Looking For Contagion

Key Takeaways

- Given the events of the past couple of weeks, we dove deeper into a few of the critical risk vectors remaining in the market, some of which present a greater risk to market prices than others.

- Risks considered, in no particular order, include (1) cascading liquidations from overall leverage in the crypto economy, (2) forced selling from unprofitable miners with sizeable debt service costs, (3) a Tether implosion, (4) a MicroStrategy margin call, and (5) a failure for DCG to obtain a capital injection.

- While steady price action in the face of continuous bad news is encouraging, we do not find it appropriate to be too aggressive with buy orders just yet. However, depending on the details that emerge from the reported DCG capital raise, we could find ourselves on the other side of this contagion as early as next week.

Note: We are resending Friday’s crypto weekly to include some resources pertaining to unsecured creditors in the FTX bankruptcy case.

Mapping Possible Contagion

Recently, we have discussed the risk of further drawdowns from the fallout from FTX as the reason for not being too aggressive at these admittedly favorable long-term entry levels. In this week’s note, we wanted to further unpack a few areas of the market where contagion could be lurking.

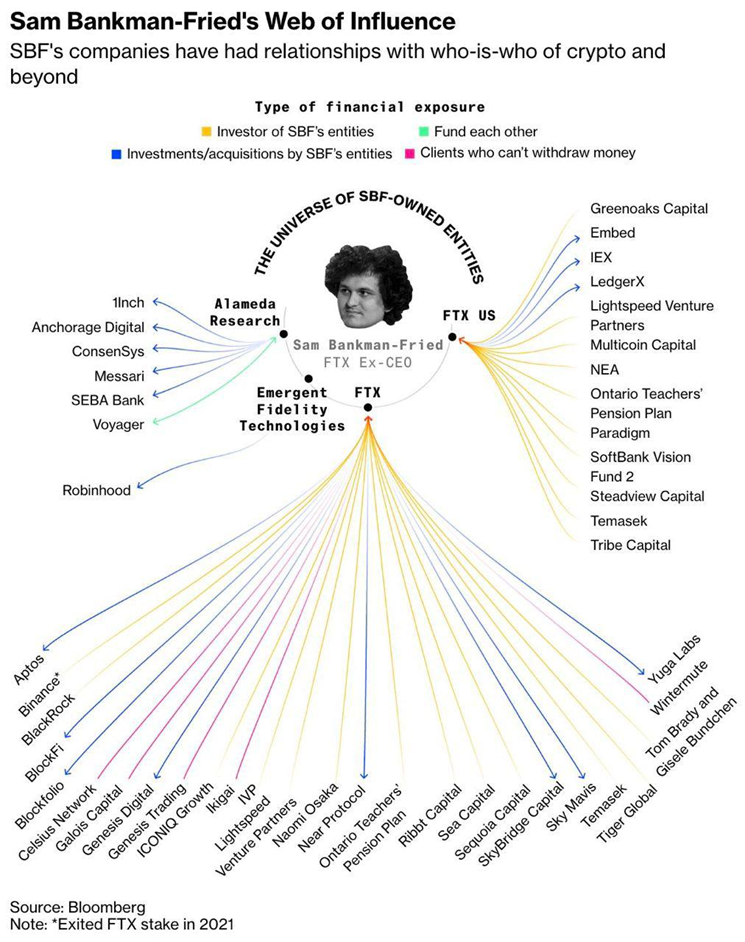

Below is a fascinating graphic compiled by Bloomberg that maps SBF’s exposure throughout the crypto and traditional financial world. Many of the entities in the graphic below are simply investors in FTX that are now marking their holdings to zero.

We think that it is essential to distinguish between two types of contagion – (1) the kind that leads to the cordoning off of toxic assets and is usually coupled with a winddown of a fund or bankruptcy (i.e., BlockFi, Ikigai, Galois) and (2) the kind of contagion that leads to forced selling due to liquidations or liquidity issues.

The first type of contagion certainly compounds negative sentiment and often hurts market participants, but the effect on market prices is not all that significant. The second type is the kind that leads to cascading drawdowns in price and is what we are concerned with analyzing at the present moment.

We will explore the following risk vectors and provide our qualitative perspective on their potential impact and probability of transpiring:

- Cascading liquidations from overall leverage in the crypto economy.

- Forced selling from unprofitable miners with sizeable debt service costs.

- Tether implosion.

- Microstrategy margin call.

- Failure for DCG to obtain a capital injection.

Assessing Overall Leverage Throughout Ecosystem

The overall level of borrowing and lending throughout the crypto economy is a logical place to start evaluating the degree of contagion risk. We have mentioned before that most of the deleveraging throughout the crypto ecosystem has already occurred. Several metrics substantiate this.

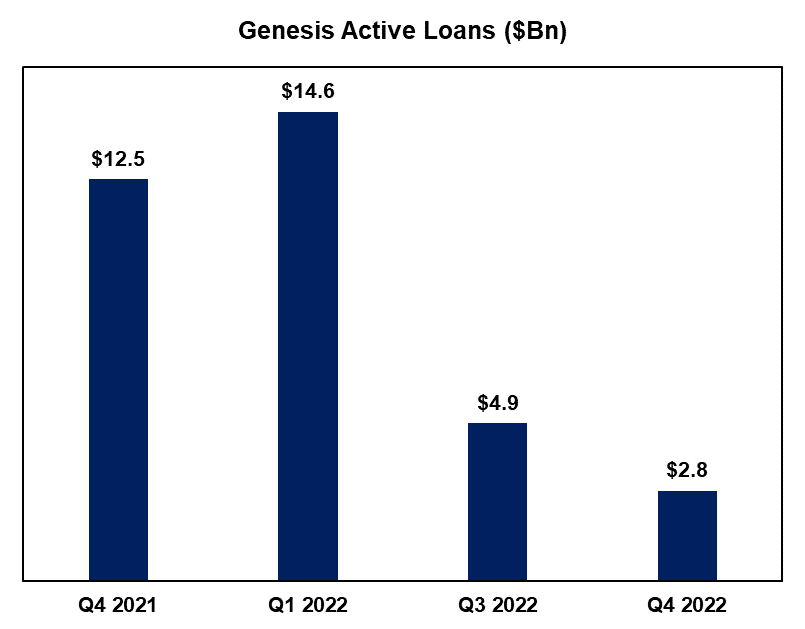

First, we must look at Genesis (which we will touch upon further below) as the birthplace of leverage (aptly named) throughout the crypto capital markets. They are the most prolific lending desk in crypto, created in 2013 as the first OTC desk, eventually building out a trading and lending arm. They are a subsidiary of Digital Currency Group, Barry Silbert’s gigantic digital asset enterprise that also owns Grayscale, Coindesk, and Foundry, among other brands.

If you recall, Genesis had already taken a hit in Q2, having lent $1.2 billion in undercollateralized debt to Three Arrows Capital. While reports indicate that they were able to hedge a significant portion of the losses away and procure assistance from its parent company, this undoubtedly left a mark on the company and the wider lending space.

We can see below how dramatically Genesis had tightened their belts since the spring. Considering that they are the leverage spigot to a substantial portion of institutional market participants, one can assume that other lending desks conducted similar practices.

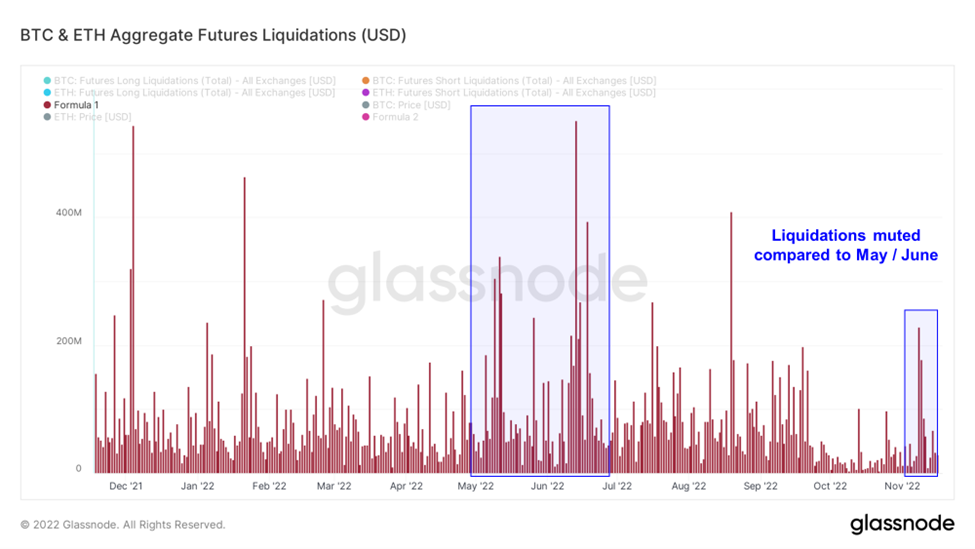

Outside of the FTX team and its investors, the decreased leverage and renewed sense of risk management had trickled down to the rest of the ecosystem, as reflected in the futures market for ETH 7.34% and BTC 5.22% . Compared to the liquidations endured in May and June, recent activity in the futures markets suggests a more conservative positioning among traders. We surmise that the extreme downtick in futures market liquidations in October into early November is likely due to the unwinding of trades surrounding the Merge, completed in September.

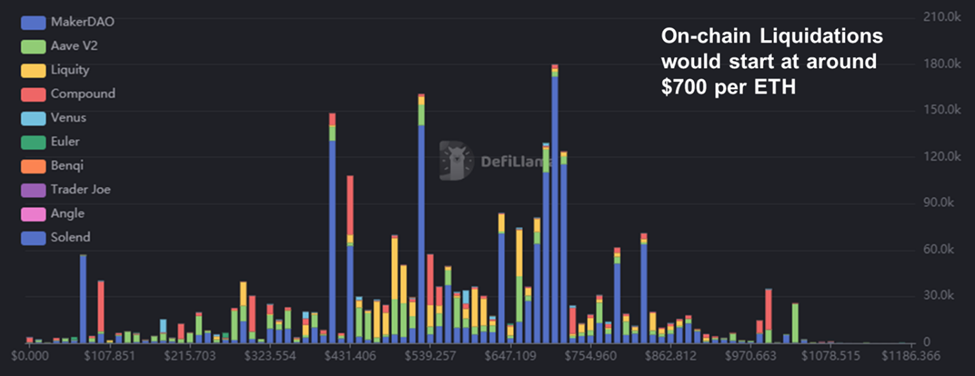

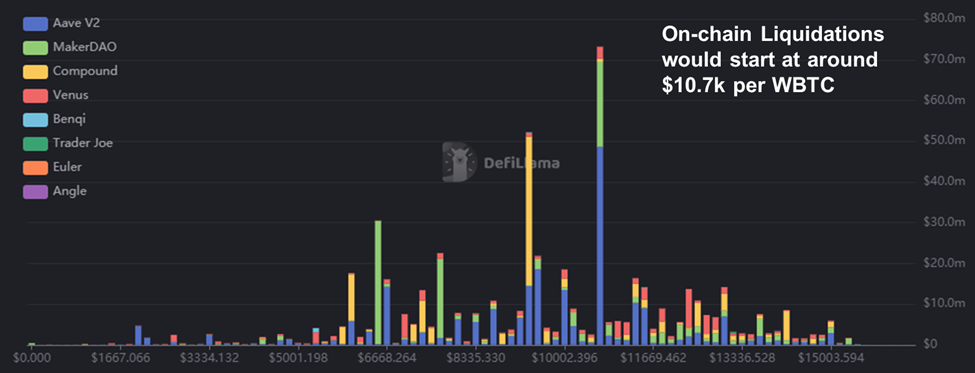

If we look at on-chain liquidation levels, we find similarly conservative positioning. Currently, little ETH collateral would be at risk of forced liquidation until market prices reached approximately $700 per ETH.

Similarly, WBTC liquidations do not become a risk to markets until around $10.7k per BTC. Even then, the relative aggregate borrowed on-chain pales compared to levels we saw throughout Q1 and into early Q2 of this year.

In summary, the risk of cascading liquidations due to existing leverage is low relative to earlier this year. Absent an additional catalyst that drives spot markets lower, the lack of speculation on exchanges and on-chain is conducive to forming a bottom.

Miners Under Pressure

Another theme we have discussed throughout this year is the stress that over-leveraged miners have endured due to a combination of (1) high debt service costs, (2) elevated energy costs, and (3) declining BTC spot prices.

At a high level, a lot of miners borrowed debt, purchased facilities, and financed expensive hardware during the “free money” era last year and were not prepared to endure a year of declining asset prices. To compound the stress, many of these miners had viewed their business model as a perpetual leveraged play on bitcoin, applying a treasury strategy in which they would not sell their mined bitcoin. Thus, not only did current unit economics compress but the unit economics of previously mined bitcoin also compressed because they did not sell at an opportune time.

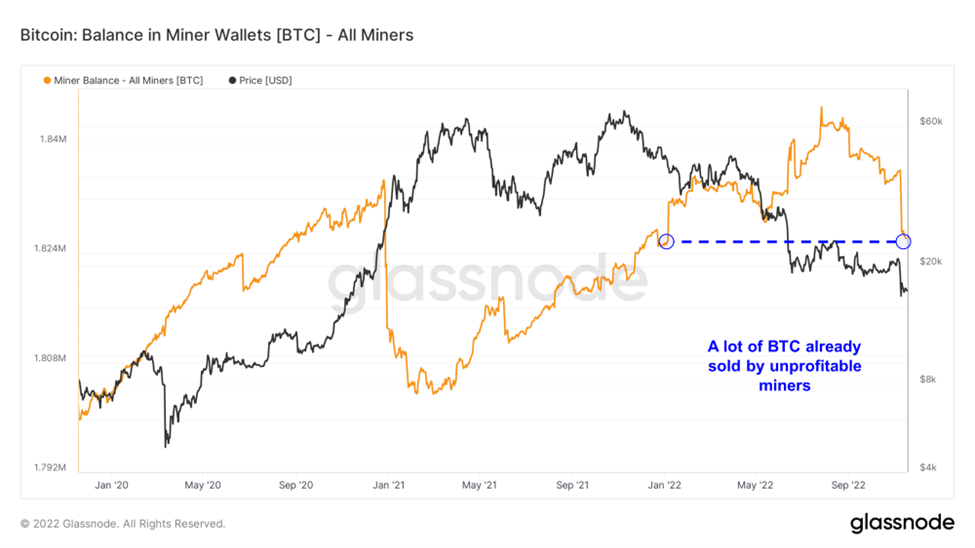

Miner selling was a big reason that bitcoin underperformed other major cryptoassets and tech stocks over the summer. However, based on how far the aggregate miner balance has declined, having returned to the same miner balance that we started the year with, one could reasonably expect that the worst of the miner selling is behind us.

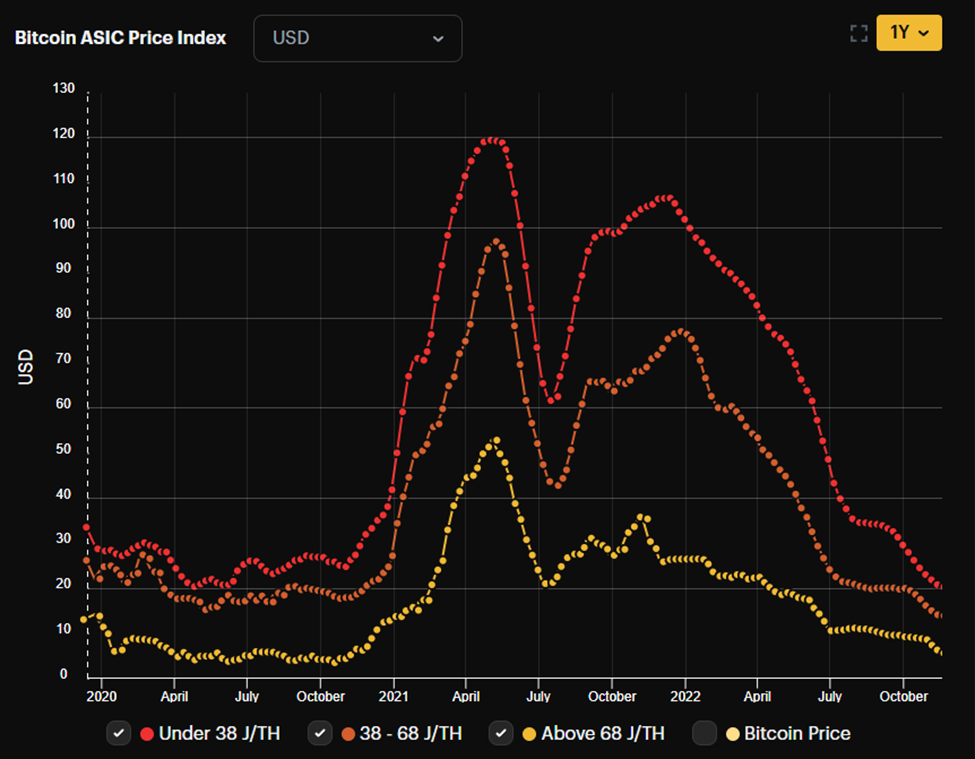

Not only have miners sold their bitcoin, but they have also parted ways with a lot of mining equipment. This is showing up in current ASIC prices. Below we can see that miners were caught up in quite the ASIC bubble throughout the last bull market as prices spiked and manufacturers could not keep pace with demand. A reduction in primary market demand coupled with a flood of supply in the secondary market has brought ASIC prices back to levels last witnessed in 2020.

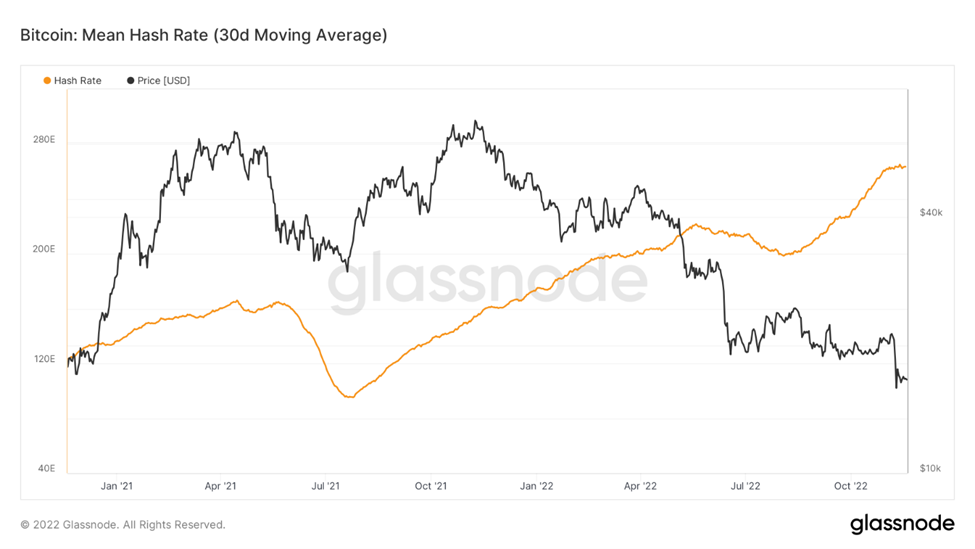

Taking this one step further, based on the continued growth in hash rate, it is reasonable to assume that these ASICs are being scooped up and turned on by the more well-capitalized players in the space.

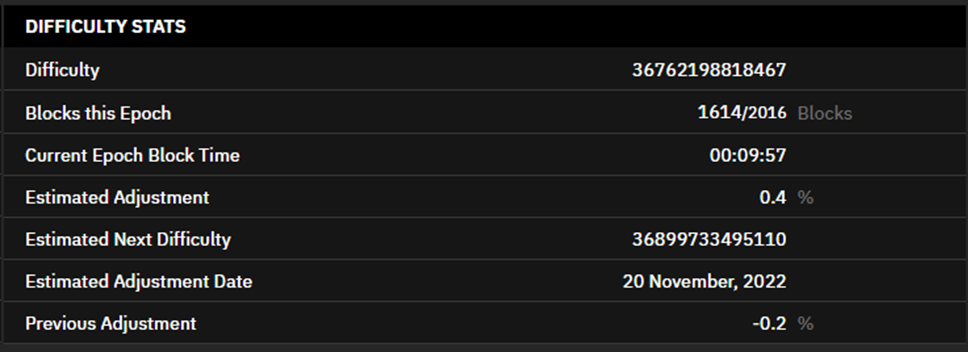

This is corroborated by the fact that despite mining economics decreasing in the current epoch, the next projected difficulty adjustment is an increase. This indicates persistent demand from the overall mining ecosystem to continue churning blocks at these price levels.

In summary, further price weakness from miner capitulation is present but getting increasingly less likely given the carnage that we have already witnessed and the fact that the overall miner balance has returned to 2021 levels.

Thoughts on Tether

The risks above were more structural in nature. They are variables that are always present and are more likely to exacerbate any downside move than catalyze one. However, the following risks that we will highlight should be viewed as low-probability tail risks.

The first of these tail risks is an industry favorite – the black box known as Tether. We have discussed Tether in prior notes due to its core place as a fixture in the crypto ecosystem.

Tether is fiat-collateralized and one of the oldest stablecoins in crypto, founded in 2014. Its goal is to maintain a 1:1 peg to the USD by allowing users to redeem the Tether token USDT for an equivalent number of US dollars at will. Arbing secondary market disconnects between Tether and $1.00 has been a popular trade for large funds over the years. The value-add of Tether is that it provides users with a less volatile medium of exchange and unit of account on-chain and serves as the denominator in trading pairs on most foreign exchanges. There is proven evidence of its utility in dollarizing foreign communities, given that it transacts on the decentralized rails of various blockchains.

Without wading too deep into the history of Tether, the concerns from many critics center around the managing company’s opacity and its history of lying about the liquid nature of its reserves. While it is tough to argue that Tether has lacked managing prowess and by no means is a bastion for transparency, it has more recently seemed to clean up its act quite a bit. For instance, CTO Paolo Ardoino was quite open about their exposure to commercial paper before the current bear market and was quick to point out that they had cleared their reserves of this speculative debt in its most recent quarter. They also undergo quarterly attestation reports, which, while not a full-fledged audit, certainly provide incrementally more comfort to those minting and using Tether.

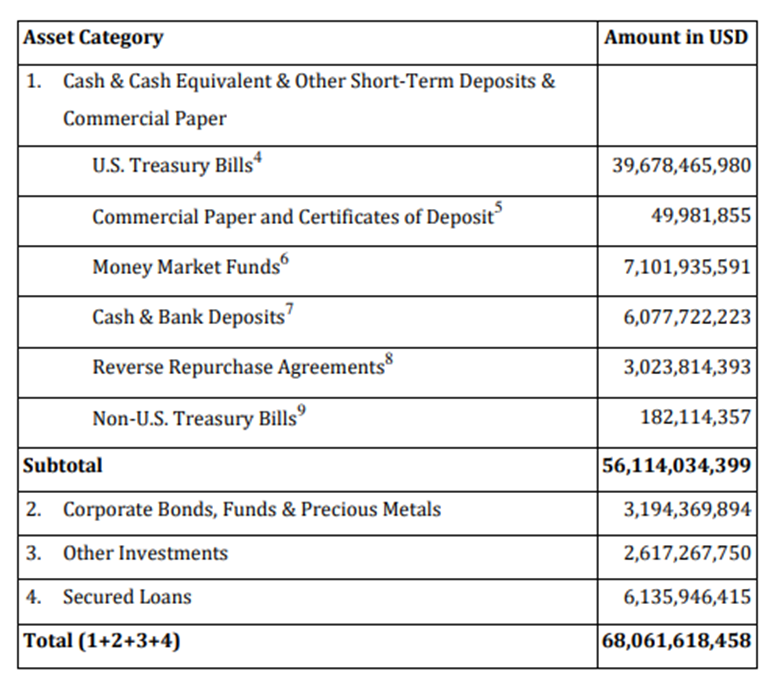

Below, we can see that the vast majority of the $68 billion in USDT circulating as of September 30th was backed by relatively liquid reserves. We do acknowledge that there is the possibility that some of its fixed income reserves could be marked down significantly if not carried to maturity. Thus, the duration uncertainty adds to the overall question of instant liquidity. That said, the reserves exist, and even if withdrawals would need to be delayed, the 1:1 exchange of USDT to dollars would eventually be finalized.

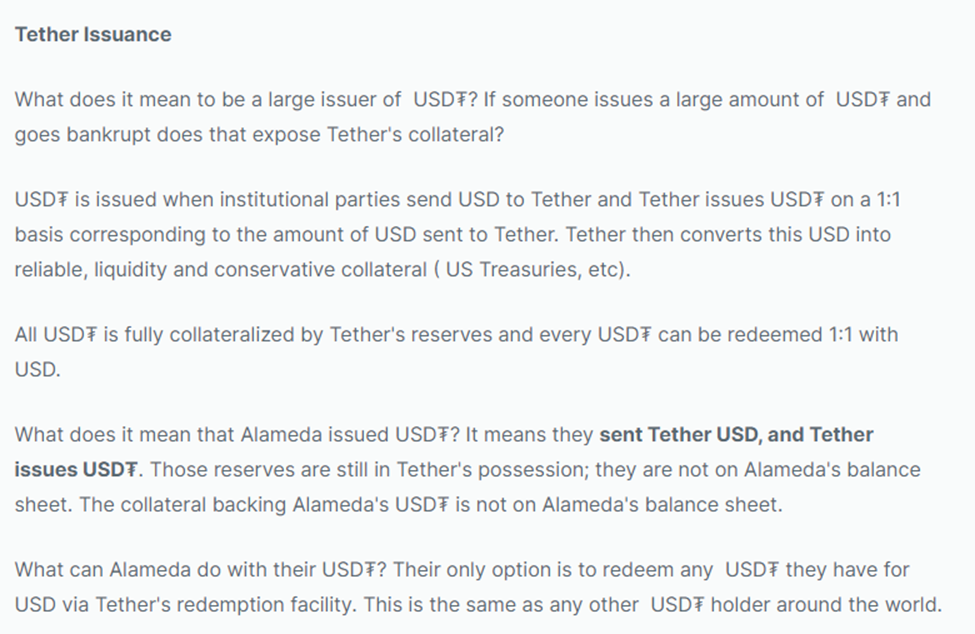

Recently, many pundits just arriving to the crypto industry have noted the relationship between Tether and Alameda. Alameda was one of the largest market makers in the industry and thus accounted for a significant portion of Tether’s overall business. Some estimates say that Alameda had minted a total of $36.7 billion of USDT over the course of its existence.

Whether that quantity is true does not really matter a whole lot. The fact is that Alameda, as one of the largest market makers in the space, undoubtedly had some relationship with Tether. The concerns echoing throughout the space now are that if Alameda had (1) compensated Tether with FTT or FTX equity or (2) if Tether had loaned some of its reserves to Alameda, then there would be a hole in the requisite USD reserves.

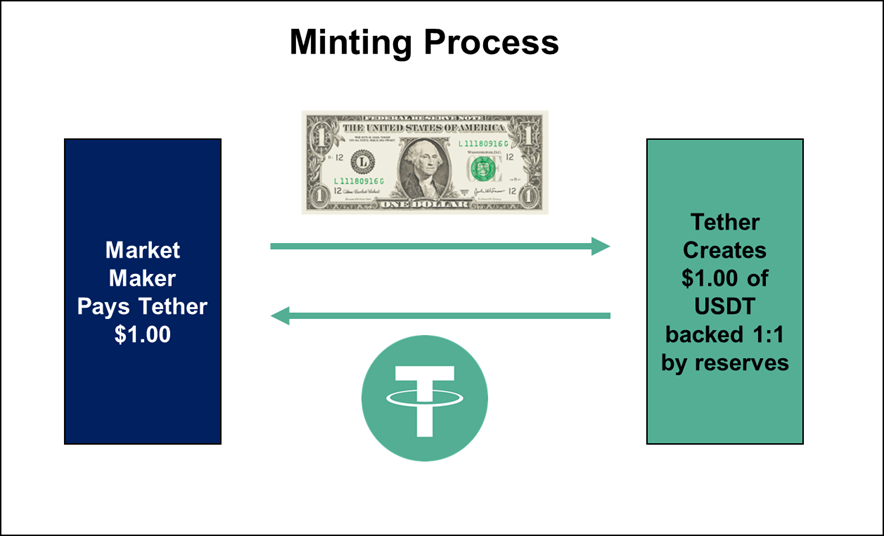

I think it’s important to understand how USDT is created before assessing whether this is a probable scenario or not. As mentioned, many believe that any liquid collateral can be exchanged to mint USDT, but that is inherently untrue, at least per Tether. The minting process requires dollars to go into Tether and USDT to be created on a 1:1 basis.

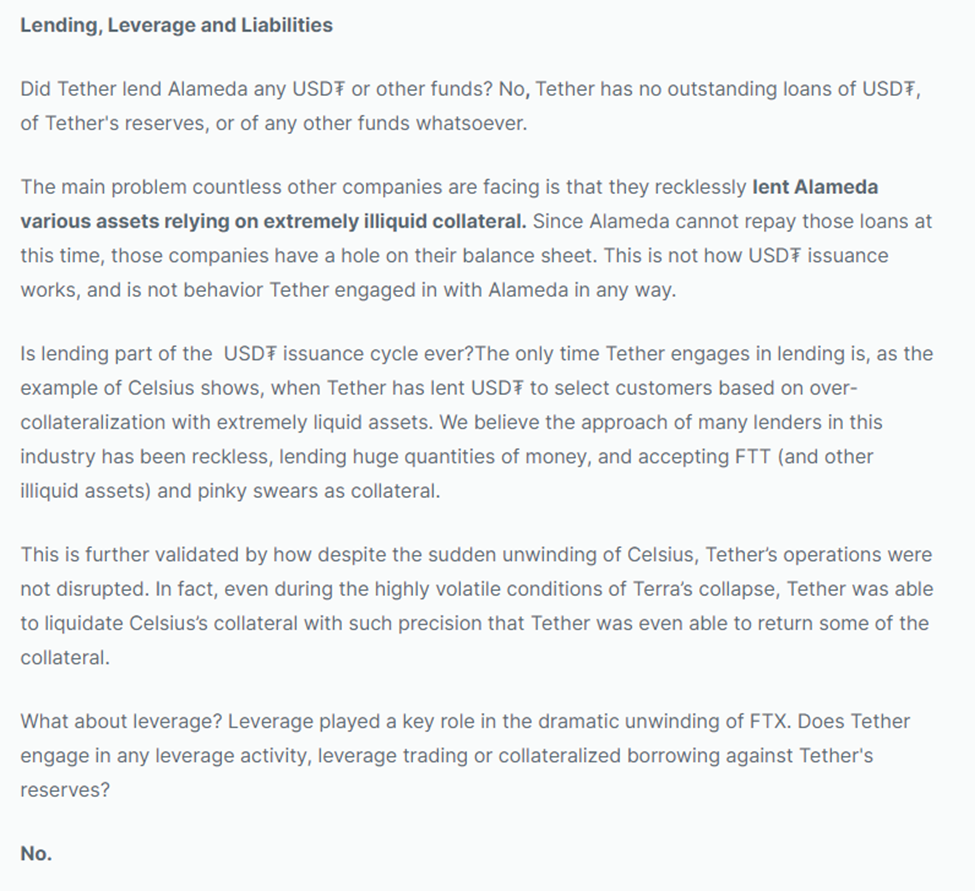

Tether further addressed this issue, specifically regarding Alameda, earlier this week. See below for a screenshot from this press release.

The second leg of concern here is the lending part. Theoretically, suppose Tether had lent Alameda USDT (that had already been minted legitimately) collateralized by illiquid assets. In that case, Tether operations may be adversely impacted by a hole in their balance sheet and might be tempted to dip into reserves to stay operational. This is an understandable concern, given their prior lending relationship with Celsius. The loan to Celsius was reportedly liquidated without issue, and Tether’s operations were not impacted. Thus, while it is not out of the realm of possibility, this precedent would lead us to think that such a tenured operation would employ tighter risk management practices following the wind-down of 3AC.

Below, Tether management speaks to this lending issue specifically.

Thus far, we have a rebuttal from Tether speaking to the 1:1 nature of its reserves and the absence of any lending relationship with Alameda. However, it is appropriate to model out the most cynical assumptions in the current market.

Thus, even if we assume that reserves are not backed 1:1 due to either a scam minting process or issues related to suspect lending practices, one will still need a significant bank run to catalyze the wholesale demolition of Tether. People were surprised by the magnitude of the FTX bank run. According to recent estimates, FTX saw a total of $6 billion in customer withdrawals over 72 hours. That is impressive by any measure. However, people need to realize that Tether has already undergone a series of redemptions of a similar magnitude this year, absent any concern over the lack of reserves.

Below we see that in Q2, Tether saw several days of over $1.0 billion in total redemptions. Throughout May and June, Tether redeemed nearly $17 billion of USDT.

In summary, at its current size, the fall of Tether would be a widespread systemic issue of cataclysmic proportions. In the current environment, it is essential to refrain from writing any possibility off.

However, based on (1) assurances by accountants and management and (2) previous stress tests this year, one must conclude that the likelihood of Tether posing a severe risk to the ecosystem is relatively tiny, absent any unforeseen enforcement from major government entities.

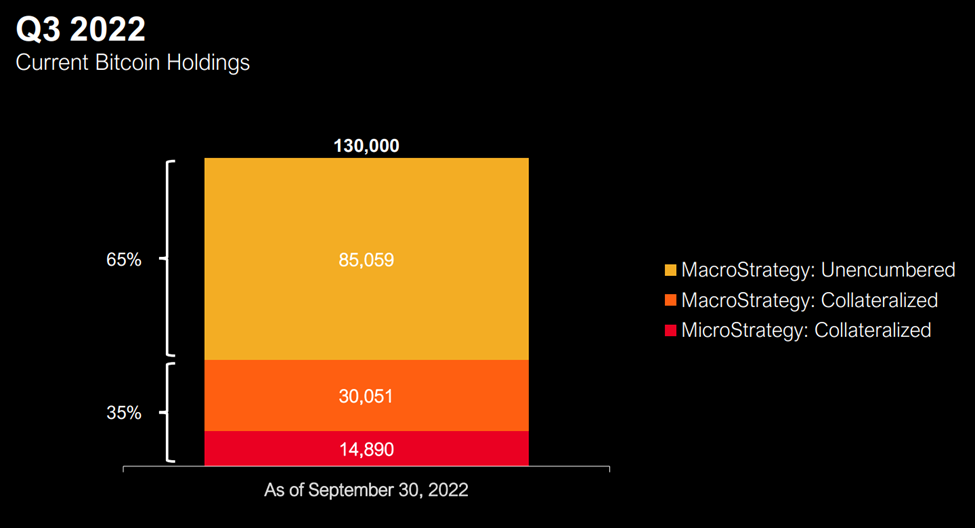

MicroStrategy

The next on our list of possible tail risks is MicroStrategy, the owner of 130,000 BTC, or 0.6% of the total bitcoin supply. As most are aware, MicroStrategy’s former CEO and current Executive Chairman Michael Saylor made waves at the beginning of the last bull run after deciding to put a sizeable amount of bitcoin on his company’s balance sheet.

As time went on, Saylor doubled down on this approach to the point of collateralizing loans with Bitcoin. Given that the company’s average entry price is $30,639 and the current spot price is hovering just north of $16,000, we should probably dig into the MicroStrategy debt stack to uncover whether there is a legitimate risk of 130,000 bitcoin coming to market due to forced liquidations.

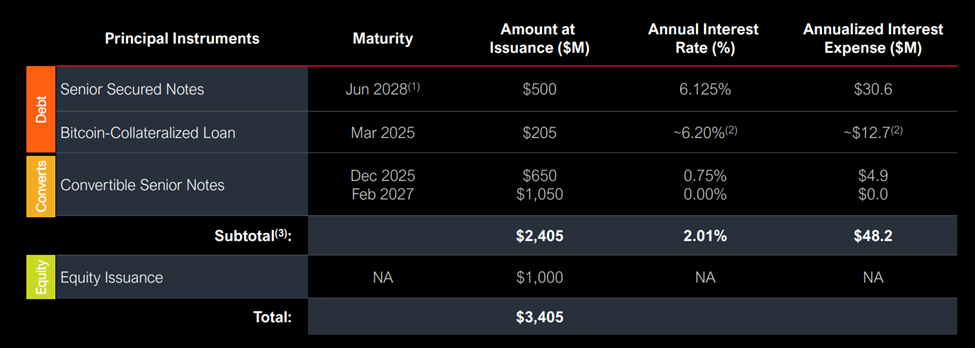

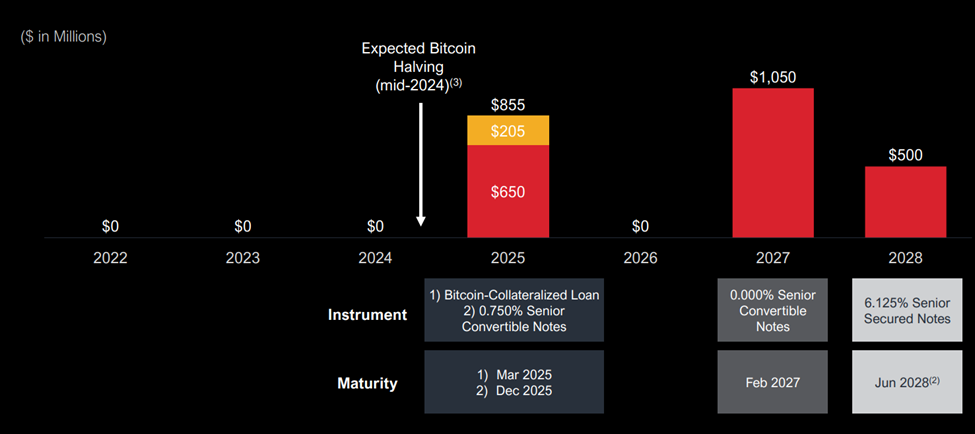

Below is a slide from the company’s most recent earnings presentation detailing the terms of its different debt instruments. We see that estimated annual debt service costs roughly amount to $48 million.

With a current cash balance of $60.4 million and annualized adjusted EBITDA of approximately $80 million (using the nine months ending September 30th and adding back SBC and D&A), the ability to pay interest on these loans is not in a supremely comfortable spot, but not exactly worth ringing any alarm bells just yet.

What we are concerned about right now is whether the company will need to either surrender its bitcoin collateral in event of technical default or market-sell bitcoin to pay down some of its debt, likely causing a drawdown in the spot market.

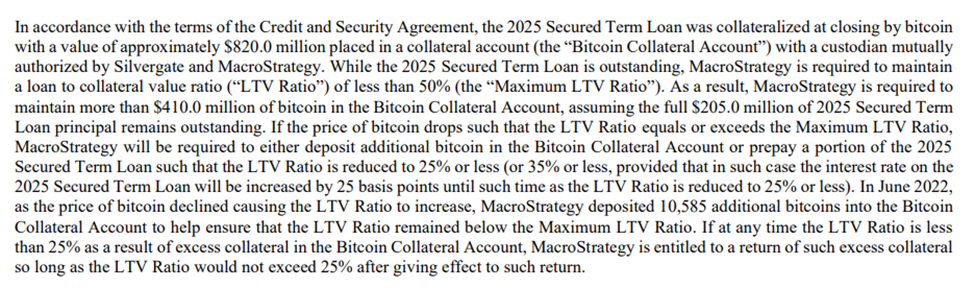

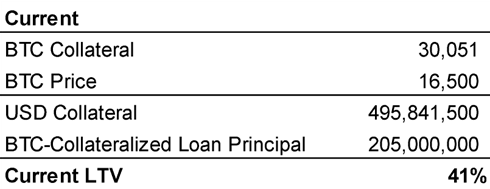

The loan in question is the $205 million bitcoin-margined loan listed above, which is collateralized by 30,051 BTC.

According to recent financial statements, the loan (issued by SIlvergate) requires the company to maintain a maximum LTV of 50%, and should the LTV rise above this level for more than 24 hours, the maximum LTV will be reduced to 25%. Should the LTV rise above that level at any point through maturity, Silvergate will retain the right to call MicroStrategy on the loan and force a sale of the collateral.

Interestingly to note, the company already had to touch up its collateral in June to prevent the LTV ratio from exceeding 50%.

Excerpt from MSTR 10-Q dated November 11, 2022:

With these stipulations in mind, we think it must be noted that the amount of bitcoin currently backing the loan is a small portion of the company’s overall balance. Below we can see that the company still retains approximately 80k unencumbered BTC.

Another important factor to consider is that the company will not require refinancing of any of its debt until after the next bitcoin halving event, which favorable price increases for bitcoin have traditionally accompanied.

The final important thing to understand about Microstrategy’s current capital stack is that it has pre-approved the sale of up to $500 million in Common (non-voting) stock, which, depending on the market for Microstrategy shares, could provide a lifeline for the company in a low-liquidity scenario.

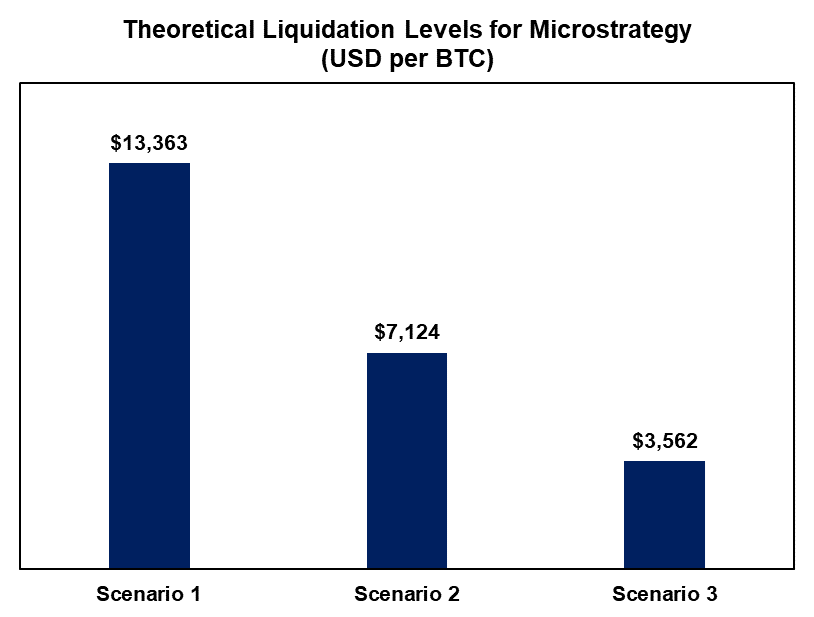

With all of the facts presented, we can now run through some scenarios to better understand where MicroStrategy could be called on their collateralized loan.

Current

First, we lay out the current landscape and the liquidation price if the company were to refuse a touch up on their bitcoin collateral, all things being equal. Assuming a spot price of $16,500, we see that the company’s LTV sits at 41%, under the 50% threshold with some margin to decline before reaching an area of default.

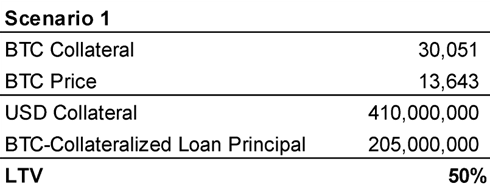

Scenario 1 – MicroStrategy sells $205 million of BTC to pay down the collateralized loan

Scenario 1 assumes that the company believes that this debt is not worth remaining in its capital structure. In this scenario, the company would not commit any additional bitcoin to the collateral account and move the loan to technical default. The company would then liquidate just enough bitcoin to pay off the debt, which at $13.6k per BTC would involve the market sale of approximately 15k BTC. Bitcoin’s 24-hour volume at the time of writing is approximately $27 billion (according to CoinMarketCap), therefore, we think the effects of this would be rather limited.

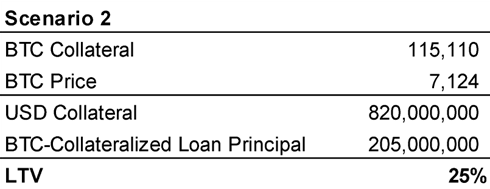

Scenario 2 – MicroStrategy allows Maximum LTV to fall to 25% and subsequently commits rest of BTC to the collateral account

As mentioned above, there is a circumstance in which the loan covenant would be amended to reduce the maximum LTV ratio from 50% to 25%. While it is tough to envision the exact scenario in which this would happen, it must be considered. There may be a price decline that is too rapid to respond to that sends the collateral balance below the required minimum USD balance ($410 million). In this case, the margin requirements for MSTR 8.83% will double. Assuming that following the decrease of required LTV from 50% to 25%, the company commits all remaining unencumbered bitcoin to the collateral account, then this brings the prevailing liquidation price to $7,124 per BTC. If bitcoin’s price were to drop below this level and MSTR falls into default, then SIlvergate reserves the right to liquidate collateral to pay down the loan. This would entail the market sale of approximately 60k bitcoin, the same amount in dollar terms above, but a much greater impact from a BTC-denominated perspective.

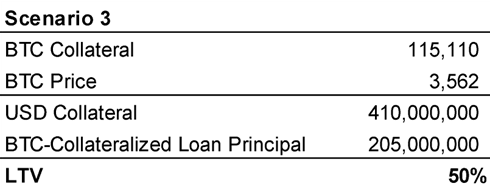

Scenario 3 – MicroStrategy keeps Maximum LTV at 50% and commits the rest of BTC to the collateral account

The final scenario to consider is the most extreme scenario. This entails Saylor deciding to continue to top up the collateral on the loan until all 115,110 (excluding the bitcoin backing the secured notes) are in the collateral account. This would bring the liquidation level on the loan to a BTC price of $3,562. In this scenario, we would have already endured another 80% decline from current levels. In our minds, this is the absolute worst-case scenario and mostly proves the point that there is plenty of room for bitcoin to drop before they are called on this loan.

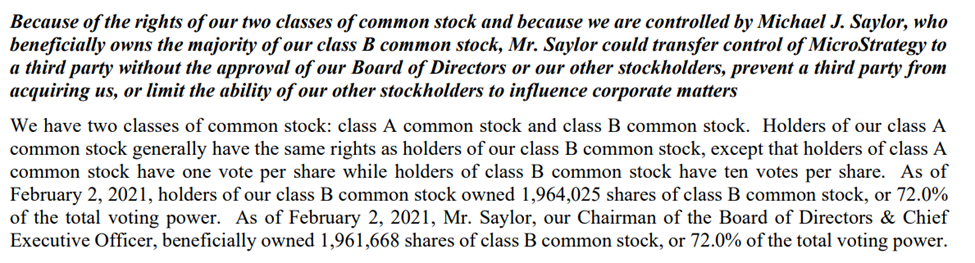

Before wrapping up our thoughts on MicroStrategy, it is important to remember that, despite MSTR shares taking a tumble alongside bitcoin’s price, the board has limited control over balance sheet decisions. Despite Saylor being removed from his CEO chair earlier this year and owning a minority of the total outstanding shares in the company, Saylor still retains 72% of the overall voting power. Thus, despite pleas from shareholders and equity analysts advising Saylor to pay down some of the company’s debt, Saylor is likely to continue to execute his strategy of acquiring and holding as much bitcoin as possible.

Below is a summary of the theoretical liquidation prices for the company, given the three scenarios that we laid out.

In summary, we think that the general public is overstating the likely liquidation price for MicroStrategy and also fails to account for the outsized voting power that Saylor retains. The biggest risk is actually any significant degradation in the software business that Saylors bitcoin strategy is attached to, which would compromise the company’s ability to service debt. In this case, it is likely that Saylor would try to sell equity. If there is no market for MicroStrategy equity, then he would likely have to sell some bitcoin, but likely only enough to service interest payments.

Digital Currency Group

The final and likely most pressing risk facing the market right now is the relative standing of Digital Currency Group, one of the most tenured companies in the crypto space. As mentioned above, Genesis, the leading lending desk in crypto, had significant exposure to FTX/Alameda. As a result, the company was forced to close down customer withdrawals following a short scramble to raise a $1 billion line of credit.

The pressing concerns facing the market now are:

- If Genesis is in serious trouble, is DCG also facing solvency issues?

- If DCG is having balance sheet issues, will it sacrifice its lending desk to save the rest of its business?

- If DCG is beyond repair, and is unable to raise a fresh injection of capital, will the company be forced to liquidate its trust products, which the company has significant exposure to?

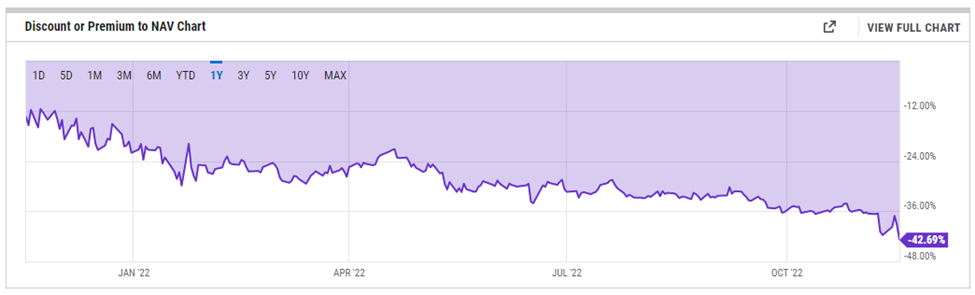

As mentioned above, one of DCG’s subsidiaries is Grayscale. They are known for creating trust products that gave investors the first real way to gain easy exposure to bitcoin. Over the years, however, more liquid and efficient ways to obtain exposure to bitcoin have come to market, thus reducing demand for this OTC product. Additionally, the SEC cited Grayscale several years ago for Reg M violations, thus preventing the Company from redeeming shares in the GBTC 5.61% trust. This has resulted in the trust deviating significantly from the underlying NAV. As shown below, GBTC 5.61% is currently trading at an all-time record 43% discount to NAV.

Grayscale has repeatedly lobbied for GBTC 5.61% conversion to an ETF, something that would immediately reduce the spread between market price and NAV because it would allow the company to create and redeem shares. Below we see the consequences of an inefficient product like GBTC.

Over the period pictured below, BTC has increased nearly 150%, while GBTC is a paltry 17% higher.

Thus, the market has been left to wonder in recent days – if DCG is truly in trouble, and since they are a large holder of GBTC, perhaps we see a world in which the trust products (along with ETHE 7.36% and other Grayscale trusts) are dissolved for liquidity reasons. To be clear, this is highly speculative but worth pointing out to investors.

The mechanics of dissolution are not certain, but we think it is likely that the liquidation process would entail the market sale of bitcoin and a return of cash to current trustees. In this scenario, one could imagine a dynamic in which (1) dissolution is announced, (2) the trusts are liquidated, and (3) bids in the BTC spot market rapidly move to the prevailing discounted price in anticipation of dissolution.

Those that would benefit from this scenario are those positioned delta neutral, longing GBTC, shorting BTC, and collecting on the spread between the two. Thus, one of the key things we are going to be watching when markets open on Monday is the movement of that discount to NAV. Any decrease in the discount likely signals large players in the market to feel confident about dissolution. Thus far, there is no sign of this taking place, and consequently, no reason to panic.

Ultimately, we do not think this is the most probable outcome since Grayscale trusts are a money printer for the company. The firm charges 2% fees on the underlying assets (not NAV), so it is more likely that they will try to raise capital based on this reliable cash flow business of theirs. Not to mention, their lending desk has taken a beating over the past year, both financially and optically. Therefore we think it is more likely that in the event they are unable to raise capital, DCG sacrifices Genesis instead of Grayscale.

In summary, we ultimately have more questions than answers as it pertains to the risk surrounding DCG. However, this does seem to present the clearest and most present danger of all systemic risks mentioned. A liquidation of GBTC would likely be unfortunate for market prices, but again, this is merely hypothetical. If we have learned anything over the past six months, the worst thing we could do is assume that those in charge have any clue what they are doing, and it is best to turn over every stone possible to prepare for what’s next.

FTX Bankruptcy and Customer Deposits

Overview

In our Leadership Roundtable discussion last Thursday, we mentioned that we would look to provide resources for those who might have fallen victim to FTX. We certainly feel for those affected by the current situation and hope those responsible for causing such harm are brought to justice. Perhaps moving forward, centralized financial services will simply use the decentralized ledger technology at the industry’s center to regain customer confidence and avoid any similar calamities in the future.

The good news is that we have a pair of historical precedents in MF Global and Madoff in which customers were ultimately able to be made whole on their deposits after they were misappropriated. The bad news is that in each circumstance, it took a considerable amount of time for funds to be recovered, and there is an element of uncertainty surrounding digital assets and their recoverability. For instance, a lack of centralized guardrails might make imposing clawbacks on historical distributions more challenging. Further, the exchange was hit by a hack recently in which nearly $500 million of the remaining liquid assets in FTX were stolen and routed to a new address. Whether these assets will be recoverable remains to be seen.

The following are some resources we have compiled that might be useful in navigating the current situation. Please note that these have been put together from various resources, and none of this should be taken as legal advice but rather a place to start.

Documentation

- Here is the FTX Bankruptcy Filing, which might serve as a useful jumping-off point.

- FTX has hired Kroll as its claims agent. Their website is a repository of relevant claims information.

- The First Day Hearing is on Tuesday, November 22nd. Hopefully, there will be a clearer path forward for unsecured creditors following this hearing.

- If able to access the exchange website, download copies of balances and transaction history for personal record keeping.

Our Understanding of Proceedings for Unsecured Creditors in Bankruptcy

- When a company files for bankruptcy, generally, the debtor will provide a list of creditors. Normally only a handful of the top unsecured creditors will be listed.

- For any claim that is not listed, the court will typically send a notice and a proof of claim form that allows you to petition for payment.

- If you don’t receive notice of bankruptcy from the court, it’s essential to contact the clerk promptly to receive your proof of claim document.

- The bankrupt company’s outstanding debt is prioritized, with preferred creditors and secured debts paid first, then unsecured creditors.

- If not listed on FTX’s scheduled creditors and don’t receive a proof of claim form, get the case number of the bankruptcy filing and file your own proof of claim.