RESEND: Bitcoin ETF Equilibrium Price Dynamics: ETF likely to drive significant rise in daily demand

Mar 1, 2024

• 2

Min Read

Author

BY POPULAR DEMAND, WE ARE RE-SENDING THIS BITCOIN PRICE IMPACT OF SPOT ETF REPORT FROM July 24, 2023

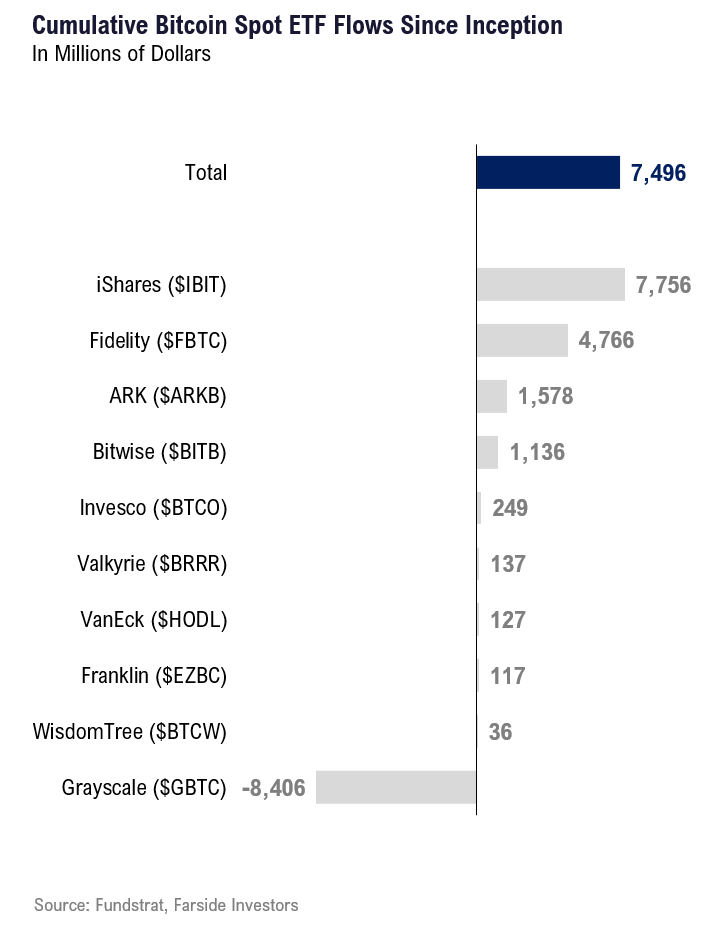

The Bitcoin spot ETF was finally approved. And we are seeing the surge in price of Bitcoin because of attractive supply and demand dynamics.

- We received multiple requests to resend this report from July 24, 2023 which looked at supply and demand dynamics if a spot ETF was approved.

- In short, we believe a spot ETF would create a sizable surge in demand relative to supply (block rewards to miners) and the resulting clearing price for BTC -0.34% could eventually reach at least $140,000.

To view the original report and deck on Bitcoin ETF equilibrium price dynamics from 7/24/2023, please click here.

Below is the executive summary of the July 24th report:

Executive Summary

- Bitcoin ETF could finally get approved. Sean Farrell sees the “Blackrock effect” making this far more likely today.

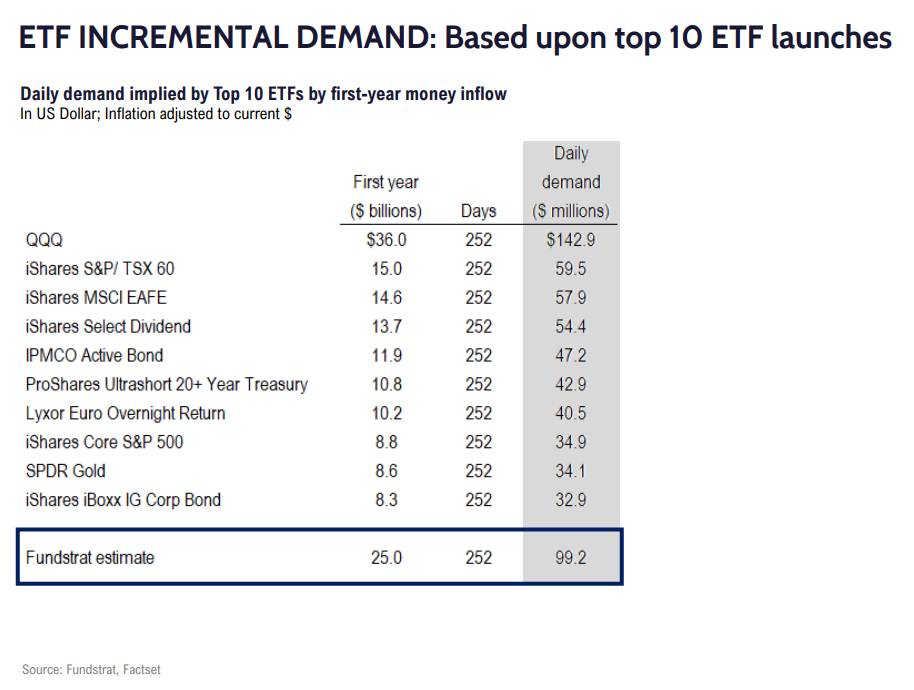

- Bitcoin ETF likely one of the largest ever launches. Precious metals ETF > $225 billion. Grayscale, largest asset manager of crypto has $18 billion of Bitcoin AUM.

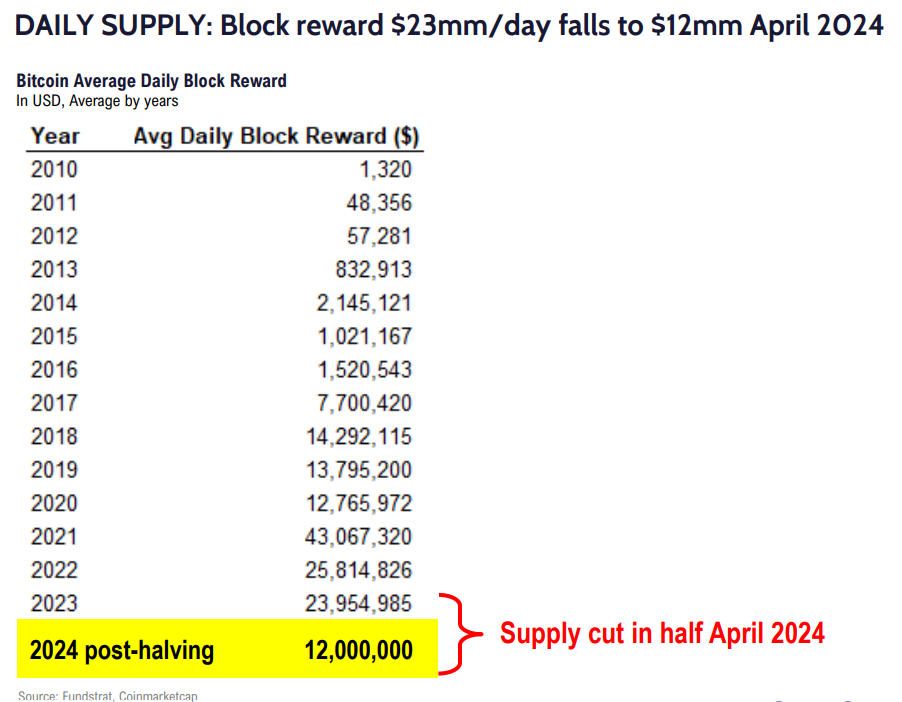

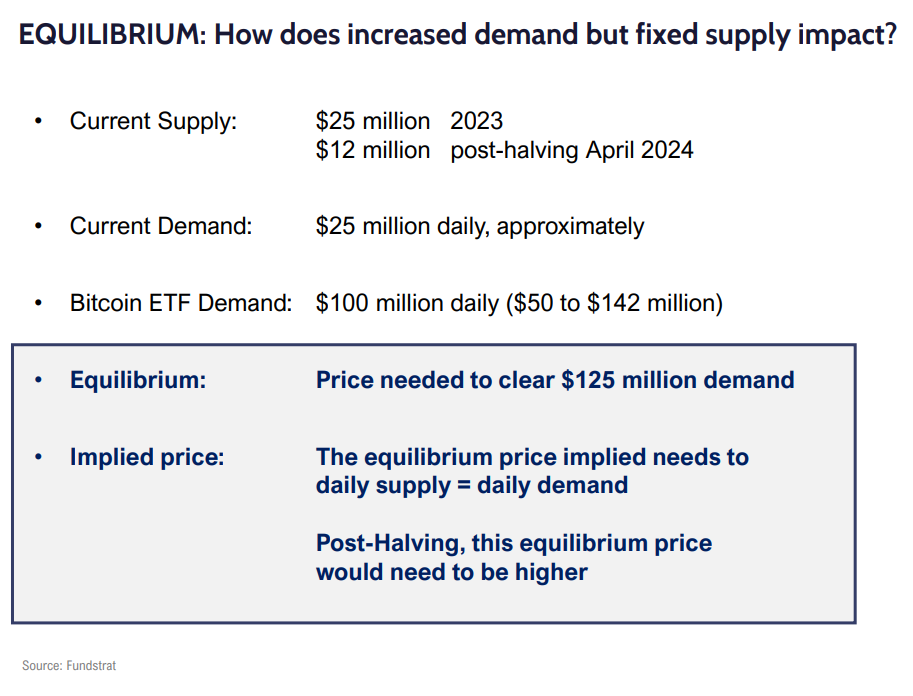

- Current bitcoin market is in balance with $25 million in daily block rewards and $25 billion in daily demand.

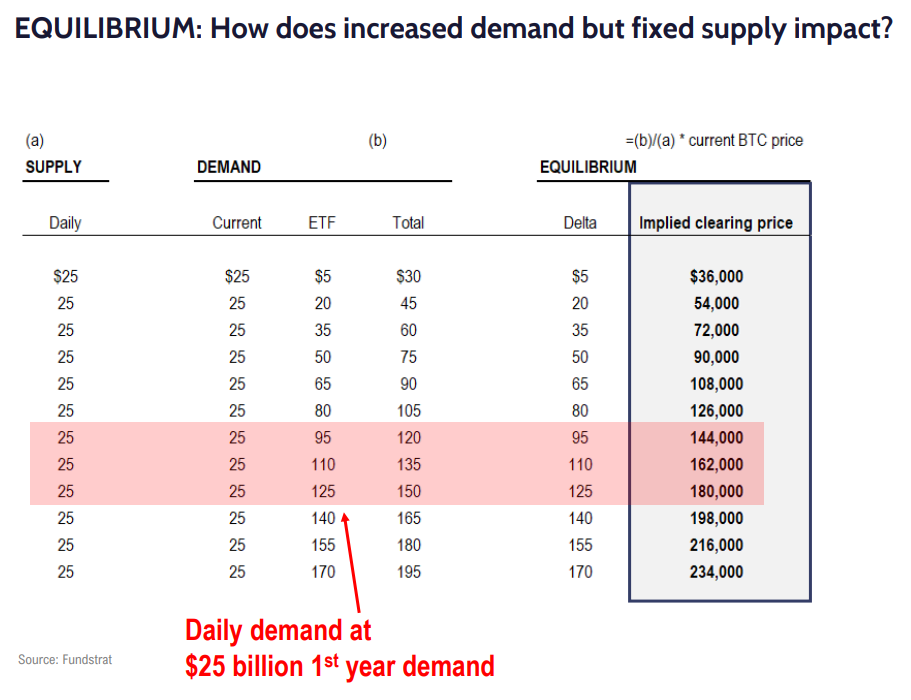

- INCREMENTAL ETF DEMAND: Sean believes $25 billion of demand is possible in the first year. This is $100 million in daily demand.

- This would bring daily demand to $125 million, while daily supply is only $25 million. The implied equilibrium price would need to rise so daily supply matches daily demand. Equilibrium analysis suggests that a clearing price is $140,000 to $180,000, before the April 2024 halvening.

- Generally, this idea of higher equilibrium price is consistent Sean Farrell estimates of flow multiplier for Bitcoin of 4X-5X.