Buy in May and Go Away (Core Strategy Rebalance)

Key Takeaways

- The recent market drawdown, driven by geopolitical tension, tax-related selling, and surges in real yields, has altered our view on the immediate-term risk/reward (measured in weeks), necessitating a more deliberate approach to the market.

- Given the surge in long rates, and a likely fiscal surplus this quarter from tax receipts, we expect the Treasury to favor bills vs coupons in the next QRA. An increase in bill issuance could lead the Federal Reserve to perceive a reduction in the RRP as a risk to the banking system, prompting them to taper QT. This leads us to adopt the mantra – Buy in May and Go Away.

- There are reasons beyond the halving to be excited about BTC. Among them include several L2 launches, the Nakamoto upgrade on Stacks, and the introduction of the Runes Protocol, all likely to spur on-chain activity and capital flows over the next few quarters.

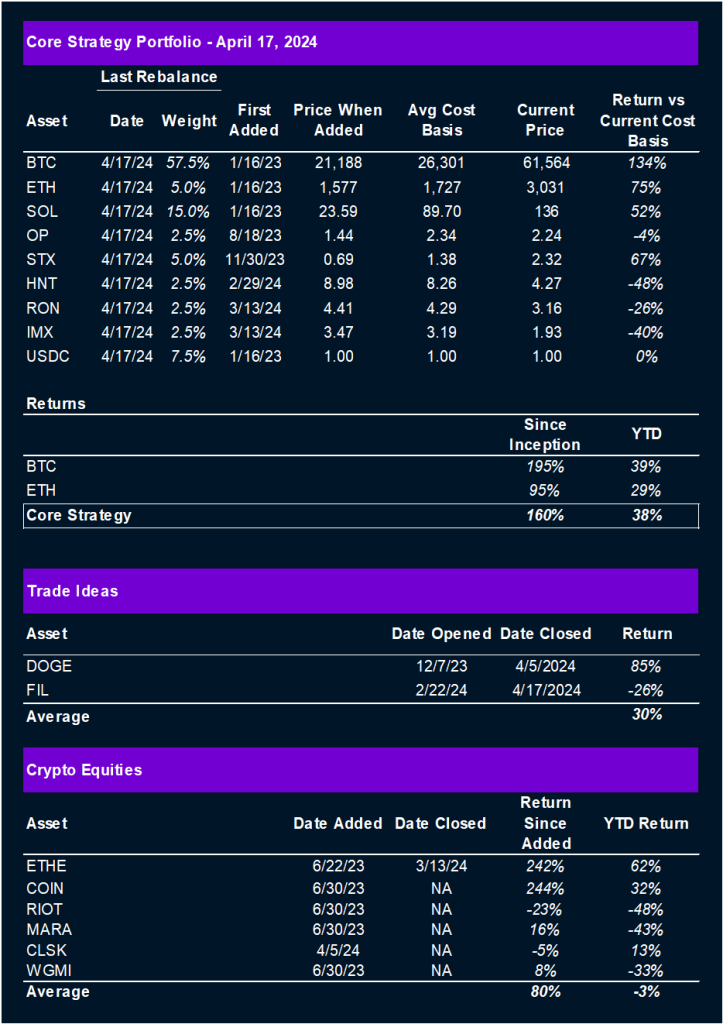

- Trade Update: Following significant disruptions and uncertainties around Filecoin, particularly with the STFIL protocol issues, we are closing our active FIL trade.

- Core Strategy: Over the intermediate/long-term, this recent weakness will prove to be a great buying opportunity. However, given the near-term uncertainties discussed in this note, we recommend increasing the proportion of BTC relative to altcoins in the Core Strategy portfolio (anticipating a rise in BTC dominance). Additionally, we advise reallocating a portion of our underperforming altcoins into stablecoins (ETH, HNT). We think it is right for investors to view the QRA and FOMC meeting at month-end to be a potential turning point for crypto markets. As a reminder, changes to the Core Strategy are detailed at the end of every strategy note.

No Shortage of Uncertainty

We generally refrain from overly frequent adjustments to our allocation strategy. However, recent developments have shifted the immediate-term risk/reward balance for our Core Strategy, necessitating a relatively more cautious approach. Based on our analysis below, we also have a good idea for when the market will find a more stable footing.

The DXY has rallied significantly, and the long end of the yield curve has experienced a persistent steepening amidst rising inflation expectations and consistent supply of coupon issuance from the treasury. This past weekend was particularly detrimental to the crypto market, influenced by a confluence of factors:

- Geopolitical tensions

- Tax-related selling and reduced fiscal flows (with tax payments to the treasury exceeding disbursements into the private sector)

- A persistent rise in the US 10-year Treasury yield, driven by strong growth figures (e.g., retail sales exceeding consensus) and inflation expectations

This combination has resulted in a significant drawdown, certainly reminiscent of mid-cycle drawdowns in previous bull markets, yet notable in its magnitude, with many longer-tail assets erasing a month or two of gains within days.

The sell-off, coupled with ongoing uncertainty around geopolitics and the inflation/growth narrative, leaves the market in a precarious position over the near term.

This is evident in the options market, where the skew indicates significant premiums for put options as traders hedge or speculate on the downside.

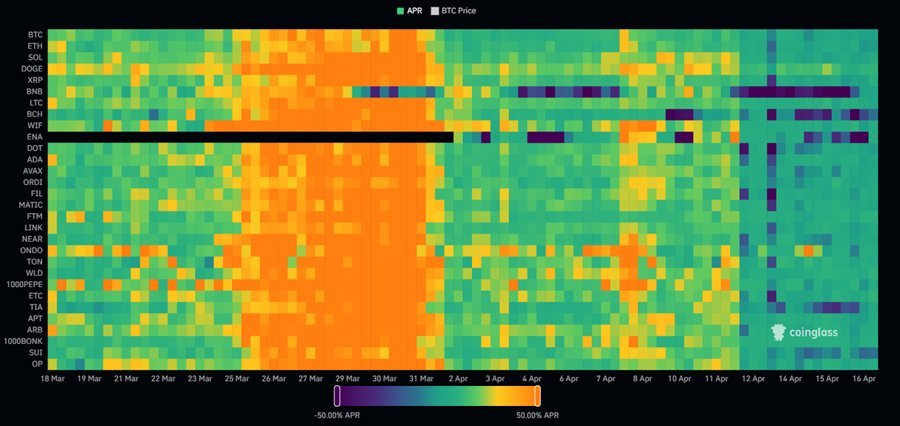

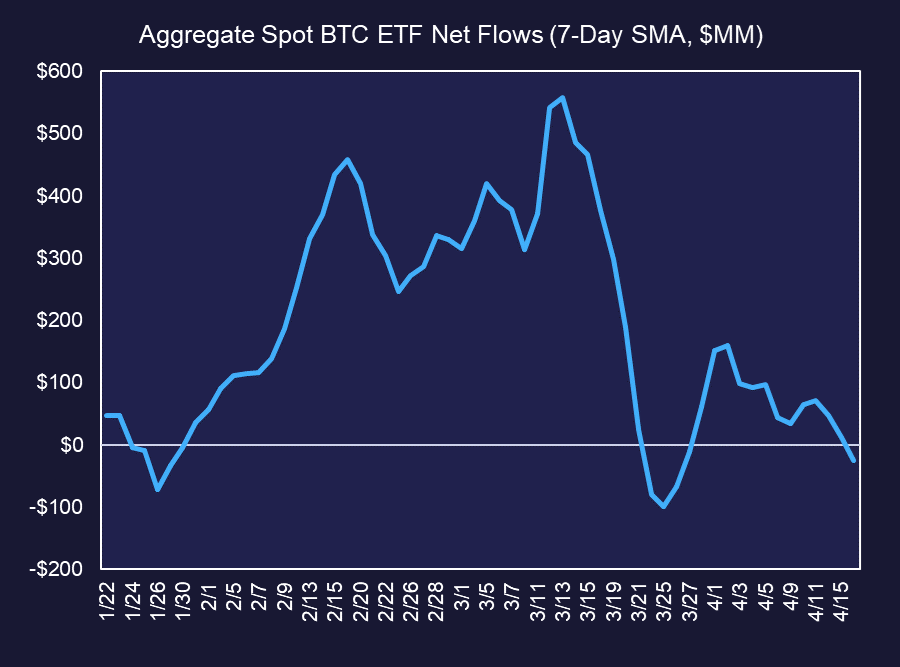

Additionally, funding rates in the futures market remain subdued, and flows into ETFs have stalled, with the 7-day moving average for ETF flows approximately at breakeven.

Market uncertainty is rampant. The spike in volatility in bond and equity markets is likely impacting the crypto markets, as de-risking in one area affects the entire risk curve. Despite our belief that real rates will decrease, and the broader trend for market liquidity is still moving higher, the market is clearly apprehensive about rates, inflation, and this is exacerbated by the reduced fiscal flows that we discussed above.

There are potential catalysts that could restore confidence in the near term. A resolution to ongoing global conflict and positive inflation data could support the market. However, predicting these developments is challenging, and significant inflation data is not expected in the coming weeks.

The Gameplan

Looking ahead to the end of this month, we anticipate the next material development to be when the FOMC meets, and the treasury outlines its funding needs at the end of April. We believe the following outcomes from these events are probable:

- Given the fiscal surplus this quarter (tax revenues greater than expenditures) and a strong economy, the treasury is likely to issue a higher proportion of bills versus coupons. This is particularly likely given it’s an election year, and there may be a push to lower long rates into Q3. More bills are beneficial for liquidity-sensitive assets since they are net neutral to banking reserves, preferred by MMFs currently leveraging the overnight rate in the RRP. If the treasury issues more bills, the capital tied up in the RRP will likely shift to purchasing these bills, keeping banking reserves stable. Conversely, issuing more coupons than anticipated could temporarily reduce banking reserves, impacting market liquidity.

- With an anticipated increase in bill issuance drawing liquidity from the RRP, the Fed may interpret this as a reduction in excess reserves. Consequently, the Fed might taper its quantitative tightening as the RRP balances decrease, to avoid any hiccups in the banking system. Both the freezing of the repo market in 2019 and the bank runs of 2023 are still etched in the Fed’s memory.

- The Fed is also expected to maintain a patient stance on inflation data, indicating that while rate cuts are not imminent, they are not expected to raise rates either. Fed Chair Powell reiterated this stance just yesterday.

These outcomes are certainly speculative, and any one of these variables could flip in the opposite direction, but we think the fact pattern over the past 12-18 months supports this view. The wildcard remains the election year’s impact on policy decisions, with the treasury potentially aiming to stabilize rates and market volatility.

With these considerations, our mantra for the next 3-4 weeks is: “Buy in May and go away.”

Core Strategy Updates

Regarding our Core Strategy, we believe it is prudent to make some adjustments in the short term due to potential ongoing weakness in altcoins. We are increasing our allocation to BTC, maintaining our position in BTC Layer 2 STX, reducing our relative exposure to ETH, and introducing some stablecoin exposure.

Beyond the notable strength in Bitcoin dominance, bolstered by the introduction of spot ETFs, there are additional reasons for optimism about Bitcoin in the near term.

The upcoming Bitcoin halving is expected to attract attention, though we do not view it as a short-term tradable event (refer to our note from last week). A significant development in the near term will be the growth of DeFi on Bitcoin post-halving. Following the halving, the Runes Protocol is set to launch. Developed by Casey Rodarmor, Runes introduces a new fungible token standard for the Bitcoin network, allowing users to create and trade tokens directly within Bitcoin’s transaction outputs. This protocol leverages Bitcoin’s security and infrastructure to provide a streamlined and secure framework for token management, akin to Ethereum’s ERC-20 but optimized for Bitcoin.

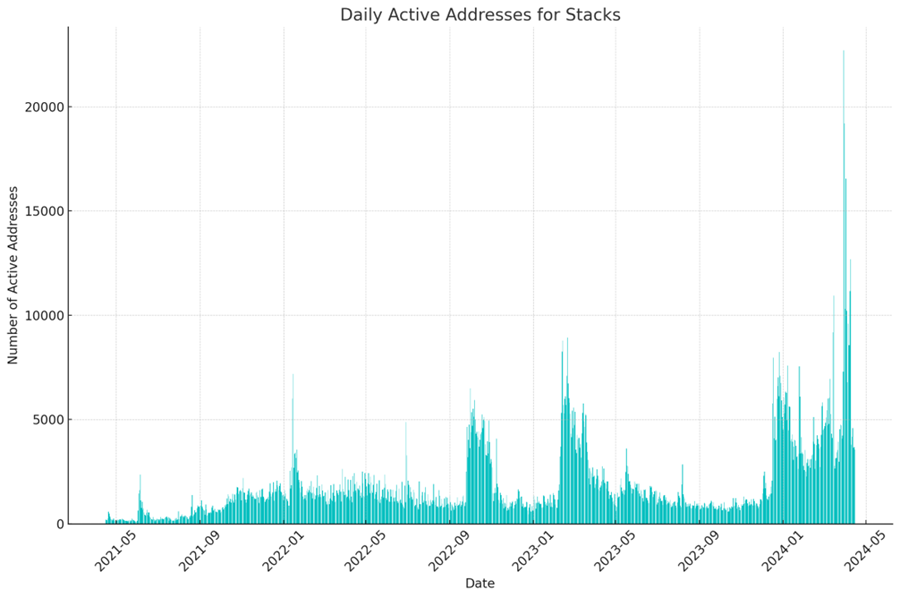

Moreover, the next few quarters are likely to see the rise of Layer-2 solutions on Bitcoin, with a key milestone being the Nakamoto upgrade on Stacks, scheduled to be completed by late May. Stacks, Bitcoin’s Layer-2 network, will begin this upgrade next week, aiming to enhance integration with Bitcoin and introduce parallel processing. This enables Stacks miners to produce multiple blocks in the time it takes for a single Bitcoin block to be mined, roughly every 10 minutes.

This emergence of activity on BTC is likely to keep in front and center in the minds and pockets of crypto investors.

Closing the Filecoin Trade

Recent developments around Filecoin, including the detention of core team members involved with the Filecoin Liquid Staking (STFIL) protocol in China, have raised significant concerns. These disruptions, resulting from unauthorized transactions and upgrades, led to the loss of $23 million in FIL tokens.

While there are clearly more questions than answers as it pertains to this controversy, one of our reasons for being tactically long FIL was the emergence of DeFi on Filecoin and the increasing demand for liquid staking.

Given the decreasing TVL in FIL terms, the controversy surrounding one of the liquid staking protocols, and with the near-term macro backdrop, we think its right to take our medicine on this trade and potentially revisit at a later date when the macro setup is better and Filecoin DeFi momentum returns.

Core Strategy

Over the intermediate/long-term, this recent weakness will prove to be a great buying opportunity. However, given the near-term uncertainties discussed in this note, we recommend increasing the proportion of BTC relative to altcoins in the Core Strategy portfolio (anticipating a rise in BTC dominance). Additionally, we advise reallocating a portion of our underperforming altcoins into stablecoins (ETH, HNT). We think it is right for investors to view the QRA and FOMC meeting at month-end to be a potential turning point for crypto markets.

A brief summary of the theses behind each component of the Core Strategy/Active Trades:

- Bitcoin (BTC): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include the halving (April 2024).

- Ethereum (ETH): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights.

- Solana (SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light.

- Optimism (OP): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. Offers beta exposure to ETH.

- Stacks (STX): A bet on the development of a bitcoin economy. Key catalysts include the bitcoin halving and the Nakamoto upgrade in Q1 2024.

- Helium (HNT): DePIN is an emerging theme in crypto that we think is bound to make waves in traditional markets. Helium is a leader in this category and has shown signs of early traction in its 5G product. Helium also adds Solana beta to the portfolio.

- Immutable X (IMX) & Ronin (RON): Both networks have displayed impressive traction and are poised to be the category leaders among crypto gaming platforms. As appendages of the ETH ecosystem, they also offer a different flavor of ETH beta.