Adjusting to a Post-FTX World

Key Takeaways

- We have gained some distance from the FTX implosion and have likely seen most of the forced selling and collateral damage. However, the outcome of DCG remains a critical unknown.

- A persistent discount to NAV tells us that few market participants have wagered on the possible dissolution of Grayscale.

- The market looks quite different post-FTX. We examine volumes, capital flows, and investor positioning.

- Some short-term correlations to macro returned this week, but the jury is still out on how strong this relationship will be in the near term.

- Our base case is that most forced selling is over, but investors might not be compensated for the market risk incurred in the immediate term. However, we speak to a few cyclical data points that support the thesis that this is an excellent time for longer-term investors to start allocating.

Adjusting to a Post-FTX World

A couple of weeks ago, we discussed several critical risk vectors remaining in the market and provided our take on each matter. Our near-term view was that it was more likely than not that most of the contagion from the implosion of FTX had been sifted through, but due to the unknown status of Digital Currency Group, investors might not be getting paid enough for any risk assumed in the immediate term. Fast forward to today, and we are still waiting for a resolution to the DCG saga. We offer a brief update on DCG below, but for the most part, we discuss the shape of the market nearly a month removed from the downfall of FTX.

Everyone Had the Same Idea

We were not the only ones who took a less active approach to the market over the past couple of weeks. Following the exit of one of the largest market makers in crypto and the freezing of billions in customer deposits in FTX, we have understandably witnessed markets become devoid of volume.

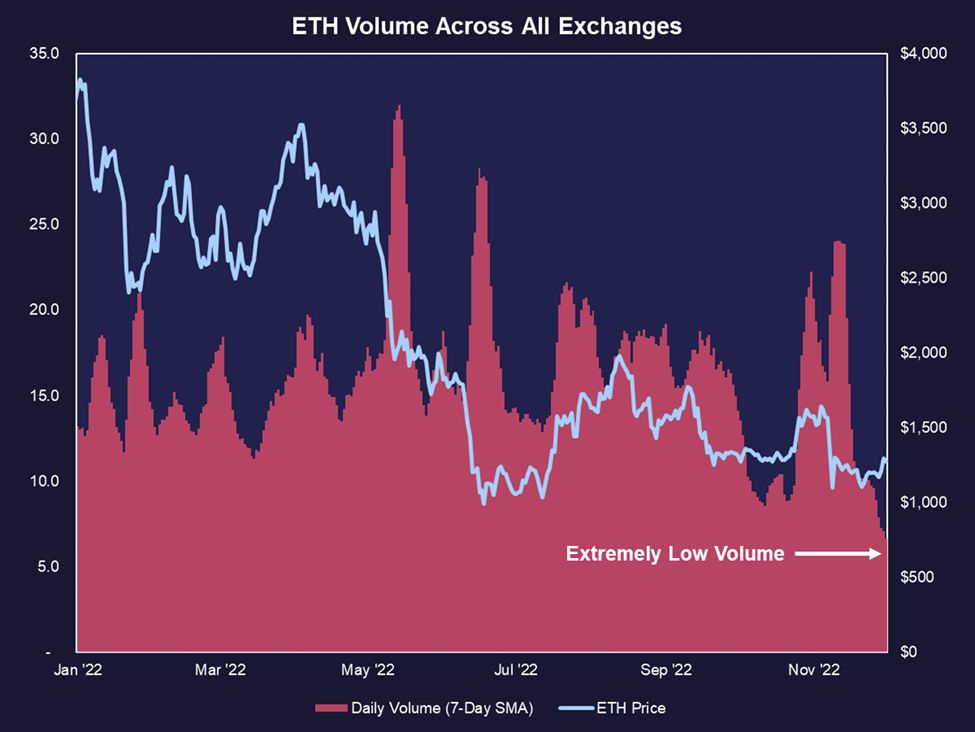

Below we can see that the 7-day moving average for ETH 0.98% volume across all exchanges is at its lowest in recent history. While some of this inactivity could be attributed to the holiday last week, the primary driver is likely a lack of participation due to uncertainty and the recent incineration of investor capital.

As a side note, we are using ETH volumes as a proxy for the entire crypto market due to a particular nuance with bitcoin volume data. Since July, Binance has not charged users fees for trading bitcoin. Thus the data is somewhat inconsistent over the preceding 12 months.

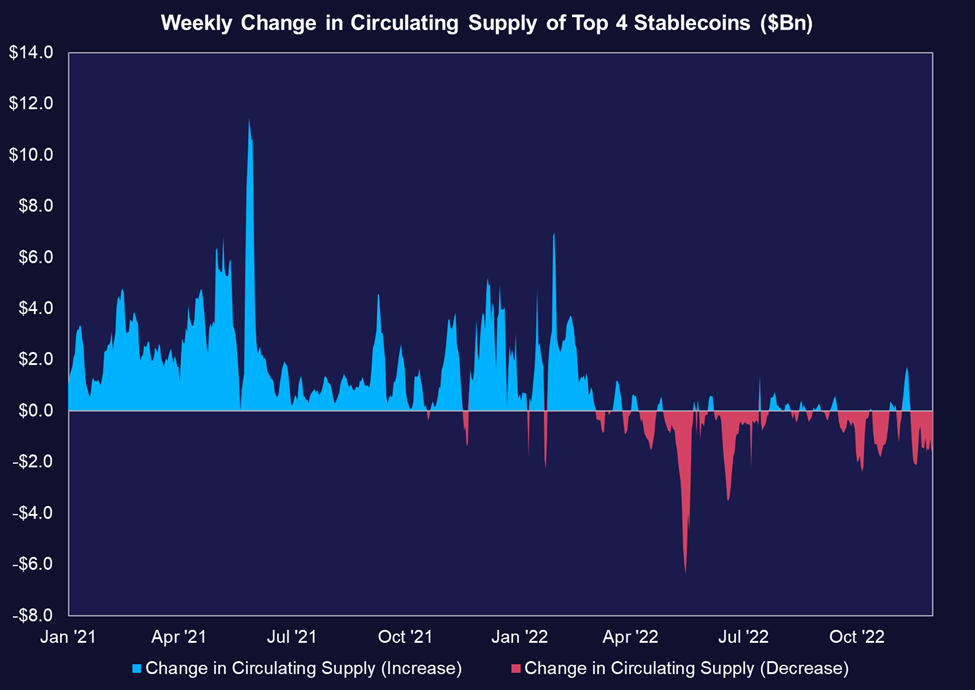

We also see capital continue to exit the space. Below we view the relative capital flows into and out of the top four stablecoins by circulating supply (USDT, USDC, DAI, BUSD). When there is more demand for dollars to enter the crypto ecosystem, more stablecoins are minted than burned. Conversely, when investors are moving back to their regulated bank accounts from the crypto ecosystem, we see more stablecoins being burned than minted, meaning that dollars are moving back to legacy markets. The chart below maps out the weekly changes in the circulating supply of stablecoins and indicates a continued exodus of capital.

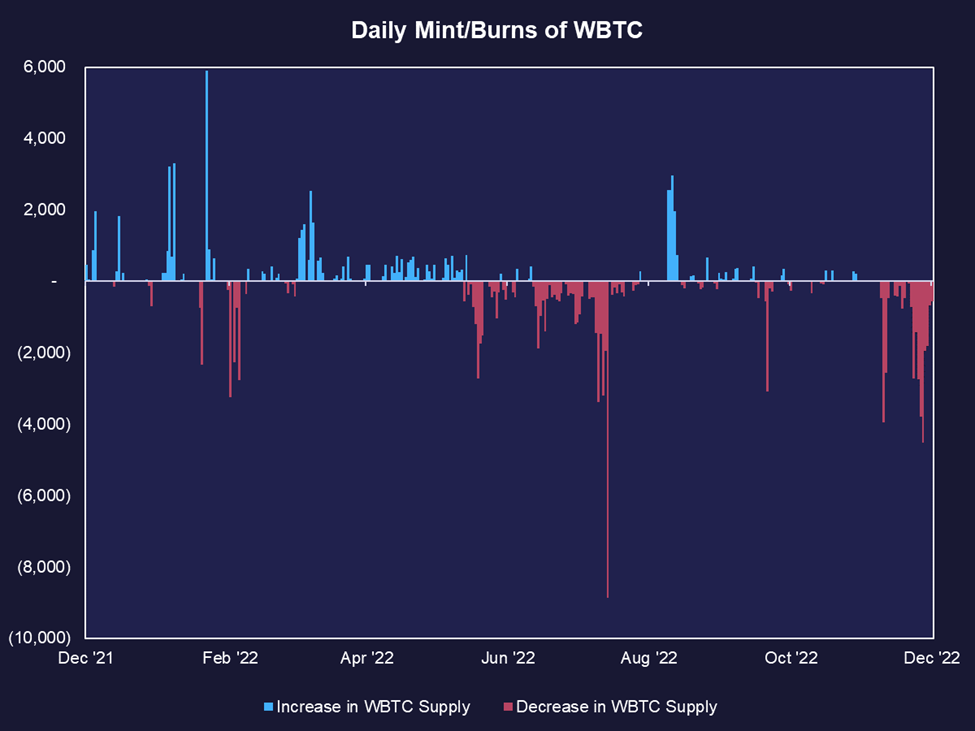

There remains less of an appetite for leverage in DeFi. As the appetite for borrowing on-chain has decreased, as has the need to port bitcoin to Ethereum to use as collateral in certain DeFi applications. The chart below displays the daily mints and burns of wrapped bitcoin (WBTC). This wrapped bitcoin is an ERC20 token created (minted) when users custody their bitcoin with BitGo. This token is then usable throughout the Ethereum ecosystem and is permanently redeemable (able to be burned) for one bitcoin, thus allowing it to maintain its peg. The net WBTC burned in recent days indicates a strong desire to remove bitcoin collateral from existing DeFi applications.

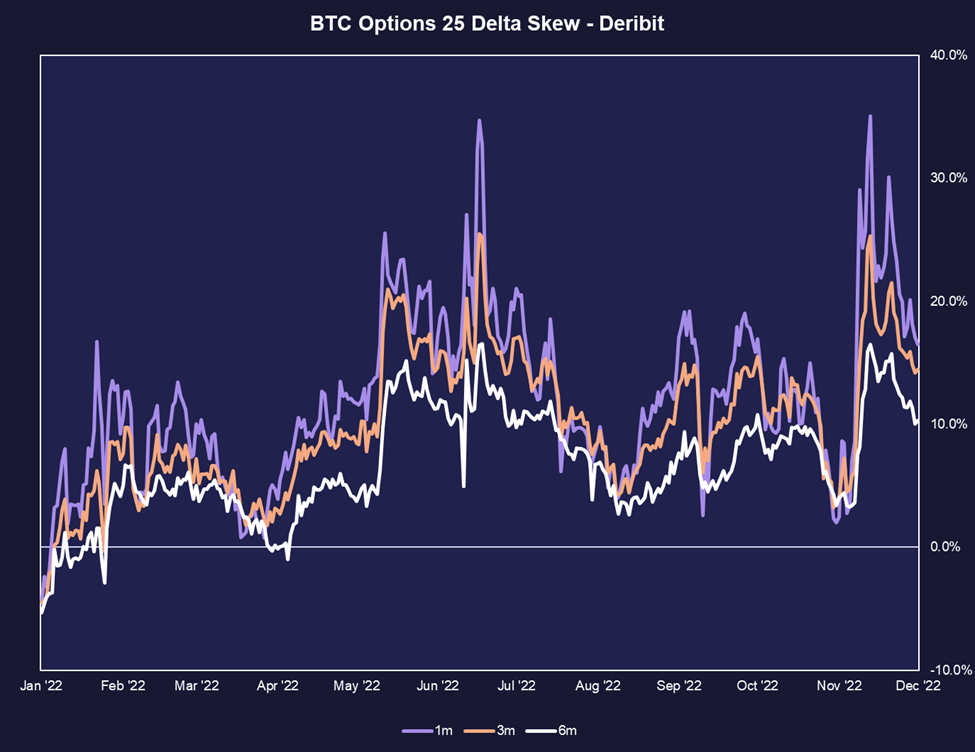

Investors are positioned cautiously. With the dust still clearing regarding DCG, downside protection/speculation appears to be in greater relative demand than the opposite. Below we see that the implied volatility of puts is still substantially greater than calls, indicating a higher level of demand for puts. The skew of bitcoin options is undoubtedly much lower than where it was at the start of the FTX fiasco but remains substantially elevated.

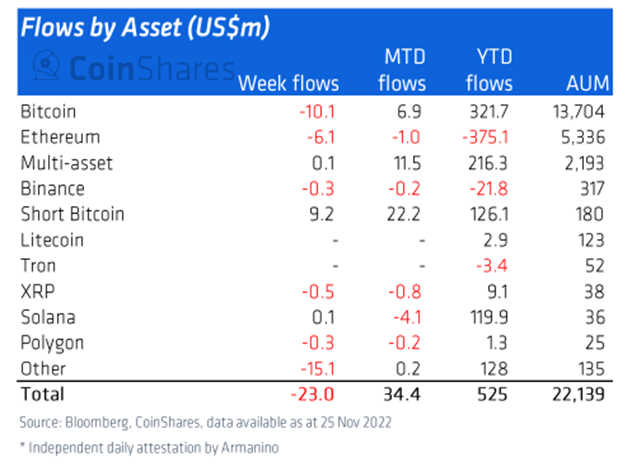

The skew data dovetails with fund flow data compiled below. This chart provides the net flows for popular ETPs, mutual funds, and OTC trusts for different digital assets. Last week, we witnessed outflows across most types of digital asset funds, except for inflows into short bitcoin strategies.

Paying Close Attention to Macro Correlations

The rapid ascent of the crypto industry to a global market cap once exceeding $3 trillion meant a regime change. It was no longer an uncorrelated asset for cypherpunks and idealists but rather a high-beta risk asset for cypherpunks and hedge funds alike.

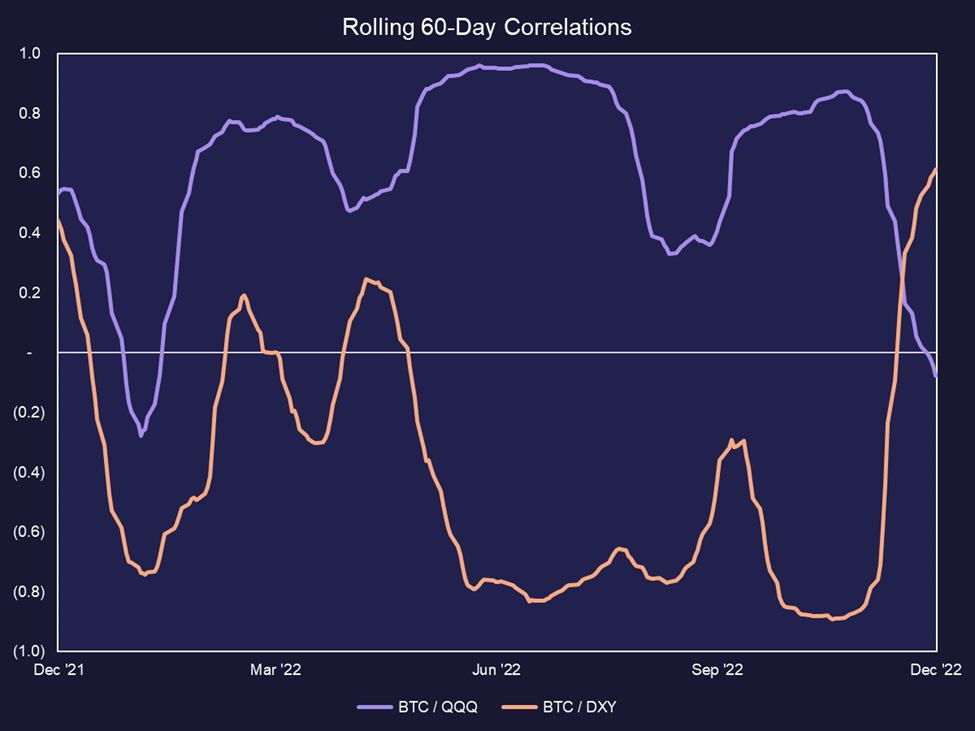

The destruction caused by FTX obviously sent crypto on its own short-term path counter to a rallying equities market. Below, we see how sharply rolling 60-day correlations to the Nasdaq and the DXY reversed at the start of November.

Now we are left with an important question – with the total market cap of crypto much lower (less accessible for traditional hedge funds) and, overall, less activity across the entire landscape, how will crypto’s relationship with macro variables look over the next few months?

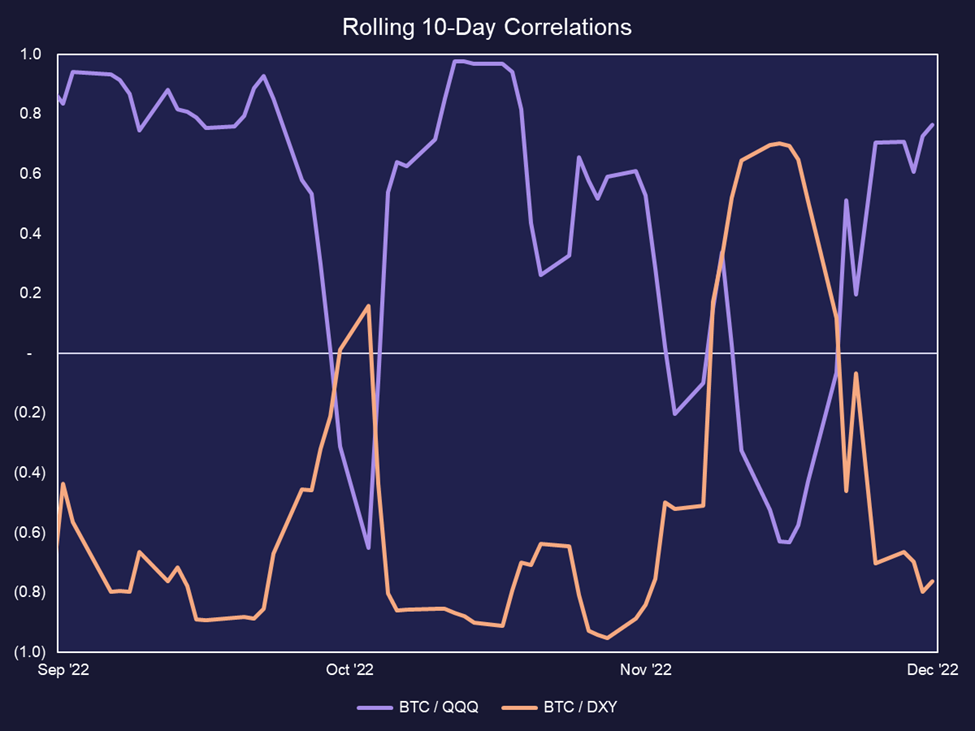

Well, market behavior this week suggests that there is still a relationship between macro and crypto. Below we see that rolling 10-day correlations displayed a sharp reversion to the prevailing correlative trends between bitcoin, tech, and the US dollar. We will continue to monitor the strength of these relationships going forward.

A Longer-Term Perspective

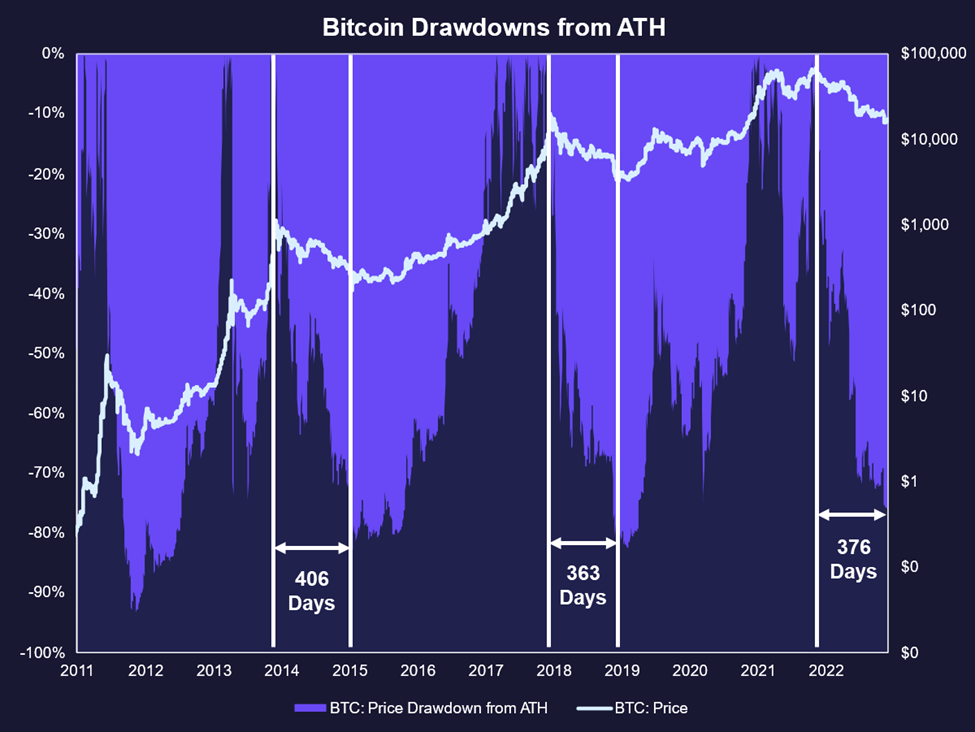

While this remains an unpredictable market, we wanted to provide a pair of charts that offer an encouraging perspective and should give those with investment time horizons of more than a few months confidence in deploying capital at these levels. While this bear market has seemed particularly bloody, this perception has more to do with the increased size and scope of the industry. Crypto has trickled further into the mainstream consciousness, and as a result, things seem more dire than historical bear markets. From a cyclical perspective, this bear market is quite similar and less severe than prior bear markets on some measures.

Viewing this through a bitcoin lens, we see below that the duration of the current bear market, from the previous all-time high to the most recent cycle low on November 21st, is comparable to the length of drawdowns in prior bear markets. The magnitude of this drawdown thus far is 77%, which is less than, but in the same ballpark as, previous drawdowns of 84% in 2018 and 85% in 2015.

The takeaway is that we have been here before, and things looked similarly bleak in prior cycle downturns. However, these price levels turned out to be longer-term generational buying opportunities.

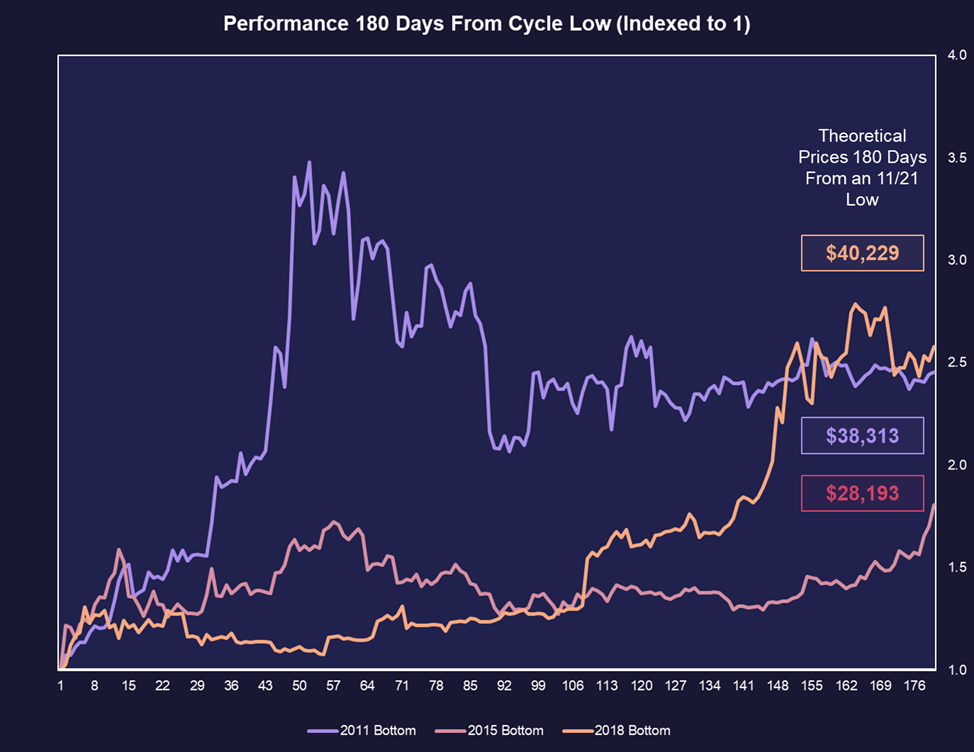

Another essential aspect to note as it relates to prior bitcoin cycles is how quickly prices bounced off cycle lows. Below we show bitcoin price action (indexed to 1) following each cyclical trough, with theoretical prices at 180 days following the low of 11/21. These are by no means price predictions but rather examples of how, despite persistent negative market sentiment in prior bear markets, bitcoin could still produce impressive returns in short order.

A Quick Note on GBTC

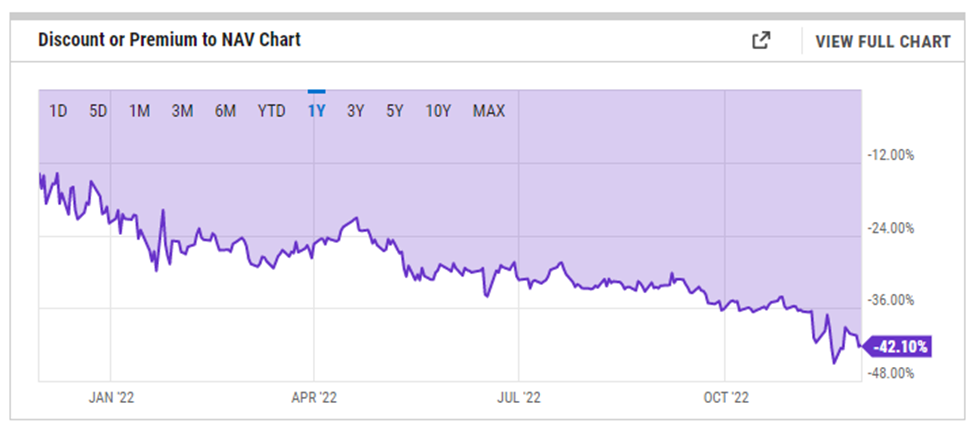

One piece of market data we cited as a possible canary in the coal mine for DCG was the discount to NAV for Grayscale’s Bitcoin Trust. Presumably, everyone working on securing financing for DCG is under NDA, but practically, we can reasonably expect that if dissolution were a viable option on the table, prominent market participants would catch wind of this.

Consequently, we would likely see a solid appetite for harvesting the spread between the prevailing market price and NAV. Traders would go long the GBTC 0.86% and short spot bitcoin, profiting from a convergence of the two, regardless of the direction that spot BTC 0.84% heads. The chart below suggests that the market has not considered this a serious option for the company.

We are still waiting to learn more about the fate of DCG and do not want to wade into too granular of analysis without in-depth knowledge of DCG financials. However, one interesting tidbit from DCG CEO Barry Silbert’s note to shareholders last week is the current makeup of the equity cap table. According to Silbert, the company has only raised $25 million in primary equity capital since its inception. That is both remarkable and promising for a restructuring. With presumably consolidated ownership, it is reasonable to think that the company could work out a deal for an equity infusion, perhaps coupled with a partial debt restructuring to put the company on better footing.