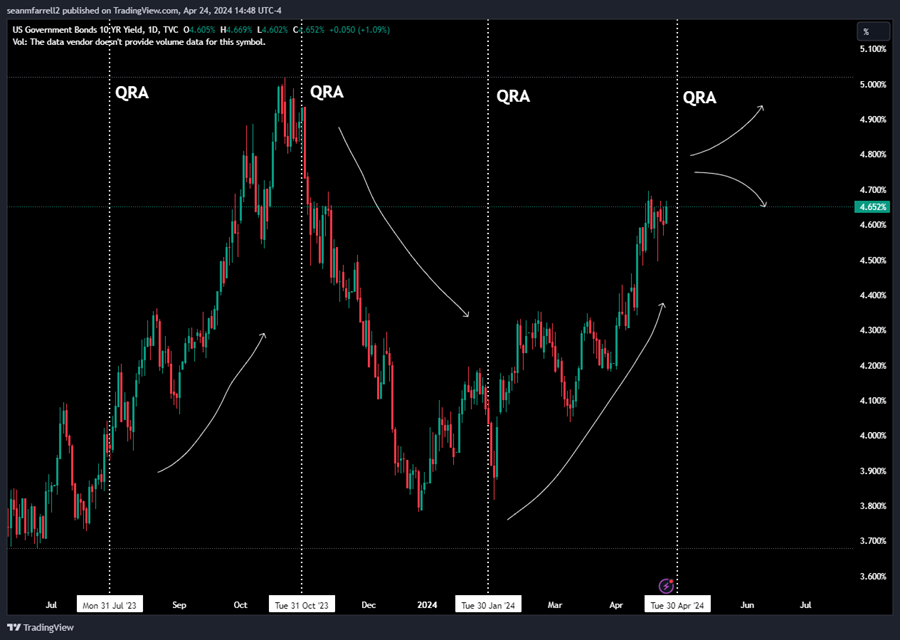

As you can see below, in the age of fiscal dominance, the QRA has had a notable influence on the broader trend for interest rates and risk assets in general.

Reiteration of “Buy in May and Go Away” Thesis

To reiterate our base case for next week, we think that the actions taken by the Fed and Treasury will smooth out bond and equity market volatility, which should create positive downstream effects for crypto.

To summarize our thoughts:

- Given the probable short-term fiscal surplus this quarter (tax revenues greater than expenditures) and a strong economy, we think that the Treasury is likely to issue a higher proportion of bills versus coupons relative to current market expectations. This is particularly likely given it’s an election year, and there may be a push to lower long rates into Q3. More bills are beneficial for liquidity-sensitive assets since they are net neutral to banking reserves, preferred by money market funds (MMFs) currently leveraging the overnight rate in the RRP. If the Treasury issues more bills, the capital tied up in the RRP will likely shift to purchasing these bills, keeping banking reserves stable. Conversely, issuing more coupons than anticipated could temporarily reduce banking reserves, impacting market liquidity.

- The RRP has recently served as a benchmark for ample reserves in the banking system. With an anticipated increase in bill issuance drawing liquidity from the RRP, the Fed is likely to want to avoid any hiccups in the banking system that could offset all of the work they have done to reduce the size of the Fed balance sheet to date. Both the freezing of the repo market in 2019 and the bank runs of 2023 are likely still etched in the Fed’s memory. Consequently, we think that the Fed will decide to taper quantitative tightening at the next FOMC.

- The Fed is also expected to maintain a patient stance on inflation data, indicating that while rate cuts are not imminent, they are not expected to raise rates either.

These outcomes are certainly speculative, and any one of these variables could flip in the opposite direction, but we think the fact pattern over the past 12-18 months supports this view. The wildcard remains the election year’s impact on policy decisions, with the Treasury potentially aiming to stabilize rates and market volatility.

With these considerations, our mantra in the near-term weeks is: “Buy in May and go away.”

More on the QRA

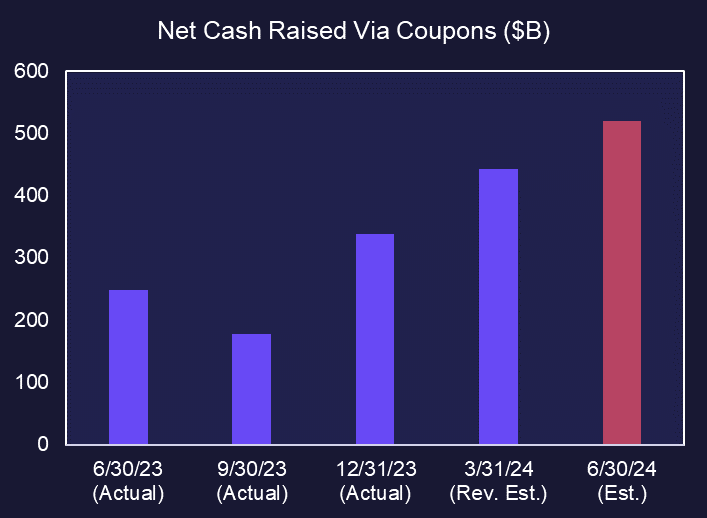

To delve a little deeper into the QRA, below we can see how the net cash raised via coupons has continued to increase over the past few months. This added supply, in our view, is a major contributor to the upward pressure on yields that we have continued to see throughout the YTD period.

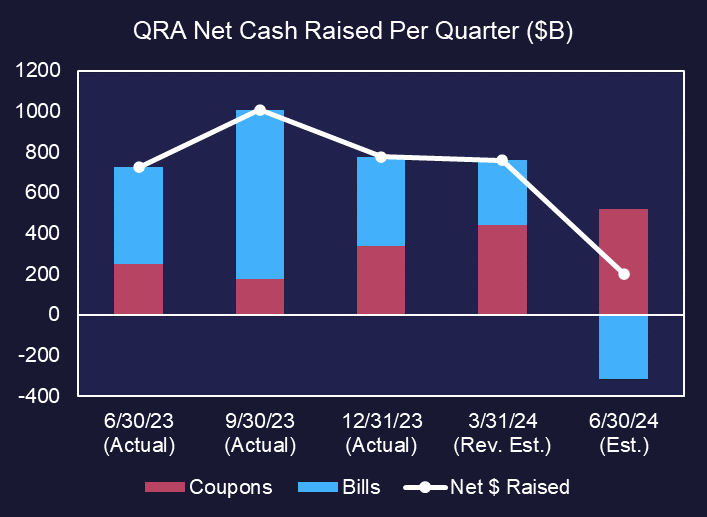

Below is another perspective as to why the last QRA was bullish for the dollar and bearish for bonds. The projected net cash to be raised in Q2 was only around $200 billion, but the issuance for this quarter was heavily skewed towards coupons, with net cash raised via coupons at over $500 billion offset by the retirement of over $300 billion in short-dated bills (remember, more coupons is bad for market liquidity and risk assets, all else being equal).

The obvious question now is – how will we know if the QRA favors lower rates and a lower DXY? Broadly speaking, it will be if the Treasury reduces their overall issuance of coupons for the rest of this quarter and next. We think it would look something like this.

However, instead of us pretending to know the precise amount of supply that the market has priced in, we think it will be important to watch the market’s reaction post-QRA and FOMC to see how rates, the dollar, and risk assets broadly perform.

Some Additional Thoughts on Memes

Memes are a hotly debated topic in crypto-native circles. There is little debate that they are highly speculative in nature, and most lack any real semblance of an underlying use case. There are quasi-exceptions to this lack of utility—DOGE was once a preferred currency for tipping on the internet, and BONK, the culture coin of Solana, is integrated with several applications, such as the Telegram trading bot, BonkBot. However, some memecoins are simply dogs with hats.

Overall, we consider memecoins to be largely pure call options on speculative flows without expiry. This is how we have always viewed them, hence our tactical trade recommendation for DOGE back toward the end of Q1. This week, there was an interesting report from Bloomberg, which covered the warm embrace that memecoins have found in the arms of legitimate hedge funds. Historically, funds have left memecoins to retail speculators, since articulating a thesis behind a memecoin to LPs is admittedly tough. However, we have witnessed three identifiable cycles in crypto (four including the current one), and each cycle has featured an explosive rally in memecoins. This has prompted many to skip the progression down the risk curve and head straight for the most speculative assets, adopting somewhat of a barbell strategy.

It would seem that the bull case for memecoins is still intact, despite their pullback with the broader altcoin market a couple of weeks ago, as evidenced by their strong rebound post-deleveraging. Below, we note that over the past week, four out of the top ten performers among coins with over a $500 million market cap are memecoins.

We shouldn’t legitimize memecoins more than they deserve, but we also shouldn’t ignore the clear signals the market is sending us. People enjoy speculating and gambling, and unlike most of the SPACs that went public in 2021, there is no pretense among investors that these are safe investments.

There was a question posed in our webinar on Tuesday concerning why we would be bullish on Solana, given the level of memecoin speculation happening on that chain. Well, for starters, there are serious products being built on Solana (see Stripe’s latest stablecoin payment presentation).

But also, the proliferation of memecoins on Solana highlights some of the chain’s important features, such as its low costs and better user experience, which have led to rapid capital formation and, yes, speculation.

We bring this up to say that adding a memecoin to one’s portfolio, or putting on a memecoin trade, doesn’t make one an unserious investor. It means you understand that humans have an innate propensity to gamble, and that the broader monetary and fiscal conditions over the past couple of decades have pulled this gambling on-chain, and that a continuation of this behavior is, in many ways, inevitable.

Gox Coins Could Cause Some Short-Lived Fear

Mt. Gox, a defunct crypto exchange that collapsed in 2014 due to a hack, is preparing to distribute approximately 138k BTC and 143k BCH to creditors. This equates to over $68 million in BCH and $8.6 billion in BTC. Recent updates in the Mt. Gox claim filing system suggest that these payouts could occur sooner than the previously set deadline of October 31st. Creditors who opted for the cash payout had their claims updated on the website in mid-March, and according to sources, the payouts were rendered just this past week.

It appears that creditors set to be paid in BTC and BCH had their claims updated this week, suggesting that, if the in-kind payouts follow the same timeline, we could see this supply hitting the market in late May or early June. This raises the question of whether this is a headwind for prices, as 138k BTC equates to roughly 20% of daily volume across all exchanges. Given that we are still mid-cycle and those receiving their BTC in-kind have been in the market for a very long time (high conviction, long-term investors) and the funds that purchased BTC claims are likely hedged, we think the selling pressure from these coins will be less than many anticipate. It is likely that the market will catch wind of the distributions, traders will pull back some risk, and prices will squeeze higher, repeating this process until the market overcomes its fears.

Further, market participants with such large holdings do not typically log onto platforms like Coinbase and market sell large orders all at once, they do so in a more orderly and professional manner that will get them the best price. Thus, there are many reasons to discount the magnitude of this risk.

It’s also worth noting that since the ETFs went live, GBTC has seen $17 billion in redemptions, which, due to the current cash create and redeem mechanism, always results in the sale of BTC. However, there have been impressive inflows into other ETFs that have offset this selling pressure. If we eventually break higher out of the $60-$70k range that we are currently in, we are likely to see flows start to recover, also mitigating any implicit risk from the Gox coins.

On the other hand, BCH is likely a coin to avoid, and if one wants to make a risk-managed bet in a post-Gox world, longing the BTC/BCH pair is likely to yield positive returns, in our view.

Core Strategy

Over the intermediate/long-term, recent weakness will prove to be a great buying opportunity. We think it is right for investors to view the QRA and FOMC meeting at month-end to be a potential turning point for crypto markets.

A brief summary of the theses behind each component of the Core Strategy/Active Trades:

- Bitcoin (BTC): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include the halving (April 2024).

- Ethereum (ETH): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights.

- Solana (SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light.

- Optimism (OP): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. Offers beta exposure to ETH.

- Stacks (STX): A bet on the development of a bitcoin economy. Key catalysts include the bitcoin halving and the Nakamoto upgrade in Q1 2024.

- Helium (HNT): DePIN is an emerging theme in crypto that we think is bound to make waves in traditional markets. Helium is a leader in this category and has shown signs of early traction in its 5G product. Helium also adds Solana beta to the portfolio.

- Immutable X (IMX) & Ronin (RON): Both networks have displayed impressive traction and are poised to be the category leaders among crypto gaming platforms. As appendages of the ETH ecosystem, they also offer a different flavor of ETH beta.